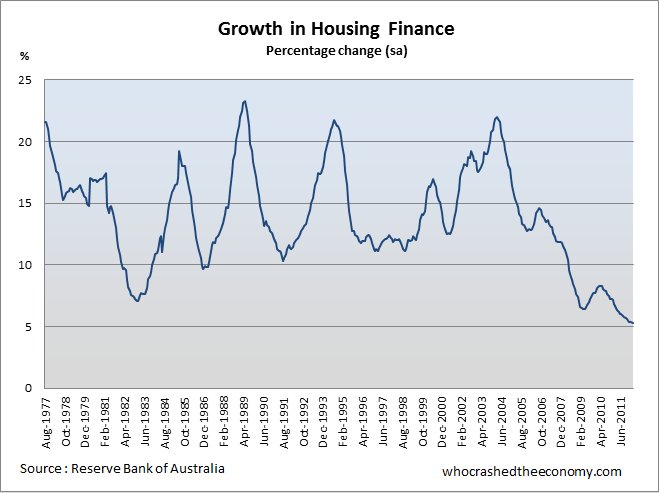

While property experts gather around to corroborate stories of a recovering property market, data released today from the Reserve Bank show housing credit rose just 0.4 percent in March to bring the yearly growth rate to 5.3 percent. Housing growth has been stuck firmly at an annual rate of 5.3 percent since January and at the lowest ever recorded figure since records started 35 years ago.

Housing credit growth had been running at double digits until the Global Financial Crisis, but excessively high household debt levels have caused household’s to re-adjust their appetite for debt in a more uncertain climate.

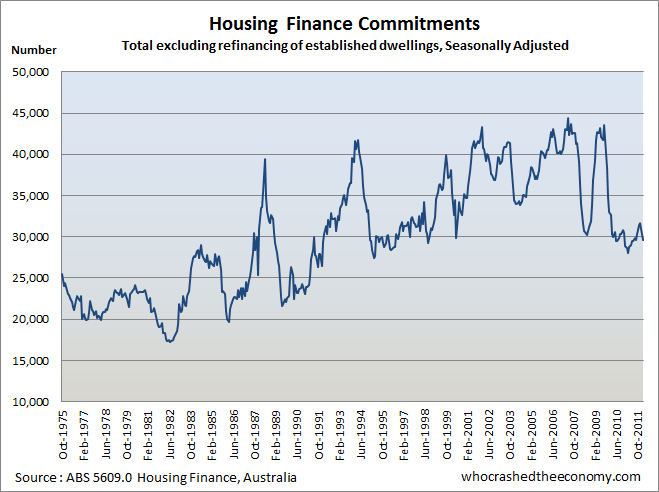

This reluctance to take on debt is also observed in housing finance commitments that is currently hovering around levels last seen in the late 1990s.

The housing industry is feeling the full effects of low housing credit growth. Figures released from the Housing Industry Association today show new home sales are at 1994 levels, falling 9.4 percent seasonally adjusted, in March 2012.

After annual CPI came in at only 1.6 percent last week, the Reserve Bank of Australia is almost certain to cut the official cash rate tomorrow. But with housing credit growth at levels not seen in decades, it is hard to see any resulting housing recovery.

» New home sales crater – Macrobusiness, 30th April 2012.

» Home sales sink to lowest since 1994 – The Age, 30th April 2012.

Lowering interest rates will have little effect this time around. People aren’t as gullible now as they were many years ago and the ponzi scheme is in the process of collapsing. The key issue is DEBT and people are already in debt to their eye balls and the economy is in the process of de-leveraging, therefore I see more pain ahead.

It can collapse after my last IP is auctioned off this Saturday…..

I reckon the RBA will cut rates. It wouldn’t surprise me if they did not. I think Westpac announced it small but preemptive cut yesterday. Maybe they [Westpac] either know something, or they’re coaxing the RBA into a cut.

I don’t think it will matter if everyone cuts rates, its’ not the rates that kill it is the amount borrowed. If the stats from Australia Debt Clock are correct or even on ball park, rates will need to go negative.

Hyper-Inflation anyone?

http://www.australiandebtclock.com.au/