According to Channel 10 Adelaide, The Reserve Bank of Australia has “denied” the Adelaide property market a much needed boost by leaving rates unchanged.

You could be mistaken for thinking it was 1989 and the official cash rate was 17 per cent. But, no, the report aired yesterday after the Reserve Bank left the official cash rate at just 2 per cent, a record low.

But it is not interest rates that is dragging on the Adelaide housing market, but rather Australians are up to their necks in debt. Household debt as a ratio of household disposable income now sits at 153.8 per cent in Australia, some of the highest levels in the world. At the height of the sub prime crisis in America, household debt peaked around 130 per cent in the USA.

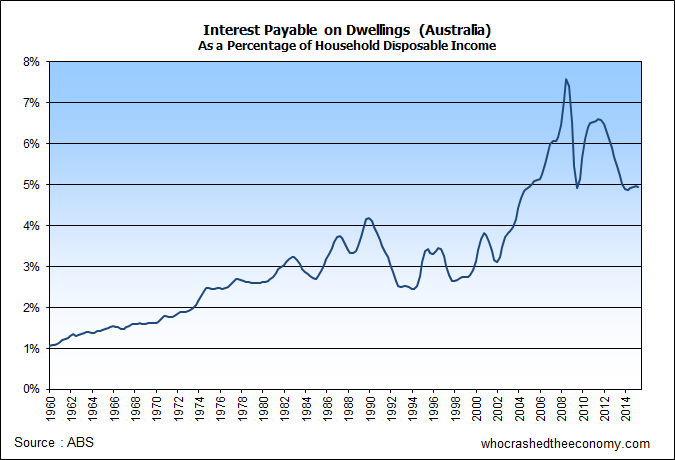

Data from the Australian National Accounts, released today, show in aggregate, households are paying 4.96% of household disposable income on dwelling interest payments, still greater than the 4.18 per cent recorded in 1989 when mortgage rates were in excess of 17 per cent.

First home buyer, Hannah O’sullivan welcomed the central bank’s decision to leave rates at record emergency lows, but said it could have been better. If interest rates went down it would put a little more sense of urgency into buying, she remarked.

But this talk is scaring regulators, with naive first home buyers ignoring what will happen when the official cash rate inevitably rises. Regulators are urging all buyers to think long term as mortgages are 25+ year commitments. Rates won’t stay low for ever.

Australian Securities and Investments Commission chairman Greg Medcraft told a Senate estimates committee, borrowers need to do their sums on a mortgage rate of 7 percent, not 4 percent.

The Ten reporter said despite two cuts to interest rates this year, Adelaide property prices hadn’t spiked like had been the case in Sydney and Melbourne. Hannah O’Sullivan said “it is a little bit frustrating,” an interesting comment from a potential first home buyer.

Property lobbyist, Daniel Gannon added what the market needs right now is “major stimulation” and interest rates do provide one potential opportunity for first home buyers to get into the market.

And as for Hannah’s strange comment, some readers have conducted a Linked In search and believe she could in fact be a Human Resources coordinator for real estate agency Toop & Toop. Apparently the photo’s a good match too. It’s been a couple of years since we have seen real estate professionals double as first home buyers and potential investors without disclosure, a potential sign of desperation in a cooling market. (‘The Real Estate industry is increasingly misleading the public‘)

As we wrote in 2009, The next time you see an article in the media about someone buying a first house or investment property, be sure to run the potential owner through Goggle to see if they are an agent or associate. It’s a good chance they are.

» SA housing market lagging – Channel 10, 2nd June 2015.

» ASIC warns new borrowers on rates – Yahoo, 3rd June 2015.

Absolutely terrible journalism.

Market denied? How is the property market being denied when rates are already at such a historical low. The property market is not owed anything by the cash rate.

How about the self funded retirees and people who are currently saving for homes being denied every time the RBA cuts the cash rate and hence the interest paid on their deposits.

First they say she is a first home buyer looking to buy but her talk quickly turns to investment.

“I want low rates so I can invest”

Wait a minute what does that have to do with buying a first home? If she is investing then will not be living in it.

As for Daniel Gannon’s “market needs major stimulation” what do you call record low interest rates, much lower than even emergency GFC levels. This is why the RBA decides, go learn some economics you fool! Have a look at what the current low rates are doing in Sydney which has been constantly noted by regulators as being a concern. But according to Danial Gannon we should just keep lowering rates yeah!

Oh yeah and since when did the Adelaide property market dictate where the national cash rate should be?

