In our last post, we reported on Harry Dent arriving in Australia to promote his new book. On Wednesday morning, Mr Dent appeared on Channel 7’s Sunrise telling David Koch his belief that Australian housing is likely to fall as much as 50 percent as the world is hit by a new economic tsunami of a larger magnitude than the first GFC. He stresses if you are a young couple, due to be married, do not buy a house now. If you are older, do not buy a vacation home or retirement home now, wait. But if your children are leaving the nest and you want to downsize, Dent says downsize now to reduce your exposure to real estate.

To watch the segment, click here.

This is not the first time, bearish reports on housing has aired on Sunrise. David Koch questioned if Australian’s were being told the truth about housing earlier this year.

Today, the experts were on Sunrise to counter Dent’s argument. First up was Craig James who said “Well It may be correct in the terms of the United States, it may be correct in terms of some of the other economies, but they are forgetting the fact that Australia has population growth. We have population that is rising. They are forgetting though, the fact that we haven’t got large tracts of land which are empty, huge apartment blocks, or homes that are empty, so we don’t have a housing oversupply – it’s always about demand and supply.”

Craig James clearly believes population growth, a shortage of land and “demand” can cause perpetual growth in house prices and overlooks the possibility that at some stage, people simply can’t afford to purchase property causing the Ponzi scheme to collapse.

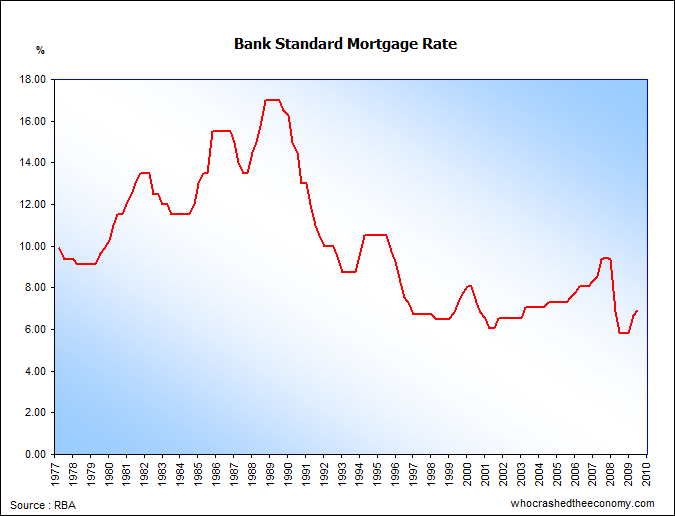

Next up was Mark Boris of Yellow Brick Road. He says over the next 6 to 9 months it’s probably a great time to buy. “What is probably making house prices a little tough at the moment is it’s an expensive interest rate environment.” – Sure is Mark, just have a look below how expensive interest rates are compared to the last 30 years.

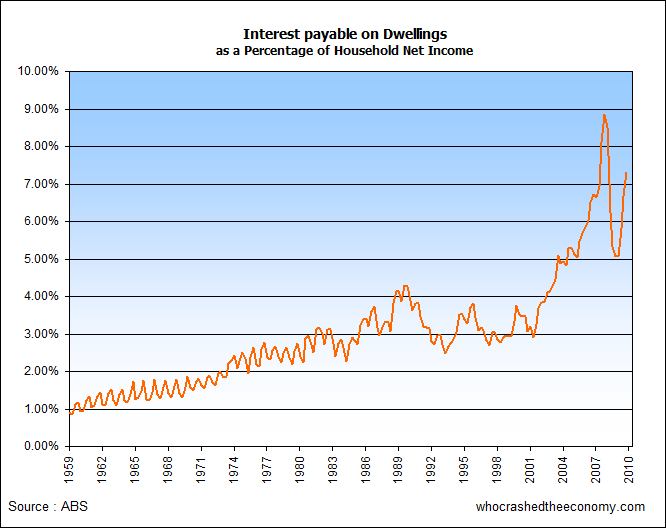

Maybe it is not expensive interest rates, but rather the mountain of debt we now have which causes interest payments to be sky high.

To watch today’s counter argument, click here.

