An unprecedented 10,200 vacant residential properties are now available for rent in Perth, according to an ABC news report published today.

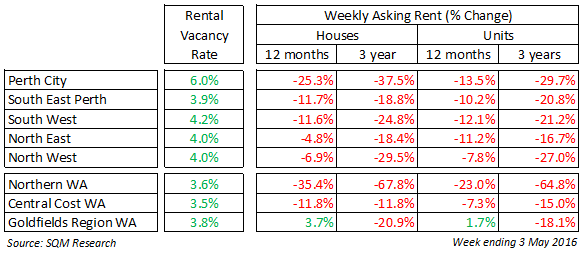

Perth City now has a distressing vacancy rate of 6 per cent, while the suburbs hover around an highly elevated 4 per cent, about three times the long term average.

REIWA president Hayden Groves remarks, “It really is quite startling.”

With every Australian aspiring to be a negatively geared multiple property landlord, and with a chronic shortage of renters, tenants are the big winners.

Groves told the ABC, “Tenants certainly have the rental market in their favour at the moment.”

Data from SQM affirm the challenge facing landlords as rents plunge across Perth and Western Australia. In the past twelve months, rents for houses in Perth and surrounding suburbs are down an average of 12 per cent. Units are holding up only marginally better at 11 per cent. Over three years, rents for houses have fallen 26 per cent and units 23 per cent. The data shows no signs of abating.

Regional centers exposed more heavily to the mining downturn have notched up even larger falls. Northern WA including the Pilbara region has seen rents fall for houses 35.4 per cent in the past twelve months.

Sale transactions down 40 percent, crash could be looming

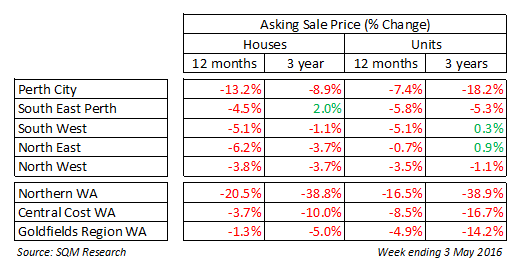

In the March 2016 quarter, Perth Real Estate agents observed a 40 per cent collapse in the number of property transactions. This has even the most bullish agents running scared, as a slowdown is normally the precursor to price falls.

While Northern WA is already a couple of years into a serious property crash, Perth has been experiencing only moderate, single digit falls for a number of years. But this is expected to soon break out to double digit falls, officially designating a crash.

» Perth property correction to continue into 2016 – Who crashed the economy?, 4th January 2016.

A Sydney Upper North Shore four bedroom house with a pool and garden on a 1200sqm block is approximately $2m. With an 80% mortgage you’re looking at $8,500 a month. The same house to rent would be $6,000 a month. Since when was renting supposed to be CHEAPER than buying?

With all this talk of Negative Gearing, haven’t they missed the point? It’s not that NG is fair/unfair or right/wrong, it’s that if houses weren’t so out of whack with what people can realistically afford – Negative Gearing would be REDUNDANT!

Aaaaaarrrrrrggggghhhhhhhhhh!!!!!!!!!!!

@Rupert and those numbers are with interest rates at historical lows – imagine when rates normalise!!!

Perth is in serious trouble. A lot of Northern WA is invested in Perth as well as the South west and are inextricably linked.

There is also a huge overhang in commercial and City office space with more becoming vacant everyday and we are still finishing projects.

We are still slapping up apartments and houses with the belief (delusion) that everybody including the Chinese want to live here.

Within the year Wheatstone will be in its death throes of buildng and the last major construction project, construction in Perth will have stopped too.

The exodus will be quite the sight and we will be electing a new government and blaming the lack of GST for our fate.

Of course we had to get a solid spruik in the day before.

http://www.perthnow.com.au/realestate/news/perth-wa/perth-home-buyers-dragging-feet-but-real-estate-industry-warns-affordable-houses-could-dry-up/news-story/0acc4c363fec608beff2f4ebe6ecfe8e

But all is not rosy……

http://www.perthnow.com.au/news/western-australia/perth-private-school-trinity-college-calls-in-debt-collectors-over-unpaid-fees/news-story/1f87e1c65b2ed5c3170659e3fd2f3407

Can’t wait bring it on I say , it’s about time , love a bargain . It’s ridiculous , we earn decent money between us , husband being the main earner , 220,000 between us and I’m still not on the property ladder . I don’t want over comit I still have a life to live other than a mortgage so I wouldn’t mind a bargain . People need be realistic with their prices anyway , and the need look at their decor , I see some around that I would not put my dog in and yet they still asking a ridiculous amount for a in modernised property . People need step up and get with the times if they want people to fall over their property for stupid money .

