Generation Y, Kev wants you on board.

During Kevin Rudd’s comeback leadership victory speech he had a message for our young generation:

Before I conclude, let me say a word or two to young Australians.

It’s clear that many of you, in fact too many of you have looked at our political system and the parliament in recent years and not liked or respected much of what you seen.

In fact as I rock around the place talking to my own kids, they see it as a huge national turn-off.

Well, I understand why you’ve switched off; It’s hardly a surprise.

But I want to ask you to please come back and listen afresh.

It is really important that we get you engaged, in any way we can.

We need you, we need your energy, we need your ideas, we need your enthusiasm, and we need you to support us in the great challenges that lie ahead for the country.

And with your energy, we can start cooking with gas.

The challenges are great, but if we are positive and come together as a nation we can overcome each and every one of them.

After 22 years of consecutive growth fuelled by unsustainable fiscal “prop-ups” and distortions, the current generation is faced with an unattainable housing dream and an uncertain future. To put those 22 years in perceptive, Professor Ross Garnaut says “Between the recession of 1990-91 and now, mid-2013, Australians have enjoyed the longest period of economic expansion unbroken by recession of any developed country ever.”

Distortions from our home grown housing bubble and the record levels of household debt currently present in Australia has spilled over into the broader economy. When combined with the end of the mining boom, it is causing youth unemployment to sky-rocket. For the first time in decades, this generation is starting to struggle to get a job, let alone provide their own shelter – something even Generation X struggles with today. And with both sides of politics continuing to pursue any avenue possible to keep our miracle economy from collapse and expanding for yet another consecutive year, it’s no surprise our younger generation is disillusioned in the system.

Without government intervention, there is little doubt the Australian housing market would have collapsed in 2008 in parallel with other over extended housing markets around the globe. At the time, The Courier Mail reported “STRESSED home owners and investors are flooding the market with thousands of houses but agents say they can’t find any serious buyers for some properties.” The number of homes listed for sale was surging. Prices were falling.

First Home Owners’ Boost

This trend remarkably reversed when a month after Lehman Brothers filed for bankruptcy and among the backdrop of a global “systemic meltdown” caused by irresponsible lending and excessive household debt levels, Prime Minister Kevin Rudd announced the First Home Owner Boost (FHOB). For first home buyers purchasing an existing dwelling, the FHOB was a $7,000 “boost” to the existing $7,000 first home buyers grant first introduced on the 1st July 2000 to offset the GST. To help stimulate new residential building, first time buyers building a new home would get an extra $14,000 boost.

The rumour mill contains unverified reports suggesting the 2008 stimulus package prepared by Treasury to combat the GFC didn’t include a First Home Owners’ Boost. Rather, Treasury had proposed more prudent saving through the First Home Saver Account (FHSA). If the reports are right, it was our Politicians that dreamed up and implemented this gem called the ‘Boost’.

These rumours do bode well with Treasury Executive Minutes stating “The FHOB was announced 14 days after the FHSAs became available as part of the Government’s first stimulus package designed to counter the effects of the global financial crisis. This short-term stimulus was designed to encourage people who had already been saving for a home to bring forward their purchase and prevent the collapse of the housing market. Contrary to this measure, the FHSA is designed to encourage saving over the medium to long term.”

And to bring forward purchases, it did. By October 2009, 190 thousand first home buyers buckled under the temptation of free money, and took up the offer. A small portion went through the agony of losing their homes in the years that pursued. The lure of free money and no appreciation for the size and serviceability of today’s mortgage was far too great.

Open the Foreign Floodgates!

At the time of the GFC, Australian household’s carried more household debt as a percentage of household disposable income than their American household counterparts. To cover all bases and ensure there wasn’t a devastating collapse of the housing market like in the United States, the government also “streamlined” the administrative requirements for the Foreign Investment Review Board (FIRB). As part of these changes, temporary residents (e.g. Chinese) could purchase Real Estate in Australia without having to report or gain approval from the FIRB in a bid to help support the market. It was sold to the Australian public as allowing the FIRB to concentrate on larger issues in the ‘National Interest’.

