“Australia is vastly uncompetitive, I don’t think they want to openly say it, which is why they put a lot of fudge and nonsense in the minutes today” commented Michael Every, head of Asia-Pacific markets research at Rabobank after last month’s cut to the official cash rate.

Michael Every is, of course, referring to the stubborn Aussie dollar making Australia uncompetitive in the international market place and resulting in the loss of jobs from manufacturing to back office.

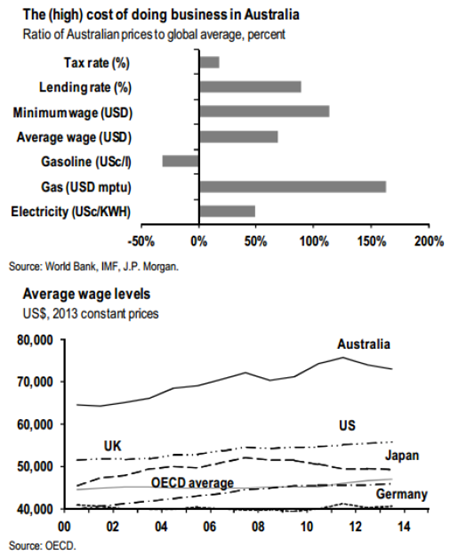

Stephen Walters, an Australian economist with JP Morgan summed up the severity of problem earlier last month with just two graphs:

According to the data, the average Australian wage is 70 per cent above the global mean, the minimum wage is 100 per cent the global average, electricity is 50 per more and gas is 150 per cent more than the global average.

Only today, Dr Bob Baur, chief global economist at Principal Global Investors said the Australian economy is struggling because “wages are too high”, Australians get too much annual leave and are too hard to fire. “In the US, we get two weeks’ vacation, so three or four weeks at one time (as in Australia) is not something that’s natural, at least in the US — it is in Europe, but then, Europe is not growing terribly fast either.”

According to the OECD, Australian wages grew the second fastest of any developed economy over the past 13 years, but times are now changing. Last Wednesday, the Australian Bureau of Statistics reported wages are now growing at the slowest pace on record.

The other reason why our labour rates are considered high globally is due to our strong dollar. The mining boom has seen a bad bout of dutch disease creep in as the dollar surged above parity with the USD. Today, a currency war and an internationally high official cash rate have seen a flight of money heading into Australia. Sending the dollar lower is considered one way of increasing Australia’s competitiveness and this is likely to be easier than getting all Australians to take a 38 per cent pay cut (New employees at Coca-Cola Amatil to earn 38 percent less).

The statement from the Reserve Bank of Australia on today’s monetary policy decision indicated:

The Australian dollar has declined noticeably against a rising US dollar, though less so against a basket of currencies. It remains above most estimates of its fundamental value, particularly given the significant declines in key commodity prices. A lower exchange rate is likely to be needed to achieve balanced growth in the economy.

The Australian economy is now in worst shape that this time last month. Unemployment hit 13 year highs last month, according to figures from the ABS. Capital expenditure is falling faster than expected and a slowing China, forced its central bank to cut rates on Saturday.

But the Reserve Bank was unable to act today due to increased risks posed by the housing bubble. After cutting the official cash rate last week, irrational property spruikers have been drumming up insatiable appetite for housing, especially in the overheated Sydney market. One commentator, ex RBA, said the market was racing away like an “out-of-control freight train.” Needless to say, this has serious consequences for Australia’s banking system.

The RBA reiterated its joint effort with other regulators to control the dangerous bubble in its monetary policy decision statement:

The Bank is working with other regulators to assess and contain risks that may arise from the housing market.

But until this framework is in place, the RBA might have to sit and wait tight.

Further easing of policy may be appropriate over the period ahead, in order to foster sustainable growth in demand and inflation consistent with the target. The Board will further assess the case for such action at forthcoming meetings.

» Statement by Glenn Stevens, Governor: Monetary Policy Decision – The Reserve Bank of Australia, 3rd March 2015.

» ‘No economic benefit’ in further surge in house prices, economists warn RBA – The Age, 2nd March 2014.

» The boom is about to go bust – The Sydney Morning Herald, 2nd March 2015.

» Australia central bank acting like it ‘just woke up’ – CNBC, 5th February 2015.

