It was once the realm of Real Estate Agents to spruik that it was never a better time to buy, but with the residential construction sector in free fall, state politicians are picking up the pieces and taking over from where agents and bankrupt builders have failed.

The South Australian State Government has launched the website – nobettertime.com.au to hard sell its new Housing Construction Grant indicating the state “has record low interest rates in a generation” and “the strongest rise in house prices in Australia.”

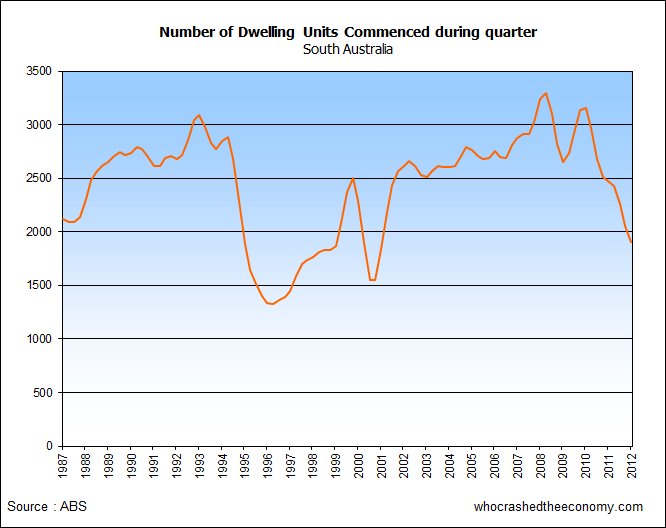

But the government omits mentioning the motivation for the shiny new grant and mass advertising campaign – new home sales are at decade lows in South Australia.

Why? Could it be that statistics from RP Data shows the cost of vacant land in Adelaide has surged 235% in the last 10 years from $139 to $486 per square metre.

Time will tell if $8,500 is enough compensation for our surging land prices at a time when the economy is showing signs of rapidly deteriorating and unemployment is trending up. We might have “record low interest rates in a generation”, but there might just be a good reason for that.

Tell ya’ what! Give me a truly non-recourse loan, all risk to the lender, and I’ll do it!

What? …No! The lender isn’t confident? Neither is the government? Hmmm… Not a good time to buy I gather.

I guess something had to offset the fall-out from the shelving of Roxby Downs by BHP.

What better to soak up all those job losses in the mining sector than another round of housing stimulus.

Who of sound mind would borrow to the back teeth in the face of growing unemployment and job insecurity.

I’ve just returned to the UK after 3 weeks in WA. The number of times people told me “There’s never been a better time to buy” was incredible! everyone urging me to upsticks and move to Oz “before it’s out of your reach”…. it was out of my reach 6 years ago guys.

I explained the situation in the rest of the world, i explained my negative equity problems, falling wages, austerity cutbacks, unemployment… the solution according to aussies? borrow more, go to the bank, remortgage! I don’t think the average aussie has any concept of what the ‘GFC’ actually meant to the world, and continues to mean.

ps this term “the GFC”…. it’s bizarre, its like a strange euphemism.

@Belfast,

Fortunately for those in power, the majority of the population is either too dumb or just can’t care enough, as long as they can have a beer at the end of the day and eat some GFC. It is a brand of fried chicken right?

PS… there has never been a better time… to flee the scene while you can, with as much as you can 🙂 There are around 10-15 better places to be for the same $$$ on this planet right now – but if you like taking it up the garry without getting rewarded for it in some way… you can “still call Australia hooooome”.

Kentucky Fried Crisis

Unfortunately many people in Australia are just too dumb to look beyond their noses and continue to believe what their idiot politicians say on their even dumber TV and radio networks. Of course everyone on here agrees with one another – and we’re the clever ones, but sadly we’re in the minority, and until we have an educated and enlightened majority in this country, and thereby governing this country, we’re going to be waiting a very long time to get what we want.

Hi Guy’s,

It seems to me we all have one thing in common, we have a rational, insightful way of thinking, I’d much rather be thought of as sensible and wise over being one of the foolhardy, non-aware types. At least we have something to be proud of.

I too, have been reading this blog for many years, I also notice many of us are very similar in age, I am 43, however I am female, I get the impression most of you are male.