But while the experts debate the housing bubble, the Australian Bureau of Statistics (ABS) yesterday released Dwelling Unit Commencements for June showing new homes construction is down 18.6 percent seasonally adjusted for the year.

In NSW, housing starts plunged 20.1 percent in the three months to June causing the Urban Taskforce’s chief executive, Aaron Gadiel to call for an emergency housing supply plan, urging the government to do something – anything!

“That’s a massive drop,” Mr Gadiel said “It’s NSW’s biggest single quarterly fall in five years.”

According the the Urban Taskforce press release “The Urban Taskforce is a property development industry group, representing Australia’s most prominent property developers and equity financiers”

Despite all the hype, starts in the Northern Territory fell 69.3 percent over three month period!

The Sydney Morning Herald reported on nabCapital chief economist Rob Henderson who said the numbers were “a surprise” and “worse than expected.”

The paper wrote “Typically a shortage of house[s] while people were looking to buy them in an expanding economy would lead to price rises. But Mr Henderson said houses have become so expensive many would-be buyers can’t afford them.”

Spot on Mr Henderson!. Someone is on the ball.

» Economic tsunami warning – Sunrise, 14th September 2011.

» Predictions house prices will halve – Sunrise, 15th September 2011.

» NSW housing in big trouble, 20 per cent decline, emergency plan vital – The Urban Taskforce, 14th September 2011.

» More gloom as home starts fall – The Sydney Morning Herald, 14th September 2011.

Gloom ? I’ll give you gloom….the price of bread is falling.

The is an under-supply of ‘AFFORDABLE HOUSING’.

Looks like some deflation heading to Australia’s shores. I love the trusted experts, they all have their barrow to push, build confidence, great time to buy blah blah blah!

I wonder how the first home owners in Caboolture QLD are feeling now, seeing Bouris still pumping real estate in a falling market. Nothing is selling for anything close to want was paid in 2009.

Enjoy your mortgage payments sheeple, I hope the lifestyle of home ownership is all that it is cracked up to be.

How does chained to the house sound? Taking a gap year? NOT

Crashing the economy has never been soo easy, once the sheeple are loaded up on debt. Now we need the UN Carbon tax to really drive the knife in………….

Now where I live it costs roughly the same, maybe a little bit less to purchase a house and land package and build than it does to purchase a pre-existing home. Roughly $120 000 to $160 000 for a house, and up to $260 000 for a good bit of land, packaged between $300 000 and $400 000. A little bit under the median house price of the area……for a brand new home on about 200-300 less squares, but with better heating/cooling and environmental ergonomics than older homes. Yet new constructions are falling?

Be careful what u wish for. We may all be out of a job soon.

Funny how back in 2008 Bouris was telling everyone that’s struggling with a mortgage to “get out now” or “within the next 12months”. (It was a lateline interview I believe)

Fast forward to an environment where firms selling personal wealth and finance are struggling, and he now pushes now as a great time to buy…….

One of the larger RE firms in Adelaide is now advertising how good they are in a “bust” market and let them sell your house…….

Great time to buy? I don’t think so.

fhb dreamdog, I’ve been there in the past and it ain’t pretty thats for sure, but long term it might be better for all of us if we had an uptick in unemployment and recession. We might come out the other end more productive and return to being an affordable country where people can make positive contributions rather than being shelter shackled to banks for 30 years. A simple buffet breakfast at a 4 star hotel won’t cost you $41 and a plumber installing some taps for two hours won’t set you back $500+materials. This is the fallout from 20 years of cheap credit, poor housing policy and dumb fiscal measures.

It’s now starting to bite and it’s saying something when a good friend who’s been here 10 years is taking his Aussie born and bred kids and family back to India………for a better life.

@ fhb dreamdog – I was recently informed that I will be made redundant in 2012. Many people where I work are in the same situation.

These so called Australian financial gurus are a bunch of tools and now very little. People like Harry Dent and Steve Keen know what they’re talking about. Although Michael Pascoe bags out Steve Keen for getting it wrong in 2008, he would have been on the money if the Govt hadn’t pumped a large stimulus into the economy.

