New research from Barclays warns Australian households have record debt levels, some of the highest in the world, greatly exposing them to heightened risk in the event of another financial crisis.

The report shows household debt in Australia is at 130 per cent of GDP, significantly more than the global average of 78 per cent. The global average has declined from a record high of 81 per cent in 2010, showing the majority of the world is deleveraging while Australia continues to binge. Household debt in Australia held steady at 116 per cent of GDP from 2008 until 2013 when Australia’s property market went into hyper drive, pushing debt unsustainably higher.

The extreme household debt levels groups Australia in with many Eurozone countries, with Denmark at 129 per cent, Switzerland 120 per cent and the Netherlands 115 per cent.

Melbourne Land Boom

News Limited, who described the alarming debt levels today as a “ticking time bomb,” said “The level of household debt is higher now than at any other time in Australia’s history, with records going back to the 1850s.”

In 1880, there was a speculative land boom in Melbourne fuelled by wealth that had been created during earlier gold rushes (mining). There was strong population growth, with the population of greater Melbourne rising by more than 70 per cent over 10 years from 1881. The land speculation engulfed most members of society and was helped by a surge in lending. The Federal Bank was founded in 1882 by James Munro and the funds used to speculate on suburban real estate.

A certificate of shares in the Federal Bank of Australia, Ltd. Issued in Victoria in 1887. Source : Museum Victoria

The crash began in 1891 with land prices plunging to around half of their perceived value at the peak of the boom. For example, average property prices peaked at around £950 in Brighton in 1888 and then fell to around £400 in 1893 and £300 in 1898. Property in Collins Street that was selling for £2000 a foot at the top of the bubble, had an asking price of £600 and still was unable to attract buyers.

While the trigger is not 100 per cent clear, it’s believed the crash started when banks started restricting their lending for land at the end of 1887. (No wonder APRA is too scared to do anything). Another observation was the large amounts of land brought onto the market resulted in poor rental yields. Coupled with high levels of leverage, more and more speculators experienced cash flow issues. (I guess they didn’t have negative gearing then!)

Mortgage defaults and bank runs started a period in history known as the Australian Banking Crisis. The peak of the crisis was signalled by the Federal Bank failing on the 30th January 1893. Five months later, 11 commercial banks had gone under and suspended trading.

It was the biggest housing bubble in Australia’s history, until now.

Australia’s household debt may be unsustainable – McKinsey Global Institute

Barclays is not the only one ringing alarm bells on Australia’s expanding household debt problem. In a report released in February 2015 by the McKinsey Global Institute, titled “Debt and (not much) Deleveraging“, it found seven countries had “household debt levels that may be unsustainable:” – the Netherlands, South Korea, Canada, Sweden, Australia, Malaysia, and Thailand.

“Unsustainable levels of household debt in the United States and a handful of other advanced economies were at the core of the 2008 financial crisis. Between 2000 and 2007, the ratio of household debt relative to income rose by one-third or more in the United States, the United Kingdom, Spain, Ireland, and Portugal. This was accompanied by, and contributed to, rising housing prices. When housing prices started to decline and the financial crisis occurred, the struggle to keep up with this debt led to a sharp contraction in consumption and a deep recession.”

McKinsey reported since the 2008 financial crisis, “a great deal of research has been conducted to establish the link between household debt, financial crises, and the severity of recessions.” (We reported on IMF findings in 2012 – Housing busts preceded by high leverage more severe and protracted: IMF“)

“The rise and fall of household debt affect the magnitude of a recession. In the years prior to the crisis, when credit was flowing and asset prices were rising, economic growth appeared robust, but it was artificially inflated by debt-fueled consumption. Then, after the crisis hit and credit dried up, the decline in consumption was especially sharp as households could no longer borrow and had to make payments on previous debts, often for homes in which their equity has been wiped out.”

