Treasurer Wayne Swan describes today’s 25 basis point cut to the official cash rate as “the early Christmas present that hard working Aussies deserve.”

In a press conference after the Reserve Bank announcement, Swan told Australian’s “We’ve now had the equivalent of seven rate cuts over the past year and of course that’s been made possible by the Government’s economic management, strong budget management and, of course, contained inflation. But it’s also good news because it comes at a time when unemployment is low and economic growth is in much better shape than many other developed economies.”

Today’s rate cut brings the cash rate to 3.00 per cent equal to the low recorded during the heights of the Global Financial Crisis (GFC), a point not missed by one journalist who quizzed Swan with “Didn’t you once refer to the level of three per cent as an emergency level, so how can today be all good news?”

But Mr Swan was quick to say things are different now. “Well, I’ve noticed today that there has been some characterisation about the level of rates now and a comparison with the level of rates back at the height of the Global Financial Crisis. Anybody who thinks that rates are at their levels now for the same reason they were at lows during the Global Financial Crisis simply can’t be taken seriously when it comes to economic policy.”

Kicking the can down the road.

Many will know since October 2008, I have been predicting a day when the wheels once again fall off and the Reserve Bank is forced to cut interest rates in vein to levels surpassing the GFC. How did we know?

We will let Wayne start the story. Earlier today he said, “Let’s go back to the Global Financial Crisis: the global economy fell off a cliff, global growth was minus 0.6 per cent back then. Global growth is just below trend right now. Anybody who is making a comparison between rates then, at the height of the Global Financial Crisis, and rates now and saying that they are at the same level for the same reason, is simply unqualified to run a modern economy.”

Unqualified to run a modern economy

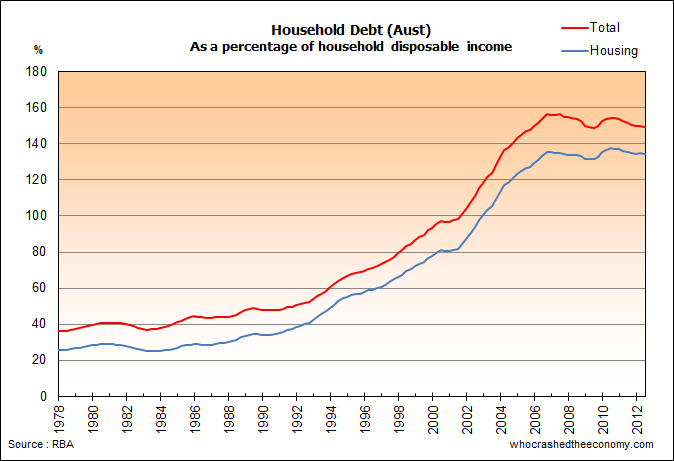

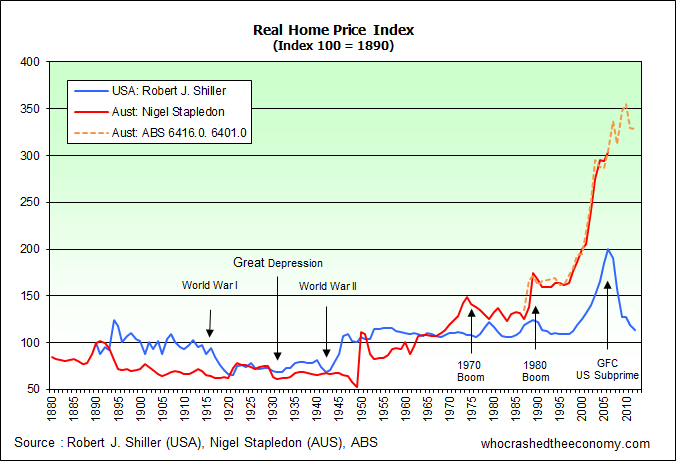

In the two decades prior to 2008, Australian households had an insatiable appetite for debt. Household debt levels grew from 40% of household disposable income to just shy of 160%. 90 per cent of this debt was “invested” in the residential property market. But we were not alone, many countries saw similar unsustainable growth in household debt levels or house asset prices and this lead to the GFC.

