More doom and gloom headlines circulate Australian media today with comments from an United States based property analyst suggesting Australian property could crash by more than 60 percent. At the same time, Australian experts counteract the argument saying it can’t happen in Australia, in fact – some say we have no bubble.

Is there any substance to the article?

Jordan Wirsz says “Right now is not a time to be buying real estate in Australia.”

“The market has slowed substantially but residential prices are likely to fall up to 60 per cent, possibly even more, within five years.”

We don’t believe the 60 percent figure has been simply pulled from the air. It is consistent with the Economist Magazine that calculates Australian housing is overvalued by 53 percent on a rent to price basis (sort of like the PE ratio for shares) and 38 percent on an income to price ratio. Such a large bubble can scar the indebted and cause markets to over correct. I would be cautious about the 5 year time frame, although. I would expect prices to deflate over a decade or two, although the large falls will occur in the first couple of years in this window.

“I’m bearish about world real estate but I couldn’t be more bearish about the Australian market, There have been corrections but they don’t hold up to the scale of what is coming, ” said Mr Wirsz.

This is also consistent with The Economist report that states house prices in Australia, Belgium, Canada and France is more overvalued today, than during the peak of the American housing bubble. Assuming house prices fall back to nominal levels, this would suggest we could potentially have a bigger housing downturn than America.

But experts in the thick of it here in Australia disagree.

Paul Bloxham, HSBC’s chief economist, said there would have to be sharp rises in interest rates, unemployment and housing stocks for property values to crash. As per our prevous post, unemployment in Australia looks shaky and is expected to be worst this year as the effects of high household debt take their toll.

SQM research shows there are now 48,586 Victorian homes on the market in December 2011, up 43 percent for the 12 months. Stock on the market is up 23 percent in Sydney, 26 percent in Adelaide, 52 percent in Hobart and 21 percent in Canberra.

Peter Green from Laing+Simmons in South Sydney told the Sydney Morning Herald in a different article today, “In the last three months, the number of people visiting open houses has been cut by half. And buyers may show up to auctions, but they don’t bid.”

This could suggest turnover of stock is falling and is likely to contribute to even more stock on the market this year.

The official cash rate is likely to go down this year, although banks may choose not to pass rate cuts on, especially the ANZ who now set their own mortgage rates independent of the Reserve Bank of Australia. But with the World Bank warning on Wednesday that we are on the brink of GFC 2 and it is expected to be deeper than GFC 1, the cost to access international credit markets is anyone’s guess.

Mr Bloxham reassures News Limited readers that the combination of rising interest rates, unemployment and housing stocks levels is not on the cards.

He also says “Surely if the market was going to collapse it would have happened in 2009 after the Lehman’s collapse when we had the biggest aversion to housing assets that you’ve seen.” Maybe he forgot the First Home Owners’ Boost was “designed to encourage people who had already been saving for a home to bring forward their purchase and prevent the collapse of the housing market.”

Ray White Inner West agent Charlie Bailey has the same thoughts, telling News Limited he believes the bubble can’t bust because there is no bubble. “People have been predicting house prices to fall every year and every year we have an increase in prices.”

The comment that there is no bubble because it would have burst by now is common. It’s a similar concept to boiling a frog, because the market is slow moving there is a perception the market hasn’t changed, just like the rising water temperature before the frog boils. This is also common among baby boomers who will tell Generation Y that they thought housing was expensive when they brought, but if they hadn’t taken the plunge, they would still be renting. While housing debt as a percentage of household income has quadrupled, it has done so over a period of three decades.

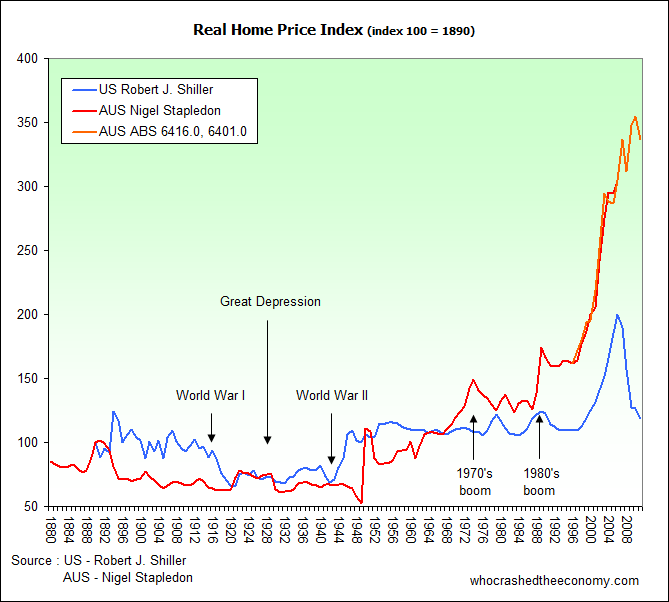

But the quote that a housing bubble can’t burst, because there is no bubble was first made famous by Alan Greenspan and Ben Bernanke. They both testified before Congress in 2005 that a bubble didn’t exist in the United States. Three months later, the America housing market started one of the biggest corrections in history (blue line):

» Bloodbath to hit Australian real estate, US property analyst Jordan Wirsz says – News Limited, 20th January 2012.

