“Paying your mortgage down before the bust is the most effective way of avoiding getting into negative equity once housing prices start to fall.”

This is the statement Luci Ellis, Head of the RBA’s Financial Stability Department made last week in her address to the Federal Reserve Bank of Atlanta 2012 Financial Markets Conference about the US housing ‘meltdown’. According to a graph shown during her address, the number of Australian households ahead with their mortgage repayments greatly exceed that of America over the last decade. But, it wasn’t shown by how much.

Back home, Australian’s appear to be heeding this advice. Household’s had a poor record of savings for most of the last decade, in some cases spending more than earned in the quest for the great Australian dream. The twelve months immediately following the collapse of Lehman Brothers saw witness to a surge in the household net savings ratio to around the 10 percent mark, and has remained at this level ever since. It is considered a reasonable portion of these savings have been ploughed into mortgage repayments as the attitudes towards debt change following the GFC and the US housing bust.

But with housing prices falling for over a year now, it would appear another group of Australian’s have found an even more effective measure to avoid getting into negative equity. They have decided not to leverage up into an asset bubble in the first place.

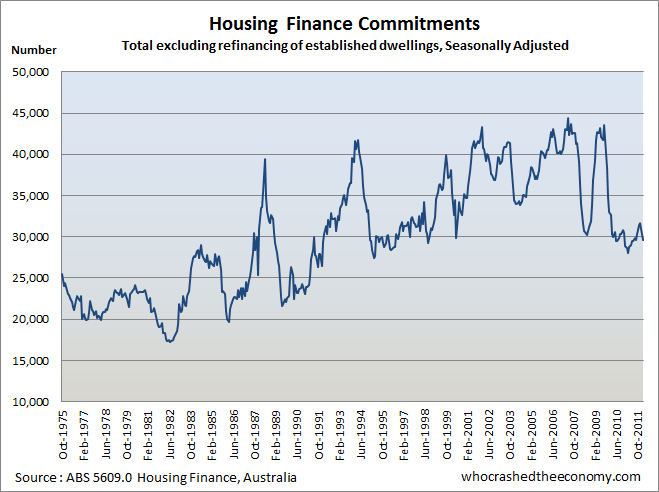

Home loan approvals for owner occupied dwellings in February is down another 2.5 percent, seasonally adjusted, according to the Australian Bureau of Statistics. This comes after a little rise last year as some first home buyers’ locked in state based stamp duty exemptions before they expired at the end of the year.

A look at home loan approvals excluding refinancing show the market is still the doldrums with approvals hovering at levels experienced during the late 1990’s. A sharp roll-off started in 2008 as the GFC took hold and reached its trough as the Rudd Government announced the First Home Owners’ Boost and the RBA started slashing interest rates. This buoyed the market until the grant ceased at the end of 2009.

With the debt adverse consumer who chooses to sit sensibly on the sidelines or with others who simply cannot access a mortgage at today’s home prices, it is unclear what, if anything, will plug the decline in house prices. Housing grants and stimulus appear to work, but they are not sustainable or in the the best interests of a healthy market.

» Moderator’s Opening Remarks for Panel Discussion on Mortgage Finance – Luci Ellis, RBA, 11th April 2012.

» 5609.0 – Housing Finance, Australia, Feb 2012 – Australian Bureau of Statistics, 11th April 2012.

With many heavily indebted households deciding to pay off the mortgage, a couple of years of directing every spare dollar paying down debt will only bring them a fraction closer to ownership,(ie reducing principal).

A couple more ‘ ANZ rate hikes’ and that extra financial sacrifice is completely wiped out.

Sadly enough, Michael’s right.

The human condition is such that at some point, these people will find the economic crunch in their lives extending its grip to their personal and emotional decisions.

I wouldn’t want to be a kid whose parents are paying off their mistake (oh sure “we did this for you”) with a combined income of around $120,000 in a Sydney suburb, or $100,000 in a Melbourne suburb.

So much for the Aussie dream-turned-nightmare.

Just read the crap that the RBA’s Lucy Ellis wrote, together with the ABS statistics, and one would be wondering in which world those morons live in and what language they are speaking.

Essentially, it’s like feeding mushrooms, keep us in the dark and keep feeding us bullshit.

Australia’s latest proposed “prop-up”:

“FIRST homebuyers could be allowed to pay off their stamp duty over several years in a HECS-like scheme to reinvigorate the property market.”

Source: http://www.dailytelegraph.com.au/news/sydney-nsw/pay-as-you-go-to-help-do-your-stamp-duty/story-e6freuzi-1226327255954

Probably a great idea for “Stamp Duty Addicted” states such as Victoria. No doubt there would be some interest accruing on the outstanding tax, so even more money for the State coffers.

– Also, pardon me for being dense, but I (and I seem to gather most other Australians) were under the distinct impression that the introduction of GST was supposed to be the end of Stamp Duties on capital purchases?? Yet another case of blatant lying from “our Elected RULERS” methinks.

Providing the translation is correct, here is a video telling us what Iceland has recently done about debt.

Search this title: Iceland forgives mortgage debt of its population

This amounts to reward for recklessness.

Nice piece, though I should add that paying extra principal off wont stop em falling in value. Better to sell up and lick the wounds than bleed over the years watching the race between the loan balance and the value drop.

Sucks to be in debt. Imagine how all the interest only punters are feeling with no capital gains for the next decade.

Enjoy being a bank slave punters?

Shit lifestyle repaying a debt that is more than the underlying asset. Depressing position to be in I’d guess

Most people still have their head in the sand as far as all this deleveraging is concerned, ‘house prices always go up’ CRAP

Cash is king! What did Steve Keen say a few years back “GET OUT OF DEBT !!!”

@2Big2Fail – the Iceland video on YouTube is fake.

“@2Big2Fail

when will be the good time buying … estimation? 1 year, 2 more years?

want to own a house , but just too expensive!