News Limited is generally considered to have a pro housing slant, but today it has printed a series of articles suggesting housing affordability is the top issue facing voters in this year’s election.

“HOUSING affordability is a burning issue for Australian voters – more important than border security, broadband and even education” reports Jacson Gothe-Snape.

The claim is backed-up by research conducted by Auspoll showing 84 per cent of Australians believe housing affordability is more important than education (82%), border security (78%) and ‘fast, affordable broadband’ (68%). It is unclear what the sample size and methodology of the Auspoll survey is.

Two weeks ago Who Crashed The Economy reported on the poor policy both the Howard and Rudd governments have implemented over a decade to create and then keep our housing bubble from collapse. (‘PM appeals in vain to the shafted generation’).

Comments to the article suggest those effected need to get more political and have their voice heard. Even Baby Boomer Khol said “We need to get political!!”

David Stolper, Senior Research Partner at Auspoll said “People are angry and frustrated by the lack of affordable housing but surprisingly this anger has yet to be directed at our political leaders, This disconnect is puzzling given the options for the Federal Government to improve the situation by coordinating land supply and incentivising the development of new homes”.

The trouble is when you talk to any politician about housing affordability, they want to fix the problem with a bigger grant. (Is this New’s Limited’s motive, knowing Rudd is back in town?)

The deeper issue is a housing bubble and banking system too big to fail. Implementing any affordable housing policy that doesn’t further distort an already over extended market could cause our economy to nose dive in to a significant recession.

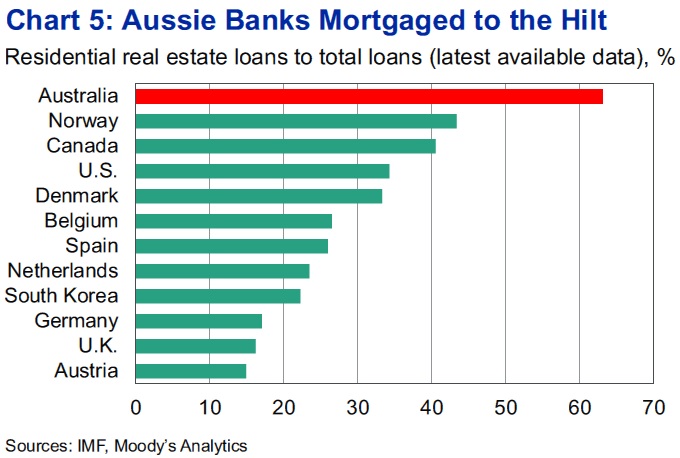

Only today, ratings agency Moody’s has warned our big four banks have the highest exposure to residential mortgages than any peers in other developed countries it has studied, making our banking system vulnerable to a US style collapse if a significant house price correction were to occur.

Tony Hughes of Moody’s Analytics told the Australian Financial Review today, “Irrespective of the complacency of local analysts, who sound a lot like many US housing cheerleaders circa 2006, this exposure represents a major concentration risk for banks and the Aussie economy. Houses appear to be overvalued. One merely hopes that the looming correction is a smooth one.”

“The high degree of exposure to the domestic mortgage market raises many concerns. Recent experience has shown that house prices can fall significantly and trigger serious banking meltdowns.”

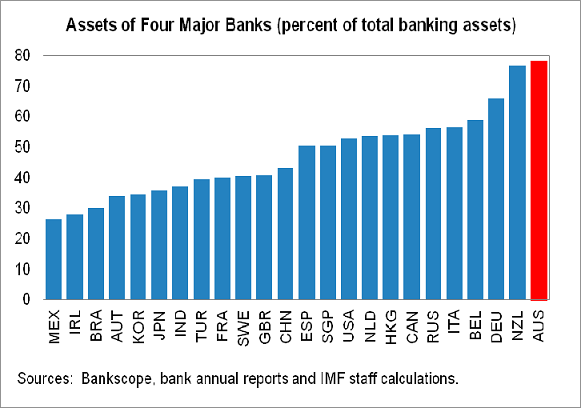

Moody’s warning today follows similar concerns raised by the International Monetary Fund (IMF) in November last year. (‘Too big to fail‘)

At the time it reported, Australia’s four major banks, The ANZ, Commonwealth, Westpac and NAB hold 80 per cent of the countries banking assets and 88 per cent of residential mortgages. Such dominance in the market, each with similar business models and reliance on overseas funding would leave the majority of Australia’s banking sector exposed to common shocks. “The combination of high household debt and elevated house prices is a risk to banks’ large mortgage portfolio.”

» Voters want Federal Government response to housing affordability – News Limited, 15th July 2013.

» Banks vulnerable to housing collapse – The Australian Financial Review, 15th July 2013.

» MOODY’S: Australian Banks Are Too Exposed To An ‘Overvalued’ Housing Market – Business Insider Australia, 15th July 2013.

» Here’s The Chart That Moody’s Says Could Be A Sign Of An Australian Housing Bubble – Business Insider Australia, 15th July 2013.

» Too big to fail – International Monetary Fund (IMF) warning on our banks exposure to the housing bubble – Who Crashed The Economy, 18th November 2012.

It’s clear that the big four banks are really not well diversified and very open to a big shock if house prices nose dive.

Could you please do an article on maybe 2-3 different scenarios of what would happen to your average joe with a home loan IF this serious price correction was to happen? For example what would happen if house prices crashed by 40% overnight? Would banks go out of business? Would the government be likely to bail them out? Would they demand people pay their loans back immediately and repossess houses if they couldn’t?

What would happen if housing crashed by 10%? or 60%?