The whole system is definitely heading for collapse, not only housing but every part of the economy, I really worry about where the jobs for the next generation are going to be in 10-20 years time. We are about to witness a huge restrusturing of debt and make believe wealth. I am currenty reading a book called “The great Crash ahead” written by economist Harry Dent.

The thing that strikes me as the most apparent is that most of us are old enough to have bought a home pre- 2001 when the government at the time started meddling/manipulating market conditions and is in my opinion a big part of the reason why we as Country are in the mess we are now in. I personally looked into buying in 1998, however, I am the type of person who doesn’t like taking uneducated risks and because I was single at the time and only earning the average income, I worried about not being able to service the debt on my own, so decided against it. Fast forward a couple of years to 2001 and everything went crazy, all I could do was shake my head in dis-belief. What I thought would be acheivable in my lifetime suddenly became out of reach through out the last 10+ years.

I had many friends who told me I was making a huge mistake and I should just do it and not be so concerned, these people funnily enough, all had support of some sort, ie: assistance with their deposit, partners, higher incomes all important factors I did not have.

Not sure what your circumstances were back then but I am sure all of you have stories of your own as to why you got the timing wrong like I did and now it is impossible to go back and have a do over. I’d be practically debt free by now if I had different circumstances in 1998 and at least would have a little more security in life. But alas, it wasn’t to be and I have come to terms with that.

The next decade is going to be very interesting and due to having a clearer idea of markets and how they operate will be in a much better position to act next time around. Although the thing that really gets in the way is my age, I’m not getting any younger and definitely do not want to be indebted into my seventies. I still somewhere deep inside have the ideal of owning the roof over my head one day, not sure if it’s a pipe dream or a possibility, we’ll have to wait and see.

Just know you are not alone, there are many others out there in the same boat, and these blogs are a great way of talking to like minded souls experiencing the same issues. I can’t talk to many of my friends as they don’t understand my frustrations, they mostly have rose coloured glasses on and are only concerned with their own little materialistic world, so I mostly keep my thoughts and opinions to myself.

Cheers to you all and best wishes. x

What makes me really sick is that the government is the sole driver behind this property bubble.

They will ruin this beautiful country and no-one will be held to account when families lose their houses and lives are destroyed. They will be the only ones to benefit from decades of this ponzi scheme where they have implemented laws to suit their ‘boys club gravy train’.

I know people should be responsible for their choices and actions, however when there is such a huge conflict of interest by the government in every aspect of the housing market from:-

Banks

RBA

ATO

Insurers

Real Estate Agencies

Media

Land Valuation

Town Planning

What chance do people have in making a good true informed decision in buying a house when every aspect of property is fixed by unethical leaders and organisations who all profit heavily.

With tax revenue decreasing due to reduced trade, reduced foreign investment, increased unemployment, reduced royalties from capital projects put on hold, baby boomers retirement and reduced stamp duty revenues, the govt’s last resort would have to be to introduce a stimulus or incentive scheme to try and inflate the property market again.

When this happens and people do not take the bait, the bubble will burst. The domino effect from the banks to insurers to estate agents and govt will be catastrophic.

I just noticed my comments were made on his headline rather than the previous. Sorry if it seems a little out of context. All issues are inter-related anyway I suppose. Anyway, just wanted to explain myself. Cheers!

http://www.news.com.au/lifestyle/home-garden/australian-investors-are-taking-advantage-of-the-dollar-to-buy-property-in-france/story-fnet0iz7-1226499904757

Look how f*cked up things are in Australia price-wise.

At property prices the highest on decades, dire prospects of economy slowdown and job loses, then the truth is really “There has never been a better time TO SELL” that is, if you are lucky enough to find a buyer and if your conscience allows you to…

@MrV

Please be aware of the politcal situation in France. They have been fighting the GFC for sometime now, and have recently voted in a radical left wing government. Overnight the tax rate on the wealthy rose to 75%.

There is massive capital flight (people shifting money out) out of France.

So yes, our prices are crazy, but the France situation is an economy in implosion, similar to what Ireland went through property wise I expect.

HiYa Folks,

This is one of those blogs I revisit from time to time knowing there is good information presented and well informed comments that have helped me greatly so a big thanks for that. However, I must admit, there are two viewpoints commonly expressed. One being I screwed the system and made it big or sadly I missed the boat.