“Just as rising house prices and larger mortgages can create an upward spiral, falling prices trigger a dangerous downward spiral. Compared with other households, highly leveraged ones are more sensitive to income shocks as a result of job losses, costly health problems, or increases in debt servicing costs. When highly indebted households run into trouble, they cut back on consumption, which contributes to the severity of the recession.”

The report concluded “reduced consumption after a financial crisis causes especially severe and prolonged recessions.”

» Australian households awash with debt: Barclays – The Sydney Morning Herald, 16th March 2015.

» Mortgaging our children’s future: Aussie ticking time bomb sparks fears should new GFC hit – News Limited, 16th March 2015.

I would not call an economic correction a recession and definitely nor consider it a bad thing. A correction will eliminate a false economy based on the accumulation of debt. It will eliminate a job market that is only temporary and not long term which is what we all want. I say bring it on and if people look for a scapegoat when they start loosing their jobs and homes I say you voted for them, blame yourself first and then the political world. Self-reflection is also cathartic.

Unsustainable household debt will be to Oz what sub prime lending was to the US in 2008. The dominos will start to fall as RE values deflate due to a slowing economy and unemployment. The big four banks will choke on their large mortgage portfolios and find it difficult to raise offshore funds in the face their falling asset backing. The government will then step in to save them and will take on unsustainable amounts of debt. GAME OVER BANKS WIN. This scenario is being played out all over the world by the Too Big To Fail.

The outcome is bigger than the politics of one country and is the net result of corporate globalisation shifting manufacturing/jobs to the 3rd world. To maintain living standards locally we have to borrow more in the face of shrinking incomes and housing bubbles.

Blaming the voter is short-sighted and will only ensure decades of austerity or worse.

This is old news, Australia household debt has been one of the highest in the world for many years, and its why so many people have forecast the crash which will inevitably come. When it does the morons in Melb and Sydney are going to lose out big time.

ALSO WHO WAS VOTED IN AT THE LAST ELECTION HAS NOTHING TO DO WITH THIS.

This elephant in the room. People seem to think that housing always goes up. Not quite and still a risk when you borrow ie leverage particularly with all the worlds economic problems and mainstream lies to sugar coat today’s reality. People have become their own brokers and financial advisors. I’ve heard people say they want to purchase an investment property on top of an already reasonably leveraged property because their children will not be able to afford a house. To look at this logically….if our children can’t afford and therefore can’t buy a house in the future then who is going to buy these properties in the future ? I don’t think it is that difficult to workout …… They will come down and basic mathematics will tell you this. There will be plenty of bargains in the near future….hold onto your cash….a no brainer. I wont discuss my investments but I sleep well.

This debt and credit consumption problem has been around for years. I thought it would have been highlighted when the GFC hit, guess I wasted a thought. Instead debt and credit consupmtion went up steep and fast, leading many to believe Australia starred down the GFC and punched it off.

Nobody paused to see that all this credit/debt consumption came from stimulus programs from here and abroad.

Now the mainstream media is stating, “too much debt”. This must mean many people are really over their heads in the thick of it.

I have seen a few recessions in my time, never seen so many people that are working and are poor across all salary bands. Not all but many.

I reckon that this will make a correction all the worse, so much deep debt.

@1. THEO, “…blame yourself first…. Indeed. I know central banks have lowered interest rates to all time lows, borrowing is too easy, there’s negative gearing, super access for your first house (to come), credit cards for all that are breathing, vehicle finance and balloon leasing, Harvey Norman’s pay nothing for 60 months weekend deals, I know they all do and offer these things. But, whoever’s signature is on the form, owns the debt.

Blame yourself first

Quite refreshing that some people are not blind folded….all the best to you all

@4 Me

Correct: If our kids wont be able to afford to buy a house, then who will buy our investment houses…seriously, then who will???? Such a simple concept.

My argument is always, if housing was such a one way bet ie. housing always rises, then why hasn’t the banking sector monopolised the housing market: Gone out and bought every damn house for sale? If it always goes up, how can they go wrong????? Simple, it don’t always go up.