I’d mainly like to see your analysis so that everyone can best prepare for what it’s clear has a very high chance of happening.

Cheers,

MM

I agree, something doesn’t gel about the article from News. We know from history that News is in bed with the real estate sector:

http://www.abc.net.au/mediawatch/transcripts/s3315985.htm

Maybe the market isn’t as healthy as New’s makes out? Wonder how the realestate.com.au business is trailing. Revenue down?

Just watching Q&A at the moment about the end of the mining boom. Lots of questions about unemployment, housing affordability. Confidence must be shot.

Mortgage Mutilator, I might throw the question open to everyone here – What are some of the possible scenarios facing Australia now?

Regarding bank bailouts, I’m sure the government has this sorted. Earlier this year we learned of the $380 billion dollar Committed Liquidity Facility: Mother of all bailout funds – The Sydney Morning Herald, 6th March 2013.

A month or two ago there was some speculation by the Citizens Electoral Council of Australia about a bill – apparently already drafted and about to be introduced – allowing a Cyprus-style bailout (“bail-in”). This is where some of your hard earned deposits are converted into almost worthless bank equity (The same happened with Spain’s Bankia where shares fell 80% when trade resumed).

What will happen to average joe? The U.S. Federal Reserve Board’s Survey of Consumer Finances (SCF) makes interesting reading about about what generations were most affected by the US fallout: Security is owning . . . but not in a bubble. (The PDF report is linked at the bottom of the article)

What’s gonna happen? The little man is gonna get screwed, that’s what.

For answers, I suggest the readers look to the 2010 Seoul G20 summit, the FSB (Financial Stability Board) framework that is going to be implemented under the G20 accord, and the fact that it allows for ‘bail-in’ of creditors in various sections, to know that Australia is about to be signed up to a Cyprus style framework that can save the Big 4 when it hits the fan i.e. by applying a ‘hair cut’ to your money under the pretext of ‘financial stability’, or just preventing you from accessing it for long periods, or not being able to take much money out each day (capital controls etc).

Oh yeah, & backed up by the RBA bailout facility (Conditional Liquidity Facility) being established shortly, and I think you have your answer.

Cyprus was a test case. The muppets (us, the 99%) didn’t hang bankers and go nuts and tear the place apart. Result is they changed the rules to allow for a bail in framework that is coming soon to a corner branch near you, in order to provide a legal cover to steal your money.

Didn’t the PM with the 10 million dollar property portfolio tell you? It’s almost as if the politicians don’t have the interests of the 99% at heart. Funny that.

If the punters don’t believe me, then they can NSA Google it and then reply back here.

What happens to Australia?

I was looking to buy pre 2000, rates were steady-ish. Prices stable-ish. But as an apprentice earning a whooping $7 hour gross decided against it.

Fast forward a couple of years to early 2000’s, and the rapid rise in prices told me to step away from property. With a back ground in stocks any rapid movement like that will have repercussions……If left alone by external forces.

I never in my wildest dreams expected the market to continue to be manipulated for 15 years! I never expected central banks to print money recklessly. And I most certainly never expected young people to be given $50,000 if they buy a house.

The system is too big to fail: Naturally fail that is. Idiot’s who control this system, by being completely unproductive in the economy don’t see what their actions are having. They cut interest, print some more money, give incentives for going into debt.

We see our brightest students study economics then go onto be bankers…. Um hang on, shouldn’t the brightest students become Australia’s Bill Gates, Steve Jobs, Larry and Sergey, Dyson, etc. etc. Imagine how great our economy could be if we made stuff and sold it to the world? Where as at the moment, all we can really do is sell our debts to the world.

Imagine money flowing into the country because we make profits…Not because we grow debts.

All along this ride of growing house debt and rising prices I have sat back an laughed at the landlords and owners with their debt repayments, while I enjoy subsidized rent and are able to grow my savings.

But now! We are in a position to buy outright several times over, but I will not pay at these prices (yes, I am a rare breed in Australia it seems). And now the Government create laws that allow them to tax me directly on my capital (ie. cyprus style) That is theft! Pure and simple. I’ve payed tax for 15 years on those savings : And it’s not enough?

I have had faith in Karma and they system over the last 15 years, but I’m loosing it rapidly.

Being in the retail space I hear almost everyday how Australian citizens are being completely ripped off by our authorities: Governments, councils, police, hospitals, utilities, environmental authorities…The list is endless, unlike my patience.

I’ve always said if your able to not buy, your better saving and picking up someones problem when they offload it at fire sale prices. Hell, that’s how capitalism is supposed to work. But the system is sooooo screwed, not only are they taking from labour, but they are taking from capital, all to cover up yester-years problems…..

The fiat, fractional reserve banking system, supported by foreign loans is the biggest ponzy scheme in history..

Do I put my cash under the bed? In some crazy stock? Some wanna-be bank? My own business? Friend’s businesses?

At any moment any of those items are accessible by the authorities… It’s not right, it’s not fair and it’s definitely un-Australian.

@matty

buy silver. buy gold. exit the opportunity for your bank account to be zeroed.

OK so if there WAS a massive property crash for whatever reason the banks would be insolvent essentially. Then the good ol Gov would come to the rescue, lending them billions at piddly interest rates (via that Committed Liquidity Facility scheme) or possibly even stealing peoples deposited money ala Cyprus.

So would this be a reasonable result for a say, 50% property price crash?

