The concensus among private housing data providers is the Australian residential property market is on the mend. Prices are once again rising, after our “mini” housing correction.

But it is hard to find the drivers of this new found confidence.

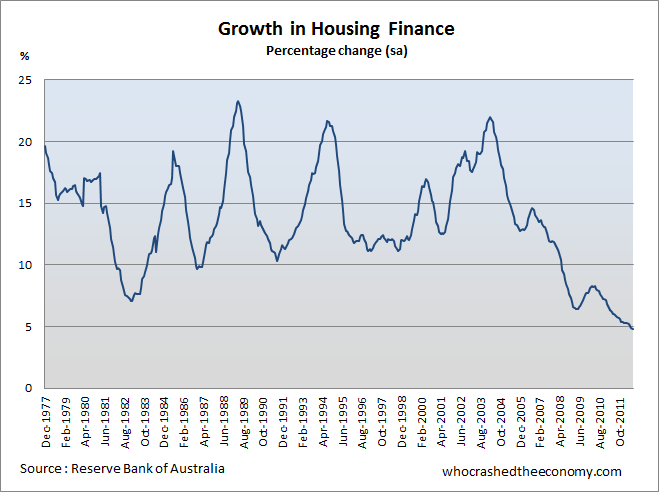

The Reserve Bank of Australia has today released the August update of its financial aggregates. Month on month growth in housing finance remains stuck on 0.3 per cent for the third consecutive month, the lowest since records exist. This pulled annual housing credit growth to just 4.8 per cent, also the lowest figure since records started 35 years ago. If there is a buying spree in our housing market, buyers are certainly not borrowing money from the bank for these purchases.

On Wednesday, the Housing Industry Association (HIA) reported the number of new homes being built has fallen to 15 year lows and down 7 per cent for the year. The Australian Bureau of Statistics (ABS) reported new housing construction fell 11.5 per cent over the same period.

Last week, research from Digital Finance Analytics showed almost a fifth of first home buyers are in severe mortgage stress and are at risk of losing their homes in the coming months. Most had loaded up on excessive debt encouraged by the First Home Owner Boost and the high cost of living is now pushing these buyers over the edge.

Martin North, Digital Finance Analytics director told News, “Most people don’t realise that the average loan size is twice as big as it was in 2005 so many people are still mortgaged to the hilt,”

“The second driver is that overall costs of living are still going up but especially for middle suburban Australians.”

» Financial Aggregates – August 2012 – The Reserve Bank of Australia, 28th September 2012.

» Number of new houses drops to 15-year low – The ABC, 26th September 2012.

» First-home buyers in severe mortgage stress – News Limited, 20th September 2012.

» Secret loan deals and discounts revealed – The Sydney Morning Herald, 23rd September 2012.

What would happen if the housing private data providers called it as it is. Increasing supply of houses to market, shrinking pool of buyers, record number of house construction companies going bust, increasing unemployment in housing industry, record numbers of mortgagees accessing their super to avoid foreclosure-the list goes on, all pointing to a huge correction of pricing with 60% falls to return prices back to the fundamental income-price-wages ratio.

This would happen; they won’t sell anymore data glossy brochures to property speculators at $500 per subscription and that spells financial disaster for RP Data, Rismark and all the other snake oil salesman that have infected the property industry.

“…buyers are certainly not borrowing money from the bank for these purchases”

This is probably mostly true. First home buyers have been essentially squeezed from the market. Investors are staring in the face at poor rental yields and stagnant capital growth. That mainly just leaves people (mostly Boomers, whom I despise) trading property back and forth.

There won’t be an American, Irish or Spanish-style bust in property. Just a long-term reduction in equity thanks to inflation. With the peak of the mining boom behind us, this will go on for the next 15-20 years. This is how long it will take for the price-to-income ratio to fall to its historical level – about 3-4 times annual income. Without the mining boom, this will sap strength from the entire economy. We’re looking at 15-20 years of economic stagnation.

Australia’s luck has run out.

Its not only first home buyers being squeezed, people on their 2nd even third home (I do speak about the very few people I know personally) that, upgraded big-time during 2004-2005. They’re also waking up at 3:00am not being able to sleep through the remaining wee hours.

That graph above, that part of the roller-coaster (2003/4 -> Oct 2011), is the part where people scream and puke.

Just thought I’d correct the article……

It’s not : “If there is a buying spree in our housing market”

I think it is actually : “If there is a lying spree in our housing market” – which is closer to reality of course.

On the same subject, a guy at work applied for a mortgage on a new home and all I can say is that I’ve never seen the ANZ move so quick to secure someone as a customer. I guess when they are few and far between you have to be quick!

All good points re cost of living squeeze etc etc. I think official CPI data has been just as big a lie. It’s been fun watching the squeeze caused by the official data being watered down to keep interest rates and wage claims low. At the same time greedy buyers have leveraged to their limit, with the subsequent house price inflation being a large contributor to general inflation throughout the rest of the economy.

So, they’ve mortgaged themselves to the hilt thanks to those low interest rates and at the same time those low inflation numbers that have underpinned puny wage rises (that are then taxed), have sent their real standard of living backwards. It’s difficult to get ahead when the cost of living is far outpacing increases in your income, all the while a massive debt anchor remains attached.