» World Bank’s crisis warning – The Sydney Morning Herald, 18th January 2012.

» How much property is on the market in your capital city? A state-by-state analysis – The Property Observer, 18th January 2012.

» Hammer falls on auctions – The Sydney Morning Herald, 20th January 2012.

Say what you want but it is plain and simple. Australia housing and economy is only a matter of time before they go through the GFC. Its coming. You can show me stats and graphs etc…… It will happen…..

Paul Bloxam is part of the propaganda machine, ie full of shit. I hope he has heaps of real estate and big fixed rate investment loans. Enjoy the interest dooffuss.

So this analyst advises the Fortune 500 CEO’s hmmm… sounds like he may know what to recommend. I place more credit in what he says compared to the world’s best treasurer that is on a sex tour in Mexico, whereby he’s bending the Australian people over and giving them some European Communist sausage so to speak.

The key has always been unemployment – one paycheck away from disaster for many greater fools that bought ‘investments’

Alan Kolher thinks it will rise to 6%, problem is the ABS will ‘manage’ it anyway. Australians will suffer in silence until they get that pissed off at the government, then they will lose it!!! That will come when they lose everything and have nothing else to lose.

Expensive properties in GC and Sunshine Coast QLD are off a fair bit now already so his predictions may be true in some areas. Noosa anyone? How’s Port Douglas doing rich yuppies?

The thing I don’t understand about these “it will never happen here” spruikers is why are there are so many houses for sale after a year of negative growth? Wouldn’t that be the worst time to sell? After negative growth has occured? Would love to know the reasons why so many people are starting to sell up…..

For a lot of peoples sake, particularly those suckered into the housing market post 2008, I hope the pricing adjustment is not a slow drawn out process, for if they are victims of unemployment and financial strife, the best thing for them will be to lose the lot then start over again, a nice clean cut, rather than a long drawn out process where they are bled dry over 10-20 years and enter their 50s with no wealth creation whatsoever for their years of hard toil in the harsh Australian sun.

Any fool (beside vested interest Australian bank and real estate employed economists it seems) can see that we are at the peak of a massive property bubble about to burst. This will start to sink in even more this year with rising unemployment and further businesses going belly up. The drop off in retail should have rang warning bells rather than simply blaming it on online shopping. This isn’t about scare mongering or being negative, it is about being honest and facing FACTS!

Lets hope we get to hear interviews from these lying self serving economists once this does all hit home. Cannot wait to see their blame shifting and excuses.

Any thoughts about Negative Gearing?

I have a freind who is negatively geared with just 1 property , and it is painfull to watch them struggle each week. Their dream was to get many properties, which has now turned into a nightmare. They are stuck with this property because if they sell it they will still be left with a substantial debt to the bank, which is too much to bare.

The prestige of owning more than 1 house has turned to regret……..

Bring on the overdue crash. They all say the bigger rise the bigger the crash.

Is that the Jordan Wirsz from this video?

http://www.youtube.com/watch?v=0aq16zomwe0

If so, the man just isn’t credible.

Well what about That!!

We have heard for years real estate is expensive but we have not heard it when unemployment is low, or retail spending

has dried up or that the carbon tax now is going to happen. What about higher water and electricity prices and land tax. WOW

It is going to happen. When all these align they will shake the housing market like the planets aligning this year that may

shake this planet.

Don’t put your dollar on real estate unless your dollar gives you back more than you have bargain for.

If you chase the dollar it will send you into debt. If you let the dollar chase you (bargain hard) it will serve you.

Nice bit of (credible) follow-up research there from Steven Shaw.

It does take the floor out from this article.

It appears Jordan Wirsz is no Jeremy Grantham.

Check out this guy…

http://www.youtube.com/watch?v=aC19fEqR5bA

Answers on a postcard folks.

What is the government and OPPOSITION planning to do re. the threat to us all of overvalued houses ? This is a serious problem I don’t either of them addressing.

Rather than short election cycles it would be good for both to be held accountable to be responsible to us for a sensible plan to deal with this.

We may face another cycle of mad increased house prices if interest rates drop…what are they doing???