IMJ we need to start considering the underlying drivers that create a healthy society. The way it is now we have the rich, those striving to be rich, and the poor. The outcome of this greed driven society is expressed in road rage, random king hits at the local pub, broken families, angry young men and suicide, etc.

My suggestion would be bike or walk everywhere. Sell the car. Pack your own lunch. Cut up all credit cards. Grow some spuds, cucumbers and other crops. Plant wild. Share housing arrangements. Shop at lifeline. Get movies and books from the libary. And share in all of this with other folk. Save 50% to 75% of salary for five to ten years, then when the time is right, buy a small, cheap house or land, and live simply.

Just an opinion.

Lenno

@Lenno – wonderful idea and in theory I’m with you 100%, but…

As a renter I can’t just dig up the garden and plant veggies, as much as I’d like to. Chooks would be nice too, but the landlord won’t allow it in the lease!

I take the bus as often as I can, but until there is a viable alternative that doesn’t involve a 2 hour walk or arriving at work needing a shower and a rest, the car is here to stay. What annoys me, however, is people using the car for local shopping. Get some exercise, right?

We make our lunch the night before and take it to work, so a big gold star for me.

The idea of sharing housing arrangements doesn’t wash, sorry. I’ve tried it and I can’t do it. My personal space is too important for my sanity. Also most people do not have the same standards as I have and pretty soon you feel like a prisoner in your own home.

I also do everything else you suggest, yet I’m still spending 70% of my salary on rent, so how am I supposed to save anything?

In conclusion – living simply ain’t that simple, and in the current climate, it’s IMPOSSIBLE to save.

But I like where you’re coming from…

Straight from the horses mouth:

Last night I sat down to dinner with my neighbours for the patriarch’s birthday. In attendance were his adult kids and their partners with whom I am also close friends.

The eldest son is a self-employed house Painter. His wife works in State Govt and has been offered voluntary redundancy. No kids. They wish to undertake a rennovation costing approx $150k.

The thrid eldest son is a Carpenter and works contracting. His wife is a Bank Manager. She advises the others not to get a Rennovation loan (due to closer scrutiny/valuation, builders contracts and release of progress payments) but rather to just apply for an investment loan.

Quote: “Just tell (the bank) its for an investment property. They’ll practically throw the money at you. Loans are only going to become harder to get from next year. You should do it now while you can still show your last two months income before you take the package. Next year, it will be harder for everyone to get finance, especially self-employed. Just come see me, even I can throw the money at you now I have the delegation.”

What does this tell you is happening now and into next year?

@ Lenno

Couldn’t have said it any better myself..

I totally agree! I am a firm believer in removing ones self from the control and manipulation of the governing systems. There are alternative means of living a fruitful, peaceful, stressful, healthy lifestyle without feeling one needs to compete with the chaos of society.

Yes, I would love to leave the family home to my children one day with the white picket fence blah blah blah…But I would much rather “teach them to fish, as opposed to giving them the fish”.

My children’s financial education is in MY hands, not the system. Their inheritance is the knowledge, wisdom and understanding of how the system works and how I can assist them to develop their analytical minds to make their own informed decisions.

It doesn’t make sense to be busting your guts for 30 years to pay off a house, only for your kids to squander it and become homeless because they were given “everything” and taught and learnt “absolutely nothing”!

I can see the “cheap as chips” farm land in the horizon right now to grow all my own food and keep my own animals.

The writing is on the wall…

Gloomy times ahead for those who followed the Pied Piper….. bliss for those who saw the signs, know history and hedged themselves accordingly.

by the way…I meant stressless lifestyle 🙂

Marcus Licinius Crassus, the man who defeated Spartacus, was Rome’s richest man.

He made his money as a property speculator, He forced the people off the land & into slums, then invented lots of ways to buy up the slum property.

Then (and this was the really clever wheeze) he would then get the state to hand out doles to the people, thus increasing his rents.

I’m so glad we have learned so much in the last 2000 years. Of course our civilisation will never fall, no matter how much of our wealth is appropriated by unproductive plutocratic landlords…

If you have a headache, dont pop more pills – simply stop hitting yourself with the hammer.