But, in Australia we pretended everything was fine. With debt levels this elevated, a housing crash and associated deleveraging cycle would have been catastrophic to the wellbeing of our country. The then Prime Minister Kevin Rudd said “As Prime Minister I will not sit idly by and watch Australian households suffer the worst effects of a global crisis we did not create.” It was clear; we had no role to play in this. None the less, an unprecedented stimulus package was needed to counter the effects.

If a source of David Llewellyn-Smith is right, the GFC stimulus package was designed by Treasury and provided to the Government with one omission. Yes, it was missing the First Home Owners’ Boost (FHOB). Our politicians threw this gem in later.

Rather than try to encourage Australian’s away from their debt addiction, the Government embraced it. Free money was offered to naïve young Australian’s to leverage up into the Australian dream. Instead of letting an unsustainable bubble burst, they assisted to turn a large bubble, into an even bigger one; I suppose you could call it a super bubble.

From the Government’s point of view, it was a leveraged stimulus plan – The Government provides $7 or $14k and gets tens of thousands, if not more, effective stimulus in return. Leverage had worked so effectively for decades prior.

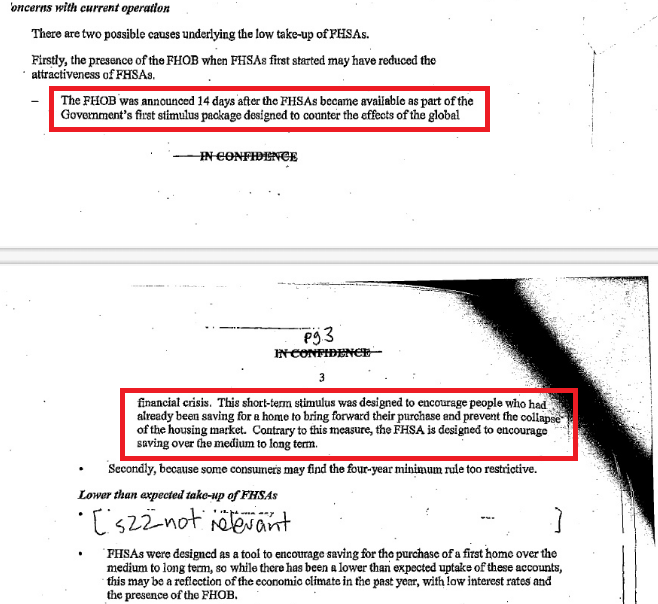

Treasury executive minutes on the First Home Saver Accounts stated “The FHOB was announced 14 days after the FHSAs became available as part of the Government’s first stimulus package designed to counter the effects of the global financial crisis. This short-term stimulus was designed to encourage people who had already been saving for a home to bring forward their purchase and prevent the collapse of the housing market.”

It begs the question then, what happens when the stimulus finishes and all the first home buyers have brought their purchases forward? What, or who will fill the void?

This is the answer:

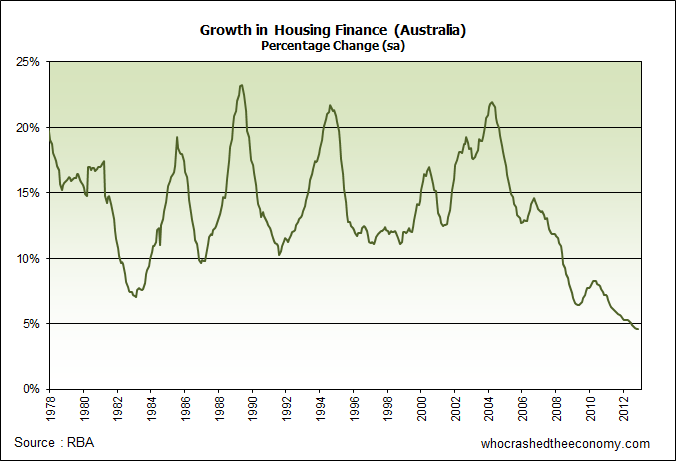

No one. Credit growth for housing is now running at levels not seen since records started 35 years ago.

Really, who would have guessed?

Falling house asset prices and deleveraging is now denting consumer confidence. The official cash rate might be 3.00 per cent but no one is buying.

Double trouble in The Lucky Country

While household debt levels were rapidly rising around the world, so was consumption. China was the biggest beneficiary. When the world economy ground to a halt in September 2008, China too, like many other economies was forced to enact stimulus measures.

