In a talk to the CEDA Housing Forum today, Tony Richards, Head of Economic Analysis Depart at the Reserve Bank of Australia said :

It is looking increasingly clear that Australia has avoided the large falls in housing prices seen in some other countries over the past two years or so. This is a good thing, because of the macroeconomic difficulties that have accompanied those price falls in some countries. But, looking forward, the risk is that we might move towards undesirably strong growth in Australian housing prices. This raises a number of concerns, which seem to be widely shared in the community, as is witnessed by conferences such as this one.

Despite the number of concerns, the media has latched onto this opening paragraph and the headlines today read “House prices about to soar, says RBA”.

But is the report really as rosy as the media would want you to believe?

The talk focuses on developments in the cost of housing in Australia, looks at both the supply and demand side arguments and ends with the incidence and consequences of high housing prices.

While the media chooses not to focus on the consequences, we certainly do. In fact, let’s start here. Mr Richard indicated :

It is important to remember that housing is a consumption item. We all need to consume some level of housing services, either rented or purchased. So a higher level of housing prices and rents allows less spending over our lifetimes on other items.

This is something we have focused on with quite some detail in March with the post Time to pick and choose: Housing or Jobs. Here, we show if housing costs continue to increase faster than wages or household income, household discretionary spending must suffer. Pay too much for your shelter, and it’s something you will pay for over the term of the loan, or in Mr Richard’s words, your lifetime.

This is very worrying when you think of this in the context of our ballooning household debt to income ratios. In the last twenty years household debt has quadrupled. In the late 1980’s for every $1 an Australian household earned, they had 40 cents of debt. Today, for every dollar they earn, we have $1.60 of debt. Debt is a lot easier to acquirer than it is to pay down, hence the effects of the current housing bubble and associated household debt has the potential to stifle domestic growth for decades to come without even worrying about the effects of a new bubble, caused by an emergency 3% cash rate and first home buyer boost bonanza from the government.

Other aspects of the talk, focused on the supply side argument of the housing bubble. The report looks at population growth and makes reference to last weeks figures where population growth in the March quarter peaked at 2.1 per cent. Also on the supply side is the increase in household income. Mr Richards says :

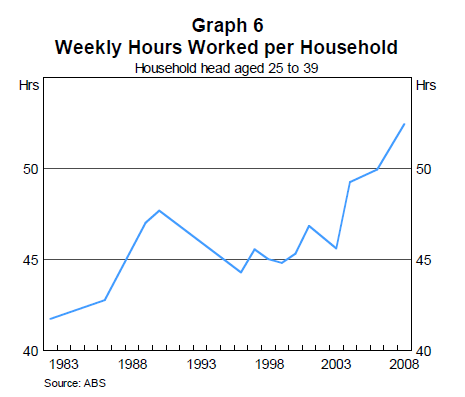

“Indeed, there is another example of this in the Survey of Income and Housing. The survey allows us to calculate the average hours worked by households. The data show a significant increase over several decades in the hours worked by households headed by those aged 25–39 years, the age when households tend to enter into homeownership (Graph 6).”

Households will spend much of their household discretionary income in the local economy. It could be a cafe latte and newspaper, a new kitchen or a plasma TV. None the less, they all employ people and create jobs. Any loss of discretionary income will effect jobs or the number of hours worked.

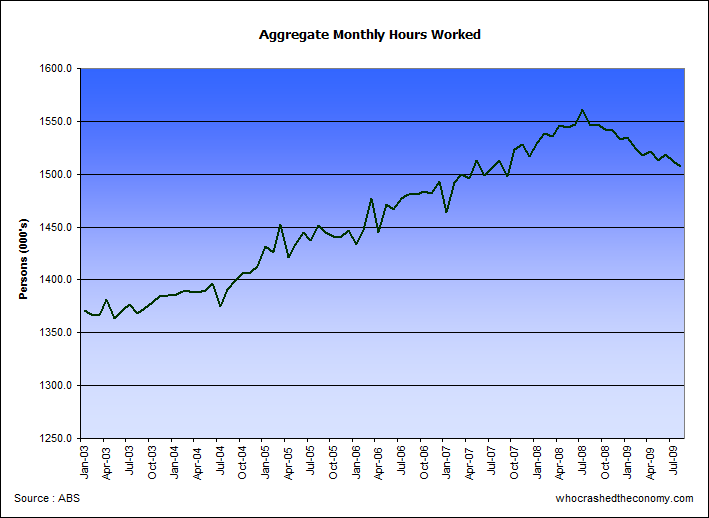

As we have seen in recent months, while ABS unemployment figures are holding above water, the aggregate number of hours worked is plummeting. Employers are opting to have a 4 day working week, rather than retrench staff. The likelihood of seeing rising weekly hours worked per household now is about the same than a flying pig.

Today the Commonwealth Bank took the lead and has increased mortgage rates while Maquarie Bank interest rate strategist Rory Robertson says back-to-back interest rate hikes of up to half a percentage point are now “looking increasingly firm” in November and December. This combined with rising unemployment and the four day working week due to falling discretionary spending and rising housing costs could just put the dampener on “soaring” housing prices.

» House prices about to soar, says RBA – The Australian, 29th September 2009.

» Interest rates ‘double-whammy’ – PerthNow, 28th September 2009.

These suits just don’t get it.

There is only so much we can earn. There is only so much we can pay back. There is only so much we can borrow.

When all three of those are shrinking, how can a consumption item disguised as an asset continue to out-strip income?

I ain’t scared of interest rising. Not at all. I welcome it. I got a list of houses I’m gonna purchase. They are all idiots at work who have extended themselves beyond belief. One guy has $15 left per week after his repayment. Oh yeah, they’re trying for kids….Hows that gonna work when she stop working?

Another guy eats 2minute noodles 3 times a day. But he “owns” his own house.

Its laughable how we got to this point. How stupid people are.