Negative gearing was intended to create more affordable housing, but as house prices surge, causing rental yields to tumble, more evidence is mounting to the contrary.

Research by UNSW’s City Futures Research Centre has found a higher concentration of vacant homes in the inner cities. When it investigated further, it found a strong correlation between empty homes and poor rental yields.

Inner city dwellings typically attract higher prices but return lower yields due to a ceiling on incomes. They have, in the past, exhibited better capital growth prospects. Apartments with a rental yield of approximately two percent were 2.5 times more likely to be intentionally left empty compared with apartments yielding 6 per cent.

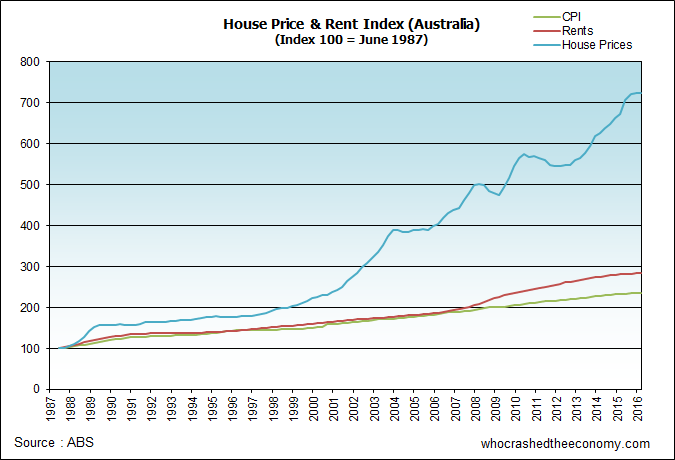

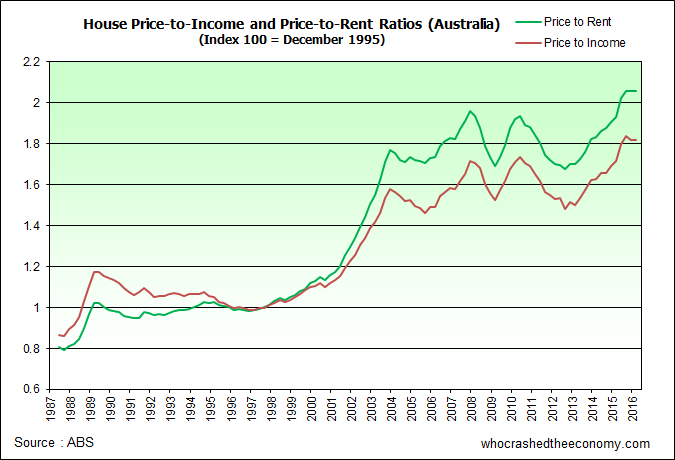

Since 1997, price-to-income and price-to-rent ratios have close to doubled. As home prices continued to outpace rental growth, rental yields fell to the point where for many investors it is no longer worth offering the home for rent. There is less hassle with tenants, limited maintenance requests and no wear and tear on the property. Rather, the focus is now firmly on capital growth and as a result, some 90,000 properties sit idle in Sydney, a trend that is set to continue.

In Melbourne, 83,000 properties, representing 4.8 per cent of the market is considered empty based on water meter readings.

UNSW’s Professor Bill Randolph and Dr Laurence Troy state, “Leaving housing empty is both profitable and subsidised by government,”

“This is taxation lunacy and a national scandal.”

Tax distortions such as negative gearing and the fifty per cent capital gains discount is believed to be behind this ill-considered trend. Leaving property empty allows investors greater negative gearing offsets while capital gains is treated more favorably with a fifty per cent tax discount.

High housing costs are making Australia noncompetitive in global markets and channeling vital capital from what was productive sectors of the Australian economy into non-productive housing. If we are fair dinkum about jobs and growth, structural changes are urgently needed around taxation policy driving these distortions. Pain will be felt in the short term, but the long term benefits will exceedingly outweigh the negatives should politicians have the vision to see past one term.

Flawed housing policy has resulted in Australia having some of the highest levels of household debt in the world, relative to both GDP and household disposable incomes. Such, precarious and unsustainable levels greatly exposes Australia to external economic shocks such as the Brexit. Australian banks rely heavily on foreign wholesale debt markets to fund many residential property loans and a global liquidity crisis could cause quite a road bump.

Tax distortions are also establishing the scene for one day, when house prices are unable to achieve anymore growth and the yields simply won’t stack up.

» Negative gearing has created empty houses and artificial scarcity – UNSW Newsroom, 29th March 2016.

» Thousands of empty homes adding to Sydney’s housing crisis, experts say – Sydney Morning Herald, 28th Match 2016.

An interesting thought is what happens when real estate values are collapsing and capital gains become capital losses. Will current investors subsidise renters out of their own pockets or keep empty properties in the desperate hope they will reinflate in value in the distant future?

Surprise! China wants its money back.

http://www.zerohedge.com/news/2016-06-28/crackdown-begins-chinese-bank-sues-seize-vancouver-real-estate-assets

Yeilds are falling and the investors are dumping their empty apartments.

“But there were losers. In inner city-Melbourne, 19 per cent of all apartment sales were below the previous purchase, which is the highest level of loss recorded by CoreLogic since 2005.

But in inner city Brisbane, 11 per cent of sales were at a loss and the figures were higher in inner city Canberra (21 per cent), Perth (24 per cent) and Darwin (26 per cent).

In regional Australia, which includes many coastal areas and mining towns, 11 per cent of homes, and 19 per cent of apartments, were sold for less than the seller had paid.”

http://www.afr.com/real-estate/loss-makers-where-homes-and-apartments-lose-money-for-property-owners-20160628-gpu591#ixzz4CvQrsFFA

Love the small caveat on CoreLogic’s numbers “… (The CoreLogic numbers do not allow for the costs of purchase, finance and sale and under-estimate the level of owners suffering a loss. Nor do they show the magnifying effects of gearing on both profit and loss.) … “

I have hope yet that we may see bipartisan support for changes to negative gearing and capital gains to fix this mess.

“The Parliamentary Budget Office is not allowed to provide identical costings to opposing political parties and emphasises that its costings –provided confidentially to parties asking for them – only apply to the particular detailed specifications included in the brief.

However, the Coalition asked the PBO to model a negative gearing and capital gains policy similar in all apparent aspects to Labor’s policy, except that it started a year later, and included the removal of the temporary budget repair levy in 2017.”

http://www.afr.com/news/politics/election/election-2016-questions-over-reliability-of-labors-tax-base-20160628-gptvi5#ixzz4CvQv896d

In the upside down world of Keynesian eCONomics and digital Ex nihilo money this is not necessarily a problem.

All that is required is to forgive the debt immediately, then bulldoze the premises using cash out of thin air. Then immediatly rebuild the units using new loans to the same people as before. Think of all the employment, taxes and superannuation that could be created that way!!!!

This is the modern equivalent of Keynes filling bottles of cash then burying them in disused mines then getting people to dig them up, to generate employment.

Reality and Keynesianism cannot coexist in the same universe, and unfortunately we now have the latter.

Now back to work slave.

The fat cats don’t care about us the mice. We have all been done over big time. Now they are banking on the CCP invasion. I just have a feeling they are not stupid as we were.