Nine banks have today hiked interest rates, out-of-cycle, on regulators confirmation of a housing bubble.

On Monday, the Australian Securities and Investments Commission (ASIC) chairman Greg Medcraft remarked “I’ve been saying for a while I thought it was a bubble, other people are catching up now,”

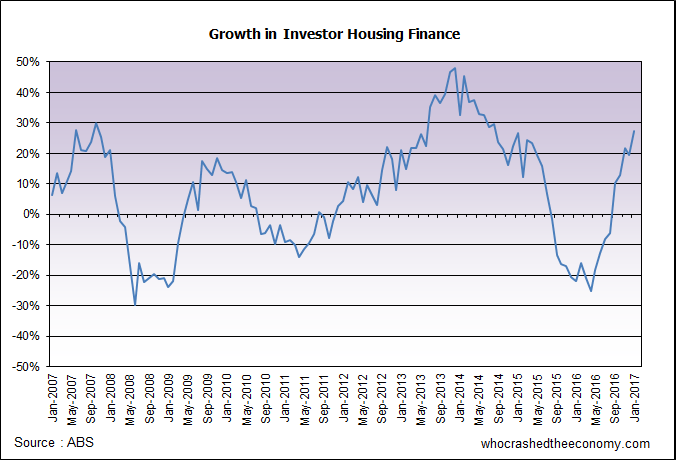

The latest Australian Bureau of Statistics (ABS) data on mortgage growth shows more risky investor loans surging 4.2 per cent in January, bringing the annual total to a worrying 27.5 percent.

Macro-prudential controls introduced in early 2015 (APRA to keep banking crackdown secret) had worked its magic until the Reserve Bank blew it, slashing the official cash rate in May and August of 2016. One month later in September, investor mortgage growth had rebounded.

Admittingly, the Reserve Bank has learned its lesson. The most recent statement on monetary policy states, “Recent data continued to suggest that there had been a build-up of risks associated with the housing market.”

“Borrowing for housing by investors had picked up over recent months and growth in household debt had been faster than that in household income.”

The central bank’s mistake has pushed it into a corner. It is now too risky to cut rates while the housing market runs red hot. And the rapid build up of household debt, means the market is now too indebted to hike rates.

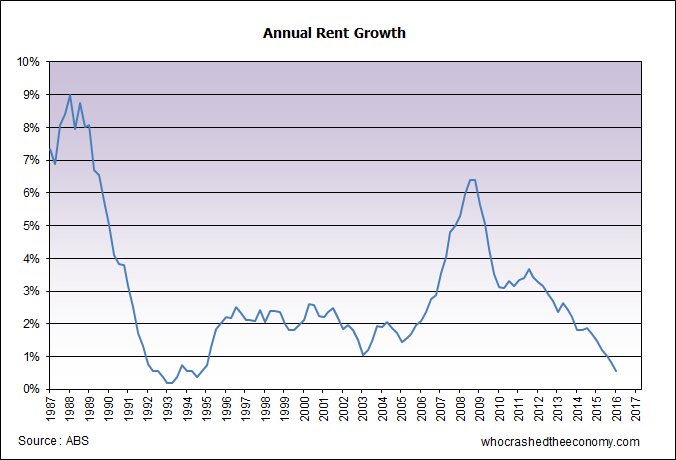

The influx of investors into the rental market has been a win for renters, but has added significant additional risk. While investors each strive to become multi-property landlords, the steady supply of extra rental properties into the market have seen rental vacancy rates in some suburbs punch through ten percent and rental growth plunge to 22 year lows.

The increased vacancy rates are a risk for many investors, who rely on rental income to service their repayments. But the problem is about to get much, much worse.

