If you have landed on this page searching for information on the Australia Housing Bubble, then you are not alone.

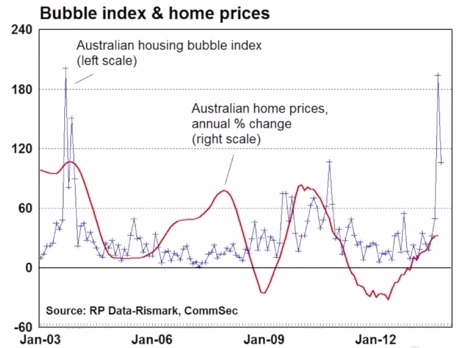

According to a new CommSec Housing Bubble Index, there were 194 mentions of “housing bubble” in Australian Newspapers in September this year. This is just shy of 201 mentions last recorded in January 2003 when Australia’s housing market first entered bubble territory.

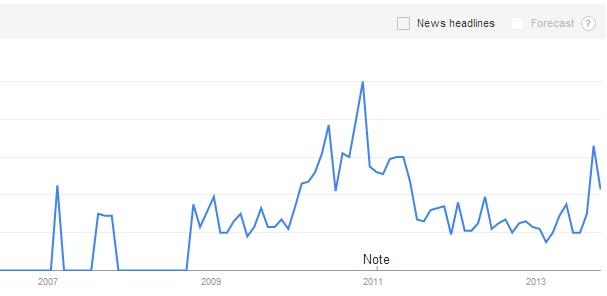

Renewed talk of the housing bubble in mainstream media has seen a remarked increase of individuals doing some homework on the topic. Google Trends reveals a significant increase in September of savvy participants searching the term “Housing Bubble” on Google: (The last data point consists of incomplete data for the month.)

To date, confidence has kept the market a float. Could this be a leading indicator that the tide is changing?

» Approaching peak bubble: new index to track housing bubble hype – BRW, 30th October 2013.

» CommSec Economic Insight: Bubble trouble: Measuring housing market hype – CommSecTV/YouTube, 24th October 2013.

Was the right scale cut out?

@Matty – The direct link for the Google Trends is Term “Housing Bubble”, Geographical Location “Australia”

You will note they don’t have a Y axis scale. It appears to be a index scaled with the peak in November 2010 being 100. September 2013 had a index of 66.

It’s ashame that they don’t have an index for ‘For Lease’ signs. If they did there would be a rush to the exits by those who own bank shares and property.

Many political figures and so called leaders of industry are still adamant there is no housing bubble. These are people who have never lied to us about anything in the past?

@Michael – SQM has rental vacancy rate indices by postcode

http://www.sqmresearch.com.au/vacancy.php?t=1

You are right, in my area vacancies have doubled since the start of the year.

Let’s hope that all this bubble talk raises awareness amongst the ignorant. What would be even better is for the bubble talk to actually bring about its bust.

@Michael Francis

i used to check out ‘For Lease’ and ‘For Sale’ numbers on realestate.com.au, they got rid of this function recently, i wonder W-H-YYYYYYYYY!!!!!!!!!!!!

There’s definitely a bubble, there can be no doubt about it now, the problem is even Steve Keen says it will go on for some time longer, refer below…….

http://australianpropertyforum.com/topic/9979267/

Steve says it’s the foreigners and SMSFs pumping up the bubble now, and no sign of it popping soon!

Time to leave this country. I’m going to go buy a house in America, you get get something decent there for $200K.

Welcome to the future.

http://bcove.me/53nngtnv

@Marge – yeah but America has guns and racism and Republicans, not to mention that anything decent in a decent neighbourhood in a decent state will cost you way more than $200k! Wild horses wouldn’t drag me to the US – unless it was California of course. I’ll stick with renting in Sydney thanks. I love it here!

@Average_Bloke – more global births + more immigration + more efficient technology = housing shortage, resources shortage and jobs shortage. Sounds like an Owellian dystopic nightmare to me!

So so dangerous. Asian investors and SMSF are the governments next card they are playing well to keep it all afloat. People should be ready to see another spike with prices rising another 100 points on the Schiller index over the next 5 years. Then once SMSF realise there’s no more people with money in their supers to throw it at housing they will all pull out at once.

Asians love to horde even if they property is worth nothing they don’t understand loss of income from not making their money work.

Every and I mean EVERY Asian person is of the mind that once you buy a house you’re set. They won’t give it up even if it’s worth $0 Asian investors are like cattle they don’t know what ‘value’ is or what economic cost is. An apartment can cost 50k to build but they will happily throw 1mill at it because they simply want to ‘own’ it. Think of china and chinese investors as 10yr old kids who won the Lotto. They have no concept of yield or returns or fair price. And there’s 1 billion of them…

I doubt Australia will crash for another 5 years. I would expect another surge in prices. China just prints all the money it wants and it’s citizens don’t know what to do but buy more property. It’s insane.

http://www.smh.com.au/business/property/first-home-buyers-disappear-as-prices-heat-up-20131101-2wpnh.html

derrrr

@Bestwest

Actually China from the year 0 (and most likely before) until the late 1800’s was the world’s wealthiest country along with India, so I think they would have some concept of value.