By March 2010, the media was flooded with articles (Australia for Sale) on Australian’s being outbid by an army of Chinese residents, effectively pricing Australian’s out of their own housing market. But the ‘streamlining of administrative requirements’ actually meant no records were kept, or more specifically it would seem that these foreign temporary residents no longer needed to lodge applications with the FIRB. There was public outcry and no real data to support just how big or small this issue actually was.

The outcry had grown so intense, that on the 24th April 2010 the government buckled and a tightening of foreign investment rules relating to residential property was announced, complete with a package of new civil penalties, compliance, monitoring and enforcement measures. The government even went to lengths to set up a 1800 hot-line for residents to report suspicious property buyers and help calm an outraged public.

The press release by the former Assistant Treasurer, Nick Sherry said “The Rudd Government is acting to make sure that investment in Australian real estate by temporary residents and foreign non-residents, is within the law, meets community expectations and doesn’t place pressure on housing availability for Australians.”

Kev’s Property Portfolio

Five years on, the unsustainable stimulus measures implemented in 2008 is wearing thin. Credit growth for mortgages is at near 37 year lows despite interest rates sitting at 53 year lows. Gaping cracks are now starting to appear in the China miracle and the “mining boom is over” according to Rudd. Many metrics now have the economy in a worst position than during the depths of the GFC.

And Rudd is now back as Prime Minister.

For the shafted generation, already disillusioned by Australian politics, it begs the question, what surprise now? What can be pulled out of the hat?

Their concerns are not unwarranted when on Tuesday, News Limited publishes a story titled, “Rudd’s luxury property portfolio miles from Struggle Street”

With a $10 million dollar portfolio of homes in Canberra, Brisbane and on the Sunshine Coast, can Rudd really be trusted to make decisions in the best interests of Australia?

Or more precisely, how soon before the next housing stimulus package will be announced? How big can this bubble get?

Howard & Costello

But, Rudd can’t be given the credit for creating or nurturing Australia’s housing boom, only for pulling out every stop possible to save it. Rudd had in fact inherited a housing bubble “too big to fail”, when Labour rose to power in November 2007.

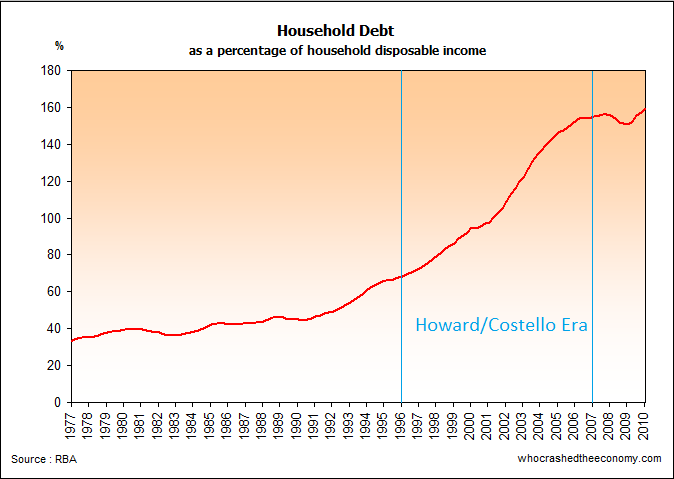

The Liberal’s Howard and Costello had more to do with creating the housing bubble.

Only last weekend, Former Prime Minister John Howard was rallying Liberal constituents in a Coalition rally at the Melbourne showgrounds. He told loyal supporters, he had left the economy to Labour in 2007 with no net debt.

But the same can’t be said for household balance sheets.

While Howard and Costello had the reins of the Australian economy, household’s packed on significant amounts of household debt. Some of the drivers was poor policy such as the 50 per cent capital gains discounts which when used in conjunction with negative gearing, really started to fuel speculation in housing markets. Other poor policy could include change of legislation to enable self managed super funds to leverage into the housing bubble.

www.nicholsoncartoons.com.au – 25th Sep 2002

But Australia wasn’t the only country in the world to experience a significant housing bubble caused by an abundance of cheap credit, hence some of the blame should sit with Howard and Costello’s failure to act on the household debt problem. And have a feel for our regulators, trying to instil sanity and protect the public from irrational government decisions. ASIC is currently overwhelmed with rouge “super” spruikers encouraging SMSF to speculate in leveraged property. Last month, one insider told ABC’s The Business, it’s a “ticking timebomb.”