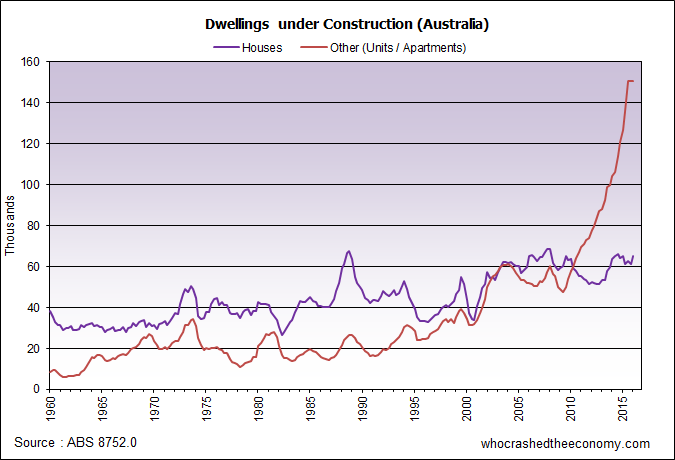

Australia is in the grips of an unprecedented apartment construction boom. Over the next twelve to twenty-four months, a flood of apartments will hit the market.

The confirmation of the property bubble, now means debate can turn from the housing market to the stability of Australia’s banking system. Australian households carry some of the highest level of household debt in the world, making an “unquestionably strong” banking system so much more of a challenge.

The council of Australian regulators, comprising of the Reserve Bank of Australia (RBA), the Australian Prudential Regulation Authority (APRA) and Australian Securities and Investments Commission (ASIC) are working on the next round of macro-prudential controls in response to the out of control 27.5 percent investor mortgage growth.

Banks must hold adequate loss absorbing capital (Common Equity Tier 1) based on the perceived risk of the loans they write (risk-weighted assets). Historically, both owner-occupier and investor loans for residential property have been lumped together and risk-weighted.

As the bubble evolves, Australian property investors are carrying ever increasing risks. Property investors have, over the last decade, traded yields for perpetual capital growth. When the market inevitably runs out of puff, it is unlikely investors will hold their properties with such poor rental returns. Doing so, in effect, they will be subsiding the living expenses of their tenants. Additionally, more and more investors are faced with the prospect of empty properties but are “materially dependent” on the rental income to service the mortgage.

Australia also has an extremely high portion of property investors on highly risky interest only loans, speculating on perpetual capital growth without paying down any principle.

It therefore makes perfect sense to categorise investor loans, especially interest-only, as much higher risk when contrasted to owner occupier loans. They are more likely to default.

Our four big banks currently have a minimum risk-weight for residential mortgages (both investor & owner-occupier) set at 25 per cent. Our remaining, “regulated” banks have a minimum of 35 per cent. It is believed regulators are mulling over increasing the minimum risk weights on investor loans to the region of 75 to 100 percent.

Increased risk-weightings on investor loans mean banks will have to hold significantly more extra loss absorbing capital. It will help make Australia’s banking system “unquestionably strong”, but will come at a cost to investors – a user pay system as such.

While regulators contemplate their next move, banks are already re-pricing those risky investor loans.

Last week, Westpac and NAB made the first move. Westpac nudged up owner-occupier (safer) mortgages by 8 basis points, and hit property investors with a 23 basis point hike for principal and interest loans and interest-only investor loans (high risk) with a 28 basis point hike. The NAB pushed owner-occupier loans up 7 basis points, and investor loans up 25 basis points.

Today the Commonwealth and ANZ followed suit. For property investors banking with the Commonwealth, this is the second rate hike in just six weeks, up 26 basis points. ANZ hit property investors with a 25 basis point rise, and the interest-only property investor with a 36 basis point rise.

I am asking the owner of ‘Who crashed the economy’ to write more articles on the Federal Reserve Bank of Australia. Is it a privately or publicly owned bank? If it is a government owned Bank then why don’t we print more money to cover Budget deficits? Who does the government owe money or its debts to if the Federal Reserve is the government’s? I believe more people should be made aware of the role of the ‘Federal’ Reserve bank of Australia so as to expose the lie that is the ‘Federal’ bank and so called ‘Budget’ deficits.

Does this rate rise have anything to do with the US Fed raising its rates by 25 basis points on the 15/03?

I am glad that this is happening, sorry but all the greedy people out there that thought they could make easy money are going to lose it all. Australia has been living beyond its means for too long now, people need to learn a lesson, and theyre all about to very shortly.