Most Australian’s completely mis-understand what the GFC was about. I had a work mate tell me “I don’t see the big deal, I mean, fuels gone down, interest is down… I’m better off now than ever”, and then borrows for a car etc. etc.

Things are slowly getting exciting.

Before our kids can buy homes, they need jobs. The housing bubble has pushed up labour costs to the point that Australia is one of the highest cost economies in the world. Domestically, so much disposable income is going toward debt repayments, when traditionally it went towards goods and services underpinning employment.

Google “generation jobless”

I am intrigued to how this will play out. The RBA wants a low dollar to stimulate business investment hence the rate cuts. I believe that if we went to 0% cash rate it won’t work as there is nothing to export anymore. The mining boom is over. Non-housing construction is stagnant. I think unemployment is under reported. I know a few people who have experience in their fields but can’t get jobs. As the dollar drops imported goods get more expensive reducing consumption. Wages are also stagnant. The only things that are increasing in value are assets, not for dividend yield or rental income, but purely for capital gain. Its for speculation.

If the fed raises rates midyear our dollar could overshoot too low and the RBA might have to raise rates to compensate. This will cause mortgage stress. If the Fed doesn’t cut we get more of the same and more asset speculation making the situation more vulnerable.

I don’t see Australia progressing for another 2 years without a major economic collapse. It is different this time. There is not mining boom to save us this time. Nor can the government afford to keep propping up housing like in years past. The defecit is too large.

@ Brad

Totally agree with your post.

Every time I hear the argument in the MSM that interest rates will be cut further to stimulate business, I ask myself “Has the last half a dozen cuts improved the country’s economic outlook?”.

The answer is obviously no. But with a government that is paralyzed with the very thought of proper tax reform the RBA has no choice but to kick the can down the road.

@9

You’re right about the the government not having the credit to pour into housing to keep it solid, hence the plan to access super: This will have only a positive effect ( if only short term) on housing, which will bolster the budget somewhat.

The pro-housing crew have completely missed reading between the lines: Accessing super should be seen as an absolute last resort…. Doing it for housing should be ringing alarm bells everywhere as it clearly shows how out of control housing has become. But it’s not.

Hell, I was up at CBA yesterday: Big screen tele with a picture of Hockey with “Housing is far more useful than super” or words to that effect….

We all know the country is in dire trouble, but we can recover from here. If we open the flood gates on super (not only will you piss off every business owner that has poured thousands and thousands of dollars into their staffs accounts) we are cornering the younger generation into a future of poverty, with no self funded retirement or dismal government pensions.

There are two kinds of people on this earth:

Type A: Those that watch stuff happen

Type B: Those that can see what’s going to happen

Our school system has breed and supported TYPE A personalities for decades, type b are a rare breed. Most of us here are type b, and we should be worried about the future. Luckily for most of us here, we have had time to prepare somewhat, while we never have enough time, money and resources, I’m better prepared now than I was for the 2009 bump.

Perhaps “helicopter drops” of money and debt cancellation are the solution. This idea was first mentioned by Milton Friedman and then Ben Bernanke as a cure for deflation. The Rudd government was probably the first to try it with the $900 handout when the GFC started, and it did work for a short time by boosting businesses. The theory is print and give out loads of cash to everyone and then when inflation raises its head, up the interest rates to control it. So how much would be enough, $1000, $100,000 or perhaps $1million each and should it be means tested? It will all depend on how desperate governments get when the SHTF.

unfortunately for the speculators it will not end well but the reality is that it will create opportunities for individuals with the common sense to sit on the sidelines and wait. You all seem to have common sense and really that’s all it is….you don’t need a degree or to know what the Daily Telegraph or the news is saying etc ….just some logic. The more I hear that the Real Estate market looks stronger the more confident I feel because it just means the iceberg is getting closer however too many believe that there is no need for a life raft because this boat never sinks.

I am 39 and almost paid my house off. I learnt from old school parents to live within your means, make sacrifices (hence go without) and don’t spend more than you earn.

