Fairfax Media, with vested interests in Australian Property Monitors (APM) and the Domain has today published headline articles in both the Sydney Morning Herald and the Melbourne’s Age on-line portals about “diving” house prices.

Reporting on house price data for May released today by RP Data-Rismark, Fairfax printed “Home values fell the most in at least six years in May defying Reserve Bank efforts to spark a recovery in the nation’s lacklustre housing market with interest rate cuts.”

According to the statistics from RP Data-Rismark, home prices fell 1.4 percent in capital cities around the country. Melbourne lead the plunge, recording a 2.7 percent fall for the month.

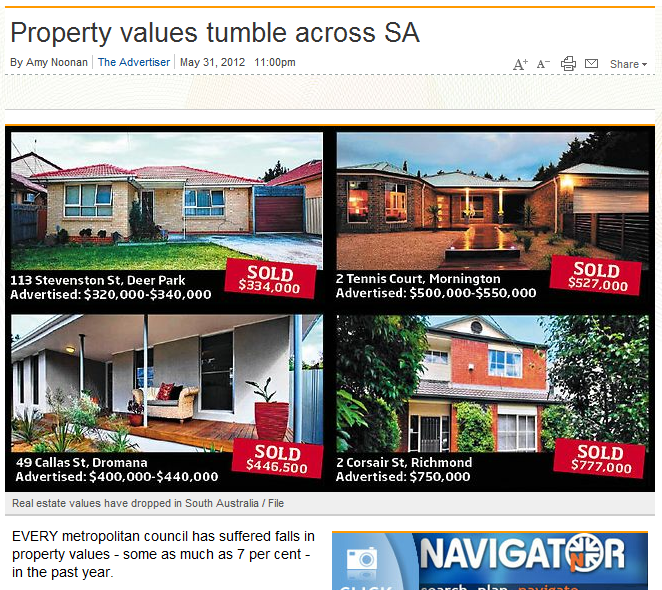

In Adelaide, AdelaideNow has published data from the Valuer-General’s department showing “Every metropolitan council has suffered falls in property values – some as much as 7 per cent – in the past year.”

Today’s update of the RP Data-Rismark Home Value Index supports comments we made a month ago suggesting a rate cut of 50 basis points would do nothing to support a housing market drowning under the weight of household debt.

» Home prices extend national retreat – The Sydney Morning Herald, 1st June 2012.

» Home prices extend national retreat – The Age, 1st June 2012.

» Property values tumble across SA – Adelaide Now, Friday 1st June, 2012.

The end of the world is coming 😉

I had an email from a real estate agent today telling me that there has never been a better time to buy than right now! They’re on the ropes. The denial phase moves into the fear stage as far as the vested interests and spruikers are concerned. Nothing gave me more pleasure in responding to the above-mentioned real estate agent with a few home truths. Whether he pays any attention to what I wrote or bothers reading or even understanding it, it felt good to sow some seeds in the pee-brained twat!

Makes me feel reminiscent. Nothing to say anything particular to this post, just reminds me of conversations I had in the past where I was slapped down with slogans as such;

“…but we have China…!”

“…no, not at all. You see in the U.S. you can hand your keys in and walk away from your mortgage…”

“…Chinese don’t want to live in China, they want to live here…” (My personal #1 favourite)

“…we’re not broke like the U.S….” (My personal #2 favourite)

“…don’t you understand the the world now runs on debt…” (My personal #1 equal favourite)

“…you know China has ensured our (Australia’s) boom for the century…” (My personal give up the conversation point)

No matter how logical, how much common sense, concrete proof, self-evident truth, crystal clear reasoning, documents, research you provided. These were just a few “hand slam on the table” conversation destoyers. I heard many other ones too.

If anyone has other conversation destroyer slogans that finished their dialogue, please post it. I’m sure there are many just as hilarious ones.

Just imagine how much more substantial this correction would be if changes were made top the Negative Gearing Tax Rort.

The Negative Gearing Tax Rort is time bombed anyway. “Investors” will not tolerate having to subsidise their tentants week after week, and have only a capital loss to show at the end of it.

@Tommy:

I totally agree. These fools who claim negative gearing will provide a floor under prices have no concept of how negative gearing and human psychology work.

I studied human psychology in a marketing course, and you can apply these principals to any investment bubble.

There are numerous studies that show even though people believe a market will crash, the will still enter in the belief that they can exit the doomed asset to another fool.

It is this psychology the ALWAYS provides the classic market pattern of up the stairs (bull market starts slow and then accelerates) and out the window (massive market price correction….tulip bubble, dot com bubble, (can I put facebook in here? LMAO)

These classic spriukers who love negative gearing have NO ESTABLISHED EXIT PLAN.

The first rule of investing according to Warren Buffet: Never loose money.

Therefore you must have an exit plan.

