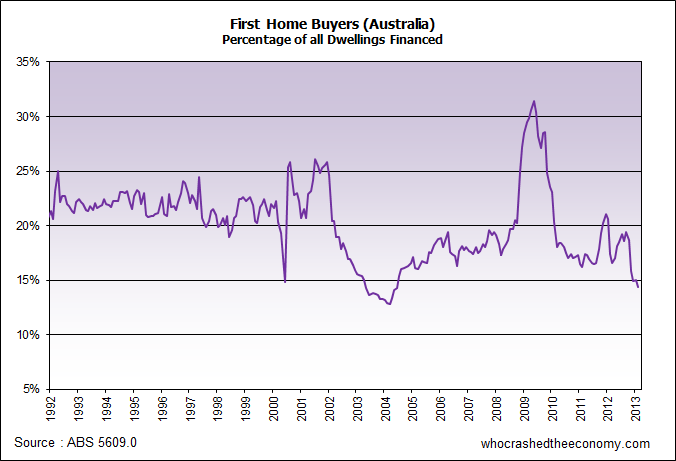

Stats out from the Australia Bureau of Statistics show continued weakness in the first home buyer segment. The portion of first home buyers taking out loans fell 1.5 per cent in February to make up only 14.4 per cent of the market.

Analysis from ANZ show changes to first home buyer grants in New South Wales, Victoria, Queensland and the Northern Territory has caused the plunge. Without the incentive of free money, smart first home buyers are deciding to defer home ownership.

Loans for owner-occupier homes were up 2 per cent in February showing a healthy pick-up. Loans for the construction of dwellings increased 1.5 per cent.

» 5609.0 – Housing Finance, Australia, Feb 2013 – Australia Bureau of Statistics, 15th April 2013.

» Housing finance rises but first time buyers absent – ABC News, 15th April 2013.

This Ponzi keeps getting thinner at the bottom. China slowing even more, Terms of Trade falling for 5 quarters. Time to throw money at first time home buyers to prop it up! Will it work again without a huge Chinese stimulus package? Who knows. I would just hate to see another Govt endorsed vintage of mortgages with high mortgage stress, arrears, and at best a slave to the bank for eternity with young Australians not being able to start a family because they need two incomes just to keep their heads above water.

Both parties and all politician should be sacked!

First Home Buyers on strike are like falling snowflakes–individually insignificant but potentially powerful in large numbers. Every snowflake counts in creating an avalanche.

One more snowflake and we could see an avalanche of vendors crushed by falling house prices. First home buyers on strike have gravity on their side.

Our politicians and bankers have created the perfect conditions for a powerful and devastating avalanche. We are at the tipping point.

The longer we wait for the last snowflake to fall the more destructive the avalanche.

Distressed sales report – may interest you.

http://www.propertyoz.com.au/library/LandmarkWhite%20report.pdf

This is a very good post by Business Spectator. Every bit of it is spot on.

http://www.businessspectator.com.au/article/2013/4/16/economy/why-gold-slide-signals-australian-alert

Interesting piece in The Guardian predicting an uprising against the culture of greed and debt and comparing it with the downfall of the Soviet Union. Australians take heed.

http://www.guardian.co.uk/commentisfree/2013/apr/16/britain-stop-blaming-itself

Hmm, I’ve felt that FHB have been largelyt irrelevant for some time due to the fact that Negatively Geared Property Investors can fill the void left by the FHB’s…. for existing property that is.

I think these new greenfield housing estates on city fringes are designed for FHB’s and any Property Investor with half a brain wouldn’t touch them when they can still get Negatively Geared goodies from the taxpayer on an existing property that would have better rental return and long term capital growth prospects.

So in other words like how the aussie concept of a fair-go in the housing market has been silently murdered so too the FHB segment has been suffocated with a pillow in the middle of the night …. but no one really gives a crap do they?

