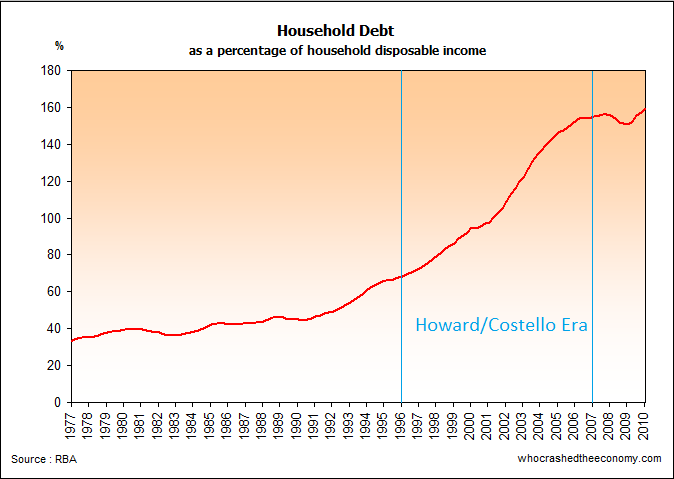

The Howard Era is known as a period between the 11th March 1996 and the 3rd of December 2007 where John Howard held the position of Prime Minister of Australia and Peter Costello, the Treasurer of Australia. It’s also known as the longest period of economic expansion in Australia. But as rosy as it sounds, it was achieved in part by sweeping the issue of household debt under the carpet. In 11 years, Australia has increased household debt by 2.3 times. By the end of 2002, household net savings started going through the floor with 90 percent of household debt caught up in residential housing.

Wayne Swan took office of the Treasurer on the 3rd of December 2007 and not long after, found himself at the helm of Australia’s economy when the Global Financial Crisis hit. The GFC was caused by speculation in real estate, and as household’s started defaulting on loans they couldn’t afford, governments had to bail out the banks, effectively shifting the debt from household balance sheets to that of the government. On top of this, governments were forced to try to stimulate domestic economies adding a further drain to sovereign finances.

Among the backdrop of the global “systemic meltdown” caused by irresponsible lending for housing and spiralling household debt around the world, the then Prime Minister Kevin Rudd and Wayne Swan announced a $10.4 billion economic stimulus plan including a $7,000 first home owners’ bonus to encourage young Australians to take on burdening levels of debt. With so much money directed towards housing, individuals were given $900 each to spend in the shops in a bid to underpin retail jobs and try to keep that sector afloat for a couple more years.

Treasury Executive Minutes later indicated “The short term stimulus [BOOST] was designed to encourage people who had already been saving for a home to bring forward their purchase and prevent the collapse of the housing market.”

Delaying the collapse of Australia’s housing bubble was successful, and today Wayne Swan was rewarded for his hard work in making Australia’s economy the envy of the world. Euromoney Magazine has awarded Wayne Swan the title of the world’s best finance minister. Well done, Mr Swan.

» Honoured as the world’s best treasurer, Wayne Swan is set to give advice to G20 leaders – The Australian, 21st September 2011.

What a joke

Retail is at its worst in 30 years, manufacturing has all but shut up shop in Australia, we have the most expensive housing (i.e bubble) in the developed world.

I read today Genworth Financial says

The Chinese Economy would have to crash first.

All Swan did was throw away AUD 200 billion to prop up building and retail for two years. He is an incompetent fool. The house of cards is crashing down. We have the most expensive food in the world due to the Coles and Woolworths monopoly. Politicians NEVER protect the people. They are all fools. Douglas

Moving money from the government sector to the private sector, in the hope of paying off debts, is exactly what the real people who run the world (so called elite bankers) and their motives want.

Get this punters – Yoda was informed today that the same magazine Euromoney also made Lehman Brothers the best bank in 2007. Oh shit we are doomed.

Australia’s GFC 1 is just reaching our shores. Brace yourself for when society loses everything, they lose it.

Austerity coming to a neighbourhood near you.

Can’t wait for the protests when the World’s best finance minister advices all the public servant of a 25% pay cut.

The mortgage belt will explode!

Well its going to be funny when the OZ market hits the fan over the next few years, anyone can look good for a while on borrowed money, but now that the party is just about over the hangover is going to be FN painful! SWAN is a joke and we all know it. I could go out a borrow to the hilt and spend like a drunken fool but that dont make me smart just a drunk fool! As the debt he has run up starts to drag us into the toilet just remember he is the worlds best!!! The fact that people overseas have given hime this pat on the back just explanes why the rest of the world is screwed!

Context is everything. First thing is to check out the past record of those issuing awards.

http://blogs.news.com.au/heraldsun/andrewbolt/index.php/heraldsun/comments/swan_wins_and_lets_hope_the_judges_got_it_right_for_once/

Great link MrV.

I had a laugh of some of Swan’s comments :

http://www.wilsoncenter.org/event/australia-and-the-great-recession

“According to Swan, an understanding of details and values is central to success in policymaking in general, and no more so than in the recent financial crisis. During the crisis the Australian government was not merely focused on economic growth but keenly aware that the “destruction of jobs and capital” following an economic downturn would “eat away at communities,” making future growth difficult. The deputy prime minister noted that key decision makers had clear memories of such social erosion during the recession of the early 1990s. The government’s priorities therefore lay with “looking after people in a way that was rational.” The result was a series of stimulus packages that Swan described as “one of the most successful policy responses of modern times.”