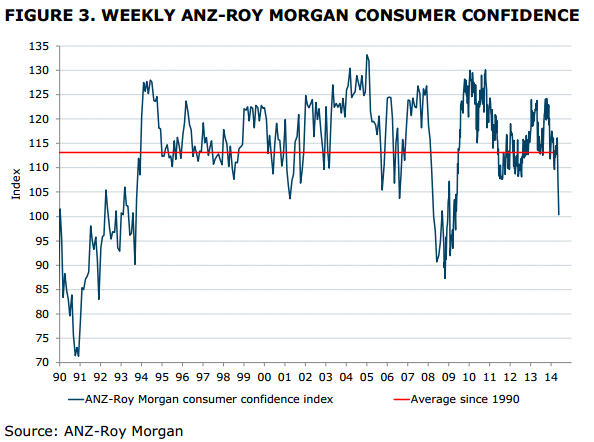

Consumer confidence has crashed in Australia – just one week since the release of the Federal Budget.

According to the ANZ-Roy Morgan survey out today, consumer confidence plunged 3.2 per cent last week pulling down the monthly index by 14 per cent, as word started leaking onto the street of the fiscal policies due to feature in Hockey’s first horror budget. It is now the steepest decline in Australian consumer confidence since October 2008, the month after the collapse of Lehman Brothers.

It would be nice to think confidence is falling due to genuine awareness of the deterioration of our economy and knowledge of the factors driving it (China/mining, Dutch disease/high Aussie, high labour costs, household debt etc), but from the rhetoric reported in the main stream media over the past week, this is clearly not the case.

After years of being told Australia is a miracle economy – the envy of the world (‘Ten reasons Australia is the envy of the world – News Limited’), Australian constituents still expect unsustainable spending and big promises at a time when Commonwealth income is under a little bit of pressure. 22 years of continued economic expansion creates some heavy complacency. The weekend was meet with austerity style street protests as the axe fell on health and education spending.

It was clear Australians were starting to exhibit the effects of cognitive dissonance in the lead up to the election. Anxiety of significant budget cuts were cast aside by fierce debate on Australian government debt levels ranking some of the lowest in the world and why any cuts to spending were actually required. Few understood the connection between deficit and debt, and why you would need to balance the budget when you can spend yourself to prosperity.

The rhetoric drowned out warnings from the International Monetary Fund (IMF) a month out from the budget that, of the world’s 29 most advanced economies the IMF monitors, Australia’s budget position had deteriorated the most over the preceding 6 months. Also absence from the main stream media until this week was the fall in iron ore prices – Australia’s largest export – down approximately 21 per cent in the four leading weeks to the budget.

When colleagues asked my thoughts on the budget Thursday last week, (Wednesday they were still in despair) I started talking about the recent fall in the iron ore price. Just as I started to question what iron ore price the budget was modelled on and if our position had already deteriorated further, I was interrupted with the statement, “but I want to know how the budget will effect me?”

So it was an immense relief to find my sanity today when News Limited’s Terry McCrann wrote under the headlines, “Worry about the iron ore price, not the Budget”.

Terry McCrann writes:

JOE Hockey’s Budget has unleashed an unprecedented wave of fear and loathing.

But if you really want something to worry about, worry about the iron ore price.

Surely, you might respond, that’s Gina and Twiggy’s problem in particular, or the big end of town more generally. If they lose a billion or two, your attitude might lie somewhere between “what’s it to me, anyway?” and “they’ve got it coming to them”.

If so, think again. In the most direct way, Gina and Twiggy’s — billionaires Gina Rinehart and Andrew “Twiggy” Forrest’s — losses would very much also be your losses.

More specifically, what’s happening to the iron ore price could rip a huge hole in Hockey’s Budget, potentially far bigger and more immediately than the Senate and Opposition Leader Bill Shorten could do. But also, last into the so-called “out years”.

