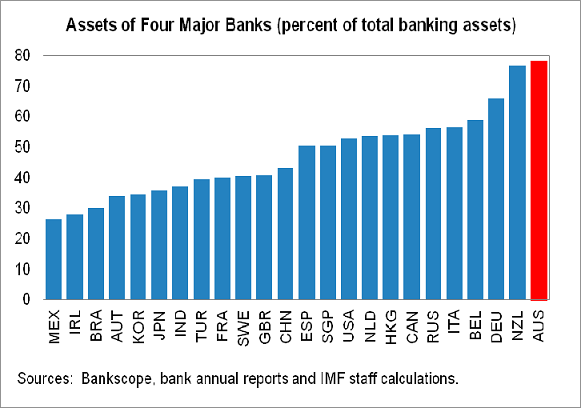

The International Monetary Fund (IMF) has highlighted concerns about the concentration and interconnectedness of Australia’s big four banks in the most recent Financial System Stability Assessment on Australia. It reports Australia’s four major banks, The ANZ, Commonwealth, Westpac and NAB hold 80 per cent of the countries banking assets and 88 per cent of residential mortgages. Such dominance in the market, each with similar business models and reliance on overseas funding leaves the majority of Australia’s banking sector exposed to common shocks.

The IMF wrote “While their [The big four banks] pricing power and greater risk diversification help sustain profitability, their size implies that, in the event of a failure, the impact on the financial system and the economy would be potentially substantial.”

“Given their systemic importance, special risk mitigation arrangements, including more intensive supervision, higher loss absorbency, and robust recovery and resolution plans, will help prevent the failure of major banks and, should one occur, limit its impact and fiscal costs.”

The IMF also notes “The combination of high household debt and elevated house prices is a risk to banks’ large mortgage portfolio.” It says 90 per cent of Australia’s household debt is in housing loans and Australia’s household debt is above the average of other advanced economies in the G20.

“Strong house price gains over much of the past two decades have made Australia’s house prices relatively expensive now. This combination exposes banks to negative income shocks generated by a sharp increase in unemployment. Moreover, around 30 per cent of new mortgages are interest-only, a potentially riskier type of lending than regular mortgages, and 55 per cent of those mortgages are interest-only investor loans.”

» Australia: Financial System Stability Assessment – International Monetary Fund, November 2012.

» Banks ‘need more capital’ – The Australian Financial Review, 16th November 2012.

How can I get a job with the IMF? I could have told them all of that:

A: Far cheaper than their current analyst team

B: With out being so complicated about a simple topic

and here’s the cracker:

C: Years ago

It is amazing how these finance types can be so proud of themselves about providing us with information, that is old news?

If they could predict the future, or even likely events, then sure be proud of yourselves. But here we have a display of information that has been in the making for over 15 years. IMHO all this was predictable around 2000, when housing started it’s meteoric rise in dollar terms and as a topic of conversation amongst the middle class.

Does anyone else get offended by strangers asking if they rent or own? Seriously, is it your concern? But then, when my blood pressure drops, i realise, they are in a huge mortgage and looking for validation. So why am I offended? That’s the underlying cause of human behaviour, no-one wants to feel out of place.

“Be fearful when others are greedy, and greedy when others are fearful.” Very wise words indeed.

Oh F[CENSORED]K…!

I still have so many friends who really dont think there is any problem BUT I am starting to see some of my friends who are actually pretty smart starting to see there is a problem. With the media and govt determined to keep talking it up then no one will ever get the truth unless your read sites like this and Macrobusiness

Interestingly you can still get No Doc (liar) Loans via brokers with 20% down and 5.75% interest only. Queensland has 58% of mortgages taken out after 2008 in negative equity.

Definition of insanity: Continuously repeating the same behaviour and expecting different results!

Yet there is STILL the pervasive mentality where being a “renter” is regarded as an admission of failure , or that one is in many respects a “second-class” Citizen.

Helped no doubt by the very poor legal status of renters in Australia (in comparison to renters in, say Europe), especially in terms of minimum notice to leave.

This may be but one reason why there’s such a strong incentive to “Own”, as well as the number of Government benefits associated with owning too (if you’re a first-time buyer of course!).

Wow! Are those QLD figures correct ??? Amazing stuff. Meanwhile Spain’s RE market is still convulsing as bad debt hits new highs. How long until Aus starts offering ‘Residency Permits’ as an inentive to foreigners for buying a house ?

http://www.bbc.co.uk/news/business-20391588

Matt:

It is because of the complicateness in arguing against Australian economists, government officials, real estate industry experts that IMF has to prepare the report this way and slowly. Otherwise all the sprukers in Australia would say this report is groundless, ignoring the fundamentals in the country, etc. etc. But coming late is better than never. At least there are people who still look at the world with reasonable human eyes.