It seems strange that Harry Dent is saying the world is going to be hit by a new economic tsunami of a larger magnitude than the first GFC and that silver and gold are in a bubble! Wouldn’t that make Gold and Silver a safe haven?

50% falls ? I love it when people like this tool just pluck a random fig like 50% out of the air!

I don’t believe 50% is plucked out of the air. To revert to long term trend, housing will fall by 50%.

Reality is that it will probably fall further, as human psychology causes us to consume/sell in groups.

Never mind the fact that Australia’s productivity is falling in real terms, our domestic economy is already in the toilet, and our banks have foolishly borrowed from the USA Federal Reserve (so when the USA bumps up rates, our banks will HAVE TO follow)…I just don’t see how housing can sustain these crazy heights. After all, who is paying the mortgages on these things?

The taxpayer and renters.

well, I guess I was right in waiting to upgrade. Instead, I just received my yearly bonus for the year and put it directly into the mortgage, now the mortgage is looking almos non-existant. I think I’ll wait now. My wife and I and two young kids will be a little cosy for a while and I wont have a formal study (apart from the kitchen table), but who cares, at-least I can guarantee to put bread on the table…

I live in the eastern suburbs of Sydney in an area fairly densely packed with units. Till recently, the real estate agents were littering letterboxes with junk mail about record prices they had achieved and how many cashed up buyers had missed out on their last property and how they would be ‘in your street next Monday to do official appraisals’. You know, the usual sort of rubbish we’ve all seen. Today a real clanger from a major, well established agency (McGrath) got my head spinning. It basically said that the easy days are over and that if you want to sell you cannot be ‘an unrealistic vendor’, think your home or unit is somehow special and worth more than recent sale prices suggest or insist on a sale with no advertising budget and no open house viewings. Now it is all 100% the truth – but as a sales pitch from a real estate agency, what gives????? Prices have come down but not dropped much (yet) in this area. However, while there are ‘For Sale’ signs everywhere, the volumes of actual sales in this area have fallen off a cliff. Pretty much 2/3 auctions get passed in and the ‘Sold’ stickers are few and far between now. I guess the desperation to get listings that can be forced over the line to a sale (and commission) is reaching crisis levels. I wonder how this is going to end. I was never a ‘housing crash’ doom and gloom type person, but seeing this flyer today really took my breath away.

a shortage of land? has the sea began to rise? we still have the same area of land that we’ve had for a long time. much of it we have now destroyed and its no longer suitable for homes, (or for growing food), or not close to jobs or services.

a shortage of housing? we have excess housing in this country, but , as mentioned above, we have a shortage of affordable housing…….not for much longer!

@George,

I grew up and lived most of my years in Sydney’s Eastern Suburbs. My Parents are still there. On the street my Parents live on there are two semi-detached houses for sale. There are other houses for sale too, but these two semis are special. They have been on the market since late 2009. 18 months before late 2009 semis in the area were fetching $1.2Mil. These 2 can’t be sold. Both owners have now drawn their unmovable line at $880K. One semi has not had a look in for months now, the other had an offer of $770K which the owner knocked back. On that note the Real Estate Agent through his arms up and gave up, taking down the For Sale sign down and leaving it to the owner, and owner blames the agent.

Around the corner from the same street, someone has put their (full) house for sale wanting $2.1Mil for it. So far no real eastate agency has gone near it.

Sydney’s Eastern Suburbs really surprises me now, I grew up there when it was a nice area to live in. Now it is highly conjested, over-built with more buildings coming, small, crowded,… tense??? And so expensive, like you’d pay all that money to degrade your quality of life.

Australians (maybe everyone else too) seem to be a funny mob when it comes to property. I get the impression that, because this is my house, its’ worth $2 million!

Well, packing up and moving to Asia 3 months ago looks like it was exactly the right thing to do, sadly.

Unfortunately you all know as well as I do that “property is sacred” in Australia, and the government / RBA will throw everything they’ve got into the fire in order to keep it going.

If that means interest rates to ZIRP, currency collapse, massive inflation in imports, even more f**ked economy… you know damned well that they will do it.