On Friday, Reserve Bank governor Glenn Stevens said the housing price boom in the decade to 2007 was “unusual” and was unlikely to re-emerge any time soon.

Today it is Westpac’s managing director, Gail Kelly singing the same tunes.

News Limited reported today :

In a closed session, Ms Kelly told business leaders that the years of compound growth in house prices were over for good.

She also said Australians were rejecting the high levels of debt that allowed them to borrow vast sums against the equity in their house.

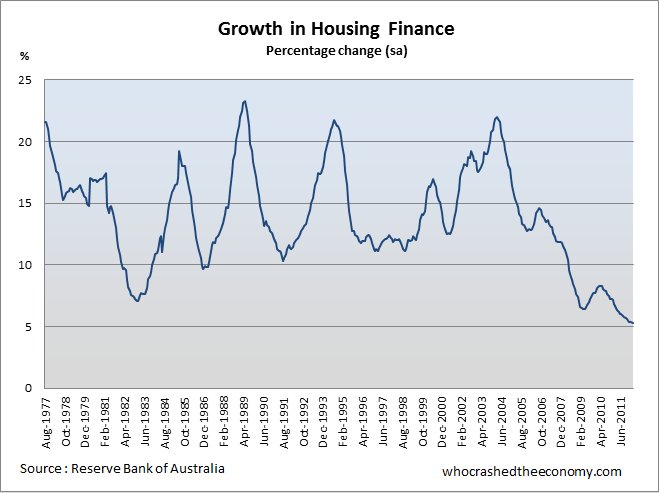

Figures from the Reserve Bank of Australia show credit growth for housing continues to sit at the lowest rate since records started 35 years ago, supporting Kelly’s claim. January, February, March and April have all recorded annualised growth rates of just 5.3 per cent.

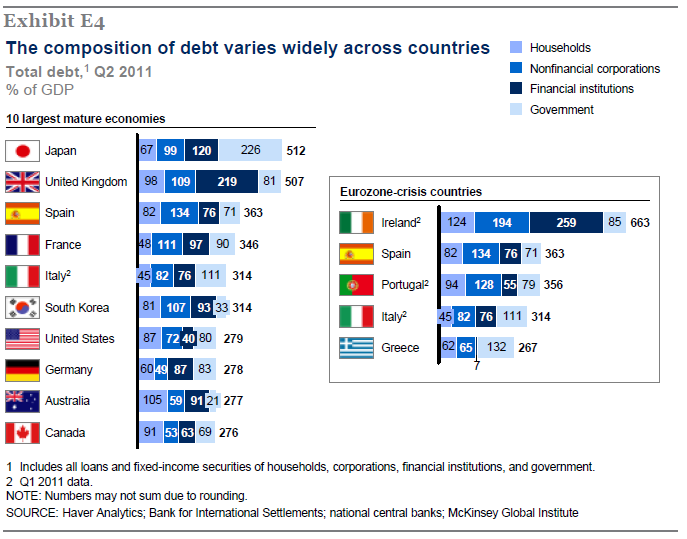

According to a McKinsey Global Institute report released last year titled “Debt and deleveraging: Uneven progress on the path to growth“, at 105 per cent of GDP Australia has some of the highest levels of household debt in the developed world.

» Westpac managing director Gail Kelly says compound growth in house prices are over for good – News Limited, 14th June 2012.

Why is Greece copping the public flogging? OK all are very deserving of a flogging, why are all eyes on Greece?

The public sector is bloated in Greece. They employ 25% of the country . . .

http://news.bbc.co.uk/2/hi/programmes/from_our_own_correspondent/9526090.stm

Hi BotRot,

imagine those bars on the right if you only look at Government debt and ignore all the others.

Greece will be the first Post War Industrial Nation to go completely bust on it’s own.

That’s the reason for the focus on Greece.

Look at the levels of debt in Australia. It is SHAMEFUL, made by greedy pigs who have the LARGEST houses in the world. No wonder it is coming to an end.

Now that the banks acknowledge that house price rises are a thing of the past and house price falls are on the horizon, expect the banks to demand higher deposits from home buyers to protect their positions.

Michael- Yes, the banks must be crying in their soup at the moment, obviously if one of the big bosses has openly admitted the high levels of capital gains seen in the past are coming to a abrubt end! The banks must now all realise the obscene profit margins made by roping gullible people into more debt than they can manage are also over. They must be worried sick about the future of their balance sheets…(boo hoo).

The thing everyone needs to learn and WILL be taught the hard way is that debt is something to be taken seriously, not friviously, even so called good debt has to be paid back with INTEREST! To sum it up simply, if you can’t afford it don’t buy it/do it.

@ Michael Francis. Agreed, but meanwhile, the sensible ones who have saved a sizeable deposit will have blown the lot on rent! i don’t know whether to laugh or cry.

This is off topic so I apologise in advance but have posted it here because of its relevance to other posts.

Source: Money Morning

Website: http://www.moneymorning.com.au

In the Daily Reckoning yesterday, our old pal Dan Denning told readers about a news scoop in the Australian newspaper.

The article notes:

‘Subprime-style lending practices were rampant during the last property boom despite claims by lenders that local practices were superior to global standards.’

The author – Anthony Klan – reveals:

‘Fitch Ratings estimates low-doc and no-doc loans now represent 8-10 per cent of the $1.2 trillion national mortgage market. That’s between $96bn and $120bn.’