I’ve been looking at rental properties over several days and noticed several properties that look like a detached house with a single enterance but are advertised as a duplex. Does anyone know if that is legal in Qld?

Nothing will change until Negative Gearing and Chinese Foreign Investment is restricted.

Case in point – this “house” just sold for $1.61 million.

https://www.realestate.com.au/sold/property-house-vic-hawthorn-124848370

@ #2 Gavaroo.

Yes the US Feds increasing rates does affect us as the Big 4 Banks have taken loans out with the US Fed banks to keep the credit flowing here. About 40% of the loans on their books are funded by foreign loans, thus movement in their markets expose us and thus they are forced to do similar movements to keep up with their credit repayments.

The issues in the banking system here go deep and the carelessness is extreme and worrying.

Greed is good…..for some. $1.6M for a 2 bed home is just obscene. Some people have loadsamoney

So now we have macro-prudential restrictions and rising interest rates at the same time..

Demand will vaporise, bloodbath to ensue….this is an embarrassment to the country especially in the eyes of international rating agencies.

Demand may continue for Sydney , but only greater fools are participating.

This blog has had many interesting post since the GFC, especially through 2011/12 when the training wheels fell off the the trike but were sured up by Fed Gov aka ponzi perpetrators.

The trike is still on 3 wheels but well past its service date, even the mechanic doesn’t understand how is still going.

10% growth is aimed at banks investment housing growth on their balance sheets, it’s has nothing to do with approvals. And at the moment every major bank is under 10% but some are approaching that limit. So that 27.5% figure has nothing to with the APRA cap.

@Sam can you explain how they’re different?

The APRA cap is a growth cap on lending right? So it’s a cap on approvals.

If banking profits drop they can simply hike up rates, regardless of the damage it might cause to the wider economy. If people start declaring bankruptcy then the tax payer with come to the rescue, and no we won’t be given a choice in this, but something we’ll be told “mates” do as they seize our cash.

@ Sam I had another look into this, I found the figure 27.5% figure confusing when I first heard it.

Growth between Jan 2016 – 2017 in Lending commitments; Investment housing; Total = 27.5 %.

The book value went from $10.811 Bill to $13.784 Bill.

The 12 month ended growth though is 6.6 %, which like you point out is under the 10% cap.

Looking back , the book value peaked in April 2015 , the increase was truly absurd, 5 % in a few months.

When 12 month ended growth was at 10 % ..and APRA were carrying on… the annualised book value was increasing too, Jan 2013 – 14 was 26.7 % , Jan 2014 – 15 was 32.8%…just like now

I guess this is why its news again.

I notice also from April to December 2015 Investor values down 24 % Owner Occupiers surge 13%. Smells of Loan switch Ponzi. Why is it even a thing in this country where a person with a PPOR can pay IO, its a joke.

This is the final stage before the nxt global meltdown. The rise of interest rates under our current economic conditions spell the beginning of the end. Same thing happening in America. First the US economy will collapse probably in the next few years depending on how rapidly Yellen ushers in her rates increases, then we’ll follow. Fake economic data being spriuked out of US, China, Australia, etc wont mask the debacle about to happen. Its been too long since we had a recession, so the fall will be big to make up for that..

Who’s going to live in all those new apartments? No one will buy them.

@ Damian the 200 k 457 burger flippers we shovel in fired from the barrel of the governments Ponzi rifle

I sold up and cashed in. Cash in the bank doesn’t seem safe either. What do people on here advise with savings?

Aussie banks?

Credit unions?

Gold?

U.K. Bank?

With all these rater rises, the big banks want to push away all the now risky investors off their books. Get them to refinance over to smaller lenders or non-banks like pepper who repackage them into securitised wealth products, who get sold onto the remaining investors who didn’t buy properties directly. We’re basically recreated the derivatives mess in Australia that took down the US. There is going to be a huge wealth armageddon very soon

http://www.afr.com/real-estate/westpac-group-banks-hike-rates-by-more-than-30-basis-points-20170327-gv7k9u

@Matt, it’s hard to know, but oddly property seems the safest bet. Gold is dubious and more trouble than it’s worth. Much of it is just ‘paper’ gold anyway.