Can anyone translate this? and what does it mean will happen from the end of 2014 onwards? if anything.

i just saw the words mortgage, repo, insurance and bank in the same paragraph and got sus…

http://www.rba.gov.au/media-releases/2013/mr-13-08.html

Scary how the ANZ logo looks like a crucifixion, it probably is.

@ JJ

It just means that the issuer of RMBS has to comply with certain standard in order to transact in the repo market. Both the reporting template and the cash-flow template (in VBA language) need to submitted. It will be published for public.

Like financial reporting, the intent is good. The question is whether the “public” has the ability to comprehend it (let alone analyse and make a decision for their own best interest) is another question. It could be just another loose link on the website with no one in the general public able to use it anyway … How many readers in this website anyway? (500 at most out of 20 Millions?)

Cash-flow waterfall template in VBA language …. The person would need a very sophisticated combination of VBA programming language, financial mathematics and broad finance knowledge that is tailored to Australian market … Plus data warehousing and possibly PhP for web publishing … Good luck!

jj, there is not much information within RBA policy change over MBS. The regulation context is not clear.

Being a FHB on strike, renting is a much less stressful alternative. Being in debt for most of an average persons life is frightening to contemplate. Houses once cost one to two years average wage to buy. Today an average house costs 8 times more than the average salary. All this I blame institutional government and their unfair and biased support of a minority called home investors. Many people hear, see and read often is of illegal corruption in many areas of institutional government. But what about legal corruption? When politicians fiddle around, change and rephrase the laws creating ‘legal’ loopholes called ‘subsidies’ ‘negative gearing’-literally giving away our taxes at the expense of budget blowouts and increasing the national debt making a minority called home investors wealthy while the maority of us become home debt slaves literally foe all our lives

SPREAD THE WORD-STRIKE-DONT BUY NOW!!

@ Theo. As a fellow FHB on strike, it should also be noted that most people simply can’t afford to buy, even with low interest rates, NG, government hand-outs, bank of mum and dad etc. Property is just way too expensive. The only people buying now are the stupid rich. The clever rich are on strike just as much as the poor.

Look at this fool. I hope the bottom drops out of the market. $839k for 3bed 1br.

http://www.news.com.au/realestate/selling/hell-no-i-wont-go-a-cent-lower-says-nick-papadopoulos/story-fndbawks-1226624907407

@13 – I sometimes work near George Street in Redfern and park my car outside that house when there’s a space. The area is a crap-hole, derros shuffling around with grog, and very near two polluted and busy main roads. The man is a fool and utterly deluded. I wouldn’t pay $400k for that house, let alone $800k. Maybe I’ll put a ‘Don’t Buy Now’ board outside his house.

Perhaps he needs the money to buy a Greek island! (see below)

http://www.telegraph.co.uk/news/worldnews/europe/greece/10007606/Greeces-great-fire-sale.html

Half the problem with the market are the deluded sellers and the greedy real estate agents. Just get those two groups out of the equation and we’ll have ourselves a correction.

@Rupert The only people buying at the stupid rich? We saved up for 4 years, and bought a house in Sydney’s nothern Suburbs. After having been there for 2 years, we’re now paying less cash when we add up interest/rates/home maintenace that we paid in rent. If interest rates went up 1.5% we’d still be better off. We’re not rich, and just got sick of quartley inspections, rent increases, and having to find a new house each time the rent got too high. Some people have a good rental situation so they don’t have to buy, good for them. We didn’t.

“Economists predict multi-billion dollar budget deficit.” ABC News

http://www.abc.net.au/news/2013-04-22/economists-predict-multi-billion-dollar-budget-deficit/4642290

Here we go – let the games begin!

@MrV. He may be a fool, but this is realestate for ransom and it will continue with the majority of vendors whom are financially sound, aren’t in any rush and greedy. I have seen countless properties for sale around my area, and if the Vendor doesn’t get what they want they take them off the market -no harm done. Eventually when they re-list them some “fool” gets caught out and pays a premium and the vendor benefits.