The undeniable fact of the economy is it cycles from boom into recession over and over again. Fact! The other fact is there are only two things you can do with money: Invest it or circulate it. And you need both. Over investment means money is taken out of circulation and in this case replaced by credit. Banks hoard the money and pay profits to the few idiots running them who don’t really circulate money. Money stops circulating and consumption slows to a grinding halt, jobs are lost, people tighten their purses causing less money to circulate and eventually we get deflation. The cycle continues and we get a good old recession. During a recession house prices go south. Fact.

The other fact or very real observation is that people plan the future based upon what they believe to be true today. But the thing that catches everyone by surprise is always going to be unpredictable and changes the game. People born after 1995 would never have experienced a recession, they don’t believe in it, they have no clue what it’s about but they will be guaranteed two in their lifetime. The economic cycle is tighter than the birth-death cycle of a human.

Bathing in 5 minutes grandeur today often turns to crap purely due to time and the inability to plan contingency and believe one’s own BS. Our grandparents experienced two world wars in their lifetime and that was 75 years ago, less than one human lifetime. Think the US won’t fight China over China’s plan to share power? Think again, because no one saw Germany coming and the US didn’t see Pearl Harbour coming.

So as much as we speculate over what will cause the housing bubble to go pop, chances are no one will see the cause coming.

I live for chaos 😉

Michael Hudson:

https://www.youtube.com/watch?v=pvlCot8B47M

That’s what modern “investing” in the stock market has become. It’s not about investing it’s about speculating.

There are many more quotable sentences in that interview. It’s well worth the time.

@Stomper thats what I have been thinking for a while. What will all these people do when rates have to go to 7-9% they will be absolutely stuffed.

@ Stomper and LBS

Yes, what most muppets don’t understand is the RBA can push rates lower, until our economy hit’s a tipping point.

Unlike USA (worlds reserve currency, not changing any time soon, Chinas market is not open enough for the money markets), UK (massive tax haven), SG (financial centre), Middle East (massive oil exporters) we are an island dependant on imports. We can’t push rates lower, and lower and lower without consequence.

As rates drop, our dollar drops, as our dollar drops, imports rise, as imports rise confidence drops, spending slows, more interest rate drops..and so on, until we reach no growth……

If our rates are low, with no growth with expensive imports do you think that lowering rates is going to help anymore? No, so our banks will need to get more offshore funding….

Oh hang on, we already owe the USA fed billions upon billion, written in USA dollars….Will they lend cheaply to little old stagnant island Australia? Hell no.

so then we have the interesting situation, just like Iceland, Ireland etc. where the central bank rate is low, but the retail rates are high…. didn’t it hit 30% in Ireland? Iceland?

Ha! An ‘average’ $300k loan at 30% is…. $90k p.a. in interest payments alone! That totally destroys 98% of all family balance sheets.

So this is still a few years away, but the rising unemployment is here, the slowing RE market is definitely here. In this sort of economy the ruling government ‘usually’ retains power, but the conservatives have messed even that right up.

The one thing you can rely on is instability is the new norm. You must be flexible, proactive. If you have a property that hasn’t done anything in 10 years (large parts of new property developments especially and the apartment market) you must dump it if you have debt against it. It’s financial suicide to think that things are going to get better from here.

The last 20 years have been a once in a life time event, many made some good money, but where is it all? They’ve cocked up. Blown it on overpriced PPOR’s, holiday homes, holidays, cars, boats, bikes, crap at home…..

Oh well, I’m good.

@LBS rates will not be going up to 7-9% anytime soon I can assure you.

@10. GlennStevens, and @8. LBS,

Too true GlennStevens, they only need to increment very small amounts and the landscape will look like the moon’s surface, cratered that is.

Many people (not all though) are struggling at current interest rates. What would happen if over a period of 18 months, interest rates went to, say, 3.75%? Funny thing is, I’m posting such a question to a blog in which people here already know the answer.

I reckon, we will see at least one more drop in interest rates before any increase, and even that will be some time off. I think that also means we’ll be in a dump for some time.

We’re in a system where the people on top, and those below, are as screwed up as each other. Its’ always been that way.