We were stunned when we saw those figures. We always knew Australia had a potential subprime ticking time bomb, but how could we prove it?

The suits at the Reserve Bank of Australia and their puppets in the mainstream press insisted Aussie banking standards were far better than those overseas, and that subprime lending was only a small part of the Aussie mortgage market.

As RBA deputy governor Guy Debelle said in a speech in 2008:

‘Non-conforming loans in Australia accounted for only about 1 per cent of outstanding loans in 2007, well below the 13 per cent sub-prime share in the US. The share of new loans in Australia that are non-conforming has also been very low over recent years, at about 1 to 2 per cent, significantly below the 20 per cent sub-prime share that loans reached in the US in 2006.’

The deputy governor even provided a chart to prove it, as you can see below. However, we’ve taken the liberty of adding the real level of sub-prime lending as revealed by the Australian:

That’s right, according to the Australian, there are eight to ten times more Aussie sub-prime loans than most previously believed.

In fact, if the Australian and Fitch Ratings are right, Aussie sub-prime lending was or is only slightly lower than US sub-prime lending levels.

So rather than the banks being more prudent with borrowing standards, they were knee deep in dodgy loan applications.

And arguably the only reason Aussie sub-prime lending didn’t reach US levels is because the Aussie banks joined in later and had some catching up to do.

So it seems the outlook for the Aussie housing market is even worse than we thought…and we thought it was pretty bad. Even a higher home-buyers bribe in New South Wales won’t stop the slow collapse of house prices.

But, that’s not the worst of it. There’s an even bigger problem, which could send hundreds of thousands of Aussie retirees to the poorhouse…

Further to Craig’s comments above, Today Tonight featured some sub-prime developments last night:

http://au.news.yahoo.com/today-tonight/money/article/-/13950854/bank-lending-loopholes

Should heat up next Friday in the High Court.

Denise Brailey (Banking & Finance Consumer Support Association) has a little blog which is interesting to follow:

http://www.bfcsa.com.au/index.php/easyblog/blogger/listings/deniseb

Another expectation is the mother of all margin calls when the value of the property is less than the amount borrowed (negative equity). Occurs when the mortgage is reviewed or is rolled over. The bank then demands that the mortgage holder find the cash within 30 days to make up the difference. If the mortgage holder fails to cover the loss in equity then the property can be sold by the bank leaving the home borrower homeless with a debt that covers the shortfall which still needs to be paid.

@ Douglas yes so right but wait and see there be 2 familys living in the one large house becouse the bills will be to high for one family to pay them. no: of people living in house has all ready started to increse.

@Micheal Francis.

The loan doesn’t have to be reviewed by the mortgagee for a margin call. The bank can execute a margin call at any time.

Is only most likely to occur in the case of full market melt down, where the bank knows the market will collapse and they believe they are better off getting market value for it immediately than wait for (if) the loan to be paid out.

“Interesting conversation” overheard whilst having lunch in Miranda Fair Westfield. Two “Twenty-somethings” on the adjoining table commenting on the “right time to buy” to further their “investment porfolio”. Seems they have noticed prices are not rising, and plan to “wait a few months for the Market to bottom out, then buy just before the next big rise”.

Our point is, the “Investors” have obviously noticed that cap. gains are falling (i.e. now negative), so they are now waiting (so the “Buy now or forever be locked out of the Market” mantra is now old hat). There should be no doubt now that the general perception of house price movement is negative (and this perception has been well worked over by all the MSM “Usual Suspects”), so we’re now seeing a real change in purchasing strategies – no longer is the vendor “in charge” and in a position to name their price (and “they” will willingly come running!), rather the purchaser has now started to realise their power in this situation, and the mind-set has turned to the dreaded “if it’s cheaper now than last month, maybe if we wait another month, it’ll be cheaper still”. (dreaded for the cap. gains hunting “flipper” that is!).

On the basis of the amazingly overvalued Aussie housing market (and don’t even start us on dire build quality, and energy efficiency!), our “Investors” may be waiting a little longer that they expect for “the market to bottom”, and may be waiting until a future life for “the next big rise”!!)

We wish them luck in their venture . . . . . . . . .

I’m very likely wrong here, that’s OK cause I’ll be corrected. The numbers for Australia in Exhibit E4, states Australia’s Government debt to GDP ratio at 21%. OK, fine this could be correct.

Looking at and assuming the folks at Australian Debt Clock (http://www.australiandebtclock.com.au/) figures are correct we have (with rounding);

GDP: 1.358 Trillion

We have the Government Sector Economy debt in three categories. I don’t know whether they are mutually exclusive or not but here they are;

National Debt: 512.3 Billion

Commonwealth Government Debt: 228 Billion

Government Debt with Australian Financial Institutions: 83.9 Billion

Now if I’m on the wrong path here, so be it, I want someone to correct me. Adding the Government Sector debt yields:

824.2 Billion

Divide that by GDP and x100:

(824.2 / 1358) * 100 = 60.7%

I don’t know what constitutes what is defined to be Government debt, if you leave out ‘National Debt’ above, the debt to GDP ratio does yield, 22% (with rounding). So another question I ask out of naivity, is National debt is not Gevernment debt? Or is it something else by definition? Is it left out on purpose? Tax payers are paying off National debt? Is Australia Debt Clock wrong?

Thanks everyone.