You can blame banks, govts and vested interests, but ultimately it’s the people whom are to blame as they have made stupid decisions based on greed, keeping up with the Jones’ and wanting it all now.

Unfortunately the only way stupid greedy people learn is the hard way through a deep recession and/or war. (just like the 1930’s depression)

The good thing about Adversity is it brings Wisdom and common sense. It will be bad for Australia, but it will bring everything back to equilibrium and opportunities / lower prices thereafter for the younger generation. This is a cycle of the current system we are in and will repeat again.

Yes the economy will suffer once Australia begins de-leveraging and will cause a much anticipated recession that will last for many years.

Bring it on!

The People’s Republic has 1\4 of the earth population.(with India and the rest of Asia,maybe close to 2/3 of human world population).Since everything now is made in PRofC,the director’s of these co-operatives have become the new boss.If there are 20 million elite 1%,over there,we are in trouble.Housing and commercial construction,in Sydney, is almost dead.Yet,at the same time,we are watching the biggest high-rise apartments building boom in Sydney’s history ever!Do you think Packer is building the casino for us.When they push us out,to the regional areas,let us pray, that they have mercy.

If the average worker,in Sydney,makes $20 per hour,and a 1 bed apartment costs $650,000.How can we have the highest wages in the world?Spin and lies!In the USofA the average worker makes $15 per hour and their condo’s are $100,000.These moneys borrowed, over thirty year loans,are two and a half times the original loan.This is not rocket science.In OZ we are being shafted big time.

Sydney early seventies,most people could pay the loan,for a house,in 4 to 5 years.Why did it all change?

It’s official, and what I’ve been sprouting for over three years now:

THERE IS NO FUTURE BUDGET SURPLUSES!!!!!!!!!!!!!!!!!!!

http://www.abc.net.au/news/2015-03-18/senior-bureaucrats-express-concern-for-looming-budget/6329810

Note the title, it’s not even dramatic.

@ 56andoverit. Yes you are correct my parents paid there mortgage off in only a few years. In the 60’s & 70’s we didn’t have CHINA, GLOBALISATION, FREETRADE, NEGATIVE GEARING, PONZI SCHEMES and so forth.

The man was the MAIN worker in the family back in those days and the Banks were a servant of the Real Economy not the master, as they are now.

House prices were tied to wages based on real productivity when Australia actually made things and had a large manufacturing sector.

Now they are completely disproportiate to anything.

When someone has a dependency on drugs, the government will ruin them. When someone has a dependency on credit, they get a pat on the back.

Jim Fetzer : “We confuse authority with truth,when the truth should be our authority”.

“When someone has a dependency on drugs, the government will ruin them. When someone has a dependency on credit, they get a pat on the back.”

“We confuse authority with truth,when the truth should be our authority”.

Pure Gold!

Isaiah 5:20 – “Woe unto them that call evil good, and good evil; that put darkness for light, and light for darkness; that put bitter for sweet, and sweet for bitter!”

I guess the people (will eventually) suffer due to a lack of (truth) knowledge so to speak.

Notice how the spruikers use the word “boom”. It’s a way of avoiding the word “bubble” as if to say the expansion will never end or will reach “a permanent high plateau”. In reality a boom is just a bubble that hasn’t burst yet.

Be suspicious when you hear someone use the term “boom”. It is a way of denying that the economic cycle exists or that things like the “great moderation” can continue on into infinity.

Another term used in this vein is the “end of history”. All of these terms are used by neo-liberals and neo-cons to let the general public know that they’ve never had it so good and that this is as good as it gets.

Whether the bubble in Oz bursts this year or in a few years time it will eventually burst. It will be events like the collapse of the Chinese Communist Party that will ensure that the bubbles here and elsewhere burst. Australia is not in a place where it can weather such events.

Matty

Don’t trust bankers.

Translation: don’t trust anything that a banker is trying to sell you.

I don’t know why Matt Taibbi didn’t point out the implication of that statement (i.e. nobody should trust the stated value of anything that a banker is trying to sell you).