Also it’s not only property they are accumulating….

Hey does anyone wanna laugh real hard? Who’s from Sydney and knows the Central Park development?

https://www.facebook.com/pages/Central-Park-Sydney/111314825567886

Check out the reviews on the top right corner… I know it will eventually be taken down one day… I just wish there was a way to capture and frame that forever. Friggin gold!

DX – interesting to see they removed the function allowing you to see the numbers for sale/rent

BUT, go to map view and zoom out and it will show bubbles with numbers in it where there are very high concentrations available.

for example, i looked at Geelong properties at a one zoom level there were TWO bubbles showing 100+ properties for rent. i was amazed, and dragged the map over to melbourne where no such high densities of avail rentals were seen.

Two points for mentioning this. one, use the map view to get numbers! second, watch Geelong as a leading indicator of what is likely to come elsewhere ‘soon’.

SMH is busy talking about it again too…

http://www.smh.com.au/data-point/home-truths-20131101-2wry7.html

Yes, and in the article it says, “Economist Stephen Koukoulas says the anxiety about overpriced housing is overblown because the burden of today’s big home loans has been completely offset by the saving from low interest rates.”

So what happens if interest rates go up? Well down the bottom it says, “That would be bad news for the whole economy, not just the housing market.”

So again we have to persist with the perennial prices up is a good thing and prices down is bad, but never the possibility of a bubble happening. The fact that we’ve been in a bubble for years, is as usual, completely ignored.

@Jj

compare to ‘Newport Quays’ in Adelaide, ‘Central Park Sydney’ is nothing.

Check it out, ppl

http://www.thenewsmanual.net/Resources/medialaw_in_australia_05.html

I reckon I’ve worked out this whole ‘bubble denial’ charade thing.

This is how it works:

Deny there is a bubble even though the Govt and Investors are pumping furiously. Say via the compliant media that this all normal ‘nothing to see here’ etc etc.

Then when crap hits the fan and there is a ‘unforseen sharp correction’ (can’t say the ‘word’ crash ,might spook the horses) you can, in hindsight, refer to the bubble as a bubble.

Do I win a prize?

I just read a Sydney Morning Herald article, and house prices in Sydney are getting ridiculous. The average price in many suburbs is close to $1 million dollars, and we are not talking about prestige suburbs or huge mansions, just average homes.

With the average wage in Australia at around the $50 to $60K pa (before tax), and rapidly rising unemployment, the “great Australian dream” will be a thing of the past.

The property spruikers,corrupt politicians,banks,building industry etc, can make up all the BS excuses as to why property keeps going up, but I think it all comes down to GREED.

Most of that Google activity is probably me. I’m obsessed.

https://www.youtube.com/watch?v=5fbvquHSPJU

Funny that… Review section on facebook for Central Park previously mentioned has disappeared overnight…

@Jj

I had a look but what specifically were you referencing, the comments about Daiso? There was so much wankery on that page I couldn’t tell.

Mr V, no… there were 2 cases specifically in the review section which was removed about getting a smaller unit than paid for (first case specifically mentioned they bought a 53m2 off the plan, but got a 48… so as a result they couldnt get mortgage insurance). Second person also mentioned they got smaller than they bought/paid for and that the colour scheme was also done incorrectly not as ordered. Other reviews mentioned something about a promised gym being non existent and there were other general complaints and comments like “before you focus on publicity and shows, maybe you should focus on getting the units finished first”. They were apparently promised for April but some are still waiting. Also comments about how it was initially marketed as premium residential but how they later decided to add a student accommodation section/area. If anyone is unfamiliar with what the words student accomodation can do to property in that area… look up what a unit in a place called Unilodge costs just down the road…

There are so so many ‘family/residental’ apartments being built for the sole purpose of student housing. They are 1-2 bedroom, 50-70m2. No or 1 car bay.

After 5 years these areas turn to shit. Imagine a party every weekend at your neighbours that’s what it’s like. To avoid them you have to get 3-4 bedroom with 2-3 car bays. And 2 bathrooms in a building where ALL the units are 3-4 bedroom and it ensures you get young family’s not poor students.

I hate student share housing. It always sneaks in as residential because someone on the approval board is approached by a developer with a kick back to approve the building.

@Master Yoda. You are on the money my friend, I live in Sydney and property prices have gone crazy. No joke sub-standard 3B/R houses built in the 60’s & 70’s going for close to $1 Million dollars.

We are talking about stock standard suburbs 15-20km from the CBD, places like Rockdale, Kogarah, Bexley, Hurstville, etc.

Investors in sydney especially are distorting the market as they are willing to pay much more than a home owner so they can sub-divide build townhouses or units and make a profits.

If you live in Sydney and you are smart sell now, take the proceeds and go anywhere as you would be much better off.

@Placeholder

go read this article

http://www.propertyobserver.com.au/foreign-investment/australians-shouldn-t-fear-chinese-buyers-but-should-the-developers-marketing-to-them