Thursday morning I almost burn a hole in my shirt. I was ironing my daily attire when Steve Mickenbecker from Canstar joined Kochie on Sunrise to talk about if it is cheaper to rent than buy.

Kochie introduced the segment with the following slide showing the stats over the past decade:

While average wage growth (probably distorted by mining) increased a little more than inflation over the last ten years, average mortgage repayments have surged, up 105 per cent. Kochie explained the mortgage is taking a larger chunk of your income now despite lower interest rates.

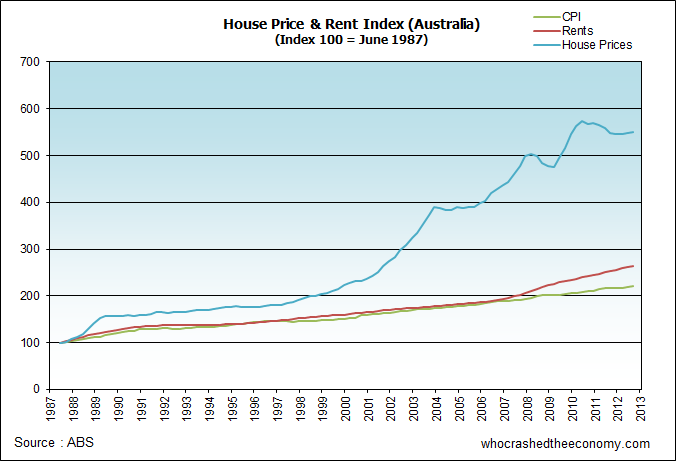

The following graph shows house asset prices have outstripped both CPI and rents over the last decade:

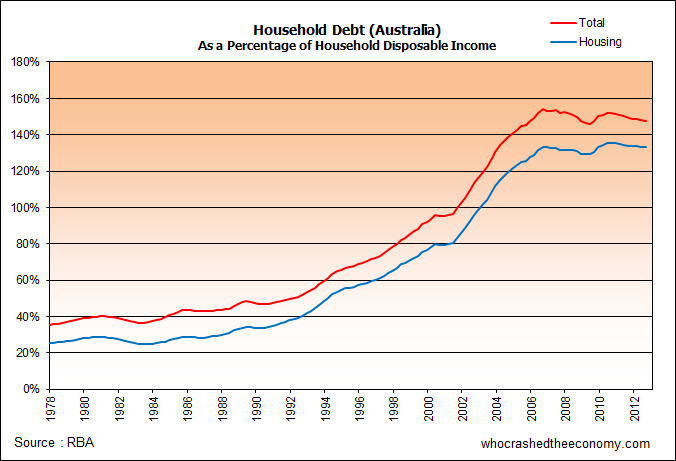

This has led to a significant rise in household debt as a percentage of household disposable income:

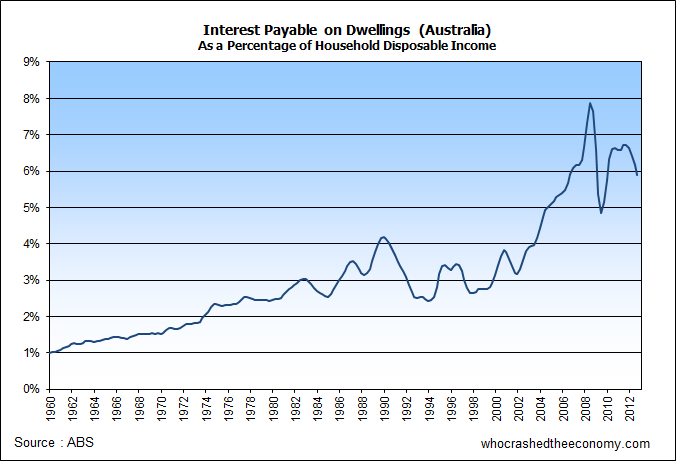

And while interest rates might be at close to record lows, mortgage repayments are a product of both interest rates and the amount you choose to borrow. Interest rates are low, but debt is astronomical. This results in substantial interest payments as a percentage of household disposable income. From this graph, you can see households today pay a greater portion of income to mortgage interest repayments than in 1989 when interest rates were over 17%.

Apparently Steve Mickenbecker has been crunching the numbers. Kochie asked “Were you a bit shocked by the mortgage increases?”

