A flawed report claiming Labor’s plan to quarantine negative gearing to new homes would result in rents surging by up to ten percent, and new home builds falling 7,200 annually, has embarrassingly backed fired for the government.

The BIS Shrapnel report, riddled with significant errors such as Australia’s GDP being only a paltry $190 million, made sensationalist front page news in most News Limited tabloids today. (‘Negative gearing: Adelaide renters to be hit hard by Labor plan, BIS Shrapnel study shows‘)

News Limited claimed, “Consulting firm BIS Shrapnel will on Thursday release modelling showing Labor’s proposed changes to negative gearing would hurt tenants, landlords and the economy.”

Later, It was declared the report was written late last year and had nothing to do with Labor’s policy. In fact, the modelling made many different policy assumptions such as investors could only deduct losses against their property portfolio, while Labor will allow losses to be deducted against other investment income.

It comes at a bad time for the government as it tries to argue that negative gearing doesn’t distort the market, yet claims serious adverse consequences if negative gearing is quarantined to new investments only.

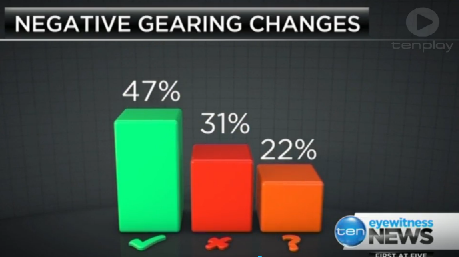

Early polling shows the majority of voters are in support of Labor’s negative gearing curbs.

» A Low-Cost way to Derail the Housing Debate – Inside Story, 3rd March 2016.

Would it be true to say if negative gearing goes, investors would try and move to a positive cash flow position? If so, does this mean them selling properties and buying up ghettos.?

@ Jaime, yes/no.

In reality what it does is it removes 1 reason to purchase investment properties, at an on going cost higher than it’s income.

The two remaining methods to make money off IP’s are then capital growth (cashflow neutral), or rent income above costs(cashflow positive).

It’s a crazy system, that barely ANYONE understands.

Marketing 101: Charge what the market will take.

Rents are already at what people are willing to pay. So, what does that mean???? It means, if the incentive to -ve gear is removed, then the purchase costs of IP’s WILL drop to a level where capital growth or cash flow positive IP’s exist.

It’s simple maths. But as usual, bankers, the RE industry and politicians try to cover up and complicate the issue. Make themselves appear the authority. Make you believe them as if they are gospel.

Sprouting that rent’s will rise is utter tosh. There may be a slight uptick in the short term, but on the whole, rents are already at a place where the market can absorb the stock on the market.

The Malcolm experiment has been an utter disaster for the Lib’s. Just as it was for Labor.

Oh, how ironic it will be if little Billy can steal the job out from under our richest ever PM on the topic of the economy.

I’m betting it will go nowhere, even if Labor get in. We are painted into a corner.

If negative gearing goes, Australians might invest more in Business, Manufacturing, Farming, Horticulture and our Children’s Future. Added bonus it will end the pyramid scheme called the Australian Housing market that is making Australia one of the most privately indebted countries in the world.

Looks like staff cuts at BIS re creating gross incompetence. Bit like the local economy really..

Remember Jamie, under Labor’s proposed plan, those who are already negative gearing could continue to do so. It only affects new investors.

Australia is screwed. Once the bubble collapses chaos will ensue and negative gearing will be the least of the problems.

@md .. Great, an amnesty, spare those already over leveraged and punish the rest .. FFS

Lil 100%… PONSI/ PYRAMID SCAM….australian housing … thanks to our fearless greedy leaders. .. Land of opportunity. .. what a joke we are..

When the American housing bubble burst home owners were able to hand the keys back to the bank and end the liability and limit the destruction to the American economy. That will not be the case in Australia where the liability of a home loan does not end with the property initially borrowed for. All other assets owned by the borrower and the assets of the guarantors/underwriter (parent’s assets?) will become the property of the financing bank. If the Australian housing market bursts suddenly the house of cards will fall, and then, the dominoes will topple. The middle class of Australia will be even more destroyed than in America. However will the higher wages paid in Australia somehow even things out and limit the destruction to the middle class?

The government will NEVER change the negative gearing rort because those who benefit the most from it live mainly in their electorates. Mr Turnbull’s Wentworth electorate claims twice the national average at $20,248.

The wealthiest 20% of whom no doubt support the Liberals receive 67% of the benefit. So don’t hold your breath waiting for a change under the current Kleptocracy.

In Vino.. nicely explained.

I would like to know the 22% who do not have an opinion about the subject. How on earth are these these people allowed to vote? Their opinionless view is dangerous in any election. That is why voting should not be mandatory. It is undemocratic and borders on totalitarianism. I do not want people voting when they do not have a clue on what and why.

@ Lil

Don’t fall for that old myth. It is only 11 states out of >50 that allow non-recourse loans.

It’s been spread as gospel by Aussie banks, politicians and the real estate industry….. When it’s available in less than 20% of the states in USA.

Of course, the reality is did the following countries have non-recourse lending?

