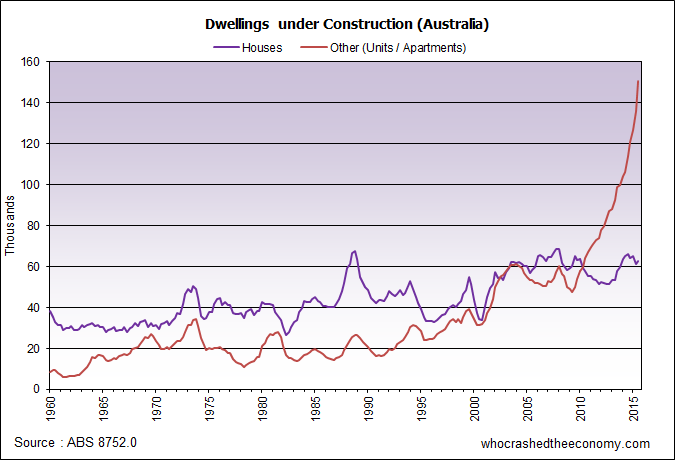

Australia is facing an unprecedented apartment oversupply as an estimated 230,000 new apartments flood the Melbourne, Sydney and Brisbane markets over the next 24 months.

The surge in new apartment building was in an attempt to satisfy the insatiable demand from the foreign Chinese property investor. Under an Australian law designed to increase housing stock, foreign investors can only purchase new dwellings.

But as we reported in May (“Banks tighten screws on foreign buyers“) the banks were uncovering traces of what would turn out to be systemic fraud. The ANZ bank asked its Asian subsidiaries to verify and cross check the obscure offshore companies being cited as sources of foreign income to service these property loans. Most offshore companies didn’t exist.

By the end of April, the ANZ was forced to retract the approval on 90 loans to foreign investors. Not long after, the truth came out with the disclosure that ANZ and Westpac banks have approved hundreds of loans supported by fraudulent foreign income documentation. All the banks immediately began to toughen eligibility and serviceability requirements. Some even chose to freeze the writing of all new loans to foreigners, citing the risk was just too great.

Many foreigners had put down deposits on their apartments but were no longer eligible for the loans from Australia’s big banks, loans essential to complete settlement.

To help mitigate disaster, Chinese real estate portal, aofun.com.au has set up a Nominee Sale Platform in a bid to shift some of the thousands of apartments where buyers are unable to complete settlement.

Foreign property investors locked out of apartment re-sales

But in an ironic twist, the foreign property investor has been locked out of the re-sale market and unable to snag a bargain.

According to a spokesperson from the Australian Taxation Office, “Under subsections 15(4) and (5) of the Foreign Acquisitions and Takeovers Act 1975, a dwelling is considered to be sold when an agreement becomes binding,”

“If the property is onsold after the date upon which the contract becomes binding, and prior to settlement, then this is considered to be an established dwelling.”

As foreign investors cannot purchase what is now deemed an established dwelling, they are unable to help soak up some of the burdening oversupply.

Agents target the first home buyer

Not to be defeated, apartment sales agents are now targeting the first home buyer. Aofun even claims “Australian FIRST HOME BUYERS can pick up a bargain with the deposit already paid for”

But can they soak up 230,000 apartments in 24 months?

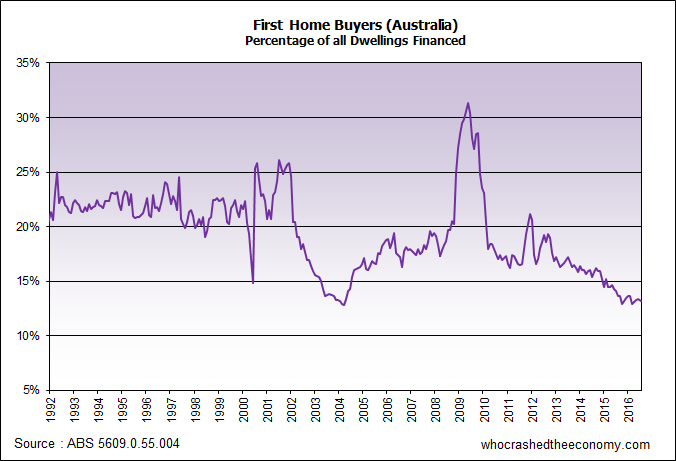

Earlier this month, the Australia Bureau of Statistics (ABS) revised down first home buyer participation in the market skewed towards the speculative investor. Original figures suggested a low of just 14.1 per cent of buyers in July 2016 were first home buyers, but actual figures are much worst.

