When the BBC last Thursday warned international markets about a 22.5 percent rise in mortgage repossessions down under in NSW, we thought the Australian media had swept this news under the carpet.

Under the headlines of “Fears mount over health of Australia’s housing market”, the BBC reported on what is considered a “worrying development” for observers of the Australian housing market, that is, repossessions and loans in arrears are rising. Australians for Affordable Housing told the BBC that over the past decade, house prices in Australia has surged 147 percent, yet incomes have only increased 57 percent. It shouldn’t take much to work out this is not sustainable.

Brendan Timmins who works in Auburn told the BBC, “People shouldn’t go too far into debt. They are trying to get the Australian dream but it is out of reach for a lot of people,”

“I used to have a house before, But it was no good, I couldn’t afford it, so I lost it”.

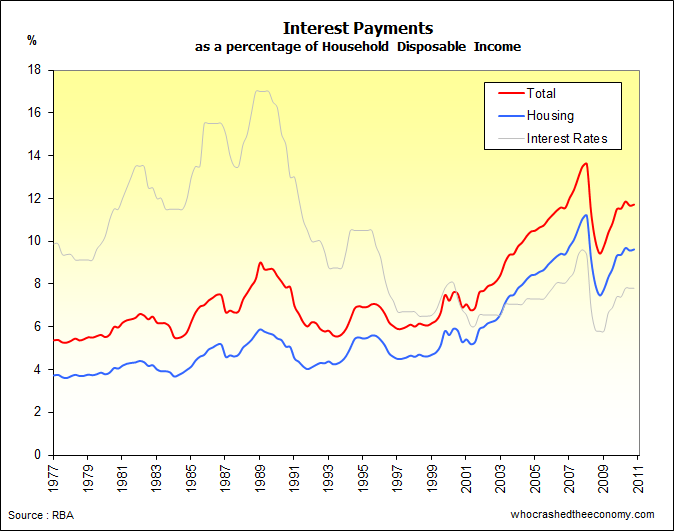

Figures show Australian’s have quadruped their household debt as a percentage of household disposable income in the last 20 years, trying to leverage themselves into the housing market.

Almost a week after the BBC story, the Sydney Morning Herald has today finally reported on these figures saying that the total annual figure is unlikely to reach the levels recorded during the GFC.

Campaign Manager for Australians for Affordable Housing, Sarah Toohey told the Herald the same figures regarding the rise in house prices verses income over the past decade, going on to say households were paying more of their income on mortgage interest payments today than when interest rates were at 17 percent.

Channel 7’s Today Tonight has jumped on the band wagon and dedicated an entire 5 minutes 43 to the topic following the even news tonight, showing what it calls is some of the ‘foreclosure ghettoes’ around the country. You could have mistaken some of the footage was from Spain with half built homes laying dormant on the Sovereign Island.

Watch the video here. (Mansion repossessions)

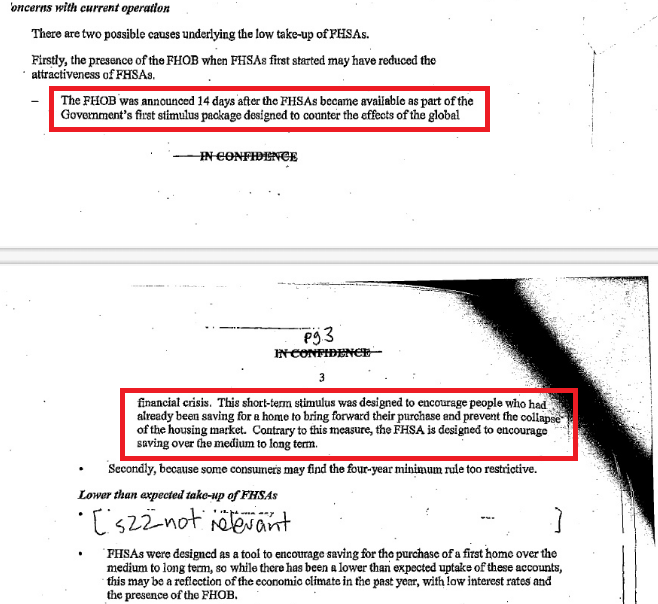

SQM Research’s Louis Christopher was interviewed saying “2011 was a bad year for many people who owned a home – no doubt about it. Many first home buyers who basically took out that First Homeowners’ Boost in 2009 got burnt in 2011. And that was as a result of the rising interest rates that we had in 2010,”

He blamed the Rudd Government’s First Home Buyers Boost – “it was all designed to actually save the housing market. Well they saved the housing market for a time, but at a major expense for their voters. Right now, many of them are facing bankruptcy.”

Treasury Executive Minutes show “This [FHOB] short-term stimulus was designed to encourage people who had already been saving for a home to bring forward their purchase and prevent the collapse of the housing market.”

Will repossessions continue to rise in 2012? Or is it, as buyer’s agent Tony Coughran says, never a better time to buy – “I think now is an opportune time, especially if you go to auction and buy it.”

» Fears mount over health of Australia’s housing market – The BBC, 29th December 2011.

» Foreclosures rise as more borrowers fail to repay – The Sydney Morning Herald, Tuesday 3rd January 2012.

» Mansion repossessions – Today Tonight, Tuesday 3rd January 2012.

It’s the old saying – “How do you know when a real estate agent is lying? Because his lips are moving.”

Of course property prices have been ramped out in suburban woop woop. They were always over-priced and as in the US and in the UK, it’s always the dumb rich and the dumb poor that get shafted by real estate agents and banks because they’re too greedy. Repossessions will rise, because people have been duped into over-levaraging themselves in pursuit of some out-dated and quite frankly sentimental ‘Australian dream’.

The real litmus test is what happens to property prices in Adelaide, Brisbane, Melbourne and of course, the big one – Sydney.

I’m still in the UK, with my visa ready to come to Australia, but at $1.50 to the pound, I’m holding out for a crash in Sydney and a weaker dollar. It’s a matter of ‘when’ not ‘if’, folks!

Then Westpac’s reporting error of 30billion in loans reported wrong. Come to find out they were investment properties.

Rupert you are smart to wait.

Sorry the link

http://www.theaustralian.com.au/business/financial-services/apra-angry-as-westpac-reclassifies-mortgages/story-fn91wd6x-1226235101393

http://www.theherald.com.au/news/local/news/general/hunter-repossessions-rising/2409089.aspx

But wait … there’s more:

http://au.news.yahoo.com/today-tonight/consumer/real-estate/article/-/12486561/mansion-repossessions/

Note that even the ‘57% rise in household incomes’ is effectively wrong — the ‘income increase’ is not wage and salary income, but rather rental income to the 12% of households that became new landlords in the housing craze and are using negative gearing to offset their losses.

So a say $80K p.a. income became a $100K income overnight with the acquisition of an IP, with a 100% loan that leaves a $10K loss p.a. The ‘average income’ calculation then spreads this parasitic arrangement over all incomes as though households have been having a payday bonanza, which they haven’t. Lies, damned lies, and aggregated statistics.

At the same time, the ATO is haemorraghing $6bn a year out of the tax coffers to these perpetually underwater speculative landlords, instead of the few hundred million that used to be the case, year on year on year. It’s a beggar thy neighbour, robbing Peter to pay Paul (= the banks) system that will fail terribly if there are no appreciable cap gains in housing over time — and there probably won’t be.