Person 1 with a $300,000 loan and $300,000 house:

– House drops to $150,000 value

– Still has $300,00 loan

– Gov goes further into debt to bail out the banks

– No deposited money to steal

Person 2 with no loan and $300,000 house:

– House drops to $150,000 value

– Gov goes further into debt to bail out the banks

– Gov possibly steals some of their deposited money to bail in the banks

Person 3 with no loan, $300,000 house and $200,000 in deposits

– House drops to $150,000 value

– Gov goes further into debt to bail out the banks

– Gov possibly steals some of their deposited money to bail in the banks

Doesn’t sound very good regardless of how much debt or money you have to me. Obviously if you don’t have large mortgage debt you’d be better off. Also if you have a large storage of cash in the banks it seems like it’d be prudent to invest them instead in either money markets, shares or bonds perhaps… at least then they’d be less likely to be “stolen” during a bail-in yes?

I think the people who need to be REALLY worried though are the baby boomers. Whilst Person 1 above is in debt for $300,000 and has a house of $150,000 (assuming they’re young) at least they can work and wait it out over time. I’d possit many baby boomers are wanting to sell off their propery(s) to fund their retirement. If they were to halve in price then they’d be in serious trouble.

there’s only one way you can stop people taking your money. threaten to shoot them if they do. actually do it when they do. . force is the only language the greedy understand. that’s why they use it so lovingly. if the cyprus people made it a deal and systematically had those responsible assasinated, well I don’t think they’d get thier money back, but the banksters would think twice about it again. ah the human condition. destined to repeat the same mistakes over and over. can we ever save ourselves from these greedy scum sucking parasites that pervert society. if only we could be just violent enough to keep these cancerous people in check, but then stop there and not go overboard. even if you buy gold and silver, these bastards will concoct a legal means of taking it. only a couple of well placed 303 rounds through the heads of these crims as they gleefully stroll away from thier workplace of theft will ever be enough for them to keep their hands off what does not belong to them. but who’s going to do that? we are not psychos! so best thing one can do is accept it how It is, enjoy life for what its got. and hope there is a god after it all to reward us for not murdering these who deserve it, and then likewise giving these bastards what they deserve….

I was just looking in the Perth suburb of Piara Waters (which is in the middle of nowhere) as I regularly drive by there.

You can get a block there, lot329 Villatella Gardens, Riva Piara Waters. The sum for this 329 sqm block is 240k @ $729 sqm.

If you are looking for a house might I suggest 8 Dealy Elbow, Harrisdale (just around the corner).

It is only 620k for a 3 bed on a 364 sqm block @ $1703 sqm.

This cannot end well and is only going to drive our household debt even higher, I cannot believe people are still buying these prices, but hey, nothing bad happens in the west, right!

Kaboom!

The many examples in other countries of governments ‘stealing’ depositors to bail out a corrupt government/bank/real estate monopoly on home and land prices is a warning to everyone not to become complacent with government promises and guarantees of “your money is safe”. When a government is facing bankruptcy it will resort to many illegal and undemocratic acts of legal theft. Dont forget,their assets will be safe somewhere overseas. It is up to us if or when that day comes here to Australia that we will not just sit idly by and accept their lies and excuses and act against it by any means possible.

So if property is overpriced and you can’t trust banks, where do you put your money? Agricultural land? Credit unions?

@ Steve.

Yes, I agree. Here in Adelaide we have a suburb with land prices at $1000 per m2. It’s 8 km from the CBD. What they don’t tell you is that in traffic it is almost 1 hour from CBD.

I have friends who are back from the USA. Admittedly this is in Michigan (a leading example of how Salisbury/Elizabeth will be with out Holden?). They are considering a mansion, over 100 years old, built by a timber Barron. Beautiful gardens, water features, pools, 2 story etc, all for the asking price of $75per m2. Oh, and asking price in USA means “make an offer”. Yep $300k all done.

Reminds me of a friend considering buying an apartment in Adelaide CBD. Approx $800k…Then the night before he was going for his second viewing he watched four corners where they showed furnished apartments on the strip in Las Vegas for asking price $300k. Put it into perspective for him and he hasn’t looked at property since.

We are way past ‘this will work out ok’. No nation on earth (sorry, first world nation) has ever faced the debt levels we hold. And most of it is on unproductive ‘assets’.

If it was all margin borrowed against Berkshire Hathaway or Google I could have some level of faith it will be ok, but this is against an item that is considered a necessity. Despite what morons think, they do create more land: Every time they build more apartments they have effectively increased the land available for living in.

With the improvements in building methods, housing should be like any other item that is man made, and fall in price over time…. Remember the first CD players? Computers? Cars? etc. etc. they are all cheaper than ever.

No good will come of our dilemma in this country. That is inevitable.

Mortgage Mutilator, you say “if you have a large storage of cash… it’d be prudent to invest in either money markets, shares or bonds perhaps”.

I fall into this bracket and was wondering how one would go about investing in the money markets and how it would guard against the government stealing my money?

Gold and silver,

The only two currencies that has survived for over 5k years.

We are at the end of the great fait super cycle… if you dont hold the two ultimate currencies (Gold silver), you have nothing…

prepper

Sorry,

I should have read previous posts… catching up…

search this

http://news.goldseek.com/GoldSeek/1373643545.php

want more…

i could fill your inbox for months…

prepper

USA! USA! here I come baby!

bye bye aussie, sob. ill miss u…. ill come back when uv crashed and burned.

I’ve been reading blogs like this with articles like Paul’s @15, for over three years now, yet absolutely no-one has any alternative ideas of where to park one’s cash. The answer is not precious metals I’m afraid – sorry. Gold and silver are bubbles too!