After revision, the ABS now believe just 13.2 per cent of participants in the market in July were first home buyers. Numbers had been steadily falling for four years.

High housing costs have been zapping disposable incomes, shutting down business and leading to higher unemployment and the casualisation of the workforce. Coupled with run away house prices, first home buyers, the one who have jobs, are struggling to get into the housing market – regardless of if their staple diet includes smashed avocado with crumbled feta on five-grain toasted bread.

With trouble brewing in the apartment market, the banks are further cracking down on lending. On Saturday, the National Australia Bank (NAB) expanded its confidential lending blacklist to cover over 600 towns and suburbs. Buyers now need a minimum 30 per cent deposit to purchase property in these suburbs exposed to the mining downturn or apartment oversupply. Today, Bendigo and Adelaide bank cracked down on high risk locations increasing the minimum deposit to 40 per cent.

If first home buyers were struggling to save a twenty per cent deposit, they will face even more difficulty to cough up a thirty to forty per cent deposit for a high risk apartment.

But it’s also a mistake to assume all Generation Y and X endeavor to enter Australia’s housing bubble and become lifetime debt slaves.

So the question stands, just who will purchase all the apartment defaults?

» NAB cracks down on property lending to ‘reduce risk’ – The AFR, 21st October 2016.

» Adelaide Bank cracks down on property lending – The AFR, 24th October 2016.

» Failed off-the-plan apartments ‘second-hand’ – News Limited, 24th October 2016.

» First home buyers at lower numbers than previously thought, ABS reveals – The ABC, 6th October 2016.

@Admin ,

“So the question stands , just who will purchase all the apartment defaults ?”

The CCP . There are 90 million members in the people’s republic . They have the largest amount of billionaires in the world . They buy in cash .

Scott Morrison will have to introduce the FHB Apartment Grant. $100k taxpayer funded money for any FHB that buys a resold apartment prior to settlement. Fixed!

@56 – The ATO has ruled resales are classed as established. Chinese nationals can’t buy them, even if they could get wads of cash out their country.

@ James

I have a contact who’s ex is selling (second hand/old) houses direct to the Chinese, bypassing the ‘official’ channels.

So I don’t know what’s going to happen short term, but long term, the most epic of wealth transfers in Aussie history is on.

All those ‘rich’ baby boomers, and idiotic IP investors are going to have their dreams torn out from under them.

They’ll blame the EU, US, Canberra, banks etc. But it was them, all along.

Personal credit growth stalled last year, outside real estate, we are in recession. The smart ones know it, the idiots are still borrowing. ON TERRIBLE ASSETS!!!!

Pad your nest, and enjoy the show.

@1. 56

“The CCP . There are 90 million members in the people’s republic . They have the largest amount of billionaires in the world . They buy in cash .”

Before you look at billionaires, look at millionaires, actually lets all look at the number of millionaires in each country (that matters).

United States ……… 15.7 million

United Kingdom …….. 2.4 million

Japan ……………… 2.1 million

France …………….. 1.8 million

Germany ……………. 1.5 million

China ……………… 1.3 million

Italy ……………… 1.1 million

Canada …………….. 984,000

Australia ………….. 961,000

Switzerland ………… 667,000

Now the China stat, is similar to all the other coutries listed. It represents those with asstes + cash totalling at least 1 million dollars. China has 1.3 million of them. As for they pay cash, yes, they indeed do. They borrow it from their own banks, whether individuals or a small group of investors, then buy a property or properties here. They get all benefits, like negative geaqring, while collecting rent, and making payments on their loans.

Before accusing you of sounding like an un-real estate agent, where did you get the largest amount of billioaires in the world, and they buy in cash info from?

There are (many) other things going on with the property market here, not just a housing shortage and wonton credit issuance. I wonder what the corruption dynamics that are disguised as Governemt, APRA, RBA, and lobbyist policy and recommendations really are?

Good friends , do you really think that these apartments are being built for our children .

1 bed 700k , 2b 900k , 3b 1.3 million . If they are lucky to be working on $25 per hour net .