@Matt. I would stay in cash, diversified among a couple of banks, but be ready to move it. I suspect equity markets (dominated by our banks) will correct before the banks start going under. At this point, you may want to move your money out of cash and into quality shares with solid outlooks.

https://www.businessinsider.com.au/australias-rental-market-is-getting-its-first-taste-of-disruption-2017-3

@ Damian

Well, yes that is disruption; But with yields at like 2%, that’s disruption enough for me to avoid.

@Matt

That is the big question. While I’m sure you’ve done the right thing by cashing in, you’ll get pressure from everywhere to get back in. What to do with that cash? I bet on myself, and went into small business: Tough, tough gig. How far the gov’t will go to keep this bubble going remains to be seen. I’m not sure they can help support it too much more, as there is now a lot of pressure saying things are clearly out of wack.

This apartment situation is something I never, ever, ever thought I would see in Australia. It is one of the stupidest things I’ve seen in my life. We’ve a tiny population, with one of the largest countries, a capable workforce, yet we’re craming each other in HK style, at stupid prices??? Seriously.

December quarter, Sydney and Melbourne grew 5 %

That means a house in Sydney on average rises $4500 a week.

No bubble.

@ Matty, Terrace houses in greenfield developments. I’ve gone off about this for ages, people are like “but they’re cute”

FFS

“That means a house in Sydney on average rises $4500 a week.”

Ha ha!!! Yep, that’s gotta be sustainable! Just look at the politicians pretending not to notice…

@16 Matt. I have found Martin Armstrong to be spot on with his forecasts of what we will all have to face. He predicts interest rates in the US will rise, pushing the value of the US dollar higher, pushing interest rates higher in Australia. Having an American bank account with US dollars, whilst waiting for the Oz property market to crash would be one option. I have posted this before, but I recommend everyone should spend 20mins watching Armstrong outline the problems we face. The first 40secs is a bit dodgy! https://www.youtube.com/watch?v=ARBduyoXsP4

@22 Jamie. “That means a house in Sydney,on average, rises $4500 a week”

No, it doesn’t. It means that a lot of expensive new houses have been built, and a lot of money has been spent on renovating old houses. This has the effect of raising the MEDIAN price of houses. No one talks about “average” prices when referring to houses and apartments.

If you have a house that has not had money spent on it you will find that its value may only increase (over a period of many years) by a much smaller amount than the median house price. This only becomes evident when you sell.

Fraying at the seams…

http://www.afr.com/real-estate/residential/sizzling-hot-deals-brisbane-apartments-offered-at-39pc-discount-in-fire-sale-20170328-gv8q9k

APRA clamps down on interest-only mortgage loans:

http://www.abc.net.au/news/2017-03-31/apra-clamps-down-on-interest-only-mortgage-loans/8403712

“from now on interest-only loans must be restricted to 30 per cent of new residential mortgage loans.”

They say that currently IO loans represent 40% of the stock of residential mortgage lending. But I assume this is 40% of all mortgages and that the % of new loans that were IO were much higher than 40%?? Can anyone verify this? I heard on the 60 minutes story (about the property crash in mining towns) that ~50% or more of all new loans were IO.

And more

http://www.news.com.au/finance/real-estate/selling/developer-offers-big-incentive-to-sell-apartments-left-unsold-in-parramatta-development/news-story/f3f5d090b156a28c8a09d45edf5b890a

@26 Geoff

Maybe what you say has logic, but there have been several pieces in the media lately about homes that haven’t been touched selling for hundreds of thousands of dollars more than they were bought for, often in under 12 months.

This housing/finance/FOMO/Cash hiding thing called the Aussie property market is so far from logical, I simply am lost for words.

It’s not a train wreck in slow motion, it’s much, much worse.

@Jamie

That building is just across the street from the old flour mill site which had a sales office on it back in 2009. The mill was subsequently burnt down and the site still sits vacant. I was skeptical that the development would ever get off the ground back in 2009, and am even more certain of that now. Unless there is a market correction most people simply cannot afford the prices.

I imagine that those who bought at premium price would be furious at the possibility that others are getting a 39% discount.