I’ll tell you what it is, and I’ll keep bleating on about it until the cows come home (literally). Pretty soon, in our lifetimes most likely, there will be food shortages on a massive scale. There will also be a water crisis and an energy crisis. It WILL happen. So, instead think about investing in yourself and your own future by becoming self-sufficient. Spend your money on solar panels for your needs, wind turbines for your needs. Learn about horticulture, farming and permaculture. Buy land, buy animals. Trade with your neighbours, share your skills and resources. Lose your dependence on cash. Lose your dependence on the bank. And LIVE!

What annoys me is that I have quite a bit of money in savings but I rent (I hate debt and believe the price of the cheap fibroboard, badly put together prefabs called housing is passed ridiculous) and I don’t want my money used to bail out greed ridden idiots and gullible morons.

BUT, where can I transfer my money to?

Banks can put their money in tax-havens and the ATO doesn’t really go chasing them. I miss $100.00 interest on my Savings Account and I get a threatening legal letter.

I can’t seem to transfer my money to an account overseas in a foreign currency.

I’m not too keen on gold and silver when I saw some colleagues at work lose money on gold a while back.

So I’m expecting a Government rape of my bank account during a crisis to try to save a$$holes!

Little discussed and yet key to the entire debacle is that these banks, and their politician friends, are colluding to prevent the impairment of bank collateral, pure and simple. They do not care about the “homeowner,” because the legal standing of this individual, vis-a-vis the particular piece of real estate, is entirely fictitious. In other words, the people, by and large, do not own their homes, the banks do. What the people own is the debt, and the debt is not at issue, just the value of the collateral.

To remedy this unfortunate situation, large numbers of persons would simply have to decline to debt-finance real estate purchases. Widespread cash purchases of real property would necessarily, and at a minimum, cut price levels in half. Demand would be decimated. The average person is being abused by their own need for instant gratification. Your families were sold the idea of debt-finance as a convenience. Buy now, pay later. As is plainly demonstrated by recent events, the sales pitch was a deception, and a theft. The problem is not the home price, but the act of borrowing itself, particularly when there is little or no down payment.

Thanks Rupert @18,

Agree on all you say other than the bubble part.

If Gold silver were in a bubble more than 2% of the population would own it… Rather than property where 68% of just units in Australia are owner occupied

https://en.wikipedia.org/wiki/Owner-occupier

You second paragraph agree with 100% and can be defined by one word (prepper). We all need to prepare for what is coming.

I would like to make my point more clear.

You can’t take a cow to you fence line or local butcher, baker, candle sticker to trade with for a doz bangers 2 loaves and a doz candles. That might be worth only a forequarter. So it would be hard returning with a three-legged cow. This is why Gold silver have filled this void in barter as the medium of exchange for almost six thousand years.

All the currencies we have created (over 600) since we have used money (Gold silver) have all collapsed to zero. The average life of the over 600 is fifty years. We have been using the green back as the global currency for 100 years this year. The US dropped its full precious metal standard to a half standard around 80 years ago. The half standard was dropped around 40 years ago. Since we have had an injection of currency along with the fractional reserve system.

http://www.investopedia.com/terms/f/fractionalreservebanking.asp

Enriching all with a credit-fuelled boom that has inflated asset prices worldwide. All based on a peace of paper USD.

Can anyone tell me when it will become worthless?

prepper

@Paul

Good post. I was unaware of the 50 year average life span of fiat currencies. I am well aware they have all collapsed to zero.

Given the USA dollar has been unbacked for 40 years, a remaining life span of 10 years could be about right.

At some stage the USA dollar WILL collapse to zero. I don’t believe it is in the next few years: But that’s not to say awful times are coming up.

Very few respectable economists (and what a rare breed they are!) believe that the USA can be pulled out of it’s escalating debt spiral. So the only real option is for policy and monetary makers to contain the collapse as much as possible. And this is what we have seen over the last 8 years (housing topped in 2005 in the USA…how time flies). Bank bail outs, negative real interest rates, third attempt at QE (aka creation of generation poverty).

PREPARE: I have a two prong attack:

A: No debt (I would like to say that I have good debt, but I lack the skills to make that a low risk option)

B: Understand, develop knowledge of and take advantage of being a capitalist: Ie. learn the skills to create businesses with next to no resources.

Geewiz, doesn’t that sound boring amongst the general population: No debt, and doing things with no resources: “mate, just borrow some capital or lease your equipment”.

Not on my life!

Don’t believe all we are feed.

Have a look at some of these and make up your own mind.

http://ausbullion.blogspot.com.au/2013/06/the-biggest-ponzi-scheme-in-history-of.html

http://www.macrobusiness.com.au

http://www.whocrashedtheeconomy.com

http://www.gold88blog.com

http://thelibertymill.com

http://www.silverdoctors.com/federal-judge-dismisses-silver-manipulation-lawsuit-against-jp-morgan/

http://www.petitionbuzz.com/petitions/aussiegold

http://www.silverseek.com/article/silver-saga-7861

http://www.youtube.com/watch?v=JdbYztGEgbU

http://www.youtube.com/watch?v=wtqccOjfXAY&feature=player_embedded

http://www.reuters.com/article/2013/02/15/us-pope-resignation-immunity-idUSBRE91E0ZI20130215

http://www.collective-evolution.com/2013/04/06/crimes-against-humanity-arrest-warrants-issued-for-pope-benedict-xvi-queen-elizabeth-and-stephen-harper/

http://betabeat.com/2013/07/woof-google-now-funding-wearable-computers-for-dogs/

http://www.fastcompany.com/3014203/fast-feed/meet-darpas-humanoid-robot-that-could-someday-save-you-from-a-crumbling-building

http://www.larryhannigan.com/australian_government_frequently_unanswered_questions.htm

http://www.larryhannigan.com/who_rules_the_world.htm

prepper

The modern fiat currency regime is a regime of relative valuations. The value of the USD cannot “go to zero,” under the current system unless all other currencies collapse first, which is to say they must hyperinflate. Further, the USD is in essence a petrodollar. You blokes posting comments here should probably look some of this stuff up, eh?