The bigger the bubble gets, the harder it becomes to pilot a soft landing. By the time Rudd inherited the housing bubble, it was too big to fail. And when Lehman Brother’s collapsed, Rudd pretended everything was a-okay domestically – “As Prime Minister I will not sit idly by and watch Australian households suffer the worst effects of a global crisis we did not create.”

It’s no wonder younger generations have given up on politics. Can you really blame them?

» Rudd’s luxury property portfolio miles from Struggle Street – News Limited, 2nd July 2013.

» The stampede into property by self managed super funds is a risky business – The ABC, 17th June 2013.

I’d like to see the Murdoch press do a piece about Abbott’s property portfolio! Yeah, and pigs might fly. Rudd’s only been in 5 minutes and already the media have it in for him. No wonder the youth aren’t interested. For this election to be truly fair, the media should just frack off! (pardon the pun)

Ha ha! Exposed!

Maybe get a few more kids stapling insulation foil into power circuits without RCD protection. That program was a farce. 2 weeks after it was announced i saw family station wagons sign-written “Insulate now, the govornment pays!” Rudd let the cowboys loose and he deserves a caning.

Oh thats right, he apologised. Thats nice kevin.

The only Gen Y i know that want krudd back in are the ones that are stuck in units and want another sugar hit stimulus on property, so they’re not stuck retiring in it.

Young people in this country have been sold out by government policy, as aptly described above. Fight club style, “..and we’re very, very pissed off.”

Its not just Australian youth that have been sold a dud.Look at Europe. 26 million out of work….most under 25

The problem is not so much Kevin-Julia-Kevin but the whole Labor party itself ,they made the opposition look very good.

Admin great piece of your best I have to say. I think if you look at all of the politicians you will find that they all have a vested interest. Including the RBA and its board. They need to let this thing pop. Its going to at some point. I dont feel sorry for the Gen Y nor X. They need to find out what saving is all about not spending and debt. They also need to experience a recession and wake up to the fact you need to save for a rainy day. I am 41 and have done this and have no debt at all expect my investment property which I about to paid off.

Well don’t worry about the generation X,Y,Z they’ll be allright just fine, they have their whole life in front of them to learn and grow hopefully wiser. But the Baby Boomers on the other hand now that generation is a lost cause,wait till the government really runs out of cash,what then?…I know! Mr.Government will use that Billions of dollars sitting in the Superanuation fund and cut off pension benefits I mean who cares those retirees are old anyway they don’t eat much.

The only reason Gen Y and X spend on going out and an apple iPad every five years is because they can’t afford property. It has taken me 15 years to achieve a 20% deposit. What a joke. Seriously, saving every month for 15 years solidly and renting to save up for a stupid housing deposit. It has actually caused myself and my partner a lot of stress and we have sacrificed lots to have the chance of buying a mediocre overvalued asset. If most young people in this country is in a similar situation as me, then the property market is guaranteed to go bust. Zero new entrants into the ponzi……BANG

@John – As you can see I am “very very pi$$ed off” !

@ FHB Dreamer..

You can now get behind me, join the back of the que.

of the financially repressed in this country.

Ahead of you and I, are hundreds of investors, who will out bid you twice over..

On property you’ll only just consider you can afford.

All because your countries central bank, and its political institutions use their power combined..

To continue lowering rates and incetivise debt issuers and borrowers, over the value of the workers time and toil.

This will surely crush your dreams of financial freedom and prosperity. It is, in fact, stealing your retirement years as we type.

This is not superlative. It is the misery that continues to drive the Australian housing market. No one in power cares about our interests. Why the system needs to fail..

Le them push the bubble higher, I’m betting on it, the bigger the bubble, the bigger the crash. I feel sorry for those who are buying now, but nobody forced these people into debt. After the final crash I’m going to buy like crazy on the cheap. People must learn to study basic economic principles, starting with #1 governments do nothing but distort the economy, they don’t make their own money, they only steal from people who produce real wealth by calling it “tax”. I don’t think Gen X, Y, Z, or whatever generation you call them will ever learn the truth, that is why it is important to learn about the greatest teacher of them all, called HISTORY.

