Transparency surrounding real estate investment by foreigners has returned with the Foreign Investment Review Board Annual Report 2010-11 showing 9771 real estate investments worth $41.5 billion was approved in 2010-11.

In December 2008, the Rudd Government announced a change to legislation, it claimed, was designed to ‘streamline’ some of the administrative requirements for the Foreign Investment Review Board (FIRB). As part of these changes, temporary residents could purchase Real Estate in Australia without having to report or gain approval from the FIRB and would allow the FIRB to concentrate on larger issues in the ‘National Interest’.

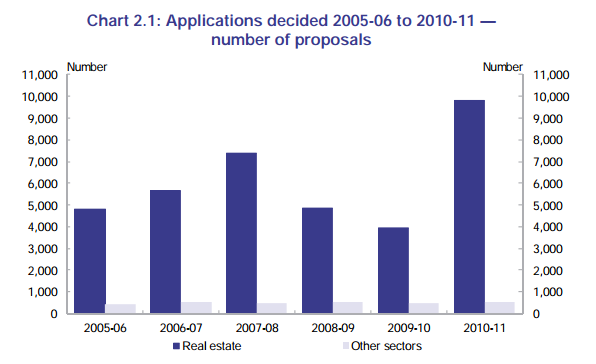

As you can see from Chart 2.1 extracted from the Foreign Investment Review Board Annual Report 2010-11, Real Estate transactions do make up the majority of the applications considered by the FIRB, but many questioned the timing of the announcement. It was at the height of the GFC, and two months after the announcement of the First Home Owners’ Boost, designed to help prop up Australia’s Real Estate sector. House prices had fallen 4.7 percent. Opening up the floodgates to foreign temporary residents could be seen as a further measure to help provide extra demand and keep the housing market afloat.

By March 2010, the media was flooded with articles on Australian’s being outbid by an army of Chinese residents, effectively pricing Australian’s out of their own housing market. But the ‘streamlining of administrative requirements’ actually meant no records were kept, or more specifically it would seem that these foreign temporary residents no longer needed to lodge applications with the FIRB. There was public outcry and no real data to support just how big or small this issue actually was.

The outcry had grown so intense, that on the 24th April 2010 the government buckled and a tightening of foreign investment rules relating to residential property was announced, complete with a package of new civil penalties, compliance, monitoring and enforcement measures. The government even went to lengths to set up a 1800 hot-line for residents to report suspicious property buyers and help calm a heated public.

The press release by the former Assistant Treasurer, Senator the Hon Nick Sherry said “The Rudd Government is acting to make sure that investment in Australian real estate by temporary residents and foreign non-residents, is within the law, meets community expectations and doesn’t place pressure on housing availability for Australians.”

According to the FIRB Annual Report 2010-11, “As of 24 April 2010, temporary residents residing in Australia are no longer exempted from notification of proposed acquisitions of established residential real estate for their own residence, established residential real estate for the purposes of redevelopment, new residential real estate and vacant residential land. Temporary residents were previously exempt from April 2009 under the changes announced in December 2008. ”

The Financial Year 2010/11 is the first full year temporary residents must apply to the FIRB and where records have been kept. It may never be known just how many temporary residents purchased Australian Real Estate in the years 2008/09 and 2009/10.

» Foreign Investment Review Board Annual Report 2010-11 – Foreign Investment Review Board, 20th April 2012.

» Government Tightens Foreign Investment Rules for Residential Housing – Assistant Treasurer Nick Sherry, 24th April 2010.

» Australian Federal Government gets tough on foreign ownership rules – News Limited, 24th April 2010

» Real Estate Investment by Foreign Residents : Top Secret – Who Crashed the Economy, 4th January 2012.

» Australia for Sale – Who Crashed the Economy, 27th March 2010.

» Foreign investment is overheating our property market – The Punch, 10th April 2010.

» Secret government business – The Age, 30th December 2011.

Just incredible. Ironic how Rudd really screwed ‘working families’ every which way regarding property.

Ownership laws tested as agents target foreigners

Wonder how many are buying illegally?

It’s not just Rudd – although his First time Homebuyers Grant was a stoke of stupidity. it is all the dumb politicians. They are all participants in the great housing ponzi scheme. The current clowns need to be voted out but for what? Alas another set of clowns. Bring on the clowns.

This is interesting, not only are the Chinese getting their capital to a stable economy that respects individual land rights/title but they are also gaining the opportunity for residency.

What is really bad though is that the Government just wanted to stop the deflation of the property bubble for the sake of their own power.

This is so incredibly poor … to have sold out their own people to hold onto the seat of Government.

I find this abhorrent.

TM.

It’s dispicable. 40 billion dollars of Chinese money in a single year pushing up the prices of Australian property. No wonder we are all up to our eyeballs in debt. We are competing with billions of corrupt money from overseas.