You have heard it time and time again. A small miracle has occurred down under, we have dodged the biggest financial crisis since the great depression and are on the road to recovery.

But are we? Are we really in the Great Impression – The impression that everything is a o.k?

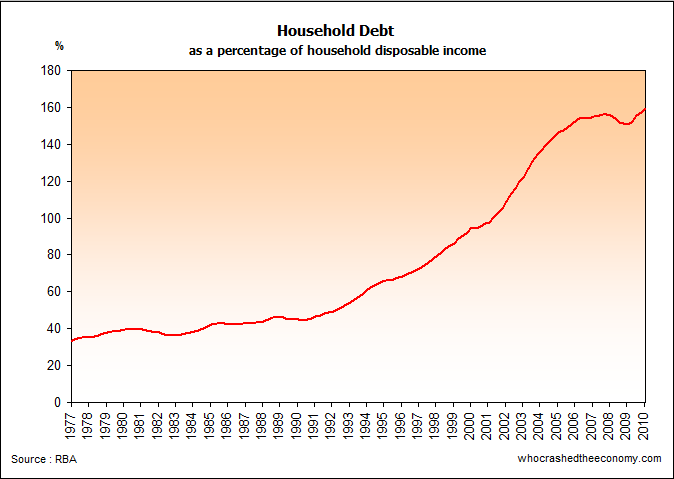

According to the RBA, prior to the GFC Australian household debt peaked at 156.1% of household disposable income. The GFC had Australian’s questioning popular belief if money does in fact grow on trees and caused many Aussies to start making extra debt repayments. But this only lasted for a while, and now we are lead to believe nothing is wrong, household debt has reached new heights in June 2010 at 159.2% – not long now before we punch through 160%!

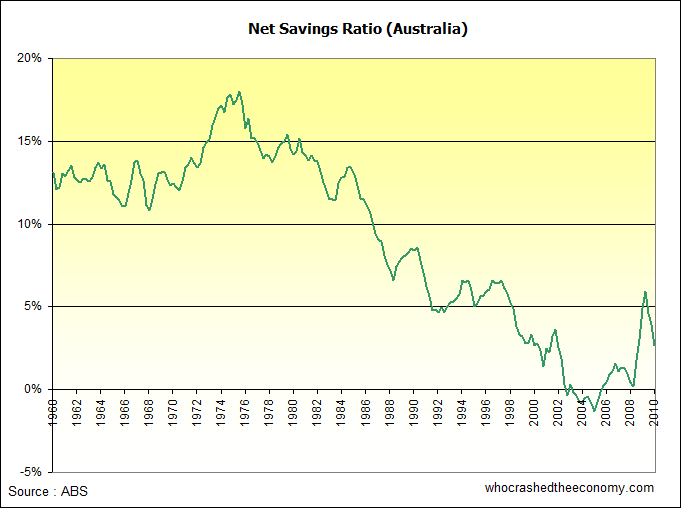

With the knowledge that once again money does grow on trees (this is one of the things different about Australia), we can start to spend more than we earn. The household net savings ratio has started to head towards negative territory. In fact, while the above graph is the net savings ratio for a 12 month period, in the June 2010 quarter households spent the aggregate $1.9 billion more than we earn’t. That’s right, we are back to the good old times of prior to the GFC where spending more than you earn is the norm. Quite sustainable, really.

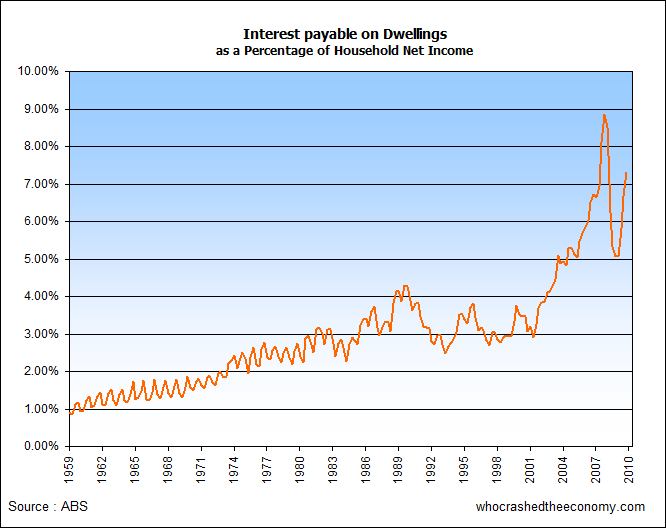

Most Australian’s still struggle with the basic concept that debt repayments are the product of interest rates and the debt owing. Quite often we are told how good we have it, because interest rates are so low. The boomers won’t hesitate to remind you of 1989 when Interest rates peaked at 17%

But over the past 30 years, household debt has quadrupled. In 1989 interest payable on dwellings represented 4.15% of all household disposable income, that is the aggregate of all households in Australia. That same level was reached in 2003, and since then we have been paying more in debt repayments now than in 1989, simply because of the sheer size of household debt. In June 2010, national accounts show Australian Households as a whole are putting aside 7.30% of household disposable income to service mortgage repayments.

