Lending for dwellings continues its sustained decline in Australia according to the latest Australian Bureau of Statistics data released Thursday.

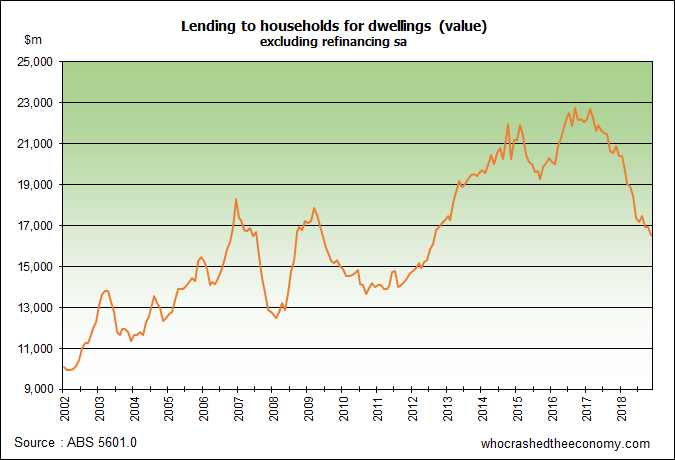

Across both the owner occupier and investor segments, lending by value is down 20.8 per cent in the past 12 months to May 2019.

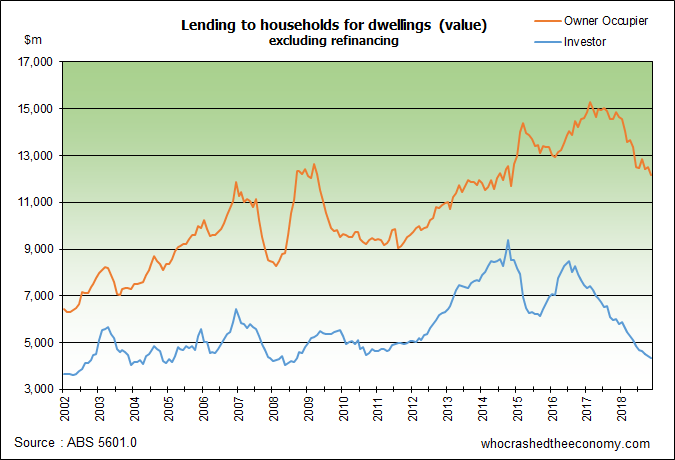

The decline in more pronounced in the investor segment of the market where lending by value is down 27.8 per cent over the year to levels last experienced during the GFC.

The larger owner occupier segment saw declines of 18 per cent.

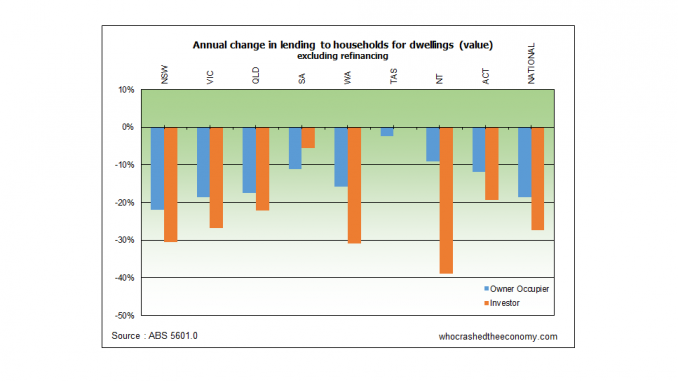

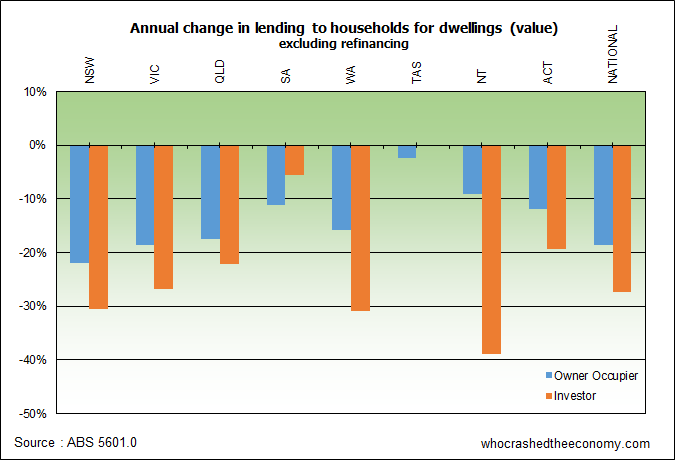

At a state by state level, lending fell in every state, territory and market segment (owner occupier & investor). Significant falls are being experienced in the eastern states (NSW, VIC and to a lesser extent QLD) most exposed to the property asset bubble as well as mining states Western Australia and the Northern Territory.

Reversion to the mean can be pretty brutal.

Let the whole house of cards come crashing down.

There are people in WA who are touting that we have reached the bottom of the downturn and that we will be turning a corner very soon. My belief is that we are far from bottoming out and there is a lot further to go. When the real estate agents and others with vested interests in housing prices going up stop talking about turning a corner because they keep getting it wrong – that’s when we will probably have reached the bottom of the downturn.