The Sydney Morning Herald reports :

Households will begin to feel the impact of more interest rate rises, after years of racking up more debt, a report shows today.

The Melbourne Institute Bulletin of Economic Trends for November flagged the increased likelihood of a Reserve Bank rate rise in December as the economy’s recovery gathers pace.

However, the research group noted that rising household debt would become a bigger factor for Australians as interest rates rise.

This year has been lost on Australians. While the rest of the world comes to grips of the consequences of spending beyond their means, year in, year out, Australian’s have been out accumulating more debt.

That said, we did get off to a good start, but the temptation of “emergency low” interest rates got the better of us.

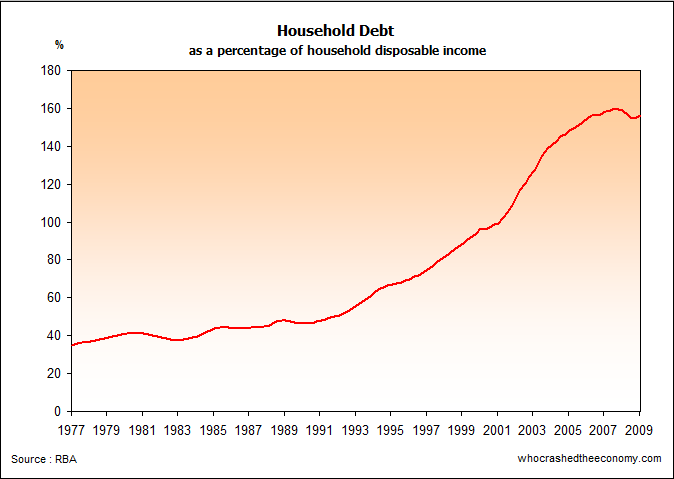

As the Sydney Morning Herald article indicates, Household debt as a percentage of household disposable income has been accumulating into a mountain for years. In the June 2008 quarter, debt peaked at 159.0%. If your household disposable income was $100,000, the “average” household would have $159,000 in debt.

The GFC brought a rethink of debt levels. Australian’s started paying down debt in droves, and for the next 6 months they made a good go at it. But then the RBA intervened and sent Interest Rates plunging.

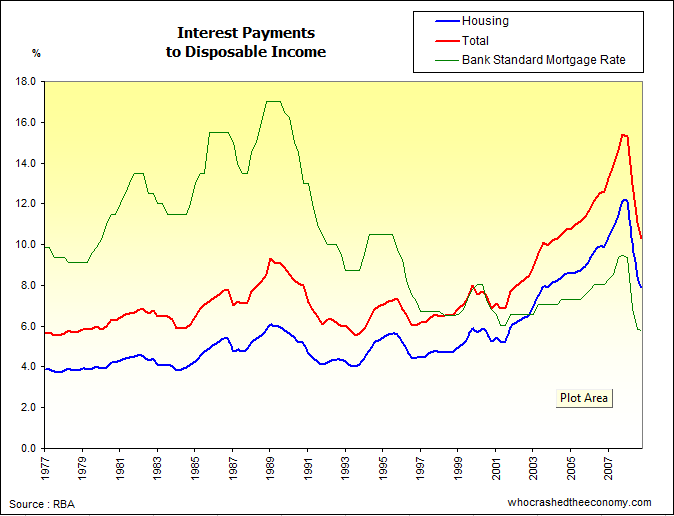

The above graph shows the percentage of disposable income used to service debt. The blue line represents mortgage repayments, while the red line shows total debt repayments. Look what Falling interest rates did to payments.

However note, the payments today, at emergency low interest rates are still higher than in 1989 when interest rates peaked at 17%. It is due to the shear mountain of debt households have now compared to 1989.

Interest rates are now on the way back and with the level of debt owing, will cause payments to skyrocket. With Market expectations for Interest rates to return to 5.25%, Australian’s may have wished the paid down more debt when they had a chance.

» Households set to feel debt squeeze – The Sydney Morning Herald, November 20th 2009.