Treasurer Wayne Swan says it is “utterly irresponsible” to call today’s 25 basis point cut to the official cash rate as a cut to “emergency” levels. He is referring to the emergency low 3.00 per cent the cash rate reached after the collapse of Lehman Brothers and at the height of the global financial crisis. So to avoid conflict, we will report the official cash rate now sits at levels “lower than emergency lows”.

As the economy continues to deteriorate, today’s slash to 2.75 per cent is the lowest setting ever announced by the Reserve Bank after it started setting rates in 1990. It is also the lowest cash rate in 53 years. It could be seen as a tipping point.

The media release from the Reserve Bank of Australia states “The exchange rate, on the other hand, has been little changed at a historically high level over the past 18 months, which is unusual given the decline in export prices and interest rates during that time. Moreover, the demand for credit remains, at this point, relatively subdued.”

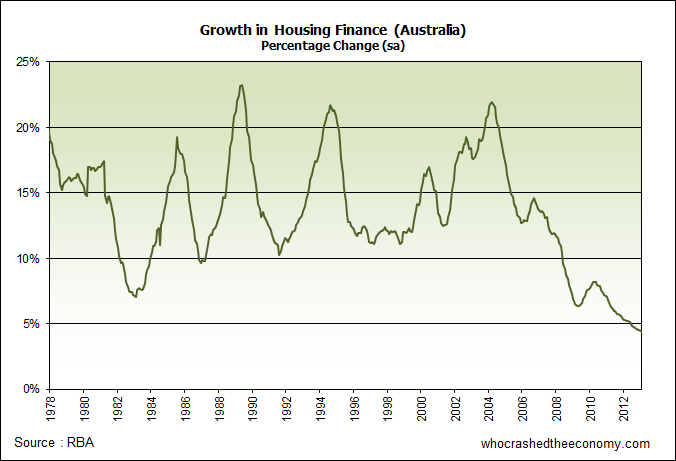

This time last week, the Reserve Bank of Australia released credit aggregates for March 2013 showing housing finance once again fell to the lowest level since records existed 37 years ago. Monthly housing credit growth now sits at just 0.37 per cent.

Even with interest rates at record lows, the confidence to borrow for a huge mortgage required at today’s mind-boggling prices is close to non-existent. The Reserve Bank will hope today’s cut will turn this around, but it is unlikely to stroke much, if any interest, for buyers to leverage into a bubble.

Today’s rate cut is the first this year. Figures from the Australian Bureau of Statistics (ABS) Australian National Accounts show interest payable on dwellings as a percentage of household net income stood at 5.7 per cent in the last quarter of 2012. Record levels of household debt means it’s still noticeably higher than in 1989 when interest rates where in-excess of 17 per cent.

The ABS today announced official house prices nudged 0.1 per cent higher in the March 2013 quarter, bringing year on year gains to 2.6 per cent.

The move today by the Reserve Bank could also be seen as an attempt to cool the strong Aussie dollar. The Australian Industry Group manufacturing index released last Wednesday shows manufacturing has slumped to a four year low in April under the burden of our defiant dollar.

» Interest rates not at emergency GFC levels: Swan – Yahoo Finance, 7th May 2013.

» Australia Manufacturing Gauge Plunged to Four-Year Low in April – Bloomberg, 1st May 2013.

» Home loan growth stuck at record lows – The ABC, 30th April 2013.

5 injections in the past 2 years and the patient ain’t responding. But picking the brains of people around me, no one seems to think the property market can drop so where are we at now? House prices are plateauing in a narrow range until the next boom?

I can’t see how Aussie banks won’t have funding stress if the AUD goes down since they rely so much on borrowing USD from overseas market esp the London interbank markets.

@Doodoo, sit back and relax. Unemployment will now start to rear its ugly head as business is forced to sheds jobs. There is no such thing as a permanently high plateau. Even for the AUD.

sorry I was being sarcastic before, I know the Aussie economy needs to go DOWN. I am not too happy lately because my husband’s accountant friend has advised my husband to go down the NG path as he is paying a lot of taxes at the moment.

I am NOT keen on the idea at all. Avoiding paying tax to the government and instead to the stupid banks on interest is but a placebo effect right now as I think property investment is not a sound investment right now. I just want to congratulate the people who bought developments off the plan back in 2011 due for completion now or next year.

THEY PICKED A TOP.

Spot on Pete. Now that the budget is not going to be a surplus this is going to make things worse. Its just getting started. ToT are falling through the roof and when all the other markets realize that the Aussie govt is full of S$%t then the AUD will drop dramatically. I think within the next 12 months Australia will lose its AAA rating.

http://www.sunshinecoastdaily.com.au/news/hidden-loan-trouble-looms/1855224/

Denise Brailey says Australia has the world’s biggest sub-prime mortgage problem per head of population. Probably makes sense given the size of the bubble. This could also be a black swan event when the market starts to correct.