@MrZ – I completely understand, and I didn’t mean to be inflammatory, but you bought over two years ago, when interest rates were higher, property was cheaper and the dollar was weaker. Recent events and global trends, however, strongly suggest that anyone buying now is making a very bad financial decision, irrespective of personal circumstances and the ‘necessity’ to move. There will always be people who ‘have’ to move, but a fool and his money are soon parted.

Personally I don’t mind quarterly inspections, and the rent I pay is less than a 90% ‘interest only’ mortgage would be. So, our situations are clearly different. But if you’re happy and you can afford to own a decent house, then that’s fantastic. But you are in a minority.

The saddest thing about the Nick Papadopoulos story, alluded to several times above, is the blatant real-estate listing dressed up as journalism. News.com is a pitiful joke and its journos should hang their heads in shame.

I can’t wait for ‘The Guardian’ to launch in Australia. The current Australian media just peddles the agendas of special interest groups and right wing propagandists.

Thanks guys,

And today we have a speech by Luci Ellis.

http://www.rba.gov.au/speeches/2013/sp-so-230413.html

But we certainly can’t rule out the possibility of a major housing downturn in the longer-term future. It is hard to know exactly what the outcome would be because it depends on how we got to that point.

“The saddest thing about the Nick Papadopoulos story, alluded to several times above, is the blatant real-estate listing dressed up as journalism. News.com is a pitiful joke and its journos should hang their heads in shame.”

I’ve been following this site for a while now but could not help but now post this cracker of a news article:

http://www.news.com.au/realestate/buying/time-to-buy-property-prices-to-double/story-fndban6l-1226626822141

I mean jesus… just wow. Prices to double in 10 years? Where do we even start with this…

@21 Says it all doesn’t it? Total and utter desperation from the so-called ‘media’. The fact that the CEO of News allows this garbage to be made public says more about his political agenda than it does the contempt he has for his idiot readership. Gaia help us all!

its ‘Time to Buy!’

a lovely little spruik

http://www.couriermail.com.au/realestate/buying/time-to-buy-property-prices-to-double/comments-fndboawi-1226626822141

@23 And it gets worse! When all this blows over, do you think we should name and shame all of these so called ‘journalists’ for the utter bollocks they right. That’s three disgusting property-spruiking articles in as many days. Pass the barf-bag!

@24. Rupert, they will not be reprimanded. The real estate/property industry can publish such analysis (garbage), even advise people of their findings (garbage), and not be punished, or even questioned when things don’t turn out as said. No other industry has this privilege.

I know I’m tell you something you already know. It just makes cringe, and want to tell the world (again).

In response to a small part of these articles, rents may be high, but they’re not unbearable, mortgages are.

We just got the ‘property doubles article’ over in SA on the Adelaide Now website with our local ‘hotspots. But with the curious tendency by the newspaper to disable comments being posted, just in case any readers care to shatter the dream !

Notice the NZ Reserve bank continuing warnings for mortgage borrowers and home buyers.

http://www.stuff.co.nz/business/money/8591152/Mortgage-heaven-won-t-last

If anyone checks the Yahoo Finance page today they will see two stories, the main story is about the RBA saying the housing boom is over, and another story underneath saying house prices are set to double in the next 10 years. Talk about contradiction…

Article just posted on ABC website.

http://www.abc.net.au/news/2013-04-24/strong-house-price-growth-a-thing-of-the-past/4648580

@ admin

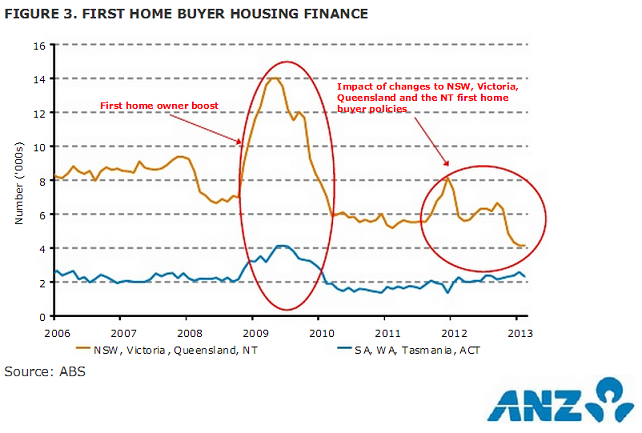

I have one comment about the graph.