Anyone would believe that property prices are the only thing the RBA should consider when setting the cash rate and completely ignore the rest of the economy as a whole.

What is really sad is just how many people believe this trash, delivered straight into family living rooms.

How dumb have we become as a society?

It will be interesting when the prices start to drop some meaningful amounts, protests on the street, looting, riots. Sue the government etc.

Happy days for the continuing renter, thanks for the subsidy landlord !!!

Watching the property spruikers is like a rerun of “Dumber and Dumberer” When they say we need the housing prices to keep going up to stimulate the economy they show total ignorance of what caused the GFC in 2008.The 400kg gorilla in the room is of course that they will not be able to stop interest rate rises worldwide as bond yields crash. Read the article below and weep if you have bought a house in the last 2 years with a mortgage.

http://www.zerohedge.com/news/2015-06-03/roaring-interest-rates

Wow I just LinkedIn her and sure does look a like. How do these people go to bed at night? Terrible and so misleading. Govt needs to really crack down on them.

Exactly Andrew.

Either move with dumb herd or will be punished with lower rates and high price for roof over the head. Looks like we are steered for global deflation or bust event in future as stated my Marty.

http://armstrongeconomics.com/archives/31208

It’s absolutely astounding what people believe. Sorry to offend but I think people in Australia are some of the dumbest in the world. The walking dead I say.

Here’s a profile of our lovely first home buyer

https://au.linkedin.com/pub/hannah-o-sullivan/81/967/4a5

@ 9: Tony

I see the problem: She gave up senior public servant jobs thinking the grass would be greener in real estate.

Of course she needs rate cuts! She deserves them!

Why a real estate agent needs a HR coordinator is beyond me: It just proves the excesses that REA’s are making of the sheeple.

Things are ultra shaky in real estate world, there’s just no stability across Australia: Falling prices everywhere except the expensive areas….. Doesn’t sound like a top in the market does it????

Kinda surprised there was nothing in the budget for home owners/ investors….

More than willing to watch and wait.

@ admin

Even better: https://www.toop.com.au/contactus.asp

Scroll to the very last picture!

@ admin

Do they really think we are that F#%^^g stupid!

https://www.facebook.com/ToopandToop/photos/a.10151963310555801.1073741830.39078915800/10153288697715801/?type=1&theater

Hey everyone can we do something about the outright propaganda lie against the channel? However lets all send complaints of scammers and frauds to the real estate company and everyone should expose this company and give it bad reviews on our personal Facebook and twitter sites

@ theo,

I agree with you all the way with your comment and something should be done however I have no doubt in my mind that everyone from the top down including the Government are fully aware of the lies in which get told on many levels. I have no physical proof but I have instincts and they serve me well when I pay attention. all the best bud.

Wow. Lucky we’re not in a bubble or else this long term unemployment stat could be bad.

http://m.smh.com.au/business/the-economy/longterm-unemployment-sharp-rise-taking-a-toll-on-australias-w inellbeing-20150606-ghhp6i?&utm_source=social&utm_medium=facebook&utm_campaign=nc&eid=socialn%3Afac-14omn0013-optim-nnn%3Anonpaid-25%2F06%2F2014-social_traffic-all-organicpost-nnn-smh-o&campaign_code=nocode&promote_channel=social_facebook

Comments form a real estate employee should ALWAYS be ignored as they now jack schitt about economics or town planning 99% of the time. This is the first thing you learn in the property game. Sorry Hannah, you’re a joke.

CH10 did it again the other night.

Another property porn story where someone spoke about record prices in Sydney and how the average auction sale is now around $1.1m there.

They did mention however that the low rates are affecting self funded retirees who only get between 2-3% on cash deposits now (cues to shot of some old people playing lawn bowls) then the guy comes back on and says they just need to take their money out of the bank and buy property which will give them 5%.

Crazy talk! as you approach retirement you need to have less risky investments.

@ 17

Yep. Crazy talk. Spoke to business bank manager about my pathetic interest on cash. Was told to think seriously about buying property.

What the hell? You want me to turn my business into a property company?

Not happening….

Well, not until after the bust…. Cue haters

This is very excellent! The greed is turning to fear, folks!

Adelaide is going to be smashed. No more manufacturing post 2017. Less defence work (the minister wouldn’t even trust SA to build a canoe, remember). The oldest and least educated population of any major Australian city.

I’ll be amused to see people driving 2 year old V8 Land Cruisers and BMW X5s to Centrelink, and blaming everyone but themselves when their overpriced house is reposessed.