Steve Mickenbecker responded, “People talk about affordability in quite short term measures, they say well affordability is improving over the past couple of years. When you look at it over 10 years, you really see the impact. And doubling of repayments for people entering the market is a massive hike up when salaries have only gone up half that amount. So new home buyers are really paying a lot.”

At this stage my arm was frozen, iron caught on my shirt pocket, my eyes glued to the set. We have someone that knows what they are talking about on main stream television. I was truly stunned.

Steve Mickenbecker continued, “Well shock, should not have been, because property doubles every 10 years or so.”

D’oh! We were so close.

Hopefully for some clued up viewers, they were concentrating more than I was on my ironing and questioned how house asset prices/interest payments rising faster than wages are sustainable in the long term? If prices double every 10 years, but someone’s ability to make the repayments don’t, what gives? We may have dual income households today, but what does the future lie? In twenty years, will two couples (four breadwinners) occupy a house together? In fifty years, four couples (eight breadwinners) in a three bedroom house? Maybe the dog and cat will have to get a job to help service the mortgage?

If you scroll up to the top graph, did house prices double in the 10 years prior to last decade? Maybe, just maybe, house prices don’t actually double every ten years. Maybe the last ten years were an anomaly, or bubble if you like? Maybe Mickenbecker, like the average real estate spruiker, only looks at prices in “quite short term measures,” say under 10 years?

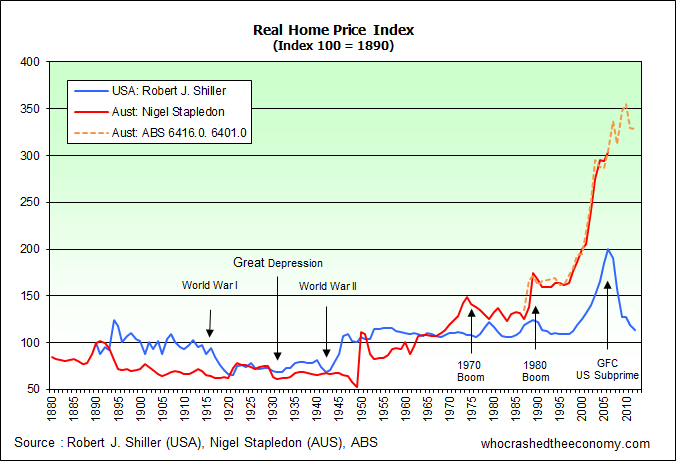

Economist and Yale Professor Robert Shiller created a real home price index for the United States (blue line on the graph below) going back over 120 years. Real means the house asset prices have been corrected for inflation. What you can observe is house prices have not increased much more than inflation over the 110 years – i.e. in the late 1990’s the index was barely over 100 where it started. However, quite visible is the very distinguishable “Subprime” housing bubble that in essence triggered the Global Financial Crisis. You will also note, house prices in the United States are almost back to long term trends (index of 100).

Ex Westpac Chief Economist and Academic at the University of New South Wales, Nigel Stapledon has done the same for Australia, going back 130 years to 1880. While there is a slight upwards trend postdating rent controls during world war II, there is a very distinguishable and sharp rise in house asset prices after 2000.

Answering the age old question of if it is better to rent or buy, Mickenbecker said “.. Rent is cheaper, buying costs you more in current terms – however you don’t get the pleasures of home ownership, the stability of home ownership. And probably most importantly, participate in capital gains. And if properties double every 10 years, and you are renting, you are funding that, for your landlord.”

You can watch the interview here.

On a side note, We are ramping up our facebook page. Please like us and share among your friends.

» Renting vs buying – Sunrise, 11th April 2013.

You can show these graphs to governments, spruikers and bulls until you’re blue in the face. No-one is listening. They are all vested interests in denial. The way the government is manipulating the market to avoid a ‘correction’ is criminal. It goes against everything capitalism stands for. We all know they are doing it to protect their own interests and to win votes. It’s disgusting. But as Ned Kelly said – “Such is life.”

I’m still renting though. Wild horses wouldn’t drag me to buy right now.

Too bad no talk about demographics either.

http://au.businessinsider.com/matt-kings-most-depressing-slide-ever-2012-12

“And if properties double every 10 years, and you are renting, you are funding that, for your landlord.”

And the taxpayer funds landlords as well with Negative Gearing.