Thanks Matt. Forums like this give preliminary insights into the troubled behaviour of OZ dreamers. Your comments are quite insightful. When evidence and data are enough, I belive many of your views can be converted to similar strong and formal arguments which the sprukers cannot deny. It takes time…

IMF:

Standing on the outside lookin’ in

Standing on the outside lookin’ in

Oh-oh, I never strayed outside the law

Standing on the outside lookin’ in

Room full of money and the born to win

No amount of work’s gonna get me through the door

When I go walkin’ down Bluewater Bay

Surface in the city at the end of the day

Oh-oh, I got a bad case of the benz

Standing on the sidewalk you can see

Somebody everybody wants to be

They got the means to justify every end

I had a friend broke through illegally

Pulled a job on a small-town T.A.B.

Five grand down on her own piece of Eden

And I know . . .

And I know . . .

The first thing I do when I get into town

Is buy a twenty-two and cut the whole thing down

No amount of work’s gonna buy my way to Freedom

I’m on the outside lookin’ in

Standing on the outside lookin’ in

Oh Yeah!

http://m.smh.com.au/opinion/politics/after-the-moderation-comes-the-new-reality-20121120-29ny4.html

The “new” reality? Dunno bout everyone else but

that”new” reality has been farting in my face for a looong time. Recently, a senior citizen reminded me of something. He said, “I dunno, but I’ve noticed something in my time… things that come quick, go just as quick, if not quicker.” Also reminded me that we die a lot sooner than we think… u can draw ur own conclusions from that one.

Bernanke on US house prices…….

……….But Bernanke pointed to the housing sector as an encouraging sign in the recovery. Home sales, new construction and home prices have all started rising recently. Bernanke said he hopes that will turn into a “virtuous circle” where higher home prices lead to a rise in mortgage lending, which in turn, could lead to even higher home prices.

http://money.cnn.com/2012/11/20/news/economy/bernanke-fiscal-cliff/index.html?iid=HP_LN

Hmmmmm, Am I missing something? High unemployment, bankruptcies, fiscal cliff, debt ceiling, trade deficit, soup kitchens, mortgage stress and homelessness. Yet a “virtuous circle” constitutes higher home prices and increased lending.

Isn’t that what caused the problem in the first place?

I would have thought the opposite was true, lower home prices = lower borrowings = less debt = more people housed = increased financial security = increased discretionary and disposable income?

Oh, but of course, the plebs are only happy when they have a life-time of servitudal debt to pay off.

How “unvirtuous” of me!

Sometimes I question my sanity………….

So what, the government WOULD underwrite the banks just like in the US. Relax punters, we have the world’s best treasurer and our government budget is one of the seven wonders of the world. WTF !!! Strangle the taxpayers is their motto !!!

Maybe 2013 will be the year of reckoning for Australia. Wage deflation, declining living standards, rising unemployment, government austerity etc etc. Mining Ha!

The banks and monopoly corporations have the country and its people by the short and curly’s. If you borrow money you are aiding the system of fiat currencies and fraudulent fractional banking.

Enjoy the unfolding mess as Australia steps into its soft depression for the next decade.

Maybe the Chinese buying all the gold and silver they can are the smart ones???

The largest store of ‘total monetary wealth’ in contemporary history is presently stored ‘in money’ & the smallest store of ‘total monetary value’ is in assets that generate an economic surplus… Go figure!

Of course it’s always missed in all the banks chest beating about their billions in assets, that the other side of the book contains a liability!

The IMF has it wrong on this one. The banks may be over-exposed to the residential property sector but the government considers the Big 4 “Too Big To Fail” and will print as much money as it takes to save them. Further, the IMF has completely ignored the $2 trillion war chest the banking sector is sitting on. You and I know it as “superannuation”. In no way does this money belong to you. This is evident because you can’t access it until you are statistically at the end of your life. It was designed to feed the two worst non-producing sectors of the economy – government (via taxes) and banking (via fees). And boy has it been a roaring success.

Who is to blame? Behold the Dutch Disease Donut.

http://www.macrobusiness.com.au/2012/11/whos-to-blame-for-dutch-disease/

Thanks for the link AverageBloke.

“The GFC stimulus was well handled with the exception of one policy. When Treasury sent its proposed stimulus package to Cabinet, there was no First Home Buyers Grant boost in it. It was added by the pollies.”

Good to see our Pollies were active it keeping the bubble afloat.

Spot on Jimmy. I had some people tell me to invest my money in super. I never believed it as I think one day the govt will just come in and tax the crap out of it and make it impossible to get until you are on your death bed.

http://m.smh.com.au/nsw/sydney-housing-most-affordable-since-2009-20121127-2a680.html

LOL Keep going… another few dozen quarters to go yet…

Red brick concrete vomit ceiling anyone? want some insurance with that? good luck selling these people…

There is one site I really would like to see…. whocrashedtheaverageiqofaustralia.com

Slump looms as a third of new home sales abandoned

http://www.theage.com.au/business/slump-looms-as-a-third-of-new-home-sales-abandoned-20121128-2ad95.html