I hear people say how are our children going to afford a house. I think that’s the point you idiot, most people can’t afford one now and therefore if things keep going the way they are then nobody will afford one in the future. That includes anyone’s children. Its as if today’s property investors/owners/mortgagees think they are the last true generation to be able to afford a house. Seriously…. Probably the dumbest yet funniest mindset this century and I’m sure we all know at least a few with that mentality. Not only will people loose lots of money that really wasn’t theirs to begin with but friendships and families will drift apart because of embarrasment due to their decisions. A lot that happens over the coming years will stain a lot of people for a long time. Its a sad time but unfortunately you can’t save evryone but you can save yourself.

Mindset lol..

Have a mate in Canberra, young family with three kids under 5. Lifestyle alone is outstripping income. They have two nice new cars, an investment property in outer Melbourne, kids have all the junk of 5 daycare centres + holidays. I often get the distress calls (not asking for money, just wineing) about how far behind the rates are, the electricity bill, the car rego out for 6 weeks. And the forecast of being $40,000 in the shit by years end.

The bank gave this guy $230,000 10 years ago when we both had $10 in our pocket. He worked very hard, many weekends in construction. But now that work is not there and the missus is very unimpressed she has to work and tighten her belt. But even as though water is now flooding E deck, she wants a larger set of breasts at around $10,000.

Property doubles every 7-10 years I was told, equity mate- no worries.

The best is the Melbourne property. I was told on Monday that’s the deposit on 3 homes in the next 15-20 years for his kids. This 3br brick home is gonna be worth $1M-1.2M easy he says. Currently it’s valued at $480,000. If that’s the case these kids will need damn good jobs to pay of their first homes.

It’s all utter greed. It’s about having it all now based on a bet. He tells me he’s worth a million. I say no you’ve borrowed $500,000 and the rest is speculation at best, an iron anchor at worst.

It’s obvious where it’s all headed.

‘The Velocity of Money’ kinda says it all, doesn’t it?

https://damnthematrix.wordpress.com/

And how about the ‘Baltic Dry Index’

http://www.telegraph.co.uk/finance/commodities/11387837/This-is-the-most-important-financial-market-in-the-world-right-now.html

Dear dear me, are we in a pickle or what.

@21 And Oz is full of morons like your Canberra mate. Hence the idiotic obsession with property by fools who cant see, let alone understand, the big picture..

Slightly off topic, I’m not sure if people remember that young girl Emma who a few years ago started a website / blog to document her plan to buy 2 properties every year for 10 years and retire in her 30’s (probably read about people doing it in property investor mag)

So she set about writing her blog called “My Property Journey” to document the whole thing (I mean shove in everyones faces as if “I’m going to be rich I told you so”

The domain where it is hosted is no longer updated but you can find archived records on the internet wayback machine.

One of the last posts was made in January 2014 about purchasing a property in QLD, but then radio silence. I take that as an indication that things have either failed or not going to plan at all.

I really can’t see how it would work unless prices were increasing by large amounts year on year. Each new property relies on some deposit which she was probably planning to use equity from the growth of previously purchased properties. There is also the issue of most likely being negatively geared on all of them and not making enough money from a day job to pay for all the losses. Something that probably worked 15 years ago as we transitioned from a high interest environment to a low one.

Facebook page is here

https://www.facebook.com/pages/My-Property-Journey/309623435763289?sk=timeline

Twitter is here

https://twitter.com/propertyjourney

Website is here: (linked from the wayback machine since the blog has expired)

http://web.archive.org/web/20131213033238/http://mypropertyjourney.com/2013/12/13/purchasing-interstate/

my bad the twitter link I posted above may be the wrong one..

Just when you thought our clueless politicians couldn’t get any worse, Joe Hockey comes out with this howler.

http://www.smh.com.au/federal-politics/political-news/joe-hockeys-advice-to-first-homebuyers–get-a-good-job-that-pays-good-money-20150609-ghjqyw.html

Seriously, our so called “elected leaders” are so far out of touch with reality, that it borders on scary.

Does anybody know what qualification and experience does Abbott and Hockey have to run the economy affairs of our country. By what they do and say one may conclude they’re complete illiterates in the field of economics. Abbott’s talk about Captain’s Call ? WTF ? Oh yes, sorry I forgot but I get it now… Titanic’s Captain.

master Yoda-Their comments do not surprise me. They must ne on something. That explains why the Liberal Party supports drug lords and dealers. It also explains their support of the two drug lords who were executed in Indonesia

@ 4. Yoda:

I doubt those protests will have any great effect. Remember OWS? That fizzled in the end and the bankers walked away from the ashes with pockets filled with taxpayer dollars, and the media told the poor to stop whinging.