Have we really dodged the worst financial crisis since the depression, or is the bubble still building? With the RBA warning today that interest rates will have to rise further to combat an overheating economy, is breaking point just around the corner?

It doesn’t matter if we are in a mids the biggest housing bubble in history, or the biggest tulip bubble in history. The fundamental issue why economies are colasping around the world is they borrowed beyond the state of sustainability.

Its one big debt bubble, with 89% of Australian household debt in residential housing.

If you look closely – it’s all a feedback loop.

Reserve Bank tells everyone that we are ‘OK’ and begins to raise interest rates.

Therefore as a result, our currency strengthens against the US dollar.

This means that due a strong AUD, the cost of goods and services in Australia reduces (as we import most of our consumables and export mainly commodities).

Retailers due to competition pass through the bulk of these reduced import costs, thus the general population begins to consume more items and purchasing more then they earn. As a result, old spending habits begin to re-emerge.

As 70% of Australia’s GDP is made up of consumption spending, our GDP figures receive an uplift from the increase in consumer spending due to a high AUD value.

GDP grows, spending grows, which then leads the Reserve Bank to continue to indicate that future rate rises are on the way.

This starts the positive feedback loop all the way.

There is a relationship between raising interest rates, increased AUD value, increased consumption, increased GDP.

This causes a false sense that we are ‘recovering’ and ‘doing OK’ when the real dark horse is the private debt levels hiding in the shadows in the corner..

But it is being sustained. Banks and Governments are to blame.

Pete,

You are spot on, its a simple fact that if you live beyond your means the only way you can keep going is to keep increasing your debt, this is why the average Australians debts have been increasing so much as a % over the last 10 years. The simple end to all this borrowing is a massive crash. This is a basic fact that can not be escaped for much longer because peoples ability to repay the interest on the debt is starting to run out.

In Jan 1990 interest rates hit a record high of 17% & people managed to keep their homes then so how would this compare in todays housing market?…The 1990 Median house price was $100K with a 20% deposit & a loan of $80K payments @17% interest over 30 yrs would be $1140 pm or 32% of wages with average family wage of $42K pa…so in 1990 @ 17% the worst interest rates in Aust history payments only ever got to 32% of average family income…Fast Fwd to 2010 Median price is $500K less 20% deposit & a loan of $400K payments @ 7% interest over 30 years are $2661 pm or 43% of wages with average family wage of $75K…in 2008 interest rates were 9.5% this would work out to payments of $3365 or 54% of current wages …. Now historically for the last 30 years interest rates have averaged 10.11% this would works out to payments of $3545 pm or 57% of wages going to mortgage payments ….So summing up current housing mortgage payments @ 7% is still worse than when rates were at 17% but just imagine what will happen when rates rise? AFFORDABILITY will not allow future CAPITAL GROWTH & investors will D*U*M*P P*R*O*P*E*R*T*Y because without MASSIVE CAPITAL GAINS Property investment WONT WORK!!!

A 7% home loan interest rates in 2010 is equal to over 22.5% interest in 1990 ….when comparative incomes / payments etc are applied

DEAN, whats the average household income today? You didnt state that.

I hear $60k PA is average income so is it around 90 or 100k?

Hmm actually you did state it, 75k, missed that.

@ Chargin …. $75 K is latest ABS data I could find this is JOINT Income …. Single Male income number is around $60K … A friend pointed out the above info in my previous post when I was looking at a investment property thinking that capital gains of the past could be repeated & in 7-10 years I would be able to double my money … But when he put it in the context that a 7% interest rate today is comparable to 22.5% in 1990 it was a wake up call ….. My assessment here is back of the napkin stuff … it would be good if the moderator of this site ran a update around 1990 17% Vs 2010 7% ….. As a rough guide it works out to a factor of 3 so if rates got to 8.5% as forecast today it would work out to a comparable rate of 25.5% in 1990 terms…. Property investment must have massive capital gains to work unfortunately affordability will not allow this & without massive capital gains investors will start exiting the markets causing damand & pricing to fall