He even mentions our housing bubble:

More broadly, both the Budget and the economy are built entirely on the twin pillars of super iron ore profits and super bank profits, with the latter built almost entirely on the reborn strength in the property market.

A slump in iron ore profits would be bad enough — for the Budget and the economy; it really does not bear thinking about if property were also to hit the wall and bank profitability went into reverse.

So what is driving our reversal in iron ore fortunes? Frequent readers here will know it’s cracks in China’s stressed housing bubble.

China’s residential property sector absorbs 24 per cent of worldwide steel consumption. China’s National Bureau of Statistics reports new property construction has fallen 25.2 per cent in the first quarter this year.

But it is not the first time we have been witness to this. Overnight the Iron Ore price fell 2.2 per cent through the psychological $100 USD tonne to end up at $98.50. The last time this happened, on the 24th August 2012, I posted that day, (‘Has the mining investment boom come to an end?‘) reporting on the decision by BHP to delay the Olympic Dam expansion and China’s Fixed Asset Investment Binge. At the time, China’s housing bubble tried to burst sending Iron Ore prices plunging to sub $90 USD tonne in the weeks later before the Chinese government was forced to provide stimulus and prop the bubble back up.

Perhaps this is the reason few has been interested in the Iron Ore fall this time. Endless bailouts has built a thick layer of complacency.

But what happens if it is different this time?

China is now under the new leadership of Premier Li Keqiang, after assuming office on the 15th March 2013. While he served as first Vice-Premier under then Premier Wen Jiabao from 2008 to 2013, he brings refreshing views on economic sustainability and regularly voices objection to using short-term stimulus policies to boost economic growth.

Earlier this year we witnessed the first onshore bond defaults under new Chinese leadership (‘China: Did the first Domino just fall in GFC2?’). The expectation was for a bailout, but to everyone’s surprise no one stepped up to the plate. Many described the collapse of Shanghai Chaori Solar Energy Science and Technology Co. as a “Watershed” or “Bear Stearns” moment.

Not long after Premier Li Keqiang warned “We (china) are going to confront serious challenges this year and some challenges may be even more complex.” (‘Premier Li Keqiang: China to confront serious challenges this year’) Li said China must prepare for a wave of bankruptcies, which at the time many interpreted it to signal the end of an era when the People’s Bank of China was only a stone throw away and ready with a bailout.

In an article published in Qiushi magazine, Premier Li remarked, “Last year we avoided an economic hard landing and maintained stable economic growth. This achievement was largely because of reforms…If we had used short-term stimulus measures last year, they would have brought future pain.” In a speech in April, Li said “We will not use short-term strong stimulus policies because of temporary economic growth volatility.”

Time will tell if or at what point China will step in to soften the blow of one of the world’s great property bubbles.

And speaking of ours – the 2nd pillar of the Australian economy according to Terry McCrann – we all know it runs solely on consumer confidence as any real fundamentals left the market over a decade ago…

» ANZ-Roy Morgan Consumer Confidence: The Budget Blues – Confidence Weakens Further – Roy Morgan Research, 20th May 2014.

» China property slowdown to hurt Australia – The Sydney Morning Herald, 14th May 2014.

» Government won’t resort to short-term stimulus, Li says – The China Daily, 11th April 2014.

» China’s Property Bubble Has Already Popped, Report Says – The Wall Street Journal, 5th May 2014.

» China Housing Market Bubble Start to Pop as Economy Faces Hard-Landing – International Business Times, 14th April 2014.

» Chinese developers bring in security as buyers experience negative equity – Who Crashed the Economy, 5th April 2014.

» How China Fooled the World – Airing in Australia on the ABC – Who Crashed the Economy, 31st March 2014.

» Premier Li Keqiang: China to confront serious challenges this year – Who Crashed the Economy, 16th March 2014.

» GFC2 – Will it be made in China? – Who Crashed the Economy, 30th June 2013.