What’s the bet the same happens here?

Ah the answer is so simple.

Just go out and get a job that pays more, easy!

Thanks Joe!

Its like watching Jurassic Park when the ground is rumbling and you know something big is coming. The best part will be to see who is eaten first by the debt monster. When house prices tank the backlash against self serving politicians and lying real estate agents will be ugly. Also watching the lapdog press protecting their masters is as sickening to watch as the treasurer saying he turned in his neighbour to FIRB for an illegal RE purchase. If he at least spent his spare time reading “Economics for Dummies” we might all be better off.

Sydney house price rise ‘crazy’, RBA’s Glenn Stevens says:

http://www.smh.com.au/business/the-economy/sydney-house-price-rise-crazy-rbas-glenn-stevens-says-20150610-ghkjrz.html

But then this…

Housing bubble speculation makes mistake of assuming Australia is the same as the US, says LJ Hooker CEO:

http://www.news.com.au/finance/real-estate/housing-bubble-speculation-makes-mistake-of-assuming-australia-is-the-same-as-the-us-says-lj-hooker-ceo/story-fnd91nhy-1227391247494

I dunno, I guess people have to choose who to listen to. The chief of the RBA or a real estate CEO.

@Bubby – Great post. There seems to a lot of news about housing affordability in the last week thanks to comical JH, which confirms the real concerns we all have. My point is that I also saw the same item with the LJ Hooker spokesperson, and he mentioned another very misunderstood myth we get here in AUS, and implied that we are different to the USA as ‘we do not have non-recourse lending’, and implying we are not personally liable. The feedback I have experienced here is many Aussies think over there it is as easy as handing in your house keys, and walking away and why we will never be like them, and you can rub your hands of house debt. But 4 years ago (as USA housing was folding) I had a Detroit Sales Manager on secondment in AUS in my car in ADL as he did every month making sales calls and checking up on me (until the pr*@k made me redundant). To test that, I asked that question ‘can you just hand back in your keys if the mortgage was too much in the USA ’ ?? His answer was a definite and swift no ! Although the Bank may not come after you, somebody will, and you will have lifetime financial consequences if you do not pay it back. So what I am trying to say, as far as bubbles goes, I always pick Ireland, Spain as similar economies/governments, but we are not that different to USA as we would like to feel comfortable with, and you will have to pay to back eventually. Hold on…

Yes indeed. A very similar looking Hannah Sullivan works for Toop Toop. Nothing wrong with that though is there?

She may very well be a first time buyer!

@32

Non-recourse lending: What a magnificent myth: Last I knew it only existed in 8 of over 50 states….

Then let’s not consider the details that occur after. Yes, in these <20% of USA states where non-recourse exists, where people did hand in their keys…Then what happened?????

Post Non-recourse hell is what: http://globaleconomicanalysis.blogspot.com.au/2014/10/post-foreclosure-hell-garnished-wages.html

There's no such thing as a free lunch: Unless you are the bank…. Banks never loose, they pay the government to make the laws.

Banks are the most powerful entities on earth: No bank will pity anyone who leaves them in the lurch.

LJ Hooker CEO is a BS artist: Should be fined and jailed for spreading such utter lies. But no, as part of the FIRE sector he will escape any scrutiny.

Instead, they will fine, for example, an international company adhering to international standards for advertising as such, when the local standards are different: No, I'm not an apple fan-boi, but apple was fined for advertising 4g compatibility: What Australia calls 4G is LTE in USA, in USA 4G is called HSPDA+….

The whole political system is decaying faster than the WA royalties. Don't be fooled on any level.

What's been going on in Australia for the last 15 years has been epic. When the day of reckoning comes, you will see entire families multi-generational wealth destroyed by their greed and belief in property.

Couldn't happen to a nicer group of people 🙂

Some of the flaws with the LJ Hooker CEO article.

“We do not have non-recourse lending”

True but many states in the US did not have non-recourse lending either and they still recorded large drops in prices.

“We do not have an oversupply of dwellings”

The same could have been said about the US market before the collapse. There is always a perception of under supply at the peak of a bubble. When people are having a hard time then the density of people per dwelling is likely to increase and free up more housing. Many of our states did not record large increases in population however did record large increases in price during the same period.

“We do not have speculative purchasing of property, which created the housing bubble and subsequent collapse in US property markets”

This is entirely false, at least 70% of property investors are negatively geared and therefore are speculating that the value of property will increase enough to cover their losses.