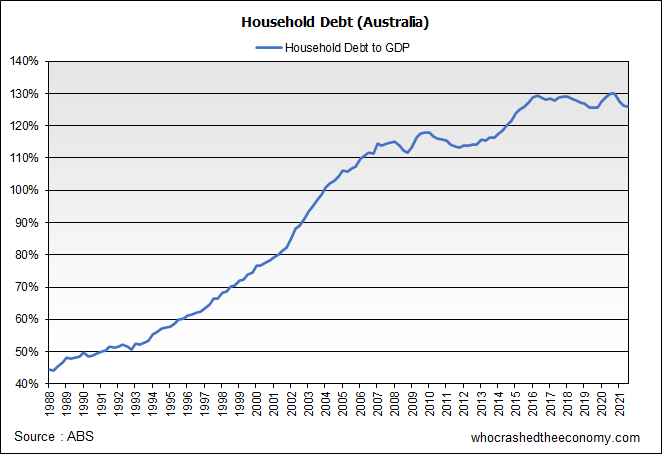

Australia has the second highest level of household debt in the world, second only to Switzerland. Most of this debt is tied up in the housing asset bubble.

This excessive debt makes Australia’s households more sensitive to interest rate rises and reduces their ability to resist economic shocks. It also makes it increasingly harder for the central bank to engineer a soft landing.

Be the first to comment