Standing in an underground train station, first you feel the breeze, then you begin to hear something approaching…then a big train rolls right through.

The collapsing commodity trade should be top of every Australian’s agenda.

But, no. We’re more concerned that middle and low class Australian’s will actually have to pay net tax!

Ask any small business operator: They are all sick to death (sometimes literally sadly) of the amount of tax they pay. And for what reason? So the middle class and the poor can pay NO net tax.

It’s business and the rich that pay for roads, schools, health. Etc. Etc. Middle Australia does not! Do I sound offensive? Sure. Do I sound right wing? Sure. But these are the facts.

This fact is one of the main reasons why Australia is no longer prosperous for the majority: Business is too risky, too expensive to try new things and create new jobs.

Which brings me back to this article: If there’s no prosperity there’s no confidence: An economy built on internal debts and non-renewable exports is a ticking time bomb.

It has been this way for years: Many on this site know and accept this. We can’t predict the time frame, but we can predict the out come: And it aint pretty.

I used to think Preppers were crazy: And while I’m not one of them: I’m sure getting positioned for the inevitable.

The Day of Reckoning may not too much further down the road. Feeling like a recession is a coming soon…

Australians might actually have to lose the concept of cradle to the gave welfare.

POP – was that our housing bubble?

I thought the budget was tame, could have done more…but at least its a start to reduce the size of our bloated government.

Happy days.

Is anyone else getting impatient? Can bubbles be deflated or is a burst inevitable.

I know this is primarily an economics blog but there are many social factors that need to be addressed in China. The gender gap in my view is by far the largest problem China faces and I dont think its unreasonable to suspect this issue will result in significant civil unrest with the usual economic impacts. 1 in 4 men in china will never marry. China is a house of cards.

http://davidstockmanscontracorner.com/why-china-will-implode/

Another worthwhile read on the China bubble by David Stockmam

There are still a few unknowns, such as China’s shadow banking system, and we have plenty of fat that can be trimmed here still (your super looks rather tasty) and interest rates can still go down further. So I can’t see any rapid deflation occurring, and in fact I’d wager housing will be protected even at the expense of jobs (the budget was consistent with that).

On the plus side I hear the big 4 banks made 30 billion in profit last year. I wonder where all that cash came from?

I like this particular article as it addresses and emphasizes the root of Australia’s ‘house of cards’ economy and that is the-VOTER. Who? else would keep the Labor/Liberal/NP party monopoly in power for decades despite having proven themselves incompetent and corrupt. Voters placing the general welfare of their pockets over that of what is best for Australia will inevitable turn this country into the ‘Banana republic’ as once predicted by Keating. Its only a matter of time. Keep up the articles with the new emphasis

Sacred cow saved!

http://www.macrobusiness.com.au/2014/05/budget-to-ignite-negatively-geared-investment/

Interest rates will be cut in July 2014

Houses will rise further this bubble will grow quicker..

The bubble will pop further down the track the rba are eating into profits but they have no choice

Matty,

I think almost everyone reading from these kinds of platforms has some prepper attributes. I was also in denial for years.

We are only the few that have any intreaged in economics, the state of our nation and the effects that will determine our near future.

As apposed to the masses interested in the footy and the dribble coming out of the box, in time during this collapse we will see a much larger amounts of posts added to blogs like this. I believe we will start to see more and more people with concerns of our future and find themselves at places like this one.

Thank you Admin

Yoda,

We have been in reason for three years

Adam,

We will all be finally told that we have a bubble and that it will deflate slowly.

That never happens…

Then there’s Japan……………..

Chockolate

Please don’t mention China’s shadow banking system and or the off balance sheet loan and or the global unbacked derivatives worldpool floating around.

The last investment adviser I spoke with told me these things scared him, but I should put some cash into the stock market………………

pepper

http://www.news.com.au/finance/real-estate/owners-think-their-houses-are-worth-more-than-they-are/story-fncq3era-1226926694081

Classic!