Nice link dibbz.

Heres another interesting read.

http://www.dailytelegraph.com.au/news/opinion/hard-yards-saved-australia-from-unemployment-and-fiscal-malaise/story-e6frezz0-1226617678021

Coincidence or do politicians wrte the news now?check the author out.

Read the first question in this article. Here’s a couple that really need a doubling of house prices. For the life of them.

http://www.smh.com.au/money/planning/reducing-interest-is-the-main-priority-20130326-2gr58.html

@4. jj, my diaphragm just about paralyzed reading that.

I am noticing a Media bombardment over real estate in the last few weeks, mostly in the favor of the bubble.

Have to say however, people are attempting to pay mortgages a lot faster than historically, average mortgage repayment at %105 is not “necessarily” a bad thing, doesn’t say “minimum repayment”. The number would need to be broken down.

Being the Media they can’t seem to get anything right

This is off topic but relevant:

In a blunt warning about the risk of rising house prices, Finance Minister Bill English [New Zealand] has cautioned that a growing bubble is likely to burst, hitting the economy and households hard.

Looks like NZ is at least acknowledging that it has a housing bubble.

Anyone interested in some prime property for sale in Broome? I can get you a great deal. Come to WA and be part of the never ending commodities boom!

I find it hard to believe the graph that shows that interest payable on dwellings is only 6% of disposable income. Is this correct?

@Vitalstatistix – it’s an aggregate figure across all households. The change over time is more important.

Thanks for the confirmation. I noticed that the trend is mostly upwards. The recent down trend is courtesy of the RBA setting interest rates at historical lows. There must be a large number of people with paid up mortgates to offset your first home buyer whose interest expense will be a very substantial fraction of disposable income.

The central banks are making a mockery of sound monetary policy with the endless quantitative easing that you are seeing all over the world. I am not sure how to deal with this as they are driving people into more speculative assets in search of yield. It seems to me that the results of the low interest rates will come to fruition in the next few years when people will struggle to retire because of low yields if the asset bubbles that central banks are creating don’t collapse before then. How long can this game continue before the public becomes aware of how destructive these policies are? We live in a strange world.

This discussion can be furthered into examplary US, UK, and other economies still in recession.

When the property bubble burst, not only the property prices have been down, but also the rent. This is the interesting part that no one in OZ would like to discuss. All evidenc is pointing that “Rent Is Right!”

Anyway, the GFC is mostly because of the property bubble. The governments are printing money, doing their best to sustain/save/restrive/slowly deflate/(whatever you name it) the housing price. This is wrong.

When housing price (a historical mistake by mankind) should be corrected, politicians and bankers kidnapped the central banks and print money in their favour. Ok, then the bigger mistake shall be corrected, still inclusive the housing price.

Mankind has now to pay a much dearer price for refusing the correction of a simple mistake. Let’s observe the renting cost in this wonderful country. May another freefall together with the selling price… I am patient in this observation. Cheers!

Latest QLD property market prop up. 15k for a new home up to $750k. If you can afford a $750k home you dont need a grant.

https://greatstartgrant.osr.qld.gov.au/index.php?s=1

20 years ago when i was in Shanghai, the house price was 5 times yearly income, I said the house is too expensive.

10 years ago, when price become 30 years average income, i say no way for house price rise again.

Now the house (oh,now is apartment) price in Shanghai is about 150-200 time of a average person yearly income. And price still rise sharply last month. There arestill tons of buyers line up in Agency buying.

The only point missed here is, 10% people own 90% wealth. Meaning, when you work full day get your 100 dollars pay, some one is getting 900 dollars without hardworking at same time. nobody really care a working couple can afford a house or not. It’s just a game amount rich ppl. And the game just start in Australia. Lets see the house price and rent price after 10-20 years when 10% pplive own 90% of australian liveable land. you can not pay the rent? Get fuck out. I still get 900 dollars everyday when you only get 100. It doesnt hurt at all even i left the house empty and lose that 50 dollar rent.

Interest rates are too low. If interest rates were higher, people could save more for their retirement and have money left to spend on discretionary items. It is very risky for baby boomers to depend on the future sale of their home or investment property to fund their retirement especially when so many baby boomers will be retiring around the same time. Baby boomers had better hope that Australia’s real estate property is not in a bubble. Imagine trying to sell your house in a falling market during a recession when many people will be losing their jobs or only working part-time for low wages.