“Impact of ….” Academically speaking, it is quite dangerous to infer a quick causality on it. There might be other reasons for the two spikes that are not related to the grants. Simply aggregating numbers and making an inference based on that is just too simplistic.

Further studies using statistical tool? A good economist would find possible variables that might “explain” the events …. Then again, if one proceed using time-series framework, it will be equally constrained by the assumption(s) beneath that. Still, I reckon it needs to be provided … for completeness.

I think Nicole Foss with more of a ‘systems thinking’ approach makes clear where we’re at and where we should be going.

http://theautomaticearth.com/Finance/nicole-foss-in-australia-its-no-use-trying-to-build-a-better-dinosaur.html

A good read it is.

Cheers,

Glenn

http://www.domain.com.au/Property/For-Sale/House/NSW/Redfern/?adid=2010089819

LOL. Here is the property I was talking about above in #13.

So he’s spent $30k on it, to add such wonderful luxuries as moving the toilet inside.

Effectively he selling for $809k now.

I think I will follow this listing to see what happens.

There are many in the bank-government-real estate conspiracy trio who bombard us with daily paid newspaper and magazine articles alongside TV ‘buying houses’ theme shows on how there is a shortage of houses and land and ‘prices are only going to go up’ etc. In a country as vast as Australia with a relatively small population I ask how is this house and land shortage possible? Is it because large house building organizations and groups hold onto vast areas of land near populated areas, trickling out enough land for development while keeping prices high? Is this not a conspiracy with unethical intent to profit? There are laws against this yes? and while the law will be enforced upon individuals like you and I, these groups get away with it with the blessings of institutional government. Maybe a land tax should be considered? To tax undeveloped land so it would be unprofitable to hold onto it and sell it so as to allow it to be developed forcing prices to come down? That would be a start towards affordable housing and get the house building industry back onto its feet again. But then again this goes against institutional government psyche of taking something simple and complicating it. Maybe the vast budget deficits will hopefully make it see the light?

@32 – comedy gold. “We’ve run out of rooms to show you, so here’s a picture of the wasteland at the back of the house. Just think of the potential. Not keen on gardening? That’s ok, we’ve got it covered – here’s a woman walking to the station. See how she uses the ticket machine? What are you waiting for? Call now.”

Hey honey, pass the Wrigleys. I feel like chewing on something!

I did not study Economics but It would seem that the road to ZIRP looks the most probable outcome at the moment.

It would also seem that as interest rates continue to fall house prices will be supported in the short term.

The problem is not that investors will feel emboldened to keep buying, but why they feel the need to do this and how long will it last.

How long until this investor sentiment becomes reality!

Even with a heavily stacked deck in favour of supporting house prices from all angles and at any cost.

The Australian economy is sick and there is a reset coming, not a good time to be expanding your debt levels in a world drowning in debt!

Still, we have China to support us even though they are a Basket Case as well!

To follow up, with the TOT falling for what will be 6 quarters soon, the dollar (which the govt and RBA have kept inflated) will fall and where will interest rates go from there?. The reality is Australians are in for higher unemployment, diminishing hours, lower wages and a rude wake up call for all, especially those who have used their houses as bank machines.

@33 The benefits of a Land Tax are well-documented and clear as a bell, but I don’t see it happening. Career politicians are just too stubborn and stupid, and in most things can’t see beyond their expense accounts.

If I was a wealthy landowner, with a hefty tax-bill on my ‘unprofitable’ land, I would either have to sell the land for development, which would increase supply of housing and therefore bring down house prices, or I would develop the land myself, either for housing or agriculture. Either way, I would make the land profitable so that I could pay my tax liability.