Quote “Postcodes that appear to overvalue their homes typically spend more, have higher leverage and choose riskier portfolios than postcodes that do not.”

Sounds like every bogan, negetively geared, “investor” to me.

Isn’t it ironic that ALL the MSM articles like this can never be commented on?

Its POPPED

Rents right now are falling 1% a week in WA. Places up in march for 600 are now going for 550. Doesn’t Sound like much but the speed is astounding. That’s 50% falls in a year.

Properties are FLOODING the market during the April/may ‘Lull’ more properties have come on the market than ever before.

Unemployment is accelerating, its doubled in less than a year and its showing no signs of slowing down…

Gold Sach has short sold Australian banks in anticipation they will collapse in the next 6 months…

Good luck but if you didn’t get out of the market or just bought you’re about to lose 20-40%

Where is the wealth going?

http://rt.com/business/160068-china-russia-gas-deal/

prepper

Paul,

I saw that article too and wonder now if the Chinese ever intend to pay off their debts. It seems to me they will rack up debt as long as the world lets them and let the global economy collapse once they have a whole lot of infrastructure and a VERY large military in place. What have they got to lose? Our current form of global capitalism has arguably only been in place post 1945 and the sleeping dragon has a very long history with equally long cultural memory.

With the US picking fights with Russia, North Korea and China, regardless of nuclear weapons a world war is coming. I know its a very paranoid prepper attitude but if history has taught as anything its that nothing stays the same, empires fall.

@Topside

yes its…

http://www.abc.net.au/news/2014-05-23/rents-fall-well-behind-home-price-surge/5473952

http://www.couriermail.com.au/realestate/news/brisbane-property-market-turns-cutthroat-for-homebuyers/story-fnihpu6h-1226929070461

Just sit back and marvel at our ponzi. It really is quite amazing. Well done everybody!

Thank you Adam,

Mate, the us or shall I say the global unbacked central banking cartel with the us as their stooges have been picking fights for years using their unbacked confetti currency to a tune that only central bankers can appreciate. You have left out that they are using the ukraine to get at russia and what about the syrian fiasco

The fights us have been in recently have all been failures afghanistan iraq vietnam…

Yes the ones who own the us T Bonds mainly russia and china are using them to purchase real tangible assets globally, using this same confetti currency to buy large mining and resources, agribusiness, property transportation, throughout australia and the world. china and russia are also accumulating gold at a rate more than production. The economy’s aware of the changes coming are accumulating gold as well as the real tangible assets. When this confetti currency being created by the west is diverted from propping up the relative share markets and diverted in purchasing gold this will be a signal that the end is near.

Our form of global capitalism has morphed into crony capitalism or fascism at the hands of these privately owned central banks since Nixon started the unbacked global confetti rehypothecation experiment by dropping the gold standard.

I believe china has been waiting for this opportunity for more than 150 years

https://www.youtube.com/watch?v=EdSq5H7awi8

prepper

every time I get property spruiker advert on my facebook – I link this site then macrobusiness. chuckle..

Craig do you have site visit charts?

cheers.

China is the new world order(global technocratic disorder).Flooding the world with quantity over quality has decimated the western world’s industries.Free trade and the $2 shops made sure of changing everything.How communist party officials have become the new millionares billionares is fact.It was all planned that way.The military post industrial technocratic madness is a monster(nuclear power) that threatens all living,small and great,on our planet.We do not need robots,to do our work,while we play on computers.We need to look back at our grandparents.Living on the land in rural areas,growing our own food,producing our own crafts skills products.Using our heads and hands.Not scamming our way,through the next deal,exploiting our fellow brothers and sisters.This is not an ideal or fantasy.The world managed like this for thousands of years.The industrial revolution has made us all debt slaves.The 1% haves and the 99% have not.$500,000 for a 70sq.meter shoe box on $20 per hour in hand,if you’re lucky to have a job,is not a better way of life.