So Kevin Rudd did not allow the housing market to correct naturally in 2008 and instead spent tax payer money on propping it up? Then he relaxed foreign ownership laws and priced Australian residents out of their own housing market, he kept no records so did not care what was going on. I am afraid I have lost all faith in Australian politics as have most of my friends. The future looks grim except for the baby boomers who have it so great, they bought houses cheap, benefited from a massive boom with no mortgage, got tax breaks on superannuation and also get a pension. It’s all a disgrace. I challenge Kevin to get rid of Negative gearing if he is serious about fairness.

^ Until there is a dedicated Affordable Housing Party to vote for the housing bubble is here to stay, I’m afraid.

Anyone who has bought in the last ten years would probably have a high debt load.

Those buying now, whether it be investors who are increasing their debt to equity ratios, or first home buyers, are going to drive housing debt through the roof.

All this at a time where hours worked are decreasing noticeably and unemployment is going to increase as the boom turns to bust.

As long as the “Serfs” can still borrow money to service their debt(s)(while eating plain white bread every night,and be stuck in the traffic everyday for work) then real estate price will keep rising…So sad..pathetic

The “Australian Dream” is now just a myth. If the standard of rental accommodation and transport wasn’t so bad in Australian, most people aged 20-40 would rent outside cities and commute. Unaffordable housing is a serious social problem in any economy but Govt don’t give a rats ass.

we could always start a revolution. bloody and violent but lots of fats cats get mauled, but could buy 20 or even 30 -years of prosperity. just sayin…. otherwise things stay as they are. im gana skip country for a bit. aussie is now a joke along with its pathetic loser leaders. this place aint going anywhere unless by force!

Just like the Egyptians did in Cairo Gen X & Y Australians need to fight for reform and change otherwise things will never change.

I am sure if 50,000+ protestors fronted up in Canberra to abolish NG and other reform then things would change.

Remember, Australia never earned it’s democracy. We simply went along with some British habits.

Comment 15 and 16 your in the right track there,you’ve been paying attention in your history lessons at high school.If you want change for the better conformity is not the answer. Wake Up Australia

@ FHB Dreamer.

I feel you. We have been saving 9 years and we are at a 14% deposit haha.

We are so stressed out trying to scrimp and save every day.

We are headed into our 30’s and don’t have a secure home for our kids.

The australian government really screwed an entire generation with the FHG for those who couldn’t afford it at the time. Now we are left with prices twice as high ad they should be with wage growth miles below prices.

And now we have to compete with internationals bidding at auction. We wife cried last time when we thought we found the perfect home. An Asian investor out bid us and they knocked the house down and left it empty for a year now. She cried so hard.

How do I tell my kids and my wife sorry it doesn’t t matter how hard you work. How much you save. Or what you do. Politicians and those who already own land have you by the balls for your entire life and we are nothing but slaves.

We are actually considering moving to America. My brother moved over there and he says its great. Bout a house outright. Shops are open 24/7. Plenty of jobs for skilled workers. Cable and fibre everywhere. And everyone in his community is super friendly and houses arnt run down negatively geared investment property shacks they actually have families inside who upgrade the place.

@AussieNight

I feel for you mate, and agree leaving for the now is the best thing to do.

I’m a baby boomer and I’m okay but I don’t think the present situation is fair at all. Like the correspondents here my 3 kids and their families can’t afford to buy homes.

Some $13 billion is Negative Geared each year. How much is this costing the Government Revenue? I would guess more than $5 billion. Negative gearing is morally wrong!

Here is another question: how can we explain our low inflation rate over the last 10 years when the price of housing over the same period was soaring? Maybe a little bit of statistical fiddling? Like remove the price of housing from the basket of items that is measured?

I agree with Ginny, I too think that if 50,000+ protestors fronted up in Canberra to abolish NG and other reforms (like 50% discount on capital gains) then things would change. We need to get political!!