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.” – Ludwig von Mises

John Pilger.Lifting the Veil on Vimeo.

The elephant in the room is the ridiculously high housing prices, which could have been corrected by government intervention long ago. I saw this being a problem over ten years ago. But then, greed got in the way.

A lot of people are going to lose big time.

The biggest decision I (and hopefully many others) have to make is which country to escape to. Anyone have any suggestions?

@3 Stay in Australia Adze. All things considered (including the ridiculous laws about swimming pool fences – don’t get me started) Australia’s got a lot going for it. I’ve lived in many countries and despite the high property prices, I’ve never been happier or more at peace than I am in Sydney.

Don’t believe this propaganda and blatant lies from Dr Bob Baur. He has either proven himself to be a voice for big business or simply a corrupt beauracrat or simply both No mention of the high cost of houses and rents which are the reasons our wages seem high but in fact are very low compared to house and land prices. Government interference, corruption and incompetence is responsible for this mess. Governments allowed negative gearing, self-managed superannuation funds to be used for investments, FHB grants, stamp duty exemption, just to name a few. All these has increased Australia’s debt just so a minority called investors, Banks, Real Estate Industry can get rich at the expense of all taxpayers. However, the most blame can be had for the people who voted for them.

@3 Adze … Rupert is about right. Having also spent many years O.S. I would agree Oz is a pretty good place to put yourself. The problems we now face are systemic and on a global scale.

“I ride after a deer and find myself chased by a hog.” Rumi

Don’t buy.

Learn something useful.

Find your ‘community’

Glenn

@5. THEO

“However, the most blame can be had for the people who voted for them.

The same people that took on loads of debt believing that one day inflation would come to the rescue and wash that debt away. Took on large debt(s) from the very FIRE sector, that Governments enabled them to do so, voted in by people who took the debt. Its’ almost a perfect looping system. Well not really, its now fraying at the edges breaking bit by bit. It will get worse for many people.

I can’t fathom how people don’t see what a preditory species we (humans) are. If someone approaches you with money in one hand, a smile one their face, and their other hand stretched out to shake your hand, you run away hard and fast and as far as possible. Not get all flattered because of it.

Today when I listening to Sydney radio station 2GB, a caller who identified himself as a real estate agent (but did not give his real name), revealed what’s going on with these rich Chinese investors who are pushing up property prices through the stratosphere. This real estate agent confirmed that many Chinese investors have walked into his real estate agent with anywhere between $1 million to $2 million in cash!!, carried in suitcases asking to buy properties right then and there.Obviously, the real estate agent smelled a rat, because usually people pay for a home by cheque or EFT, not with suitcases of cash. When the real estate agent asked these Chinese investors where they got the money, or what they did for a living, the Chinese investor would spin out some BS like they sell “Caravans”, and when the real estate agent asked them how they got the money through the customs, the investors said that they had no trouble getting past customs.

Whilst the real estate agent, said it was “happy days ” for him and his industry, he acknowledged that the next generation of Australian kids had no hope of ever buying their own home. Once again the so called Foreign Investment Review Board is asleep at the wheel.

@8 I don’t understand why estate agents aren’t legally obliged to report all of these goings on to the FIRB. For this estate agent to acknowledge the damage he his doing to the nation’s future welfare is one thing, but it is another thing entirely to be forced to report large suitcases full of cash because there is a real threat of being indicted for aiding and abetting illegal money laundering. It’s about time we stop hoping that estate agents will have consciences and start prosecuting some of them! Do they even have a legally binding ‘code of practice’? I doubt it.

@Rupert.

I can appreciate what you are saying, and I totally agree with you, the problem lies with the fact that the politicians have a vested interest in keeping the property bubble going, as it has been reported that our politicians own property portfolios to the tune of $300 million and counting. Plus there are the other vested property interests of other very powerful lobby groups like the construction companies, the real state industry, the state governments and their reliance on stamp duty revenue, and of course the most powerful lobby group of all, the banks or more accurately, the banksters.

Once again, all these noises about “dirty money” from China flooding Australia’s property market, is just lip service, the government and its toothless tiger the Foreign Investment Review board, will do nothing, because when big money gets flashed around, people tend to turn a blind eye. Also, the so called restriction on foreign owners buying established properties is a joke, the Sydney real estate agent interviewed on 2GB, said the Chinese investors walking in with suitcases containing millions of dollars cash to buy property, were buying anything, in clear defiance of the law. Remember, laws are only as good as they are enforced.