Gold MUST trade under 1000USD again. The reason why is that paper gold rehypothecation has dwarfed the supply of physical.

Anyone care about facts?

Fact: A piece of paper/plastic that is not backed by gold or other physical item, but backed by a government with a yearly $4trillion deficit can go to zero: Fiat currencies only last while people ‘believe’ there is value in it. That’s the relative valuation, people value it as worth something:

As for comparing USD to the value of petro/oil: Given that the price rises in oil are from OPEC limiting supply and not physical restrictions there is no real link between oil and USD. Infact, world oil use has fallen massively and continues to fall, this is a byproduct of a slowing world economy. I believe oil usage is now around 1997 levels.

The facts are there is evidence of all 600 recorded currencies collapsing, but there’s a hypothesis that the USD is immune and can’t collapse.

FLW: “This time it’s different”

Hi Richard @ 24,

We have had what’s has been called the Arab spring this had been happening since 2008. The so-called GFC. That is not going away any time soon…

It’s now going on in Egypt…

What we are not being told is that these uprisings are being forced buy the currency’s of these economies suffering hyperinflation. i.e. more than 1 in 5 are living below the poverty line and prices are rising daily.

The reason all these currency’s are collapsing/suffering hyperinflation is because they are all just denomination’s of the USD, as are all currency’s rated against the USD. All assets are valued against this paper.

Remember there are a lot more outside the US than in the US. i.e. china owns 2 in every three us treasuries’ bonds.

More and more country’s are making direct trade relation with China. To avoid the hyperinflation of the USD.

http://www.mondaq.com/australia/x/236650/international+trade+investment/Australia+Enters+Direct+Currency+Trading+Agreement+With+China

The petrodollar was created when the half gold standard was dropped some 40 years age. The large emerging economies are using the global banking rules to divest their holdings of the worthless paper US Treasures’ in exchang for real assets Gold silver and Oil. This is part of some of the reason why the us fed is printing 85 Billion USD per month to buy there own bonds, because no other economy wants them……………

http://dollarcollapse.com/dollar-5/china-russia-and-the-end-of-the-petrodollar/

prepper

Like others I have no idea where to put my money. Right now I’m leaning towards putting some more back into Euros, but I suspect I’d better hurry as the AUS$ is dropping.

As for gold or silver, if I’d put all my money into gold 6 months ago, today I would be 30% poorer. The goldbugs don’t seem to be talking about that…

Hi Chockolate @27,

I must say this is not advice. An easy way to get into some other currency like EUR and USD using your AUD. Have a look at EEU and USD they are ETF’s on the ASX.

As for Gold silver you would have lost 30% of you AUD. If you had went all in 6 months ago.

I don’t know how many financial advisers I have spoken to over the years, as bad as some of them are. All of then have told me to spread my risk and don’t put all the eggs in one basket. Many of them have said it’s a good idea to (dollar cost average) month after month. I think that’s sound advice. But I’m sure like that idea more when the price is dropping…

As for the price of the metals dropping so much might have allot to do with the fractional reserve system. On the COMEX there is 100 times the value in paper recepts than there is in actual metal. It seems the price can be moved around at the will of the large players.

http://moneymorning.com/2013/05/10/has-the-great-gold-crash-divorced-bullion-from-futures-prices/

http://www.kitco.com/ind/Levenstein/20121205.html this

It is said currently the price of Gold is below production cost. This is forcing some mines to close. This will not go on forever. At some point the amount of purchasers of paper metal that require the physical delivered will rise to a point where there will be none left for delivery…

Gold silver is different than a lot of other investment. They are for long-term preservation of your wealth, and silver is not for the faint hearted. It tends to make much more dramatic moves.

I must also say you cannot lose money buying Gold silver unless it is stolen or you misplace it.

They are money.

Chockolate you’re talking about currencies. You buy an oz of Gold today, it will still be an oz of gold in 20 years.

prepper

I have to tend to agree. When papers start printing about trouble ahead you know there’s trouble ahead because they don’t want to get their asses sued. Imagine if news ltd said property is going up and up nows the time to invest. And then bam. 30% crash. They would most definitely be liable especially if they had indicators that said house prices are falling. Now that house prices keep falling they can’t print house prices are going up until they actually do go up. They won’t stop them from using the 1 day statistic garbage though. ‘Today pay day Thursday after everyone got their Christmas bonus house prices rose an astronomical 5-10k. The market may have just turned around’ what they don’t mention is that it’s been negative all month for -20k in losses and then one day when everyone’s paid it goes up. Honestly daily house price movement is about as useful as a weather report on mars. But they aren’t concerned with actual stats they need readers to pay for the paper to sell adverts and as long as people keep reading the paper they will keep making up new spins on old stories to sell more and more. It’s not a bad thing it’s economics. It’s a bad thing for the average person who doesn’t have the capacity to comprehend all the stats and figures though. Like watching a professional gambler and a hens party go to the casino. Of course the hens party is going to lose. Terribly. But as long as they are kept drunk and stupid they will think they are being treated fairly.

@Paul, you can certainly lose money buying gold if there’s an overhead in buying it, storing it safely and ultimately trading it for something you can actually use. This is non-trivial.