Lots of head winds.

Looks you get telling people in Australia that theres a bubble VS the look you get from people overseas when you tell them what a crappy two bedder is worth…

SAME! (Yeah, right, who’s this idiot full of sh*t?)

I read that the cut means a $62/month saving. Is it just me or is that hardly enough motivation for people who can’t afford to eat dog food three times a day? Personally, id rather work on my menu first… I guess I’m the problem eh… Wrong priorities.

We have officially joined the world currency wars.This is now a race to the bottom.How can rates be dropping where we have a Federal govt defecit now 13 times more than predicted 12 months ago a rising stock market and a steady employment rate why drop rates? That train is picking up lots and lots of speed and when it hits the wall we all better have reached the top of the hill.Good luck suckers.

Cutting interest rates will not be enough to drive down the $AU. Australia would need to start printing money to match what the US,UK and Japan are currently doing.

Australia is loosing this currency war to the bottom as the Australian media treat the high dollar like some kind of victory.

A balanced budget seems to be relatively easy to achieve.

Try it yourself using this interactive application from Fairfax.

http://www.smh.com.au/data-point/you-be-the-treasurer-20130507-2j5gr.html?rand=1367964885853

I saved $17.75b by implementing 6 policy changes…

Eliminated NG – saving $5.2b

Eliminated 50% Capital Gains incentive – $5.0b

Reduced Tax benefits for family trusts – $1.0b

Abolished Private health Insurance rebate – $4.55b

Abolished Schoolkids bonus – $1.2b

Abolished Baby Bonus – $0.8b

TOTAL $17.75b

For those that are interested to find out more about it … an interesting insight ….

“Currency Wars: The Making of the Next Global Crisis”

http://www.amazon.com/dp/1591845564

There are a few vices that are now really starting to squeeze the lucky country, ultimately manifest in the interest rate (being cut again). Falling ToT squeezing revenues/incomes, High dollar on manufacturing, low rates squeezing retirees into risk.

Watch now the vice of ‘the hunt for yield’ on rents. Low rates, low FHBuyers/confidence feedback has seen property driven by investors. How long can this last? Surely the end game here is lower rents? Even if you assume low unemployment! And how will this then feed back on the assets only other incentive, capital gain? How soon does this occur in to an investors 15-20 year loan?

doesnt look good to me.

BTW Immigration driven rent increase is no replacement for employment driven rents and this approach will come unstuck. The RBA is running out of its ability to prevent the vices tightening.

Be nice to your landlord, they continue to subsidise your cost of living with their confidence in policy makers and their dreams of times gone by.

My tip is that the Govt will take the first step towards nipping the fiscal bleed associated with negative gearing in the coming budget.

There have been two smh articles that raise my suspicions in the last few weeks – one relating to the millionaires that pay no tax – the other relating to the $13b deductions from negative gearing.

I expect moves in this budget that seeks to redress these two – perhaps capping negative gearing deductions, removing the capital gains tax concessions from negatively geared property???

The repeated comment on the high AUD by the media is that,the lucky country has an AAA rating hence a ‘safe haven’ and this sort or punch line always goes with a comment about Australia escaping the GFC, and has the best banking system in the world etc.

But on the other hand, FX pairs like AUDJPY is a good gauge of risk appetite so how is AUD a ‘safe haven’ given how vulnerable the AUD is to falling commodity prices?

AUD was only strong because of devaluation in Euro land and the US. It’s all relative and to me, it’s not so much that AUD has brilliant fundamentals as EUR and USD have no interest in being strong.

The high AUD is great for Aussies travelling and shopping overseas and on the internet. Other than that, the victory is more a psychological one. You would have thought imports would have been cheaper in the past few years but petrol has still been expensive, a lot of imported havent’ really been much cheaper.

Instead, what’s really real is that a high AUD has killed manufacturing, the cost of businesses here has seen permanent job losses and when the mining boom was still happening most of profits did not seem to stay in Australia.

YUSUF … Thanks for the link – Currency Wars. Looks like a good read. Yet the stack of books at the bed side gets bigger by the week and the old scone is suffering from info overload. So if you would be kind enough, be great if you would give us an overview in regards to the Australian context and any insights as to what we as individuals should be doing. That would be really sweet. Cheers, Glenn

Stomper. I believe many more billions can be saved simply by concentrating on slimming down all levels of institutional government. There are many layers of needless,outdated and irrelevant rules,regulations,codes etc etc that need an enormous amount of resources to enforce. Instututional governments create bureaucracy which absorbs a major portion of the Gross domestic product of all nations. Governments are created to distribute the nations wealth and use all its available resources on the welfare of its citizens not the other way around. A good start is on getting rid of all local councils. They are nothing more than a means to build a voter support base come election time.

