ABS data released today show house prices in Australia has fully recovered, surpassing record highs last achieved in June 2010. The weighted average of the eight capital cites recorded a 2.4 per cent increase to the June 2013 quarter and a healthy 5.1 per cent change for the year to June 2013.

For the quarter, all eight capital cites recorded growth in house prices except Hobart – falling 1 per cent.

Perth lead the gains, recording a 3.4 per cent increase in the quarter, followed by Darwin (2.9 per cent), Sydney (2.7 per cent), Melbourne (2.4 per cent), Brisbane (1.9 per cent), Canberra (1.0 per cent) and Adelaide (0.3 per cent).

Despite a healthy housing market, the Reserve Bank of Australia today dropped interest rates to 2.5 per cent, a record low in Australia. Interest rates might be at record lows, but households and business Australia wide is struggling to make ends meet under crippling high household debt levels and falling consumption, further exposed in recent times by a cooling China and resource sector.

But record low interest rates could now be creating an even bigger housing bubble ultimately leading to severe financial instability when the bubble finally deflates, potentially triggered by rising unemployment or a crisis in China. Yesterday, Roy Morgan Research reported on its latest unemployment survey showing the unemployment rate in Australia is now 10.1 per cent up 0.4 per cent. Another 9% of the workforce is considered underemployed.

The problem of low interest rates fuelling bigger property bubbles is something the Reserve Bank of New Zealand is also struggling with. It needs to drop interest rates to support a cooling economy, but the single interest rate lever leaves the out of control gung ho housing sector leveraging up into even more debt, creating even larger issues long term.

It is expected the RBNZ is about to embark on macroprudential controls including capping the number of high risk low loan-to-value ratio loans as it fears rising property values will create financial instability. Time will tell if Australia is forced to consider similar measures.

» 6416.0 – House Price Indexes: Eight Capital Cities, Jun 2013 – The Australian Bureau of Statistics.

» 48,000 jobs created in July, but unemployment up to 10.1% and under-employment virtually unchanged at 9.0% – Roy Morgan Research, 5th August 2013.

» Analysts fear RBA’s rate cuts could fuel property price bubble – 6th August 2013.

I still cannot believe how much interest there in real estate !

There is building taking place everywhere in Sydney.

When is the bubble going to burst ???

Those wil lots of equity will leverage in even further.

It is an easy way for the govt and the banks to underpin the banks bottom line by stealing equity from those that have it.

With the lower interest rates banks will also lend higher ammounts to FHB based on the repayments.

All as unemployment and tradeable inflation are set to rise.

It will prolong it, but will make it worse when it comes, driving household debt through the Stratosphere.

@Joe

Never fear, if my brother-in-law’s R.E. track record keeps – he ALWAYS buys at or near a top in the market, (doing so again just recently), the end won’t be to far away!

@ admin

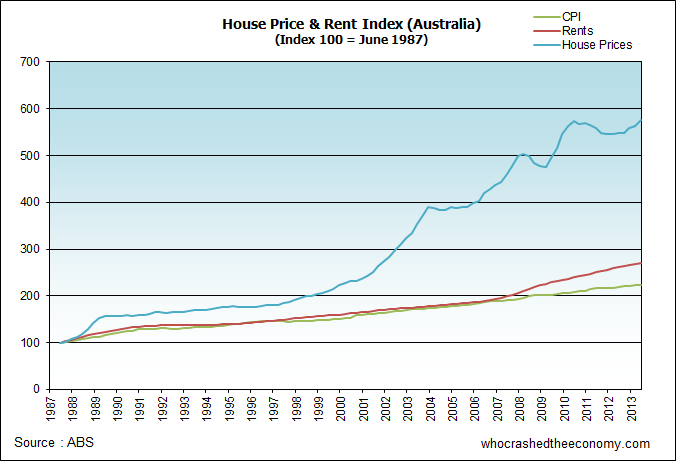

I am just wondering are the colour lines on the graph correct? Cheers

@Yusuf – sorry, this should be fixed now. Thanks for picking this up.

Firstly, I am waiting for the spruikers to start rolling out the FOMO (fear of missing out) sales approach, and are half expecting to start seeing it turn up in mainstream media, if not already.

However, as disheartened as I was feeling with this data, I do consol myself that ever increasing house prices and debt, is still not sustainable, particularly here in ADL. I feel many of the public are wary of debt, no matter how low interest rates seem.

As a personal observation, the market I have been observing here ( 2 bed modest units, 10km from CBD ),do not seem affected by the apparent upswing. In fact, a couple turned up this week, that were originally advertised last year, with new ‘healthy’ discounts. I suspect these are NG’s wanting out, for reasons not substantiated.