What the promise of gold is is that it isn’t affected by inflation, but it certainly is no guarantee to retain your wealth either.

The fact is that if you bought today instead of 6 months ago with money, you would have almost 50% more gold, thus almost 50% more wealth. YMMV.

Hi Chockolate,

I don’t know what the overheads of buying an oz of Gold silver are. (Insurance? Delivery/collection).

If you cant find an inexpensive place in storing an oz of Gold silver, about the size of AA battery. you could try these.

http://www.guardianvaults.com.au/sydney

http://www.securityspecialists.com.au/contact-us

http://www.abcbullion.com.au/storage-services/custodian-vaults

If you want to trade/sell Gold silver it you could contact these guys.

http://www.perthmintbullion.com/au/View-All-Bullion.aspx

http://www.abcbullion.com.au/

They have always have had a buy price.

To your last point.

The fact is that if you bought today instead of 6 months ago with money, you would have almost 50% more gold, thus almost 50% more wealth. YMMV.

If you bought today with money (Gold silver) you would still have the same amount of money (Gold Silver). Gold silver are money. You are confusing it with currency / paper.

The point you paperbugs dont seam to understand! In you equation you would have lost paper not money.

prepper

PS was that you at the RBA presentation today

@Paul, where on Earth are gold and silver forms of money?

Hi Chockolate,

Every central bank.

Every economies suffering hyperinflation.

http://www.youtube.com/watch?feature=player_embedded&v=s3LdNxV0yPM

https://www.youtube.com/watch?v=nNtIsSWVJBI

……………

prepper

@Chockolate,

India and China. People quite often use Gold to make purchases. Some Vendors in these countries prefer Gold.

The value of Gold in real terms never changes, you can buy the same product with 10oz of gold today for more or less the same amount of gold at any other time in history.

hi all,

This is a serious question, and not meant to be trolling in any way. This forum for 7 years has been pointing to an imminent crash… but where is it?

Here in Ireland we have been through the very worst. So much so that it appears to have bottomed out. We now have RE’s knocking our door begging us to sell such is the demand for people to buy in my area. However i’m still about £25k short of what i payed for my house 7 years ago.

I’ve watched this forum closely, as the other half of my family lives out there and one day we’d love to join them. i’ve watched in the hope that something might change and make it a viable option for us financially. But nothing.

So at what point does all of the information on this forum come to fruition? Another 7 years?

Hi BelfastDad,

Please go back to the info I first posted prior to 14, spend some time to form you own views……

I believe we are now going through the death throughs of the USD… this has been happening since the US dropped its precious metal backing some forty years ago.

Since then we have had a credit fuelled fractional reserve boom to a point where dept. is unsustainable globally. This is not any mistake. Most of our political leaders wouldn’t have the brains to see this is a problem for the populous.

I see this as the end of the great fiat supper cycle.

Every 70 to 120 years throughout recorded history there has been an economic fiat crisis.

This time instead of individual economies suffering while others are growing.

For the first time in recorded history the global economys will suffer at the same time. A prolonged process that started prior to 2007. That is not without controlling forces at play.

You may recall or have herd of the saying cash is king.

I belive this is one of those short times in history where this is the case for the average man. But is will not present its opportunity’s for long..

I could go on an on…

Re: above

prepper

@ Belfast Dad, you are not alone mate.

2 reasons:

1. Even though mining capex and commodity values are dropping like a stone there is still a steady demand for AUstralia’s mineral wealth. Ireland unfortunately does not have this key income stream.

2. My old nemesis Negative Gearing is the rock solid beam holding up Australia’s inflated housing market. No politician will address this issue so there will be no changes or quarantining of Negatively Geared tax concessions to the asset(Investment Property) rather than the current system that allows tax concessions against income.

So yeah, unfortunately it could be another 7 years or never.

Belfast dad and others, thoughts on this? http://m.canberratimes.com.au/comment/housing-bubble-is-real–its-just-not-due-to-pop-20130419-2i5jo.html

Fantastic article Jj.

The 64 thousand dollar question is if you were looking down the barrel of a 30 year mortgage for an asset approximately overvalued by double, do you jump in now, or how long do you hold off? Has anyone done the sums?

If you jump in today, and in five years the market starts falling, surely you would have been better off renting. After all, rents are relatively cheap. The other 64 thousand dollar question is how quickly will the market take to fall from peak to fair value? It’s the biggest bubble in the history of Australia, so it could take another 10 to 15 years to fully correct?

Belfast Dad, AverageBloke is quite correct – negative gearing is the reason for so many investors buying at inflated prices and pushing prices up, and no politician will do anything to change the status quo. So now that NG is keeping the bubble inflated, we have to realise that this is no longer an unintended consequence, this is now the DESIRED consequence, and it is widely understood that removing it would cause prices to crash.

Negative gearing isn’t the only reason the bubble hasn’t burst yet. Other government policies, like the highest rate of immigration per capita in the world and unrestricted foreign investment are also holding up prices. Then we have the MSM constantly spruiking property, and we have low interest rates which make monthly payments more affordable, enabling buyers to take on massive mortgages.

So when predictions were made 7 years ago of an imminent crash, what was under-estimated at the time was the determination of the government and vested interests to do anything and everything to keep the bubble going.

@ Don’t Prop Up the Ponzi

Excellent article!

Crispin Hull has summed up The Australian Property Market in one concise article.

This is what is happening to asking rents in East Perth.

http://www.sqmresearch.com.au/graph_median_rent_weeks.php?postcode=6004&t=1

Investors, leveraging in for the first time or those that got in early before the boom are now increasing their debt to equity ratios and stand to lose a lot more money if rents drop.