I think Mr Swan needs to get out more – It’s tough out here in the real world.

http://www.abc.net.au/news/2013-05-08/business-insolvencies-running-at-near-gfc-levels/4678264

Business Insolvencies are running close to GFC levels. In the mining states of WA and QLD, insolvencies are worst today than during the GFC.

I suspect Mr Swan will find this out sooner enough, when his budget gets hit with a “Sledgehammer” from falling company tax revenues. His words, not mine.

Anyone else think that the dollar will remain high whilst the govt is spewing out deficits and creating demand for $AUD denominated bonds?

http://online.wsj.com/article/SB10001424127887323372504578466311602710742.html

Of course whoring out the visa system also might work …

@ Glenn

I am not a person that like to indoctrinate what others “should” do with their choices in life.

Just between you and me in a Belgian Beer Cafe, then I would say few words in general:

1) Manufacturing is crucial. One can’t expect to import all the stuffs from overseas with no capacity to be self-sufficient. For example, if Holden has to close sites and one has to rely on importing cars from Japan (via Thailand or Indonesia)…. wow … that is a serious issue in my view. I got a friend that worked there in 2005. Ruckus about closing sites and profitability are not something new.

2) Retail? Think of it like banks but with inventories. Considering the size of population and the geography, it is a huge investment just to have an economy of scale in the domestic market. Of course, unless no one is intending to sell it … Just stockpile them in stores ….

3) Wanna compete in financial services area? Current setting is fine – compulsory super, negative gearing, low interest rate, huge household debt etc. As long as the general population pay their dues in time …. Limited default. People play dumb. Real estate bubble. No shock. All good. But the problem lies in the domestic real sector as much as the elevated overseas funding cost. A ticking time-bomb even without external interferences.

4) NBN is good to have in order to compete in the future, but NOT that immediate future. Gonski reform could be ….

5) NDIS …. Australia does not have serious ageing population issue like Japan or low fertility issue like Singapore. Hence, I don’t think it is of immediate need.

6) Thinking to export further education services? That will be a real challenge going forward. That lines have been hit hard recently by competitors with parity greenback. Furthermore, Asia universities (including China) are opening themselves fast and keen to fight on that front. Ask yourselves: “Why study in Australia, if one can go to US? … Relatively cheaper and possibly better quality” You don’t have much time here.

6) Asylum seeker … I have expressed my views on that previously.

7) Carbon trading scheme … I concur with some that it is good to have but there are more important things to be done at the present time. Who cares about putting filter / cap on the factory emission if it is about to be CLOSED anyway ….

8) Unemployment statistics … Many have voiced issue with that in which I agree that it needs to be “calibrated”

9) Tourism … Forget about it … It is a discretionary products and it won’t go anywhere with a strong AUD. Dear, you won’t mind our honeymoon is not in Great Ocean Road rite?

10) Professional services (including media) … it is a tiny market. Don’t think it can be exported overseas ….

Resources and agriculture are all you have left …. Mining tax anyone? China slowing down? Conservation of energy?

All are fine but not until the US and Europe are hit by the train-wreck on their economies in 2007/08. Honeymoon is over dear … Wake up.

Yusuf … thanks for taking the time to respond. Really just wanted to know what insights you had gleaned from your reference ‘Currency Wars’ The unravelling story of manufacturing, retail, carbon taxes, etc are going to play out in their own way irrespective of what I do.

What interests me more is how we are to prepare (not respond) to the changes that are sure to come. For me, that might include freeing ourselves of all debt, getting off grid, yadda, yadda yadda.

Maybe, just maybe, everything is in decline for decades to come. Ecological stability, climate change, H2O availability, agricultural productivity, globalized economy, etc, etc.

So what or where is one to put their hard earned cash during such extraordinary times? It’s a tricky one me thinks.

Good health, community, quality agricultural lands, essential metals, trees, water, life skills or …?

TO simply own your own (cheap) abode, seems but a small part of a much larger systemic problem.

IMJ unless the discussion is taken a little further, what transpires here is little more than commentary.

Any thoughts, any suggestions, anyone?

“Watch now the vice of ‘the hunt for yield’ on rents.”

Louis Christopher agrees;

A housing recovery is clearly underway and it has so far been driven by investors and owner occupiers.

On a capital city average, what is clear from the above chart is that rental growth is slowing… When dissecting the data and looking at 3 bedroom houses and two bedroom units, both property types have recorded slight rent declines in recent times.

That’s a little bit of a worry for investors who have been jumping into this housing recovery. Basically they can forget about trying to lift the rent on day one.

And if first home buyers do indeed enter into the market at an increasing pace, that will likely mean even less renters in the near future (as they have turned into FHBs).