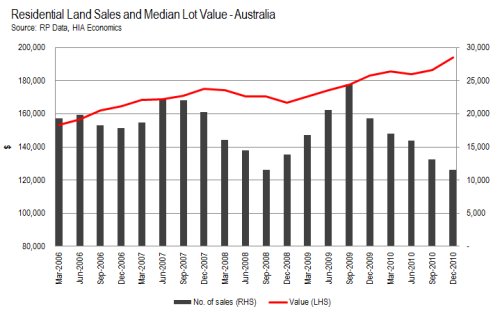

Figures from the HIA-rpdata.com Residential Land Report show the number of land sales in Australia has fallen sharply, reaching levels not seen in a decade.

Sales of land for the 12 months to December 2010 has fallen 40.4 percent and is believed to be due to severe un-affordability reducing demand, although Tim Lawless, Research Director at RPdata said “with land prices continuing to rise the fall away in land transactions is clearly supply related.”

Regardless of if the issue is supply or demand side driven, one thing is certain. HIA Economist, Matthew King says “The sharp drop in the volume of land sales signals a very weak 2011 for new home building.”

Note : The Federal Government announced the boost to the First Home Owners Grant in October 2008. First Home Owners who choose to build received a further $14,000 on top of the existing $7,000 and before any state based grants. The grant expired on the 31st December 2009, and required owners to enter into contracts on or before the 30 September 2009 to obtain the maximum benefit. Do you see any correlation in the above graph?

» Land sales fall to 10-year low – The ABC, 18th April 2011.

» Land sales fall to lowest in decade on high costs – News Limited, 18th April 2011.

» New home slump looms as land prices soar, pushing sales to their lowest level in a decade – The Australian, 18th April 2011.

I’m not an economist with the HIA, but the graph of turnover sure makes it look like demand side.

Introduce a grant in October 2008 – demand and hence turnover increases.

Take grant away in September 2009 – demand and hence turnover decreases.

Am I missing something?

How is the government going to keep the property bubble afloat now. Intergenerational mortgages, 36 month interest free loans from Freddie Wayne and Penny Mac? Teaser rates and NINJA loans. Good luck with that.

The government has already backstopped at least $8,000,000,000.00 in mortage creation to support the dead RBMS market. Might be alot higher now as not alot of truth comes from our elected leaders.

Deflation is resulting from a lack of credit growth, some call this a soft depression.

Australia has no shortage of land on which to build, ever drived across it? OMG

At some point in the future land will reflect an affordable price which new homeowners are willing to pay for. Until then, enjoy the show.

I think Mr Lawless is engaged in wishful thinking. I don’t see any shortage of land available for sale. I do see a lot of generation Y deciding that buying property is for suckers.

The First Home Buyers Grant is like viagra for the young and the effect wears off just the same.

There may not be shortage of land in Australia BUT the land made available to build by our “heroic” town planners is another story. These faceless bureaucrats have ensured that we had a shortage of supply of available building land. Reform is desperately needed in our local planning departments the red tape is costing the community dearly.

Fred you have no clue what you are talking about. Unless you want to see houses stretching from the east to the west of the continent urban sprawl somehow needs to be contained, especially in a scenario where investors are land-banking or over-building for the sake of a quick buck. Last time I checked, this country has a population of merely 22 million, its not like we’re splitting at the seams. The size of Melb, Syd, Bris etc SHOULD be enough one would think.

Government departments, ie councils, immigration, politicians etc are the reason why the Gillard/Swan team are pushing for more tax. These departments are sucking-up so much revenue that it is behond a joke! I read recently that the public sector in Tasmania cost more to run then the total GDP in that state!. All the while continuing to giving themselves pay rises and providing poorer services.

Fred, I’m not sure whether you’ve actually been looking at buying development sites lately but there are craploads of them – probably a couple of decades of supply available.

http://ckmurray.blogspot.com/2011/04/no-evidence-of-supply-side-constraints.html

http://ckmurray.blogspot.com/2011/04/housing-supply-follow-up-more-evidence.html

And approvals are not a problem either. Since 2002 for example, the stock of approved subdivision lots yet to be sold has gone from 12,800 to 30,500 in SE Queensland. That’s 18,000 more approvals just for residential land subdivision than the market could absorb.

In fact, there ar at least 88,000 approved residential dwellings (land lots and apartments) currently approved in SEQ. It’s going to take a long time to absorb that already approved supply.

You might also be interested in this discussion of the interaction of planning, supply and prices

http://ckmurray.blogspot.com/2011/04/8-lessons-on-planning-and-housing.html