The tired argument of lack of infrastructure and utilities doesn’t wash, because if there’s money to be made, they will be built. If the Murray/Darling can be used to irrigate rice production to sell to the Chinese, or cheap wine to sell to the British, it can certainly be used for housing. Wind turbines and solar energy would power the ‘new’ developments and gas lines would be brought in by the gas companies to their lovely new customers. Roads, commercial districts, schools, etc etc. It all happens as a result of a Land Tax.

As Income Tax would be severely streamlined, the resulting trickle-down benefits to this country’s economy, the welfare of its communities and the happiness of its people, is incalculable.

But it will never happen!

Yep…seen it all before. I think when you’ve lived through a massive boom/bust cycle like the one I have in Ireland it puts you off buying property anywhere again. Large debt sucks the life out of people and only benefits banks. Australians have not experienced anything like that yet and I hope you don’t. However, from what I can see, they gravy train in approaching its final stop for those asset rich, cash poor boomers. Who they going to sell too? Chinese?? Your government obviously doesn’t give a damn about the average Australian working man or woman. They are selling off your oil and gas fields to the Yanks, your mines to the Indians and you agricultural land to the Chinese. They treat you like mushrooms…..Keep them in the dark and feed them shit. Time for a revolution….what say ye?

Interesting article today’s west:

http://au.news.yahoo.com/thewest/business/a/-/national/16893038/australia-could-face-recession-economist/

Hope it happens sooner than 2015 though as I would like to buy when I move back to Oz next year.

@38 – the revolution is brewing and is around the corner. In the UK, 6,000 unemployment benefit claimants have been given food-bank vouchers, because their benefits won’t even cover food costs, let alone housing. The high cost of housing and food will eventually bring about a revolution – and it won’t be pretty.

Australia needs to act now and convert its tens of thousands of hectares of land from useless spinifex into food – http://www.guardian.co.uk/environment/2012/nov/24/growing-food-in-the-desert-crisis

Australia is in a prime position to lead the world and bring about change on a massive scale, simply by doing what is right for our children’s children instead of what is right for the current government, corporate and banking incumbents. If they don’t there will be a revolution.

Now this is an important issue at the other end of the age spectrum.

http://www.smh.com.au/nsw/council-plan-to-rob-pensioners-20130427-2ild3.html

Cash strapped councils are under pressure to remove rates discounts on pensioners, who will inevitably cry poor. The issue is they will be asset rich, but cash poor.

And rates have only gone one way.

@41 – already being proposed in the UK, only casting a wider net. The removal of discounted council rates are just the beginning.

http://www.dailymail.co.uk/money/pensions/article-2312919/Raise-taxes-pensioners-says-think-tank-Fabian-Society.html

I guess Australia is finally waking up to the impending credit-crunch/recession/austerity that is around the corner and is battening down the hatches, so the inevitable spending cuts won’t be as swift and deep as they have been in the rest of the world.

Australia is an enviable position that it can watch, learn and prepare. The only reason why the UK hasn’t done a ‘pensioner grab’ sooner is because the ‘grey vote’ gets governments elected. I can only assume that because voting is compulsory in Australia, the ‘grey vote’ isn’t as important.

Here we go again more first home suckers grants in Victoria. The banks corrupt politicians to keep their balance sheets whole by throwing borrowed money at young suckers. The system stinks to high hell. Debt serfdom or die!

@43.

Whilst it’s throwing money at the new home property buyers, it’s actually a bigger blow to the established property flippers. When there is no 7000$, less FHB will buy them. I can see prices coming down for the 500K dogboxes they want FHB to start with (then to trade up Bu$%shi$)

Even Enzo R. from the REIV knows what this means and has whine.

Rupert-That is so true. Voters should start to place the welfare of the nation first and not their own financial self-interests. I for one feel uneasy when money is the giuding force for voting and not the financial health of Australia and this is from an older generation that prides itself for its stronger moral and ethical values.