@ David C

“ANTONY LAWES Despite soaring property prices, 10 suburbs are still in a slump.”

I notice spruikers are also using the word “slump”. For example Ropes Crossing only went up 12.4% for the past two years, more than wage inflation, but it is in a slump. Likewise Haberfield – 12.3 per cent, and Elanora Heights 10.9%!! And what is it with using data over two years. Why can’t they just report the smaller annual result?

The 10 Sydney suburbs left behind by the property “boom”

Mark Twain said “If voting made any difference they wouldn’t let us do it”.

The Canadian housing bubble has begun to burst as their energy sector collapses. How long before the Australian bubble deflates due to our mining downturn?

http://www.zerohedge.com/news/2015-03-24/canadian-housing-bubble-has-begun-burst

@Max D.Leverage

You would think that Australia’s property bubble would start bursting due the mining downturn and the fact that the Aussie economy is going pear shaped, but Sydney and Melbourne house prices (especially Sydney) are still going ballistic.

Here are some Sydney Morning Herald articles, that talk about the so called “concern” the RBA has about the property bubble it helped create.

http://www.smh.com.au/business/banking-and-finance/reserve-bank-sounds-warning-on-house-prices-20150325-1m72zr.html

@ Master Yoda

No market is homogenous. We are now seeing mining areas of WA and Qld that are badly affected. Normally it is a slow creep from outer blue collar areas to the more affluent inner city areas. As your article points out the RBA knows that lowering of interest rates inflates property bubbles but they intend to keep doing it. Isn’t that the definition of insanity, when you keep doing the same thing but expect different results?

@Max D Leverage

Unfortunately “the lunatics are running the asylum” ie.the corrupt money hungry politicians and their bankster/big business masters, this is why they continue with their insane economic policies that are only benefiting the top 1%, whilst the rest of us are getting screwed.

Hi Guys

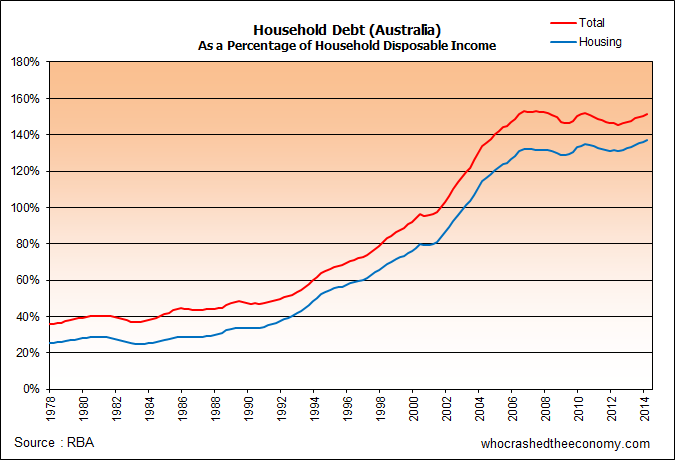

I was wondering if somebody could clarify what the above chart showing Australian household debt as a percentage to disposable income is meant to depict. I understand debt-to-income ratio (DTI) as ” the percentage of a consumer’s monthly gross income that goes toward paying debts.” In which case, 140%+ pretty much means bankruptcy. So I assume this is not a chart of DTI.

However if it is total debt to disposable income, it seems rather mild. For example, if a household’s annual disposable income is $100,000, their total debt is about $155,000, of which $139,000 of that is the mortgage. The effective DTI is therefore less than 10% (based on $9600 annual repayment), very comfortable indeed!

Considering that the average mortgage size is about $450,000 (from http://www.news.com.au/finance/afg-australians-getting-larger-mortgages-and-fixing-interest-rate/story-e6frfm1i-1227023457753), households would therefore on average have a disposable income of $320,000 pa. Can’t say I know many, if any, people on that kind of after tax salary.

So what is the chart trying to say? 🙂 Thanks Pete.