Australia’s Central Bank has today cut the official cash rate by 25 basis points to 4.25 percent, effective tomorrow. This cut follows a 25 basis point cut last month and could suggest the economy is not as robust as initially thought, having been bash about by the Eurozone crisis.

The cuts are expected to be welcome relief to retailers and home owners this Christmas, but the jury remains out as to just how much relief it will actually offer.

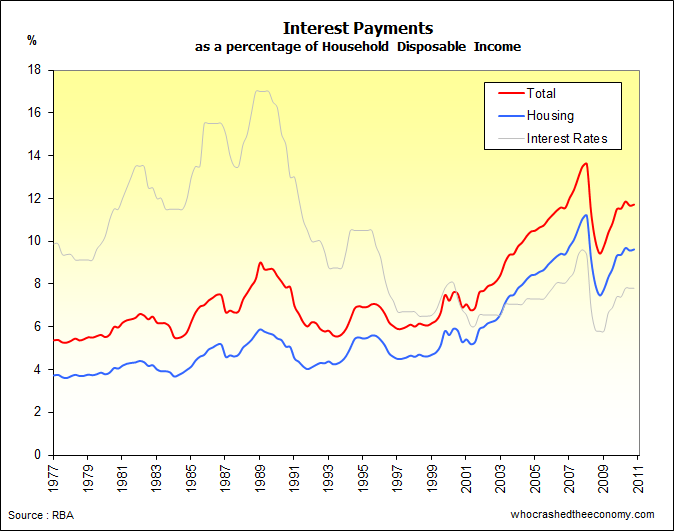

Statistics show Australian’s have grown household debt levels four fold over the last 25 years. Most of this debt has been pumped into residential housing.

This increased indebtedness has, in recent years, seen household’s fork out mortgage repayments as a percentage of their household disposable income far exceeding levels incurred during 1989 when the bank standard lending rates hovered in the 17 percent range, despite official interest rates being some of the lowest in history (grey line).

The above graph doesn’t reflect the latest two rate cuts. Assuming household debt levels remained constant (as mortgage holders will know, its far easier to acquire debt, than it is to pay it off) and the banks past on the rate cut in fall, we estimate the past two rate cuts will reduce interest paid of mortgages (the blue line) to just over 9 percent of household disposable income. This would compare to a figure of 5.7 percent in 1989 at the peak of the interest rate cycle.

Will today’s rate cut save retail and/or housing?

» Statement by Glenn Stevens, Governor: Monetary Policy Decision – Reserve Bank of Australia, 6th December 2011.

But, but, but the GFC is over. House prices are about to skyrocket! LOL

So despite the historically lowish interest payments, the percentage of disposable income spent on interest payments is higher. That is quite a remarkable graph, if I’m interpreting it correctly.

So at the times when interest rates were above say 12%, people still had more disposable income beyond the payments! Correct?.

I think you are right lifeafterdebt, houses being so much cheaper back then means the high interest wasnt feeding off such big loans.

My problem is my wife has fallen in love with 4 acres and a house near the beach here in SA. Shes not listening to me and I think we are about to upgrade.. We are debt free currently and Id like to stay like that through the coming “crisis” but shes got her heart set…

Please correct if I’m wrong.

The graph shows that in 1989, people with $100 disposable income paid $5.60 on their housing interest which incured from $32.94 mortgage at 17% interest rate.

In 2011, however, people with $100 disposable income now spends approx $9 on their mortgage which serving the $128.57 loan at 7% interest rate.

The different is that now average person has BIGGER loan than one’s disposable income whereas in the 90’s the loan size is only 1/3 of the income.

Correct. Assuming on an average household income of two working parents, disposable income of roughly $1500 a week, that means banks recieve 9% of that in interest only or thereabouts, probably less with the latest rate cuts, so we will say 8% of $1500, which is $120 a week in interest to the banks per household on average. Not including capital repayments.

I look at graphs like this and wonder how people can call me ‘naive’ for thinking house prices will drop at all.

I honestly hope the banks don’t pass on this rate cut as only tough love can fix this situation.

In order to fix this issue, kill off negative gearing and push rates higher, that will kill off all the unproductive debt and redirect money in more appropriate areas of the economy. Some bankruptcies are inevitable.

These views are not popular but, we have no soft options available.

^ That won’t happen Romsey.

Labor have ignored Ken Henry’s Negative Gearing reforms and you can bet an important part of your anatomy that the incoming Liberal led government won’t touch Negative Gearing either.

Was not pleased to see the cut passed on…………..

But……

Was happy to see ANZ announce it’s new monthly review of rates, can only hope the other big banks do the same thing as this will put a spanner in the works of the government using the RBA to bank bash and suck up to the over-leveraged idiots out there. At least ANZ can now circumvent the effect of RBA changes.

So obviously from the graphs debt is our problem. The RBA solution to too much debt is to make RAT (Real After Tax) rates even more negative than they already are so that everyone can take on more debt to try to sustain an unsustainable amount of consumption. Our Foreign debt and sell-off of our industries and resources will be further amplified.

Dear oh dear!!!!! The economics profession has come up with some weird ideas in the last 50 years!

Flawse, seen this before?

http://www.australiandebtclock.com.au/