Mr Rudd is in no position to appeal to the youth of Australia for support considering his actions went opposite to their general well being. First of all he did nothing to introduce a fairer tax system where a land tax is slowly introduced of which the main home is exempt while simultaneously lowering direct taxation of wages and salaries and eventually getting rid of the GST. This will give incentive to fully utilize available land and not be held onto for years and turning land prices into a monopoly of which a minority group control. Secondly he even allowed land and house prices and rents to go beyond the ridiculous levels they were, by his home grants to anyone who wanted it. These are not the actions of a ‘caring PM’, only one who serves the political interests of those that payed for his political campaigns (Banks,real estate industry,home investors). Mr Rudd’s appeal is also nothing but a false facade which hid his political gambling and waste of tax payers money. Mr Rudd’s grand hypocrisy is what is affecting our youth today and they rightfully feel betrayed. Mr Rudd also sees a dwindling voter base while all parties are seeing their support diminishing as people are rightfully so disillusioned and fed up with politicians using parliament house as their own private playpen to establish and promote their personal interests and agendas. Mr Rudd is a financially dangerous man to allow free reign of our taxes again. Judging from his property portfolio, he definitely came out a winner from his spending taxpayers money propping up an over inflated property market. DONT BUY NOW!!

It’s more than just those grants and the foreigners crowding us out of the market. It’s Bonernomics. I wrote an excellent peer reviewed article on it here http://homdom.blogspot.com.au/2013/07/bonernomics.html

Bonernomics might be in its final stage. Will it reemerge for its ashes or will we seek control of our own destiny?

@ Nathan

I read your writing and some of them are “nicely” put through. I do not have the luxury to check the validity of the posted figures. Assuming they are not materially mis-stated, I would comment few things:

1) Variable GST.

Why don’t just implement Value-Added-Tax on Financial Services sector for transaction that they carry, for example, purchase of foreign exchange rate, investing activities etc.

I think this will be “easier” to achieve then deciding the variable GST rates for different sectors.

2) End Negative Gearing and your comment.

“Bad or good” is relative. Looking simply from resource allocation perspective, NG is not sustainable for the system when you have more people (informed or un-informed)in the pipe doing the same things.

Although, I concur that there will be repercussion. There is no short-fixed.

3) Houses Aren’t Special Assets. Add them to Means Tests.

How are you going to do the Means Tests? Who will be the “evaluator”? Again, quantification is difficult and relative.

As an exchange, I would propose instead:

1) to come up with plan(s) to measure and/or to increase productivity. Do more with less. This portrays a society that is embedded in growth. We are all in (or heading to) a vibrant knowledge economy whether one like it or not.

Continuous improvement (Japanese called it “Kaizen”) becomes daily culture.

2) encourage creative destruction and experimentation from business to university. People that never fail, never try new things. Encourage start-up.

3) selective intake of newcomers/migrants that is profiled based on their capabilities or growth-potential in the near future NOT wealth (5Mio AUD?). In an extreme case, genetic profiling which I think will happen in certain place …. soon ….

Money is artificial created by Central Bank, vapour if not utilized well and does not signify innate capabilities. There are countless stories of “fall from grace” individual and business.

Great videos! Good luck!

Being 35 now and only having worked two years after working then doing two degrees I feel like shit everyday I go to work. I actually am a first generation Australian and am from a single income mining family (my father migrated and was mining when all the smart englishmen got the hell out and started to invest in the ponzi’s in the city). I now see the uneducated (and educated) miners now making a mint, and ones that are my age cashing in on the housing pyramid scheme and being bailed out at all costs. I am prudent, educated, assetless and watching a government completely ignore us. I think I have simply been punished by trying to “jump classes” and get educated. I should have either been born the son of a home owning australian, or kept my migrant fathers legacy and stuck with the pick and shovel.

Between the recession of 1990-91 and now, mid-2013, Australians have enjoyed the longest period of economic expansion unbroken by recession of any developed country ever.” More spruiking here and little substances. He fails to take into account not only Australia’s population increase by also the creative accounting that manages to create the illusion of the Australian “wonder” economy. Australian per capita grow has been extremely low. Without iron ore and coal exports to China there is no “wonder” economy here

Fred, the Professor Ross Garnaut quote was from his lecture “Ending the great Australian complacency of the early twenty first century.” Here, he warns poor policy created a housing and consumption bubble, later propped up by the China Resources bubble. The quote about longest period of economic expansion is a dire warning not to be complacent of our miracle or “wonder” economy: Garnaut takes us behind the smoke and mirrors

There’s actually a really good article written by a Cairns local about what the difference is in Cairns between renting and owning. Very interesting article and the results were nothing short of shocking.

http://cairnslife.wordpress.com/2013/07/28/to-rent-or-buy-in-cairns/

He’s actually of a very similar frame of mind to the guys that write on this site. Thought you’d like it. 🙂