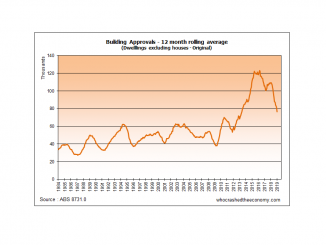

Building approvals continue to plunge

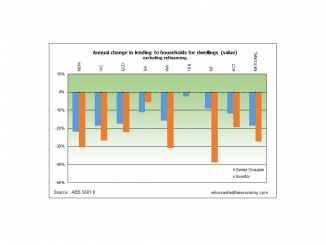

New figures released from the Australian Bureau of Statistics (ABS) show building approvals continue to decline due to a significant slow down in the apartment sector. The largest decline in approvals have been in sectors other than houses – i.e. townhouses, units and apartments. Australia turned to an apartment building …