The weekend emergency briefing about the actual state of the economy must have come as quite a shock to Prime Minister Kevin Rudd and the Government. Just as big was the shock to see both the Government and Opposition united in what ever decisive action was needed to safe guard the Australian economy and prevent us falling into recession, if such a positive outcome is possible. Not a bad word was said between either party, and this even prompted a question at the National Press Club today from an Adelaide Advertiser journalist about what was said between the two over the course of the weekend.

Today was the day to let out the bottled up tension being held since the weekend. Rudd started at the National Press Club by saying Australian’s had no role in this crisis – “As Prime Minister I will not sit idly by and watch Australian households suffer the worst effects of a global crisis we did not create.” He then went on to attack major banks and financial institutions for their “obscene failures in corporate governance which rewarded greed without any regard to the integrity of the financial system” and told how “failure of extreme capitalism” forced the Government’s hand to react to the current situation.

He also announced the government will work with APRA (the Australian Prudential Regulatory Authority) to address problems with excessive executive pay packets and promote greater financial system stability. This sparked a blast from the banks later in the day saying the nation’s financial institutions were “not being bailed out by the Government”. David Bell, Australian Bankers Association chief executive said there was “no evidence that Australian bank salaries packages have weakened our banks”.

The Opposition later attacked Rudd with Opposition Leader Malcolm Turnbull saying the Rudd Government should have acted sooner and missed the warning signs. “Regrettably, Mr Rudd’s Government missed the warning signs at the beginning of the year and talked up inflation, and consequently interest rates, at precisely the wrong time,” he said.

But guess what? It’s now my turn to attack some of their statements.

Firstly, Rudd’s comment “As Prime Minister I will not sit idly by and watch Australian households suffer the worst effects of a global crisis we did not create.”

Even today, there is still the tenancy to say this crisis stemmed from the Subprime problem which developed in the United States. I suspect this is what Rudd is referring too. He might be forgiven for having a lot on his plate of recent, but the Subprime was simply a trigger of an asset bubble fueled by cheap and readily accessible credit. Why is it now spreading to many other countries, so quickly? Because most OECD countries got caught in the same trap. They lowered Interest rates to kick start the economy after tech wreck and cheap credit, most of it in an unregulated environment, has fueled a huge global house price bubble and credit binge.

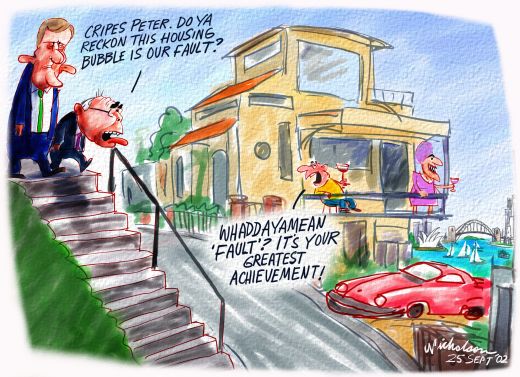

Our house price asset bubble is one of the biggest among OECD countries. At present the average Australia house is worth 7.5 times wages. At the peak of the US bubble, prices averaged just 3.5x wages. In the UK and Ireland it averaged about 5x wages.

This huge housing asset bubble in Australia has driven up household debt further and faster than our friends in the states and now begs the question – If Americans can’t afford their houses, what hope do we have?

Now the only way Australian’s can say they didn’t participate in this crisis, is if they say they didn’t speculate in the property market, didn’t sign a mortgage for a house that they probably can’t afford at large multiples to their wages and didn’t spend more than they earn’t. The banks and mortgage lenders must also say they didn’t package up mortgages into CDO (Collateralized debt obligations) or trade any CDS (Credit Default Swaps). We are yet to see what the complications are for Credit Default Swaps, both here in Australia and abroad.

Yes, we are intertwined into this crisis just as much, if not more than our foreign counterparts. We can only start to address this problem, once we recognise it.

|

And this leads us to Turnbull’s statement that “Rudd’s Government missed the warning signs at the beginning of the year and talked up inflation, and consequently interest rates, at precisely the wrong time”. Is Turnbull really saying that this crisis started at the start of this year? Off course not, it has been brewing for years, many on which was under the leadership of the Liberal Government. Surely Investment Bankers are smarter than that, even if they have entered politics. Why didn’t the Liberal government realise household debt was spiraling out of control, household savings started to go negative in 2002 and households were spending more they earn especially at a time when Howard was saying that the Average Australian has never been better off? Why now is Rudd “rewarding greed” by propping up house prices and encouraging first home buyers into a life of excessive debt?

» Banks blast Kevin Rudd over executive salaries crackdown – The Australian, 15th October 2008.

» Government missed warning signs: Malcolm Turnbull – The Australian, 15th October 2008.