Go figure .

@ James ,

Not all Chinese nationals are CCP members .

I have been following this blog for a while since moving to Brissie from China.

Disclaimer: I am not one the uber rich Chinese that people talk about.

@56,

People have misconception about China and its people. Chinese people does not have unlimited buying power. Honestly, recent flood of Chinese buyers in the market is a direct result of fleeting smart money from China, and it would not last long.

China has a long history of forex manipulation, I bet you all know. Manipulating the market has a cost, cost of real money that the government cares about, forex reserver, or more simply USD. When domestic economy is good and exports bring in incessant USD cash flow, it is not a problem. However, in recent years, accompany recent deteriorating of investment environment, smart money is on the run in fear of future CNY depreciation, I mean, Russian or Venezuelan style. This, directly sent property prices in countries that have “easy” migrational policies to the top, and guess which cities are least affordable in the world? Vancouver, Hong Kong and Sydney. Thanks for prolonged forex manipulation, early runners got the chance to take out their money in full.

However, things are changing. Factories are closing down in China, and foreign investors are moving their product lines to Vietnam and etc. Unemployment is high, and trade deficit looms. Money continues to flow out though the government is tightening all aspect of forex related activities. For example, one cannot wire more than USD 50K per year abroad, and it can be very tricky to send money to an account that is not under your own name. Withdrawls on a ATM overseas are limited to CNY 100K (< AUD 20K) per person per, and CNY 10K ( ~ AUD 2000) per day. The spread of buying/selling USD is high, and this is more obvious if you try to buy USD with CNY out of China. In short, nobody wants CNY any more. The forex reserve is bleeding to death and CNY's depreciation is accelerating, and things will soon go out of control.

I took most of my money out last year when exchange rate was USD/CNY=6.1~6.2, now it is around 6.78. Chinese forex reserver was about 15.5% of its M2, which implied a USD/CNY rate of around 8. The figure should have further worsen since then. I will not at all be surprised if one day it is 20.

I am looking forward to a major crash of Chinese economy in one year if not two. Partly because of its economy and partly because of US Fed will soon be forced to hike rate. (It is a mess in US as well, Keynesianism f*cked up the whole world). My money is kept half AUD and half USD, because Australia economy/currency value has strong correlation with China as well. I still do not own a PPOR, and hopefully I could afford one when the day comes, if not SHTF.

“According to a spokesperson from the Australian Taxation Office, “Under subsections 15(4) and (5) of the Foreign Acquisitions and Takeovers Act 1975, a dwelling is considered to be sold when an agreement becomes binding,”

“If the property is onsold after the date upon which the contract becomes binding, and prior to settlement, then this is considered to be an established dwelling.”

As foreign investors cannot purchase what is now deemed an established dwelling, they are unable to help soak up some of the burdening oversupply.”

…music to my ears.

That’s reverse Keynesianism. Reducing taxes and spending more in the good times and increasing taxes and reducing spending in the bust. It is designed to exacerbate booms and busts. That’s how the financial capitalists make money.

@5. 56

Chinese (in China) are currenlty being paid much less than that.

Anyone who qualifies for a loan, whatever that loan criteria is, will be able to buy one or many.

This is fun to read:

Quarterly ADI Property Exposures statistics (Authorised Deposit Taking Institutions).

http://www.apra.gov.au/adi/Publications/Documents/1606-QAPES-3006.pdf

My eldest has been in Brisbane for a couple of years and there has been an occupancy rate of 60% in his building and area for most of that time. He is renting and the owner has three of seven units empty. The building is not that old and owners are still paying the loans.

Add another 50-100,000 units and the occupancy rate can only go down to 50??% or so at best.

I know I couldn’t afford to cover a loan with no rent coming in.

No idea who is buying the current units coming on, but I wonder if the off plan sellers are still expiring out of contract sales like they were six – twelve months ago.

Many bought off the plan, project got delayed and went over time, original sale was cancelled by developer and units were sold for an extra 20-30% over original sale price.

Many lost out as they were at the limit of borrowing capacity, might be some bargains in the mix soon.

Our Chinese friends trust property more than banks. That is why they pay cash for units with no loan and then leave the property empty.

@average_bloke – Isn’t the Chinese economy still young, I don’t think the Chinese have ever experienced an housing asset crash.