I have never understood how anyone can be fooled into negative gearing. Forgoing money today in the HOPE that an asset will rise in price? Even in a gold backed monetary system that is crazy, add in the fact we use fractional reserve FIAT currency, and you are playing with a time bomb.

This will all blow up spectacularly.

We will see an older generation (most likely gen x’ers) who sink their entire lives earnings into bank interest, while their investments loose value.

Or the sell on mass…..Collapsing a market.

They will sell on mass. It’s human nature.

Thought this might be a bit of a laugh.

I contacted my local council and asked them if they will be doing property valuations this year in order to determine rates, they normally do it every two years to adjust rates….

Up till now, since the last real-estate bust in the early 90s they have always gone up.

I was told that they have no plans to re-value rate payers properties this year!

Gee

I wonder why? could it be that the rates intake will now fall each year?

Anyway, I will be forcing them to do a valuation (legally entitled to do so) since the value of my place has gone down, after all I can’t let them get away with it!

These house price falls are nothing, wait till the real party gets started in Europe.

Now that this is mainstream (and I believe front-page material at that!) it will be interesting to see just how much more discretionary spending evaporates.

It’s not just spending on the “luxuries of life” that is being hit – there’s a big cutback in what I’d regard as essential “strategic spending” – our local car servicing establishment (3 man small business – the sort of business that should be keeping the economy ticking over nicely) is now down to a 2-man business – the apprentice had to go for cost reasons. You’d be surprised (maybe not) at just how far people are “stretching” the intereval between services, and they are only going for the very basic service – absolutely no extras.

Same with tyres – customers are running them until the carcase is almost exposed, and replacing with the absolute cheapest. They used to stock Goodyear as a standard, then went to Kumho (which were actually better tires!), but now everyone’s using Chinese no-name brands. They haven’t fitted a Michelin in FIVE YEARS!

People “feel poorer”, there is maybe justified concern re. the “Carbon Tax”, so spending has just stopped dead.

It must be real hell in Retail!

This is just the start of what is coming. Read today that Australia is going to lose it AAA rating if goes into a deficit. Australia and China are now going to face their demon which is mountains of debt. Everyone else is going through well so will Australia and China. The problem is Europe is going to be worse than the US. Greece will be out of the Euro soon and then Spain, Portugal etc…… Once Europe goes through their correction then we have China next on the board.

Why is The Advertiser showing only VIC houses in their article ? I can give a real Adelaide example of a mate. Bought house 2009 $495K, sold March 2012 $482K ( after turning down an early offer of $490K which he tells me he regrets ).

Hi LBS – just read that article in (yesterday’s) Financial review – along with the nice front-page colour image of the steadily falling residential house price “values” (“House price fall fuels rate cut”).

Seems last years, and this May’s rate cuts (on already LOW interest levels in comparison to the long term average) just are not doing the job (apart from “threatening” our AAA Rating (which as even Blind Freddy knows is entirely dependent on REAL Manufacturing Countries remaining interested in our “resources” – i.e. whatever we can dig up and flog off)).

A year ago – “It’ll NEVER happen here ’cause it’s DIFFERENT this time”,

Six months ago – “It’ll NEVER happen here ’cause China will be buying OUR resources for the next Century”,

Now – guess what, “It’s NOT different here at all”!!

Resources – cheaper from Africa / South America: We’ve had Swannie waving his finger at all the “Bad Economies” telling them what to do, and ignoring the problems back home. His posturing has certainly gone a long way to “make friends overseas”, and this “we’re so much smarter than you” mindset will be remembered for a VERY long time. Just when we could do with “Friends Overseas” we will have done our best to alienate those who might have been inclined to help – will they now think – “if you were so smart, you can sort out your own mess!”

Add in extra new taxes – maybe the precursor to “Austerity Measures”, consider the wasted opportunity to improve basic infrastructure (we rather spend taxes on making houses more expensive, and subsidise housing “investment” losses), and “We’re DIFFERENT over here” translates correctly to the reality that “We’re DUMB over here!”

Anyway, according to some we’ve only got a further six months of “normality” to look forward to, so maybe this will all be rather academic! – http://thebankwatch.com/2012/06/01/the-end-game-raoul-paul/

@ Phil

Nice slide deck… global banking reset eh… and people say I’m a half glass empty LOL.

Of course Negative Gearing has put a floor under the Housing Bubble. If it doesn’t then why didn’t Swan, KRudd, Dillard make even the slightest change to it after the Henry Tax Review? I’ll tell you why, becuase the market would CRASH!

Average bloke. Read my post.

You confirm my points.

Its a sad reality to see as many people are seeing their wealth being destroyed by a thousand cuts.

Suck it up puppies, you were advised by Yoda June 2009 to bail while there were still greater fools around.

Don’t worry I’ll buy your property, I’ll just offer only 12 times annual rent that been received. Talk to your bank about the rest. I’m sure they’ll understand and let you off !!!!! Good luck with that

Deflation is coming to an asset near you !