The government will be losing a lot more tax revenue as the economy continues to slow and investors become more negatively geared.

Westrac figures CAPEX figures for mining will drop 5-10% this year and around 20% next.

Commercial and residential vacancy rates are starting to climb quickly here in the west, and are also elsewhere in OZ.

Negative gearing may come under pressure?

Any thoughts?

@steve

The July slump is usually. It picks up again around the end of the year as people tend to save moving house till the holidays and start of uni/school. It’s a will known fact it fluctuates by 20% 6 monthly.

The large slump/rises are also typical of the nature of Perths mining town mentality. Perth goes up fast but it also goes down fast so although it looks alarming its quite usual for a city supported entirely by one sector that can lose half it’s income then the exchange rates move 20 cents.

Fortunately Australians politicians will never let the housing market fail. Grants, loans, schemes, immigration, subsidies, negativity gearing. If you had 65-70% of your assets in 1 resource that 99% of your votes come from you would do EVERYTHING to stop it falling. Hence artificially increase demand (keep pulling in immigrants, give tax breaks for buying housing. a dead investment. make it seem atteactive to keep buying the investment. restrict supply (ask anyone who tries to build a house. Papers a mile long and tax that bends you over and destroys you. Attempt to build and you are placed 1 hr from the city in a suburb with no train, Internet or services and be prepared to spend 7-8x your income for a place you wouldn’t want your worst enemy to live in. By Meath labs and brothels in sprawling new suburbs.

I feel sad for anyone who thinks Australia’s property will crash. The more sever the loss the more the Australian government will keep pouring our time (through tax) to justify the prices to itself.

If you don’t believe how bad Australia is at the moment…

http://www.macrobusiness.com.au/2013/07/australias-huge-property-market-gets-bigger/

60% of our economy supports housing. Not including super. If super was included this would push 70%.

A country who’s almost entire economy revolves around building houses. This will never end well. No other country is quite as suicidal as Australia. Basically any and all money made outside of housing goes to support more housing. It’s it the essence of a bubble. But like Germany or Japan with cars maybe Australia is just good at making houses…

Thanks all for responses.

I must admit, Negative Gearing is something which i couldn’t quite believe, or get my head around when i first discovered it.

Hi all,

Please remember around 70% of the asx is made up of our big four banks and the three big miners…

prepper

BelfastDad, you are not alone. BoA Economist Saul Eslake says “I have to translate the words ‘negative gearing’ to people overseas because it just sounds crazy to have a system that rewards people for losing money.”

Don’t Prop Up the Ponzi:

Agree with you. The OZ is managed systematically to achieve one single target, broke for property.

MP’s are selling there land do they know it is all going to shit.before it happens.

http://news.smh.com.au/breaking-news-business/building-approvals-fall-for-2nd-month-20130730-2qw39.html

they get data, currency is a mess, and Yeh… she’ll be right! just some volatile numbers…. I hope someone is collecting these quotes to keep the meme generators busy 🙂

got a price increase notice from a material supplier the other day… what a joke. due to the continual decline of the dollar apparently… for a whole what… 2 months?

to add to the above, I never saw anyone announce a price cut during the whole time the buck went sky high…

IMO it just goes to show how much people really believe in the aud! (mate, she can’t stay this high for that long… better not touch those prices…). gonna bite people in the bum this is.

Very good comments on here from everyone and some points the think about.

My point is when the job market takes a massive hit then you start to see housing prices come down. Lets face it the numbers are BS and the real unemployment is over 10% I believe. Until unemployment takes off like a steam train then the housing market wont fluctuate to much. When it does and people cant make their payments because they have no job then a crash will happen. Its happening and gaining steam but has not taken off yet. The low doc loans are also going to become a massive issue. I think the govt in Australia can try new things but dont think it will work this time. You got to have a job to make payments and reap the benefits of NG. My 2 cents. Be interested in hearing everyone elses thoughts as there are some great comments on here….

Nicely said DPUPS……

“Don’t Prop Up the Ponzi Says:

July 28th, 2013 at 2:00 pm

Belfast Dad, AverageBloke is quite correct – negative gearing is the reason for so many investors buying at inflated prices and pushing prices up, and no politician will do anything to change the status quo. So now that NG is keeping the bubble inflated, we have to realise that this is no longer an unintended consequence, this is now the DESIRED consequence, and it is widely understood that removing it would cause prices to crash.

Negative gearing isn’t the only reason the bubble hasn’t burst yet. Other government policies, like the highest rate of immigration per capita in the world and unrestricted foreign investment are also holding up prices. Then we have the MSM constantly spruiking property, and we have low interest rates which make monthly payments more affordable, enabling buyers to take on massive mortgages.

So when predictions were made 7 years ago of an imminent crash, what was under-estimated at the time was the determination of the government and vested interests to do anything and everything to keep the bubble going”

Hi All,

Just heard the news, our government wants to impose a tax on banks (In case they need a bailout in the future). Business will always pass on a tax.

This is disgusting and immoral. Our government know this will come out of our pockets. Its outright theft?

This bailout regime that has been followed throughout the world. US, UK, Euro… taxpayers through government have handed their hard earned over to prop up the banks. Transferring the bad loans these individual business have written onto the balance sheets of populous.

Why can’t my business have a fund created to bail us out, if we take on to higher risk and fail?

This action is totally against how capitalism is supposed to work.

It looks like we are heading for the same fate as the major economies. If this gets passed we are no longer in a capitalist society. I don’t know what you would call it. But I am disgusted.