Saying that though, I would like to hear the constructive opinion of other posters of to where I should place my vote this election, taking into account housing affordability is my primary concern and focus. Refreshing to see the affordability question asked on Q+A last night, and the ( ex ?) Liberal advisor saying he likes FHB grants (I presume he meant existing homes, as well as new), which put me off straight away. The compare quite rightly commenting this was a ‘sleeper’ issue not being picked up by the major parties, not that us on this forum need convincing !

I was thinking the Greens, but am I giving a ‘backdoor’ vote to other parties without realising it ? Looking forward to some educated guidance.

Exact same thing happened in N Ireland in 06/07…. Prices rising to record levels, interest rates eventually falling to ZERO… Then POP.

@6. Skichaser,

Regarding where to place your vote, I can only speak from my view. Voting reminds me of the prol I am (as in prolateriate, the lowest class of Roman citizen). For a few reasons;

1).

We elect policians. We’re not in the class of people, committees, sub-committees, lobbist,…, etc that select politicians. That is maybe one of many reasons that from our side of the fence, they’re all the same.

2).

We are not apart of the very narrow corridor of power and privilege that any political organisation represent. The F.I.R.E sector is well represented, after all, those sectors are the government’s constituents, not you (you meaning us). Probably another reason they’re all the same from our side of the fence.

3).

Who ever you vote for, will disappoint you within months after they take office. This always happens, to everyone. Serve your own interest(s), no-one will serve it for you, not even give you the smallest help.

I don’t vote (but that’s me).

As for property price ascension, seeing everyone doing the same thing is what concerns me. I don’t consider things like; interest rates, housing supply, land banking, building constraints, foreign investment,… anymore. Group think scares me more.

Aren’t these house price increases largely driven by investors based on RBA figures showing this category taking out more loans than owners occupiers with FHB’s loan applications falling away.

As house investor loans are interest only, the monthly interest repayment on a $500k investment rental is now down to $30K from $35K a year ago. ( based on the ‘fine’ print rate and not the headline rate). As such a property would yield no more than $15K-$20K gross a year the investor is still in the red by over $10-$15K. Add additional holding costs, taxes, rates, insurances, agent fees and maintenance, the property would need a capital gain of at least 5% a year minimum just to brake even at current record low interest rates.

With China coming off the boil, unemployment increasing, wage pressures, lack of new housing market entrants, increasing taxes etc. Good luck with that.

I wish Q&A would do a special on housing. It was clear that NG and the First Home Vendors Grant are not popular among those with half a brain, including Tony Jones, who seemed to also poke derision at it. It would be a very interesting show. Come on ABC. THIS is an important issue, not “keeping out the boats”. The media slight-of-hand as usual doing its best to make sure the election will be won or lost on MINOR issues and personality attacks. Surely Australians aren’t THAT stupid! Oh, hang on…

So as mining slows down we are going back to our mainstay which is housing. We’ll all get rich because our houses will be worth more and more, offsetting the huge interest payments and taxes. It’ll be government mandated, so there’s nothing untoward about it all. Those who didn’t buy a house in the last 6 months will miss out (again) on huge windfalls.

It’s the result of a perfect partnership between the government and the banks – plenty of tax revenue, plenty of banking profits, and it’s all guaranteed by the taxpayers. What could go wrong?

Wow – I just looked up on Google the Ireland Bubble burst. I had no idea.

I think the government has way too much to loose to let the bubble collapse. I think it may be a case of prices going nowhere for years …

Its funny though, as an Adelaide buyer 16 months ago, all we saw was a deflated market, we bought and sold at quite a discount to asking price. All the houses we saw then and even now look much more reasonably priced and seem to sit for very long periods of time.

2-3 years ago we never saw price drops, last 18 months Ive seen many, many price drops.

The house we are in now I even made my wife wait for 3 months before we put in the offer to give the owners time to sweat and I was confidant the place would still be there in 3 months. We got $75k off the original price.

This was all semi rural, lifestyle, outskirt type homes though.

I am happy I bought two years ago even though I thought a crash was imminent. I was sick of waiting for the prices to moderate and have bought for the next 20+ years so it doesn’t matter. I may go on for a few more the way the govt likes to prop the housing market up. I sold a few investment properties that had doubled to do it anyway…

I applaud those who are putting up with crappy landlords to wait. A lot needs to be said for tenants rights (we were always good landlords!). I now have a renovated house that is exactly how I want it. Except for my PPOR I have no investments now. Waiting for the crash to get back in to investing….