It feels to me very much like 1991. At the time, Japan was the industrial powerhouse making Walkmans and other electronics. They were out here buying up apartments in Brisbane, and all the golf courses. The Japanese had never experienced an housing asset crash. Then in 1992, they experienced the world’s largest housing crash.

@13. average_bloke,

“That is why they pay cash for units with no loan and then leave the property empty”

They do borrow money for their purchases, they may leave their units empty, but they borrow to buy. Many have (in the past) borrowed from Australian banks, many borrow from Chinese Banks. Some form a group of investors of (say) 12, will gather a deposit, borrow the rest from a bank, and buy here. Only a percentage pay up front in full.

—

Can people shake their heads clean with respect to China and Chinese purchases here. Perhaps Chinese borrowings for Australian property will be more apparent when (if) price decline time comes. They can’t afford to buy all the apparentments build in China, yet they soak them up here? Yeah, yeah, I know, I heard it, they getting their money out from a corrupt regime… Gee! no possiblility of loosing bigtime here.

Do people really think an empty $1.24 million dollar (big) house in Kiama is that much cause a Chinese national is just busting to buy it? https://www.realestate.com.au/sold/property-house-nsw-kiama-123643054

There is more at play here;

Foreign purchases (yes borrowed money too) + free standing house supply shortage + low interest rates + wonton credit and debt issuance (well for a long while in the past) + corruption here + anything else anyone knows about?

+ allowing super-funds plunder for a property purchase + the bank of Mum and Dad + …?

I do agree and see, when prices decline, there will be tonnes of pain and tears before bedtime.

+ stupidity, + greed, + herd mentality, + over-confidence in the ‘we’re different factor, +knowing the price of everything, yet the value of nothing.

Insatiable Chinese demand

http://www.macrobusiness.com.au/2016/11/no-end-chinese-demand-western-property/

+ Government policy propping it up

@ Mark,

I work right in the middle of South Brisbane / Southbank. Cranes all over the place, units going up everywhere:

> Hope st being constructed right now. Chinese owned.

> Bouquet st just completed. My co-worker informed me that this is owned by the same block who is built Hope st, and he is not particularly concerned whether or not they sell.

> Then there is the triangular block of Cordelia / Boundary / Peel st. This was an ex Tafe site about 2 years ago, sold to someone at a very low price who then got a DA and sold it just months later for TRIPLE that price. (Government incompetence or corruption I don’t know). Anyway, marketing and sales office is setup onsite. All staff are Asian and are clearly looking to sell to Chinese.

> Merivale st being constructed right now. Every time I walk by its young Chinese wearing every expensive clothing chatting away.

> And on a personal note, I can confirm that I sold a unit in Chatswood in Sydney for +35% more that we paid for it 18 month earlier. The agent was Chinese. He said our best chance of selling would be to a Chinese family to give their kids a place to live in whilst in Australia studying. The buyer ended up being Chinese, but she just bought it as an investment property.

So yes, I am beginning to think that the Chinese just might possibly be having some impact on the property market.

Good friends ,

If you drive from St.Leonards to North Sydney , along the Pacific Hwy , there are more development sites than existing buildings .

Came here in ’66 . Never seen anything like this scale before .

There are more buildings going up in Sydney than London , NY , LA combined .

Ah , the noise and the silence .

It always just amazes me how quickly humans forget and when greed takes over disillusion generates hope that things go on happily ever after. This very much feels like a Japan situation where the Chinese are just punting to get rich quick and they have never had a massive property asset crunch that we are very prone to in capitalism.

I only just watched “The Big Short” yesterday and it still amazes me how all the people that thought they were intelligent got it so wrong. Be smart, look at the underlying metrics and never forget history because it will always repeat with booms and busts and never fall for the line….no, the boom it’s different this time. 🙂

You don’t have to be a genius to figure out what will happen to the apartment market with all the defaults on settlement….it will be a disaster because the Chinese capital restrictions will continued to be tightened over the coming months, plus they are not allowed to purchasing defaulting apartments anyway because they are considered established. So the question begs, where is all the money going to come from and can it hold up a market in fear……probably not!!

http://blog.stonerealestate.com.au/blog/articles/2016/10/31/foreign-buyers-dumping-australian-property

Jas@23. No go zones? If those muppets think this won’t ripple across the entire market they are delusional.