The bottom line is, is that this whole property bubble is motivated by greed, greed and more f@”$&@ greed, or like the old saying goes: “money talks and bullshit walks”.

The Ministry of Propaganda is churning out its usual mistruths about Chinese buyers flooding the market with suitcases of dirty money. The idea is to provide a scapegoat so we don’t blame the governments/banks/RE industry for years of pumping this bubble up. The reality is that foreign purchases are between 5-13% in total (includes Chinese) Most do not pay cash and they buy new properties (creates new housing)So lets target the real cause of over inflated real estate, the banking system and the politicians.

One has to go to China and see the average worker gets paid approx. $100 US a month and yet house prices there are even more ridiculously higher than here in Australia. Wake up voters. Your are actively taking part in Australia’s demise. The blame is on you not politicinas

The housing fiasco will doom this country as the high housing and commercial property costs have fed through to high prices and demands for increases in earnings. There is also a massive extraction of excess ‘rent’ everywhere – banks, food retail, government, etc. I could envisage property prices dropping over 50% – a return to long term values.

It has also indirectly diminished all other productive industries via the over investment in dead unproductive assets – houses. We have also under-invested in our infrastructure. Even where we do it is joke – look at the NBN.

All governments of the last 20 or so years are culpable and they have been active participants. Politicians have an interest in perpetuating the problem given that politicians have a collective $300m+ portfolio of investment properties. They are not satisfied with their gold plated pensions.

When all of this unwinds it will do it precipitously I would suspect. We need a new type of economy that is not based on a moronic notion that you can have infinite growth.

@ Nexus

The growth issue comes from being fractional reserve, fiat system. If the system was finite (eg precious metal supply) then prices across the system stabilize over time and fluctuate only due to demand (storm wipes out crop, prices rise).

Trouble with a finite system is the banksters don’t get their free interest payments from governments…. And governments need to control their spending otherwise the electorate run out of money and hence the economy dies….

So they collude to create fiat, fractional reserve lending…. Credit abounds and people buy what they want, governments spend and get re-elected….. But as people hit their credit limits, the economy slows, and then the journey towards 0% interest rates starts…..

There is a fixed base currency system in the future: It isn’t 100 years away, this current system is on it’s last legs: Where is the next round of growth to come from? Technology? Housing? Green power? All these industries have made their main discoveries…. The source of growth is no where to be seen.

With countries in debt over 300% of GDP, it’s clear that a major disaster is written in the stars: Only the public refuse to accept that it has to occur:

Of course, it does have to occur, it will occur, and it will quite possibly be the worst economic disaster ever, given the scale of globalisation that exists currently.

I don’t understand the comment about too difficult to fire. Firstly, governments must create a balance between businesses and protection of the people. Capitalism has a history of exploiting people based on the numbers. Secondly, its my understanding that there is a significant portion of Australians that are contractors (I last heard 40%) which means they can be sacked at the drop of a hat. I know there has been a surge in Labour Agency to skirt labour laws put in place for the protection of people.

But I think everyone agrees that the housing market has really hampered anyone’s ability to deal with the economy. But then, the moment the world turned to fiat currencies we were all doomed.

Maybe I’m wrong but I don’t think the Australian government will let the housing market collapse and with it its banks and large parts of the economy.

Reasons:

– a large drop in housing prices would leave the banks with tons of bad loans and in need of a government bailout

– the resulting deflation is not taxable by the government i.e. salary increase from 100 to 105, government gets more tax revenue on the 5% increase, however, prices drop from 100 to 95, no additional tax revenue even people can buy more with their salary, and less GST sales tax for the government

– if prices drop and deflation occurs, the GDP shrinks and Australia’s debt-to-GDP ratio deteriorates

– people will not accept salary or entitlement decreases (see Greece)

The only viable solution -> inflate it away, AUD will tumble, house prices and salaries regain international comparable levels and competitiveness is restored

I welcome any counter argument and different view.

@ Daniel

Sure, sounds nice, but the problem is one of mathematics. They CAN’T stop the crash. Otherwise, wouldn’t have these countries stopped their housing crash?

