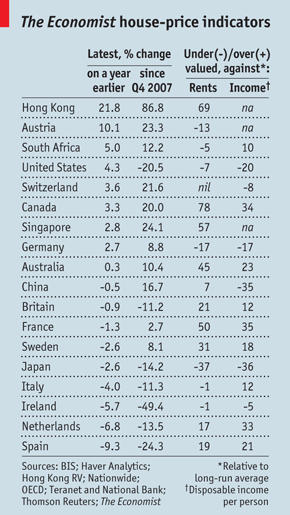

The Economist Magazine has just released its latest round-up of Global House Price indicators.

According to the analysis, Australia’s house prices are 45 per cent overvalued on a price to rent ratio and 23 per cent overvalued on a price to income ratio:

This is down from the November 2011 assessment of a 53 per cent overvaluation on a price to rent ratio and 38 per cent overvaluation on a price to income ratio.

The interactive house price tool can be found here.

» Home truths: Our latest round-up shows that many housing markets are still in the dumps – The Economist, 12th January 2013.

» Australian house prices could fall by 25% “OR MORE” – Who crashed the economy?, 26th November 2011.

How can there be such a radical change in percentages since Nov 2011?

The change in the price to rent ratio is moderate. We have house prices trending down slightly, while rents are rising a little more than inflation.

The radical change in the price to income ratio has to be due to the income component rising a considerable amount. The Economist state income is disposable income per person. Could it be mean income and we are all “benefitting” from the tail end of the mining boom, or maybe the recovery of equity markets? I’m not sure.

The Economist does at run strange stories. Once suggested that Australia is comparable to Calfornia with its high tech silicone valley, whereas Australia is much closer to resource rich Saudi Arabia, economically speaking.

But there does appear truth in this article.

Boral is cutting 8% of its on shore workforce due to the property market slump. Next couple of years will definitely be negative growth despite property market analysts predicting 3-5% growth. Don’t see articles about a shortage of residentill dwellings anymore 🙂 most articles are about a glut of properties on the market and unrealistic seller expectations

@ Fred

Would you be able to provide a link to your claimed statement? I am interested to find out the time of the publication and the validity of the statement.

Could be this one (not sure but highly probable) http://www.economist.com/node/18744197

Mortgage Crisis in a Nutshell

http://www.youtube.com/watch?v=YBbwb6Sv4PM

guys, you have to see this.

http://smh.domain.com.au/real-estate-news/economist-tears-roof-off-affordability-study-20130121-2d2e4.html

I tend to agree prices will further decline. However, I’m not sure it will be a rapid decline, rather a gradual easing for two reasons. There does not appear to be a great deal of over supply nor does there appear to be much supply coming to market, with the exception of in Victoria (which not surprisingly has seen some of the biggest price declines). Secondly, interest rates remain low and could fall further, which should contain supply somewhat, although an increase in interest rates may make servicing home loans difficult and necessitate fire sales, which would accentuate the falls in house prices.

http://www.youtube.com/watch?v=6zS7RTiipww

Lol… House valuations not an exact science…

http://smh.domain.com.au/real-estate-news/millions-may-have-overpaid-land-tax-rates-20130127-2dezp.html

Its coming this year:

http://www.youtube.com/watch?v=6zS7RTiipww

Hi,

Like your blog. But it looks like the resilience in the Aussie market is not providing much ammo for you in the past month.

Just because something is overvalues does not mean prices will crash. When supply is restricted and government polices are in place that encourage gearing, there is plenty of support for the current prices.

The arrogance of the pro-housing group absolutely astounds me.

Credit growth is in clear decline. Australian’s are paying down debt at record rates.

Yet a few fools continue to pay waaaaayyy too much for these homes, in the belief that it is the new norm.

Remember Telstra shares at $9 ea.????????? Yeah, that’s right, only a few people were paying $9 ea, but that small minority distort the figures.

And I love the whole “prices will drift downwards slowly” argument. What makes you say that? Seriously, what evidence exists that a bubbled frenzied asset will ever decline gradually?

THERE ISN’T ANY! It’s a phenomenon known as consumer behaviour. Once the asset looses it’s ‘cool’ status, it will be a ‘dud’ investment (ironically the best time to get on board the investment).

This stuff is so predicable that there are old men (usually) around the globe who make insane amounts of money from these trends. Yes, some are finance types that work in banks. But the real heros of finance work alone at home, and don’t discuss these topics with “the general public”.

Why? Cos they are so damn sick of listening to why they are wrong, and this time is different, and we are not America, and our banks are stronger, and our en-employment is good, and our debt is so low, and property never goes down, and shares are risky, and they ain’t making any new land, and our government restricts land releases, and there’s never a better time, and property is risk free, and immigration will keep prices rising, and the government will never let house values fall, and people will eat baked beans before foreclosing, and as long as you are making some sort of payment the bank will never call in the loan, and foreigners are buying all the housing…………………

OMG, what a broken friggin record.

At the end of the day two inputs have lead to this housing bubble.

That’s all, two.

Wanna know the secret?

Ok, here goes:

1: Access to easy credit in amounts never thought possible even 20 years ago (Does anyone remember when $1 million dollars was exclusive? Hell, these days the guy on $20 per hour with a wife who is an untrained secretary has access to over $1 million in credit. Disgusting as this is unlikely to ever be paid back…..Yeppa, all those deposits are covered by the Australian Government Guarantee……Moral hazard anyone?)

2: Mass perception that property is an outperforming, non-risky path to riches (not wealth, riches! You know, the cars and boats and bikes and iphones and massive plasmas and members tickets etc etc.)

Oh I am so bored of this debate. I am so like that guy in the above youtube clip…..No s#^t, a tsunami is coming. And my belongings are up in the mountains. Yeah, I had to give up my week ends and spare time to do that. I missed the cricket and the tennis, and I’m yet to play Halo 4.

But it’s nice to see that most aussie’s got a nice tan at the beach, had a few imported beers to unwind and have had a good time.

BUT be f#$ked if you think I’m gonna run my businesses at a loss or pay excessive taxes to rebuild the average aussie’s life after everything is swept out to sea.

The aussie dollar will tank. Interest rates will skyrocket. Poverty will be wide spread. I can’t predict when, but it is within my lifetime, nothing is surer.

Not even a Coalition victory in September.

@Matt. I agree with everything you say – put very well, but… Bill O’Reilly – oh purleeease. He’s nothing more than a right-wing, Obama-bashing, shock-jock. He will NEVER accept that the collapse of the US economy started under Bush. Having a YouTube clip of Bill O’Reilly on this excellent site is lowering its standards. So, if we’re going that way – here’s a gratuitous picture of some naked titties. Come on guys… Bill O’Reilly? Really?