Horrific pollution in mainland China is another reason why wealthy Chinese investors want to buy in western cities.

https://youtu.be/OwOBRH56Ic0

@24 Mark

It will be massive, across the entire economy. Let’s rewind to 2006, and see what the head of the fed said, just a few months after housing topped in 2005.

https://www.youtube.com/watch?v=u5A4Gw20dcw

Let me quote:

“I hopeful, no I’m confident in fact, that the bank regulators will pay close attention to the kind of loans being made, make sure the underwriting is being done right, but umm, I do think this is mostly a localized problem and not something that will effect the national economy”

WTF??? It collapsed the entire world economy.

You’ve all had years to prepare: I hope you have.

@Matty, the Fed gives away cheap credit and expect banks to loan it wisely. Why not simply jack up the rate then to discourage bubbles? I guess the answer is that we need bubbles for some reason…

Lol what a great video of helicopter Ben. I wonder if he ever watches them and self-doubts his high paid education and experience in economics. The RBA has definitely backed the Australian economy into a corner with this construction boom fuel by cheap credit and investor speculation….the only concern is what will prop us up if the housing sector and the banks take a real hit…..manufacturing haha.

In defense of Ben….Alan Greenspan was the father of using loose monetary policy and the markets knew he would always come to the party when things got a little rough in the financial markets.

The Chinese have been buying established dwellings anyway. The government has done nothing to police it, they don’t care. I know two retirees at my work who sold their homes to non-citizens.

The great southern province of China, otherwise known as Australia.

The “Weekend Australian” published an article about the town of Scranton in Pennsylvania. Its evidently the town where Hilary’s grandfather is buried and where her Father was born. The median income is $38,000 and the median house price is $107,000. That’s a multiple <3. One of the guys they interviewed purchased his house for $5000 and fixed it with the help of his unemployed mates and knowledge gained from Utube videos.

There is a message for all of us in this.

I’ve given up. Not on life, but the staple of a permanent home. I’ve had the unfortunate realisation that after living in the same place for 17 years and just been given notice yesterday (place is going on the market) that I am currently slave to the system. Not only can’t I give my son a permanent home, I will never will own a home. Decided to skip my inheritance and give to my child. I’ve confirmed with family and that’s my decision, I brought him into the world, it’s my responsibility to give him a chance to go to university and opportunity to buy in the future. I feel lucky in that regard. What of those individuals and families who don’t have anything to fall back on? Even going to uni I think may be a waste of time now seeing I have to do a “masters” to increase my earning capacity. By the time I reach that stage (3 years away) I may end up with a casual respectable job only. It’s a risk. Everything is a risk. What, do I raise my son, make sure he is ok then top myself afterwards? What the eff has happened to us?

@Mmm, it’s disheartening the division this has caused but it’s the wider public who are to blame as much as the government. It should never have gotten to this, we should have had our correction in 2011/12 due to the cash rate rise to 4.75% and been done with it.When the GFC hit in 2009 our government coffers were ok so we spent and borrowed our way out…Instead now the country is backed into a corner, highly vulnerable with less options…. The debt is higher, wages are flatter and unemployment is worse. The government has set the tone on this and the banks and people have speculated and once again caused trouble since 2013 People learn nothing from bubbles. Personally I think the evidence is right in front of us and we’re in the eye of the storm now, the tail of which we will see in 2017/18 and it won’t be nice and will occur at a time when lowering the interest rate doesn’t have the same effect.

Hi Mmm,

I am in a very similar predicament, but all is not lost. Firstly, just rent somewhere else – I’m sure you’ll find something – then use your savings/inheritance to buy whatever plot of land you can afford, on high ground, with good sun, and build a sustainable house with whatever you have left. If you need to borrow from a bank, assume interest rates could go up to 10% and borrow only what you can realistically afford to pay back. Have no more than one child, eat seasonally, use renewables as much as you can, and work for yourself instead of someone else.

The idea is to reduce your overheads as much as you can without compromising yourself or your chosen lifestyle, and to never be beholden to anyone but youself. That means the mimimum of debt and the maximum self-reliance and self-sufficiency and the maximum of choise. You will be liberated from the shackles of ‘the system’. After that, you will be free to exchange your skills and time to whomever you choose for whatever you choose – be it money, food, water, or whatever it may be.