Higher term deposit interest rates would help young couples saving for their first house. Compound interest can be a young man’s best friend. Young couples would actually be able to save a large deposit for a new home and the government wouldn’t have to offer first home buyer grants that only raise the price of real estate for everyone. It is amazing how people are thriftier and more careful with money they have actually earned and saved over many years.

Bankers, however, make more profits and receive bigger bonuses when customer debt levels are high. When debt levels can climb no further, bank profits will crash and the taxpayer will be asked to carry the loss. Private debt will become public debt. Bankers are capitalists during good times but they will have few qualms about socialising bank losses during an economic crisis.

I wonder what the bankers will be doing with their bonuses this year? My guess is that they won’t be keeping it in the bank or in cash. No doubt, they have all bought a fortified castle with armed guards to protect themselves and their gold from the hoards of disgruntled savers whose money will be trapped in bank accounts or made worthless due to hyperinflation as a result of the American, British and Japanese policy of Quantitative Easing (money printing) as part of a global currency war.

I would like to personally thank all the Australian politicians for their part in encouraging this real estate Ponzi scheme with negative gearing policies, first home buyer grants and for not regulating our banks more closely or from discouraging our banks from being concentrated into ‘the four pillars’ which are now too big to fail.

I would also like to thank the media who has shamelessly spruiked the virtues of buying real estate to the masses and helped fuel the desire for sexy property investment portfolios. Without our politicians, bankers and the media’s participation for the past ten years in spruiking real estate our monthly mortgage payments never would have jumped 105%!!!

It would be tempting to blame real estate agents too, but oddly I feel that they were simply at the right place at the right time. After all, when you go the barber he will never tell you it is the wrong time for a haircut—even if you’re bald.

The blame for huge monthly mortgage payments will unfortunately fall on the victims who bought houses they could not afford. All fingers will point at the debt slave for believing the fairy tale that house prices double every ten years and that if they didn’t buy now they would be shut out of the market forever. The debt slave will be ridiculed and mocked for listening to their baby boomer parents who told them that rent money was dead money. The children of the debt slaves in future years will not be so gullible as to believe that house prices never go down. A whole new generation will come of age seeing only house prices depreciating year after year. Soon we will all be Japanese.

A man’s house is his castle—but for a debt slave or a bonus rich banker, a castle can turn into his prison.

Unfortunately unaffordable housing and rents in Australia have created a huge army of homeless people who find living in caravan parks and tent cities a much cheaper proposition and alternative. This problem will continue to get worse. We are creating a new wave of vagabonds and street people. This is unacceptable in the supposedly ‘Lucky country’. Institutional government, whichever political aprty it is, only ignores the problem leaving it for future governments and generations to deal with while a false facade of economic prosperity is maintained. Future generations will curse us for allowing such a massive injustice. Lets start doing something about it today and strike-DONT BUY NOW!! and spread the word

@ Charles Ponzi – Well said mate! Now… what can we do about it? If ‘they’ can manipulate interest rates downwards, what will it take for ‘them’ to manipulate the reverse?

Rupert, what can we do about it? Unfortunately, not very much. I’ve come to realise that with about 70% of the population owning their own home, none of them want to see the price of their property going down. Once people have their own property or three, or ten, do they really give a shit if someone else is left out of home ownership?

We are the second most expensive country in the world after Hong Kong, but nobody wants to think they overpaid, and if in fact their house doubles in a few years, then they haven’t really overpaid, even if prices are hugely distorted. Blind Freddy can see we have a bubble that is completely reliant on foreign speculation, huge immigration and negative gearing to fund all the speculation and growth of this bubble. But the average person out there doesn’t give a shit as long as the bubble keeps growing. And the worst part? It does keep growing. It keeps defying the laws of gravity. Hell, even Steve Keen said today that prices would rise even higher this year. http://www.businessspectator.com.au/article/2013/4/15/property/house-prices-shoot-towards-ceiling#ixzz2QUFV7fFv and this is due to the millions of Chinese who have too much money and looking for a place to park it. And of course we Australians are only too happy to sell them as much real estate as they want, as long as will keep prices up.

One day the bubble will burst. But will it be in our lifetime?

THEO and Rupert

Well said…

https://www.facebook.com/dontbuynow