*** message for Admin ***

Sorry about the previous messages I posted.

Greg was right on the money with all his predictions.

I have learnt more from this website than any other source of information.

Amazing how many people don’t understand this: “Debt Is Not Wealth” | ZeroHedge

AverageBloke, who stands to gain from Negative Gearing? Certainly not the mass of fools that bought into it. Which few people are gaining? Their the ones whose interests Swan, KRudd, Dillard are backing. Also their own interests of re-election. I’ll add to that no matter how much the Labor Party stinks, stinks to the high heavens currently, they may just win again. There will be a few that walk from this property decline (whether it will bust or go down slowly) with tonnes of money, the rest?

Matty, yes! Always, people have entered into risk thinking they would be the winners. No matter how inexperienced, or experienced and smart, they think it will be them. I have touched (a bit) on market research too, specifically observing the psychology of Lotto. Many people actually believe this time they will win. Gambling has a similar psychology to it, which is why it is such a vice.

“Amazing how many people don’t understand this: “Debt Is Not Wealth” | ZeroHedge”

I disagree with that Craig. Debt is Wealth if you manage it and not over commit. I have my house paid off but also have a rental that is actually cash positive and have some money in stocks. I could have bought many more properties and probably could buy one today but the thing is then I would be up a creek because my debt would be negatively geared not positively. Its all how you manage your debt and make it work right for you and like I said dont over indulge in debt. That is the problem with Australians is they are going to find out what Europe and the US are going through. Might as well include the Chinese too.

@Secptic,

That is big of you, well said. The other bulls have all but disappeared on the other property/economic forums I frequent. I also thank this blog plus others. My sale of my last IP settles next week. One bidder at the auction and we got almost our reserve. By the skin of our teeth we got out…..

What’s the go with the Victorian examples shown on the SA article? And they’re all sales that have occurred within or above the quoted range. Must be results from way back! I’ve seen some old ones recycled lately, the agents are prone to that when they’re not moving stock.

LBS,

“Amazing how many people don’t understand this: “Debt Is Not Wealth” | ZeroHedge”

The operative words here are “how many people”. Considering this and what national, personal debt levels are currently, and will be in the future to come. The statement (or title) is quite correct. Also many people may now need to manage their debt, but they will forego many things that would make their life more comfortable, just to pay for their past and silliness. I know such people.

Your case is commonsense + a lot of smarts. Australia and the world are not in a debt-credit crisis cause people think or approach their finances with such commonsense nor smarts.

Many people and some I know, should have stopped themselves at their high mortgage debt, no, they kept going on borrowing to fill that house rather than save for things, one or two things at a time. If I know people like this, and I know more than a few, statistically few people that post here know one-few too.

You only have to look as far as the recent (last few years) lottery jackpot’s to see where things are heading.

http://en.wikipedia.org/wiki/Lottery

Record level jackpots across EU, US and AUS in last 3 years….. what drives the jackpot?

People are getting very desperate.

Watch this video on Youtube

Published on Apr 4, 2012 by AussiePropertyBubble

“Hope you can watch the full length of this video, it is quite long, as its mostly clips from youtube.

House price inflation in Australia and Ireland are most definitely due to many different factors. One difference was the % of property price gains from 1995. In Ireland house prices peaked to some 500% of their original value, in Australia the % increase to date is around 130%. However Its the household debt that matters and in this way we are similar, an average 300k euro apartment equates to the average 400K AUD apartment. Yes countries are different, but the motivations of people, and a countries institutions are often very similar. The characters are the same.

I finished with comments by Owen on rent control agreements. I agree with him that its a sensible and sustainable housing option, owned by pension funds, offering ‘plain old grey’ returns, but very much a sustainable stream of superannuation for the ageing population in Australia, especially considering the volatility in share markets.

Of course this option would compete with the current turbo charged debt fuelled property speculation seen in Australia (and the world). Government and banks would obviously prefer to maintain the strangle hold on supply, and maintain the ransom that forces people in to such large debt. A greedy way of yielding high taxes (stamp duty etc) and greater debt expansion.

It would take a true statesman to deny the banks the boom, but perhaps such a person may only be born from Australias bust..Our land is plentiful, the only shortage we have is efficient regulation to marry the need for housing with construction, and appropriate, sustainable dividend for government and financial institutions..

After all, a house is just a place to live!”

No sub-prime here…….

http://www.theaustralian.com.au/news/features/the-motgage-sting/story-e6frg6z6-1226383950929

http://www.heraldsun.com.au/business/barefoot-investor/we-panned-the-us-for-its-sub-prime-mortgage-crisis-but-were-not-immune/story-e6frfim6-1226389516803

Anyone with any views on Perth? Been here a year and the market is holding it appears. Massive cost to buy and lots of competition to rent. Hugely unaffordable.