Japan

USA

UK

Ireland

Iceland

Greece

Spain

Portugal

France

yada, yada, yada. There comes a time when brute force CAN NOT reverse a debt laden market.

Inflation is a massively misunderstood phenomenon. Most people believe it’s simply caused by printing currency: To some extent this is true, but the REAL inflation comes from the public at large borrowing on mass to increase the currency supply:

Check out USA: Since 2007 they have QUADRUPLED their base currency supply (ie X4) but has the price of everything across the economy gone up by a factor of four? No of course not. Why? Because that money printed only ended up in the banks and the stock market: It hasn’t been pushed out to the public at large…. Hence they are battling DEFLATION, the cause of their ZIRP.

Only when the public borrow on mass will they see any meaningful inflation… Don’t believe me? Check Japan…. Low personal debt…and ongoing deflation, they are the example, they are nearly 20 years in front of the USA on this ZIRP idea: and it doesn’t work.

As for bailing the aussie banks out: There’s already been a $380 Billion (yes, billion or nearly $20k per man woman and child) approved and ready to go: Again, don’t believe me? Google it, it’s out there and been mentioned several times here.

So if that’s already pre-approved, what are they willing to give to the banks in total?

And ironically…do the banks care if the aussie government’s revenue falls? No, cause they will provide the loan for the deficit and get more interest!

See how this works? Bank makes loans it knows it probably wont get paid on…gets bailout money by government…then gives loan to government to get interest back….. It’s beautiful, money for NOTHING…The taxpayer on the hook the whole time…People and governments get what they think they want, plus a mighty big tax obligation….

And the banksters sail off in their new yachts… or planes…. or whatever the hell they feel they want.

@ Daniel

As Matty pointed out the banks will not be able to stop the slide in property values. They will however get the bailout from the taxpayer with the latest estimates that $500 billion will not even come close for a mild decline. The balance outstanding will be met in the form of Bail-Ins from depositors.(Result of G20 conference)

In the banking world failure is success.

It doesn’t matter if they repossess your home as your mortgage was only pixels in a computer for which they get a hard asset which can be sold to a hedge fund who then rent it back to you.

The end result will be a nation of Have Nots and Have Yachts in the Not So Lucky Country.

The RBA can’t do anything. If they lower interest rates, house prices will rocket again. The big thing is job creation. If people have jobs they can pay the mortgage and repossessions will be mitigated. The Chinese investor’s are a big problem as they are running wild in Oz.

I’d be very skeptical about this claim. Was it Australian currency, US dollars or Chinese currency? I would imagine that trying to exchange a million dollars in US or Chinese currency would ring alarm bells with the banks and I would think that there are laws in place that would require reporting of such large cash transactions. It is an obvious sign of money laundering.

Hockey has shown his true colours as a corrupt shill for the Australian Property Lobby.

http://www.theage.com.au/federal-politics/political-news/joe-hockey-raises-prospect-of-first-home-buyers-using-super-to-enter-property-market-20150306-13xe3l.html

@David C

The anonymous real estate agent who called in did not say, but I assume it was Aussie dollars. That said there are ways around money laundering/suspicious cash transaction laws. For example, say (for arguments sake), the maximum amount of cash you cam bring into Australia is $20,000 (I am just using this as an example). What these Chinese investors do, is that they make multiple plane trips to and from China, carrying less than legally permissible amount. Sure, these shady investors will spend tens of thousands of dollars in air fares, but this is loose change to multi millionaires.

If the economy problems in Australia are due to worker’s annual leave being too long and Australian workers too hard to fire, so why is American economy worse off then Australia. Politicians are so good at blaming the average worker for all their own wrong doing and incompotance. Why don’t they admit that all the economy problems are over greedy executives that run the multi-nationals and reserve bank and government. Why don’t they blame their own high pay and expense accounts and stealing and cheating and big corporations not paying tax. Seriously stop the abuse on average person. Its the system’s fault and our fault for putting up and being pushed around by leadership. wake up people.

why do comments need to be moderated?? is this not a free country??

@blondy73 – 1. We get considerable spam 2. Some Real Estate agents and property experts tend to be somewhat insecure and are gung ho in taking defamation action on the smallest of things (readers from 2007/08 will understand.)