For China, it told its state owned enterprises (SOEs) to build stuff – new office towers, new shopping centres, and new apartment blocks, new highways and railroads. To do this, they need resources – Australia’s resources.

Clearly, I am hardly qualified to run a modern economy, but you have to ponder what the outcome would be today, if Australia’s elevated housing bubble was left to correct and households were to deleverage. As luck has it, we may have been supported through this difficult time from a mining boom caused by China’s stimulus package. Observing the United States housing market, asset prices have almost returned to sustainable long term trends.

Instead, we now have more headwinds and challenges ahead.

China’s stimulus is running out as SOE’s crippled with debt start winding back fixed asset investment. This has caused Australia’s mining investment boom to wither, at the same time local residential construction is plummeting due to affordability and risk aversion.

The perceived safety of Australia has caused the Aussie dollar to remain artificially high and as Dutch Disease settles in, manufacturing is dying a slow death. In a once supercharged economy, productivity has taken a back seat.

But our Government does have a plan. It hopes housing construction can take over from where our commodities super cycle left off. I guess all we need is more leverage and another housing grant.

» Press Conference, Treasurer Wayne Swan – 4th December 2012.

» Statement by Glenn Stevens, Governor: Monetary Policy Decision – The Reserve Bank of Australia, 4th December 2012

We’ve been given notice to be out of our house by January 1st! Besides completely ruining Christmas, it begs the question how the law allows this kind of behaviour over the holidays when nobody works, and the timing just seems cruel more tan anything. Anyway, as a tenant, I am scum and the law is not on my side, so my family and I must now find a home in the next couple of weeks.

The point I’d like to make is that I have been to 10 open-house inspections over the last few days (which, as you know, last 15 minutes) and we we the ONLY people who showed up. The real estate agents at all the properties told me the houses were for rent because they could not sell at the asking price, so the owners have decided to ‘sit out the market for a while until it picks up’. Most (not all), but most of the houses we saw were in dire need of updating and redecoration, yet were on the market for around $1500 a week. These are 4 bedroom houses in Sydney’s North Shore with gardens. A swimming pool adds $500 a week.

So, as tenant scum, I’m expected to fork out just under $2000k a week for a sub-standard house that I can be given 4 weeks notice to leave! If we are to become a nation of renters, isn’t it about time tenants had many more rights and landlords had to pass certain ‘standard of living’ tests before greedily asking for $100k a year in rent? Should there not also be a rental valuation tribunal, instead of just following ‘the market’, which is skewed by the wealthier suburbs and by millionaire salaries?

I’m disgusted at the rental sector in Australia. I’m horrified at the apathy I’ve received from real estate agents. And I’m baffled at the utter stupidity and greed from property owners who prey on people like me who HAVE to find somewhere to live and will charge the earth for the right to do so. Real estate agents are unregulated and have total arbitration in setting the price. I know it’s a free market, but it doesn’t make it right. With two kids, two cats, and as someone who works from home, I NEED a four bedroom house. Why, oh why, does it have to be so bloody expensive to have that?

The whole property industry is rotten to its very core.

Next year is an election year. At the rate the economy is deteriating, do you think a new bailout is just around the corner? I’m thinking of a FHOB, and a FMOG – a first mine owners’ grant. I hear there is not a lot of profitable mines in Australia.

Wow, fantastic article and overview of what has happened and why so far, especially the link between the China stimulus package and our mining boom. Assuming the government doesn’t stick their nose in again (unlikely) it seems like the air in this super bubble (love that term too BTW) is to slowly eek out over many, many months.As much as everyone would like houses prices to snap back to their long standing means and become affordable again overnight, it would be such a detrimental blow to the economy that it just wouldn’t end well for anyone I think.

For the moment I, like many others, am focusing 100% on trying to get rid of all the mortgage debt we have. Feel free to join me!

Q. What’s the next “housing stimulus” to come our way???

A. GovCo of either persuasion will let us dip into the Superannuation cookie jar in the supposed interests of affordability.

Our challenge is to find a voice in response to that. I’m all for gaining more control of my super, but not at the expense of keeping the bubble going via intergenerational wealth transfer.

An alternative? Lobby for an Aussie version of the Canadian Tax-Free-Savings-Account. Given the monumental failure of the First-Home-Saver-Accounts would it be that hard to tweak them to into something resembling the TFSA?