From MB

http://www.abc.net.au/news/2017-03-31/leaking-buildings-mould-court-battles-dark-side-apartment-boom/8403744

LOLz. Actually, it’s not very funny for those who have to fork out for the repair. The frenzy to make a killing results in poor quality products. Just another indication that we’re in a bubble.

This is the kicker:

That’s the way you do it. Drain the assets from the company making it insolvent and voila, the problem disappears.

@Jamie……Your analysis is spot on Jamie…that’s what I meant…eventually of course strong growth in approvals of loans will impact the balance sheet growth, eventually coming close to the 10% limit.

Banks will avoid that by reclassifying home loans as owner occupied or applicants will lie about it, total Ponzi and APRA is asleep.

The interest only mortgages crackdown will affect prices, watch it happen in the next 12 months.

@31

I’d be seething, but then again “sucked in”.

Almost like a teen playing in floodwaters.

@ 32

When the economy is headed and directed by criminals , eventually the facts (ie; exploited labour and cheap materials and the tactics of delayed payments or no payments to sub – contractors for variations ) will be exposed and ” the emperor will be seen with no clothes on ” . This bubble is heading for a crescendo of biblical proportions mainly because the investors have unlimited supply

to funds .

The kitchens ‘robes and vanities , in these new apartments , are painted white to cover the mdf that expands and grows mould when you add water . Sydney most expensive housing is really the highest indebted people in the world . This is beyond a con it is ” the crime of the century “.

Total amount borrowed on Interest Only mortgages:

2012 $88.7 billion

2015 $153.8 billion

1 in 4 owner occupier loans are IO

2 in 3 speculator loans are IO

I haven’t seen much in the media about this new IO loan limit imposed by the APRA but I believe it probably wont start to sink in until idiot speculators start getting turned away from the banks when trying to get their next speculation on high LVR & IO.

Australia is now NUMBER ONE … as the most crooked money laundering real estate market in the world. With 70% of Chinese buyers paying cash (BIG Suitcases) We rank as the country with the most loopholes to launder the proceeds of crime and corruption. With the Government policy of ask no questions we have become a vacuum cleaner for sucking up the global tainted currencies. A sort of welcome mat for every overseas organised crime gang to come and spread their misery here.

http://www.zerohedge.com/news/2017-04-01/australia-has-worlds-worst-money-laundering-property-market

@26 Geoff the $4500 rise is on the median. I used the word average to indicate average over the year not on the price… since not every quarter will rise 5 %.

The median is 1.1 million, raise it 5% You get 55 k in a quarter or $4230 a week. The median price that quarter rose 55 k, as much as some people annual salary.

And as Matty said, this is happening, capital gains madness, land value rises irrespective of renovations.

An interesting article about dirty money from overseas being used for property purchases. Of all the countries in the world Australia is worst. No real news though. We all know that already!

http://www.zerohedge.com/news/2017-04-01/australia-has-worlds-worst-money-laundering-property-market

@37 Ahhh, just realised that you already posted this article already.

Anyway, its worth reading.

Most of my prior posts to this website were quite negative. Venting my frustration. But I’m feeling a bit better today. Why? you ask?

Two reasons:

1. I love Geraldton WA. Have been looking to buy a holiday home there for a while now. They are now being discounted by over $100k and still struggling to sell. A random example: 27 Trigg st, Beresford: last sold June 2007 for $380k. Currently listed for $240k — meaning that they would probably accept an offer of $230k.

2. I was checking small business tax breaks. If a property is part of a small business then not only can you claim interest on loan as a tax deduction (like all other investors), but you also pay no capital gains tax (like home owners). So you get the best of both worlds. All the more reason to start a small business…

Anyone hear about NAB loosening up credit to small and medium businesses? With trends like this though who is investing?

http://www.abs.gov.au/AUSSTATS/abs@.nsf/Latestproducts/5625.0Main%20Features2Dec%202016?opendocument&tabname=Summary&prodno=5625.0&issue=Dec%202016&num=&view=

I can’t imagine there’ll be too much borrowing/lending for small businesses, everyone who is prepared to borrow has already sunk it into RE. Safe as houses.