It can be done. The only thing holding us all back is fear coupled with the herd mentality (ie “keeping up with the Joneses”), along with greed and the desire for more growth. We have also stopped thinking for ourselves and are more risk-averse than ever. We are coddled and shafted by the state to such a degree that we are sleep-walking into an idiocracy.

We’re all working harder and saving less – but this is ultimately a choice we all make. It’s time to buck the system and refuse to be a player in a game that only serves the elites.

So forget universities and masters degrees and all that crap – waste of time these days – and teach your son useful skills instead. Then rather than leaving him some money in the bank (which could be devalued by then), leave your son the home you built together. That will be his inheritance. You will have taught him self-reliance – and that is the greatest gift of all.

Good luck and please don’t give up.

*choice* – doh!

@ # 35

your first paragraph….kinda like 100 years ago?

but then industrialisation came, and then globalisation in the 90s….will we ever revert?

@37 It’s not a case of reverting, it’s moving forward in the right direction that we must be doing. The planet cannot sustain further industrialisation using fossil fuels – fact. The choice will be what I’ve descrbed, or living in shit-boxes in mega-cities. I know where the air will be cleaner and the environment quiter. As I said, it’s a choice. But it won’t be quite like a hundred years ago, as new technologies will see to it that we won’t quite live like they did then. Although I have to say, a vintage 1916 Ford Model T Tin Lizzy would be awesome fun to restore 😉

@ Rupert:

Degrees are a waste of time? what about teaching skills to your kids AND try to help them getting a good degree? One doesn’t exclude the other, you are mistaken if you believe that having the right degree is actually still very important.

It’s all about diversification.

http://www.sbs.com.au/news/article/2016/11/09/paul-krugman-predicts-global-recession-after-trumps-win

http://www.nestegg.com.au/investing/equities/10446-australian-state-feels-like-a-recession

What all the talking heads fail to mention re high rise apartments is the massive service fees involved and as the body corporate is organised to benefit professional management then most of those fees are going into management pockets before a penny is spent on the building itself. This is another reason high rise is treated with suspicion in Australia.

Layer upon layer of scams and schemes need to be deleted before any form of housing is worth buying in the land of OZ especially HR Flats.

@39 Hi Alex6, I beg to differ. For starters, 50% of college courses are for jobs that won’t exist in 10 years time (because of technology). As for the other 50%, in order to keep youngsters in education and therefore out of the ‘unemployment’ figures, those degrees (with the exception of maybe madicine and law) have become easier to attain over the last decade or so. A degree used to mean something – it no longer does. You can do degrees in ‘Adventure’ and ‘Horology’ for goodness sake.

So, my argument is what is the point of getting massively into debt for a degree that is for a job that won’t exist in a decade, all the time working as a barista to pay off the student loan? It is totally non-sensical and a waste of time.

Just my two cents worth 🙂

Agree with Rupert; once a degree meant something, now to get the same bang for your buck, as it were, in the job force you need at least honors or even a doctorate.

Degree inflation as they say.

Uni is a money making scam methinks, at least for a majority of students.

Uni is a money making scan…Teach your kids skills that they can use in the real world.

My neighbour is a Labourer in construction and brings in $1300 nett per week..Hello that’s equivalent to a Gross of $90,000 per annum.

I am educated at UNI and don’t even earn this much..WTF?

Therefore where is the incentive to study, get yourself into excessive dept with no guarantee of permanent employment??

Of course there are degrees that are a waste of time and money, no argument here.

But for most of the qualified jobs, you still need to right degree only to get a chance to be considered for the job. Yes there are exceptions but less than previously from my experience.

Then it is critical to keep in mind that a degree will not make you skilled for life, therefore the need to keep learning continuously so you can keep up with tech changes.

I reckon it is dangerous to tell your kids that degrees are worthless. You’d rather tell them that they will have to choose carefully and keep learning after getting it.

Still best to make your own way not using your degree than getting locked in a meaningless job because of your lack of qualifications.

My 2 cents as well… 😉

@ Rupert, I just completed my study recently (Engineer) and have cleared my HECS. I’m lucky (and unlucky) I did it part time and worked because I’m already trade qualified. I went straight in as a Process Engineer (full wage) in my grad year. I’d have hated to have to be a ‘green’ candidate in the mix with everyone else flooding the market desperately.