Let me ‘flesh this out’ a little more. If you want to take back greater control of your life it CAN be done, but requires a bit more gritt and determination, a willingness to compromise for your future, and some creativity and imagination thrown in for good measure.

Again do all of the above previously mentioned. My buddy pays $275 per week for a shoebox in Brissie. Ouch!!! Rent a house in a less than pretty hood, with shitty ‘large’ yard, that you can improve upon. Everyone pays $75 per week. Get like minded supportive people in.

Tell the landlord you want to take responsibility for the lawns for her – with a chicken tractor (quite breed), guinea pig tractor. Eat them. A dwarf goat or two will give you all the dairy your family could need plus more. Everone wins! That’s already an extra 15K+ in your pocket. Plant out a garden with some basics spuds, basil, toms. Lot’s of them. Use pots if need be. When your good with the landlord, build a cob oven on a steel plate that can be removed when you move out. Bake all your bread once a week. When you walk the dog, pick up your fire wood. Share your food harvest with your neighbors. Get them involved. Yadda Yadda Yadda.

Sounds crazy but this kinda ‘human experiment’ can be fun for the whole family. Graph your progress. Plan mini celebrations along the way. When things go haywire, as they do, just get back in the saddle.

Do the math. In 5 -10 years, you will have a good amount of money, in time for the crash, you will be healthier, smarther, more able in uncertain times, and ready to cut back to 15 hours a week or less forever. It can be done. Check out the

‘earlyretirementextreme’ blog! One more thing, save your seeds, and throw some on unused lots. Good luck!

@HousingTroll (to your most recent response), bit on topic, a bit off topic.

It is now more difficult to obtain credit. I sparingly use my (one and only ever) credit card. Only for online shopping, or when I buy software (always online too). Anyway, few weeks ago I bought new software, did a bit (a lot actually) of online shopping, racked up a bill of over $2,000 bucks. Few days later, I had over $2,000 bucks in my pocket. While walking past a Conmanswealth Bank, I pondered, alright! Time to wipe it clean.

As I paid the whole lot off in one hit, I was given the proposition; “Want an increase on your limit?”. No I said. “Not many people do what you just did, I can give you an increase right now”. Me looking slightly amused, she continues. “I’ll send you a NetBank message where you can increase your limit if you please”. OK, I said. “Take the opportunity, as of tomorrow you will need to fill out a three page form in order to apply for an increase on your credit card limit”. Really!, I exlaimed. “Yes, it our new policy, it will become more difficult to get an increase”. That’s good I said, I hardly touch my card. “You won’t need to fill a form out if you want an increase, I’ve put a note on your account, you’ll get approval, not many people payout their credit cards like this”.

To this day, I’ve never read that NetBank message, I deleted it as soon as I logged into NetBank.

Well, they’re clamping down on credit cards I gather. We’ll see who had no pants on when the tide goes out. 2013, we’ll see just how unlucky the number 13 is next year. Not for everyone, but for many.

@ Botrot

I believe this is part of the new regulations brought in. I could be wrong, but I thought the banks (when they come into effect) aren’t allowed to OFFER you credit increases, you have to APPLY for the increase.

On the spot increases are definitely on the way out. Found that out the hard way when trying to pay quarterly tax. Couldn’t withdraw the cash over the counter, couldn’t raise limit on the spot. Awkward. lol.

http://www.abc.net.au/news/2012-10-23/suggestion-for-a-surplus/4330352

@Rupert: I’m pretty sure good old Mr. Crassus also operated Rome’s largest fire brigade and – one can only speculate – was an arsonist. He would negotiate his terms to extinguish the fire while people’s property was burning. Those terms went something like this: “I will have my men put out the fire in exchange for your property deed”.

Fast forward 2000 years and Marcus Licinius Crassus has been reincarnated as Commonwealth, Westpac, NAB and ANZ.

@Jimmy – Yup, great analogy. And what happened to Rome? History DOES repeat itself and our idiot pollies just keep making the same mistakes time after time after time. If we educate our children properly with ideals honesty and dignity, then maybe, just maybe their children will have a great world to live in. For us though, all we can do is sow the seeds of hope.

cant wait to see what will happen in 2013.

2013 will be the same as 2012 or worse…………………………..