UK

Iceland

Ireland

Greece

Spain

France

etc.. etc…

They all were effected by the housing credit markets.

The ‘higher’ wages we have will simply be absorbed by the dollar crashing as our for-ex becomes a vacuum as all the foreign and local flexible cash will simply chase better returns off-shore.

Yes Matt , the local currency has gone down by more than 40% in the past 4 years. For overseas investors this is great incentive. Even if they pay double, compared to 4 years ago, they are still paying the same price as in 2012. For the local residents in OZ this has become a total disaster. If you have some money, and want to leave, you’re wealth has been halved. For the 1% , if one has 10 million or 6, it does not matter. As for the common man who may have had a couple of hundred grand, 4 years ago, today that 200 is really 100k. This nations residents have been fleeced big time. And the divide is only getting bigger. Communism for the rich and capitalism for the poor. Like I’ve said before great country even better people but our leaders and banks have screwed us. We have become the Argentina of the 21 century.

@ Matt and @ 56

Thanks, that clears things up a lot for me.

Has News Corp published a correction, or are they legally bound to?

@ Theo

As the old saying goes “If voting could change anything, they would abolish it”

Think of politics and voting as Kabuki theatre for the uninformed. The big decisions that affect us the most like monetary policy, defence and trade are made behind closed doors without consultation and usually at meetings like Davos and the G20. The western political system is just a big club …… and we the people are not in it.

Anyone seen this? http://m.smh.com.au/business/the-neverending-money-laundering-review-20160306-gnbse0.html

@19

Thanks for that article Jake, that was an interesting read.

Sadly, however, the government will do nothing about this Chinese dirty money that is being laundered into Australian real estate, jacking up prices that the locals can no longer afford.

Like the old saying goes “money talks, b&#*%*%it walks”.

@56, you said “Yes Matt , the local currency has gone down by more than 40% in the past 4 years”

– This is no exactly correct. The Australian dollar has lost a lot of value against the US dollar, but so have a lot of currencies. However, for example, the highest the Australian dollar has been against the Japanese yen over the past 5 years was AU$1 = 105 yen, and that was only for about a month or 2. More consistently, it has been between 80 and 95 yen for most of the past 5 years (going as low as 74 yen 5 years ago and 76 yen 4 years ago), and currently it is worth 84 yen.

Right wing, I remember the Japanese investors , late eighties beginning nineties, they were buying deposit down , starting price 2 million up to 7 or 8 million , for waterfront harbour apartments . When the shtf they pulled out leaving the developers totally $#@%!d. I have watched this town for 40 years, good friends, and I have worked their mansions for nothing but bad health. That aside, today yen has nothing to do with yuan CCP influence and investment. Look around you it’s not hard to see what’s going on .

Forget what speculators are noting. Just look at the facts.

The mortgage bonds and the Credit Default swap rates are ramping up. The market is pricing in risk to Australian mortgages – those higher rates will flow into the mortgage market at some point.

Is this nothing to be concerned about? Am I missing something here?

http://www.smh.com.au/business/banking-and-finance/lenders-face-bubble-claims-market-ructions-in-funding-bids-20160308-gndfvj.html

These are the illiterate, incompetent, uneducated and hopeless people who are voted into power by an equally as bad electorate? Democracy has failed. Corruption endemic. Australia is doomed.

“Government is the entertainment arm of the military-industrial complex” Quote Frank Zappa

Surprise, surprise. The Bank NINJA (No income no job & assets.) loans are starting to fall over. The ANZ lent $800,000 to a person who had been on Centrelink for 8 years, with no employment. They of course deny all responsibility. These same corporations will have their hands out for Bail Out/In when it all goes wrong.

http://www.smh.com.au/business/banking-and-finance/anz-bank-sued-over-alleged-misconduct-20160305-gnbcgh.html

@26, this video presentation from Nick Hubble on Australia’s Secret Sub-prime Crisis is doing the rounds at the moment.

https://www.youtube.com/watch?v=ZMcf4PUyOzY

He is suggesting all the fraudulent LAFs will come to light once the market starts to correct. Everyone is happy when prices are going up.

It’s an all round s#$t storm. So far it’s in a tea cup.

The issue is, we’re fast approaching a minski moment. When 50% of new mortgages are interest only, it’s that f#$%^&g obvious it’s about to occur that every mortgage owner in Australia should be panicked.

Oh wait…is AFL and NRL about to kick off??? I’ll talk about this later ….

LMAO….. I can’t believe how long people have had to get prepared, yet I can count on one hand how many are….

We’re going to have the show of the century.

@ Pete 27

This video was made in 2013 so I can imagine the problem is far worse now after 3 years of exponential growth in real estate. The banks and brokers have been doing it for so long that now it is accepted practice. As you point out it will only cause a problem when prices deflate. To challenge the veracity of the LAF is difficult especially if the signatures are genuine. You may be charged with trying to defraud the bank rather than having your mortgage cancelled as mentioned in the presentation.

At my workplace we have been getting phone calls from someone saying they are from a big 4 bank and then asking if a certain person works here and they name someone who has never worked here. I have been brushing these off as just weird pointless nuisance calls. Sorry to do the conspiracy thing, but am wondering if someone is starting to check the documents?