Lets say that for one that I believe the figures or data released are actually Indicative of the entire truth. In other words house prices have recovered to again way overvalued and too expenxive for many Australians. But who is to blame? People for buying them!! Many will so deserve the coming recession/depression when they lose their jobs abd find themselves on the streets. They will only have themselves to blame. I for one will not feel an ounce of sympathy for them.

To keep this rate cut in perspective, it’s only a savings of 10 bucks a week for the average mortgage.

Since petrol hit $1.64 a litre the other week this $10.00 has gone already.

Glenn stevens should be arrested and tried for crimes against humanity. This man should be in jail not a church.

Why isnt there a box on the ballet paper marked.

No confidence.

prepper

@ SkiChaser

There is no one to vote for on this issue mate.

@Paul, the greater question is why our voting system hasn’t been modernised one single bit since horse and cart days. Just what is stopping us from having a say more frequently than every 4 years?

I see auctions being turned in everywhere with sellers holding on for dear life because they cannot get what they want. Is it possible that this data is just showing a few higher priced properties finally selling while the bulk is sitting there on the market not getting purchased for the inflated price they want?

Unemployment here in Adelaide has surged from 6.1% to 7.1%, the highest level of unemployment in 11 years.

Wonder what this will do to Adelaide Home Prices, already one of the weakest markets in the country.

Hey everyone!! With elections coming soon, ask yourself how has voting for any candidate changed your life? Are your earnings keeping up with house prices, rents and the general cost of living? and especially ask yourself why isn’t it? and what is going on? Elections are a great way for politicians to ‘get’ your message but they always count on you to vote irrespective for who. You are feeding the system to continue ignoring you while it makes a minority 5% of the population wealthy including themselves. We should be calling for more referendums, instead of elections which only benefits politicians more than it does the nation. We will be actively saying NO!! to the corrupt government/bank/real estate agent industry system who have all brought about the situation and having more of a say on how we want want it instead. Your complaints can make the changes that we really need for our country-Dont encourage this conspiracy to continue to profit from you while you are in forever in debt-Its up to you. Lets make a change for us and not for them. Spread the word-and especially don’t buy NOW!!

May I suggest an informal vote. The electoral commission keeps a count of these. The more there are, the more pissed off the voters appear to be and the politicians will not be able to claim a mandate.

I will certainly be voting that way for the lower house but will still put a one above the line for the senate.

Picking up the pieces after a housing bust. With help from the Banks and the Government of course!

http://www.whiteoutpress.com/articles/q32013/banks-robbing-wrong-houses-still-above-the-law/

This is identical to Ireland lol.

Prices were so high

Banks had 70-80% of their money in realestate

Rates went to zero – (well 3-4%)

We had HEAPS of immigration coming in.

Then suddenly first home buyers stalled

And then unemployment crawled up

Then bam all hell broke loose, 10-20-30-40-50% falls.

It was a build up then a 6-12 month blow up.

And now it’s happening here!

Identically.

UnluckyUncle – I wish it were true but we’ve been saying the ‘bust is coming’ for years now. It isn’t, it hasn’t yet.

Nicholas is correct. There is a unpredictable variable in Australia called the government.

It is really 2008 all over again. All the leading indicators say the market will crash. But it’s all up to the government.

If Rudd was to announce a $1800 cash handout and $28k first home buyers’ boost, then I think we could keep this bubble going for another 5 years, as evident from 2008.

I would love to see a debate between Rudd & Abbott on how they would react to a liquidity crisis in China where the PBoC either refuses or is simply unable to step in. Demand for raw materials fall as SoE go bankrupt, unemployment rises in Australia, exposing a household debt crisis and evidence of subprime lending. Will they listen to Treasury, or will they throw in their own stimulus measures, and if so, what will they be?

I think it would be a interesting debate, and would certainly impact the way I vote.

With NZ net migration turning positive and 1.75 million temporary workers in Australia (600k kiwis, 457’s, bridging visa’s, working holiday makers, etc) as the economy slows and unemployment rises this will continue.

It takes 16 times the workforce to build Chevrons projects than to run them and as mining Capex falls away these jobs will disappear.

Most of these people are not entitled to centrelink, with the price of living and a mobile workforce, these net migrations could swing violently in the next couple of years.

A kiwi couple just around the corner took on a 500k mortgage and a 50k new car debt to find that he just lost his FIFO job and she is not working and no Govt support, he had been told his job was safe a few months back even though he had been moved to contract.

Not long ago I flew out to a gold mine and while there I could feel a sense of unease and heard comments about what they are going to do if their jobs go.

