On Sunday, Federal Treasurer Wayne Swan indicated the federal government had no intention of pulling the first home owners grant after suggestion it was fueling a new bubble. “To pull that stimulus out now would be to pull the rug from underneath recovery,” said Wayne Swan.

Today, the Reserve Bank of Australia voted to leave the official cash rate at a 49 year low of 3%. The RBA dropped rates dramatically from a peak of 7.25% on the 2nd of September ’08 to a low of 3%, where they remain today.

It was cheap and easy credit which first fueled our debt laden love affair with housing, leaving the average household buckling under the mountain of $1.60 worth of debt for every dollar they earned.

So what happens when you have the official cash rate at a 49 year low, and the government pumps first home buyers with an increased BOOST? Your right, a super bubble.

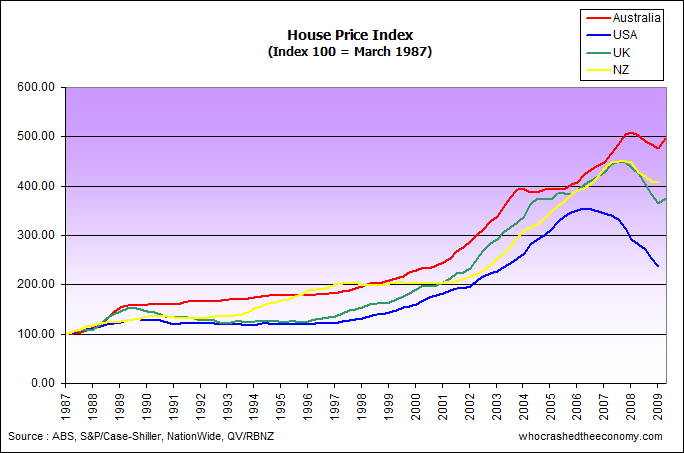

The Australian Bureau of Statistics today released the June quarter update to the Australian House Price Index. It showed, Australian house prices rose 4.2 per cent in the last quarter and supports claims that the boost has caused yet another unsustainable bubble.

The Bank of England also aggressively cut it’s official bank rate from a high of 5.75% on the 4th July 2007 to its current rate of just 0.5%. This saw UK house prices spike 2.8% in the last quarter.

Unprecedented stimulus packages and historically low interest rates with consumers who have yet to learn any lesson from the credit crunch will be the next hurdle for the government. Last Friday, TD Securities-Melbourne Institute inflation gauge shot up at it’s fastest rate in seven years. With the next direction in interest rates likely to be up, it’s quite possible the Australian debt laden consumer will find out early next year what a true credit crunch is all about.

» House price jump stokes bubble fears – Business Day, 4th August 2009.

» First home owners scheme won’t end early – The Brisbane Times, 2nd August 2009.