I can see several benefits to doing so.

I do believe 2013 is going to be “the correction we had to have” for Australia. Historians will know it as: The Great Correction.

You know who is really going to suffer? The Baby Boomers. Why? Because they are sitting on huge stockpiles of property – an asset that is deflating in value. Coupled at a time when they need to switch to capital preservation investments (i.e. fixed interest) – an asset that pays less with each RBA meeting.

I feel a tinge of schadenfreude coming on. Collectively, the Boomer cohort created the property “super bubble” and now they are going to dearly suffer the consequences when it bursts. Haw haw.

Rupert, $2000 per week? or per month?

2k a week should get you a very nice place?

I’ve been hearing ads on the radio for seminars showing people how to use their super annuation funds to invest in the housing bubble. They emphasise the tax breaks and the potential of our booming property bubble.

So it has begun….

http://www.rba.gov.au/speeches/2012/sp-dg-051212.html

And now Lowe has had a crack… In his speech titled “What is Normal?”. The RBA is getting all philosophical on us, opening the night’s dinner speech with…

“The Oxford Dictionary defines the word ‘normal’ as ‘conforming to a standard; usual, typical or expected’.[1] The question of ‘what is normal’ therefore seems an appropriate one for an annual forecasting conference. For many of us, our days are spent looking at economic and financial developments and asking whether they are ‘usual, typical or expected’. And if we conclude they are not, we ask ourselves will things return to normal, and if so when, or has normal changed? Like many of you, I often get asked if what we are seeing is ‘normal’, ‘the new normal’, ‘the old normal’ or is it something different?”

He goes on… to enlighten us…

“Finally, the sixth graph shows the increase in our living standards – measured by the rise in real income per hour worked…”

I’m noticing one thing here though… all of the reasons for our ‘growth’ are so legit. Rising income eh… LOLe10!

How about rising income on paper because so many people lied about their $$$ to get the approval? Real income per hour = decreased while house prices went up, and real income is non existent. All I hear is $70k average income all the time recently… honestly, WTH is so accurate about an average? 1,2,3,4,5,6,7,8,9,50000 = average of $5004.50. 90% of that population is pretty F*CKED tho… remind you of anywhere? Who else wasn’t paying attention in year 8 maths… bloody sickening.

@Adelaide, 2k a month in Sydney gets you a 40 year old 2 bedder with herpes… sorry I mean a landlord with herpes. The unit itself would probably just come with some broken fittings in a racially and religiously skewed suburb which you’d better be on the right side of. What’s the go in SA?

But Jj who pays $2k a week rent? Id only pay that if I was on 400k plus PA.

I wouldnt think $1500 a week would only get you a place “in dire need of updating and redecoration”.

But I havent rented in many years, and never in Sydney.

Just look on Domain folks. $1500 a week in Sydney will get you a house with an old kitchen from the 1970s, basic bathrooms and a house that has damp and mould in the winter. The standard of building in Australia is appalling. I’ve seen 20 properties in the last couple of weeks and they all need some work.

Of course there are excellent houses out there for that price, but they get snapped up very fast. The problem is REAs over-valuing the crap based on square meterage and ‘current market prices’. Quality and amenities are not taken into consideration. The BIG problem is REAs are either bone idle and useless or they fancy themselves as ‘junior’ executives. Either way, it is an unlicensed profession, with no training or regulation and these leech-like vermin are more to blame for the current crisis than the banks.

I’m no fan of irresponsible lenders and greedy banks, but companies like McGrath are ten times worse in my opinion. They are nasty, useless, voracious & rude. They take pretty pictures for the website, but when you visit the properties, you’ll be shocked at the low standard of work they’re trying to fob off to potential tenants at outrageous prices.

Remember folks – some people, including me, are being forced to spend 70% of our incomes on rent – AND WE HAVE NO CHOICE!!!

We rent for $500 week a large house no pool 3br. Bring on the crash..

One thing the author overlooked is that this is Australia “she’ll be right maaaaate” ! we are different. ; )

The collapse is going to be a economic collapse world wide caused by america not being able to pay their bills, meaning the dollar will collapse and hyper inflation will begin, buy physical gold and silver now, this will happen somewhere between 2013 to 2015, very soon