I ask you this though, what is the alternate option when one cannot enter the job market because the new minimum is a degree? Can you see the parallel between housing credit and degrees? Everyone is ‘getting in’ like the housing market….the education systems has an almost FOMO quality to it now, where a degree is the starting point and without it you’ll miss out…best enrol and rack the debt up, what other option is there…junk loans, junk degrees…speculation from universities, loose regulation, its the same sh@t over again.

Enter the conundrum, employers focus on evidence based skills over education, yet graduates have no evidence of their skills other than their education.

There are some absurdly useless degrees out there now, if anything, Universities should be offering less courses but of a higher standard instead of pumping out people with a qualification that means little.

@Jamie, Very good point and I could not agree more. Surf science.. Photography.. Creative arts.. So many useless degrees that rarely lead to full time jobs and give people a false sense of security they’re doing the right thing by going to university. It amazes me that 12 years ago a friend dropped out of his degree in Aquaculture in his first year to become a plumber. At the time we were shocked and thought he’d thrown it all in having got such a high TEE score. Three others continued on to finish the 4 year course. The one who dropped out now runs his own successful plumbing company, has paid off his house and looks set for early retirement. The others who completed the course never found work related to the degree and have bounced around low paying jobs.

RE: The education thing.

Uni-degrees are like family, seems most people have some, some are valuable, some are just painful and costly.

If you want to be a doctor, teacher, etc. It’s simple, you must have that degree.

If you want a degree in recreational management (yep, a housemate had that) then um… yeah.

So this is what most people miss: You need to be valued by the market. Simples, provide value to the market, you get the job and pay to suit.

But!!!!

But!!!!

Our leaders (pfft! as if they can honestly be called that) have ‘created’ this joke of an economy, totally reliant on housing and finance, with the rest of the economy being service based.

So if the markets demanding housing and finance, guess who get’s paid the big bucks, yeah that’s right, REA’s, bankers, developers etc.

While guys with engineering degrees and other real skills get thrown on the ‘service’ heap at $17p/h with the rest of us.

So again, the real cause of your 25 year old, uni educated kids working at BigW and Bunnings is directly caused by idiots in Canberra and the capital cities who have NO IDEA how to fix the economy.

they think ~$100billion NBN will create jobs.

They think new roads/hospitals/schools create jobs

They think new bridges create jobs

They have no idea!!!

None!

It’s 10 years since the first tremors of the GFC occurred, and we still have increasing unemployment, falling exports, increasing imports, falling wages etc. etc.

The real question is of course, when does this ponzi housing/finance market implode???? Well, it should have this year, because private debt stalled last year.

Our private debt isn’t increasing… But house prices (in syd and melb) are still rising????? It’s all the foreign money keeping it up. (Despite what Canberra says, the Chinese are buying established housing flat out).

So now we absolutely are at the mercy of China.

Think about it: Our trade terms are screwed, our private debt has stalled, our government debts are exploding, and the only thing keeping it together is a few Chinese using their private money/debt to buy our scatty houses………

This must make Australian housing THE MOST DANGEROUS ASSET IN THE WORLD.

don’t say that out loud though: You’ll be committed to an asylum.

JamesR@20, Yes there is a lot of buying going on, but there are too many new units coming up to market.

If this is to ease the housing market then why are so many sitting empty and why are state governments considering taxing empty units?

Which is crazy as they are enabling the building to keep the construction industry afloat.

@ Matty, Private debt has stalled but depends on what metric you look at..are you referring to Personal Credit?

Personal Credit figures are now as bad, maybe slightly worse than that in 2010/2011 and house prices fell nationally around 5-10 % , however the cash rate was over 4%. Today , whilst the personal credit growth is just as bad as then the total credit growth is almost double… housing credit is propping up the deficit.

Business credit is also way up today then back then, don’t know why, cant wait to see what happens 2017, surely the private credit contraction has to slow it all down.

https://www.google.com.au/?gws_rd=ssl#q=brisbane+becoming+home+to+bad+development

And from that Philip Soos article a few months back:

Just in case anyone thinks that we have a free market.

http://www.smh.com.au/business/property/john-mcgrath-shares-property-pain-20161123-gsvy36.html

Haha talk about front running your own crap float…

People got shafted by McGrath.