We should be doing what we can to stop this theft happening.

prepper

WHAT A F#$KING IDIOT….. SORRY THIS JUST BURNS ME UP…..You are exactly right Paul we will pay for this.

Yes Paul, I was quite shocked when I heard this the other day. Why is the government so desperate to produce a government surplus when it’s really the private household debt that everyone should be worried about.

It’s very disconcerting and makes me wonder what “they aren’t telling us”!

The proposed bank levy is 0.05 just to get their foot in the door and then they already have the legislation down for a Cyprus style bailout.

Must say, what an interesting article, and comments to boot.

Look into how the unemployment rate is determined, how the inflation rate is guesstimated, see who (like Australian Banks) took emergency loans from the U.S. Fed in 2008/2009, the empty and emptying commercial premises (no! online shopping didn’t destroyed them), what the terms of trade are/were for mining BOOM, who owned mining BOOM, who received what from it. Look at what Government debt is, without applying the Assets-Liabilites accounting calculation to it, look at what private (non-business) debt is.

Then right down to the individual level, look at how petrol theft has increased, how many cars run-out of petrol in the Sydney Harbour Tunnel now, compared to a few years back, cause people can’t afford the fuel. Look how full shopping malls are, but nobody seems to be shopping or carrying bags. How many times I’ve seen credit and EFTPOS cards rejected from Woolies or petrol station checkouts. Look at the increases in crimes, hell…! Even bikers are shooting out cause drug markets have shrunk, well financial intake anyway.

Look at people waiting to pick their kids up from school in an Audi 4WD with an expression on their face that looks like they have mountains on their mind. The number of people who aren’t old, are able bodied, in CentreLink Offices and JobService Providers.

@54. LBS, this can’t be burning you up anymore. From what I’ve seen of your past posts here, I reckon you would have seen this coming. I did, that is, after Cyprus was beaten up.

@AverageBloke, yes Negative Gearing, you have always been right on this. Despite other posters beating you up for it during the past few years. I have always agreed with your stance on this. There is another side that reinforces (with great strength) Negative Gearing, its’ well explained here;

Mind Control Cults

http://www.youtube.com/watch?v=mnNSe5XYp6E

Couldn’t help but to think about Negative Gearing and Australian Property while watching this vid.

@admin, you’re doing well this this blog-site. I can remember when there were a handful of comments to your postings. Now it appears you have gained a readership. Well done.

Now a question I’d like to ask this panel of expert posters and commentors. Can the numbers or derivations in this website be verified? I’m trying to find their source but don’t know how to go about it. I don’t give much credit to ABS’ methodologies on some things.

http://www.australiandebtclock.com.au/

If this (above link) is true, boy are we f[CENSORED]k…!

Hi MadMike @ 56 and BotRot @ 57,

Our government is working on the legislation for the bailout. Announce by Wong with the excuse that the IMF and RBA have suggested this implementation.

Since when have we take advice from a foreign self-created entity on our economic stewardship and or the RBA.

This is the upfront outright stealing. The major economies have used this model to steal and enslave every person that pays tax in there respective economies.

Cyprus is different. Please go back to the link in my post @15

The Cyprus deal was a bailout/bailin. Where all account holders in Cyprus could not accessed funds for almost two and a half weeks. (Oh except if you had access to your accounts through Paris and London branches). While the elected reps worked on a deal for confetti cash (€) bailout from the ECB, the result was unlike Greece where they have to sell key Infrastructure for cents in the dollar and austerity.

The Cyprus’s Government decided to take a large slice of accounts (bailin) and also sell 13 ton of Gold for the confetti cash (€).

Mad, we the have the wording for a Cyprus style bailin. Written into our last budget already.

Do you think our superannuation might be a little large for the IMF to ignore??

Bot and all others,

I must tell you all. This is the first time I have added comments to a blog. This is all new to me. I have been looking into some of the information I have listed above for many years. I hope I have been able to inform some about what is happening that is not covered or hidden by the mainstream. If you think it is note worthy please help me spread this. So people are somewhat prepared. Most people I try to express my concern of where we are going. Think that I am crazy or full of it. Apologises for being overwhelming.

prepper

@Botrot…….. Cant say I saw this coming.

The decision to rollout Cyprus style bail-in legislation was made at the recent G-20 meeting. Believe it, as the great descent into long hard economic times, which commenced with the GFC c.2008, builds up steam, politicians will be coming after your bank accounts.

I believe the recent months of stock market action can be partially explained by the fact that many, seeing the writing on the wall, are moving savings into risk assets. I think this being the aim all along,- pumping up for the last great roll of the capitalist dice.

Except this time I don’t believe there will be any winners left standing once it all comes crashing down. Meanwhile people where I live (Strathfield NSW) are still paying crazy prices for dog-boxes (approx. $2000+ per sq. metre of land).

We’re on the verge of a 14 year boom so say the spruikers – hold onto your a$$hats!!!

http://www.rememberingthefuture.com.au/

When will this finally end? So sick and tired of spruikers. The worse part is so far they’ve been right.

http://m.dailytelegraph.com.au/news/nsw/real-estate-price-surge-for-sydney-property-market/story-fni0cx12-1226690654418

So far as the gold n silver I see it as a simple currency hedge no third party exposure and no off shore transaction needed.. I now buy silver at silverstackers.com.au. if silver behaves as suggested by some commentators it could be life changing to own a stack.

The recent interest rates drop. Disgusting. Its all sickening, and I do feel a certain satisfaction when I convert some fiat to silver, taking my money out of the banking taxing cycle. Im keen on some fractional coins next.

Thank you admin and fellow blog dogs!