A line in a famous Aussie song after the Gladstone boom years ago says, “and all that’s left are debts, she cried”

So many people I meet are still spending like drunken soldiers in WA and it will be a good time to have plenty of cash in a few years.

http://www.3news.co.nz/Young-Kiwis-leading-influx-from-Australia/tabid/423/articleID/308347/Default.aspx?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+co%2FMvia+(3News+-+International+News)

Ireland and Australia are not alike at all.

Our Housing Bubble is more aligned with the Canadian Housing Bubble IMO.

Australia may be more aligned with the Canadian Housing Bubble that is now popping in my home country:

http://www.greaterfool.ca

The latest numbers from RealNet Canada paint a picture of rapidly dropping confidence. In Toronto, Calgary and Vancouver purchases of residential development land plunged in the first six months of the year, at the same time sales of new houses and condos slumped by more than a third. Land buys tumbled 51% in Toronto, 52% in Calgary and 30% in Vancouver – a clear sign, say insiders, a big slump’s coming for housing.

It is 2008 all over again but with gov with less money to hand out to keep it going.

AverageBloke @ 30.

I would have to disagree with you on that call. I lived through the boom and bust in Ireland. Came out to Brisbane in 2008. Whats happening here is very similar to what happened in Ireland. You only have to ask any Irish person living in Australia who moved down under during the past 5 years. I bet my hard earned dollars very few of them will ever buy a house in Oz after what happened in Ireland. Mind you, 90% of them probably couldn’t afford the ridiculous prices. I’d say the only people buying houses now are rich Asian investors looking for a place to hide their cash. When mining investment stops….the party is over my friend.

Poor poor Australia. Too small to understand what the international community is doing to you with it’s low rates and easy money. Just like every other country that’s had low rates shoved down its throat its going to cause massive spending in housing and misallocation of resources. Guess watching every other country who got exposed to low rates and then suffer a financial meltdown won’t be enough to stop Australia walking down the exact same path…

@Damian

I wish I was wrong mate but the fact is that Ireland doesn’t have the millions of tonnes of minerals to sell off like Australia has.

Yes, you are correct that the mining investment capex boom is over. However, that does not mean that the core demand of billions of dollars of mining exports has ceased nor will it.

Australia is very similar to Canada who also has a rampant property market and substantial mineral wealth(Alberta Tar Sands).

P.S Doug Cameron admitted on TripleJ’s Hack Radio show that he is constantly get asked about Negative Gearing in relation to Australia’s Housing affordability crisis.

http://mpegmedia.abc.net.au/triplej/hack/daily/hack_wed_2013_8_14.mp3

We are shopping for new insurance for our rental place so I post something on Facebook to see are there any recommendations. We just have one property but we are living overseas now. Anyways I couldnt believe the number of people who owned rental properties. I mean it was massive the number of my friends in Australia that had 2-3 or more properties. It was amazing. I can see now how massive the problem is there now. I thought to myself how so many of these FHB are priced out of the market. Amazing.

@ Average Bloke

Nice find…

You do get the feeling Doug Cameron knows the score with NG. If we all push with it, slowly but surely NG will become a mainstream issue.

Only Sydney is on fire. The rest of the country isn’t booming – see charts below:

http://australianpropertyforum.com/topic/9939081

If house prices take off like they did in 2009-2010, the key question is what will the RBA do? When does this new boom threaten financial stability or inflation?

For property values to accelerate further, credit growth needs to move decisively towards 7 percent per annum growth the current level of 5 percent.

Within a year we could have a situation where the economy is struggling to grow as mining falls off the cliff, iron ore crashes, the Aussie dollar is still too high, yet asset prices are booming out of control and financial stability is seriously undermined.

What will the reserve bank do?

NG Fail discussed on The Drum.

http://www.youtube.com/watch?feature=player_embedded&v=d35dt8Vlbs8

Further to what I said above, I think that I will give these people my vote in the upper house.

We possibly do not need anymore examples, but just in case, the low interest levels ‘potential property spike’ has clearly not reached Adelaide. Best mate due to marriage breakdown is selling the family home. Last night revealed purchased for $750K in 2010. Had first open yesterday, and on real estate websites for a range of between $685K-$745K.

Skichaser, I’m sure Nine News Adelaide said tonight it’s boom times…. http://www.youtube.com/watch?v=LWM6mlkabuI – Not sure if the story is ‘advertorial’. You will have to let us know if it sells in a jiffy.

http://video.foxbusiness.com/v/2609225882001/time-to-bet-on-the-euro/?playlist_id=937116503001

http://finance.yahoo.com/blogs/breakout/walmart-earnings-miss-exposes-collapsing-economy-davidowitz-142435260.html

since we r talking about Adelaide housing, i just want to add that one of my friend lost 70k from selling his house, and the other one lost 60k. P.S. none of them were on mortgage.