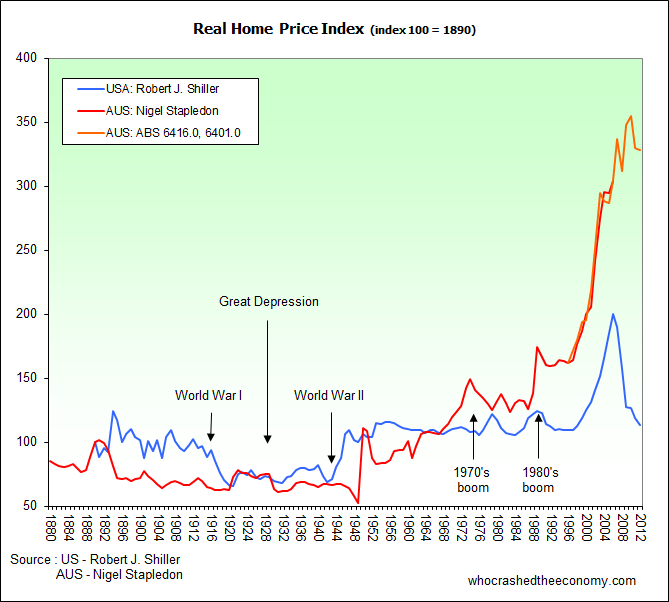

While the property lobby is saying it is never a better time to buy following a single data point showing rising house prices, a look at real house prices (corrected for inflation) raises a lot of concern:

Making the above statement in the United States, however, is much more convincing. After the U.S. housing bubble popped spectacularly in 2006, house prices are now only a few percentage points away from levels recorded prior to the boom. But with such a large bubble, there is a real possibility the U.S. could see the market over correct.

Earlier this week, Mike Shedlock of Mish’s Global Economic Trend Analysis wrote the following in a blog post titled, “Shades of 2006: That’s What Australia Housing Bubble Looks Like From US Perspective

The Australia housing market did not bust when it should of and the delay is going to be painful. The bigger the bubble, the bigger the crash, and the Australia bubble is bigger than we saw in the US.

On a timeline basis, Australia is about where the US was in 2006, essentially a state of denial.

Read more here

That graph says it all.

Negative Gearing is the reason why we haven’t followed the U.S.A

Looks like its time to pay the Piper………………………………..

sshh … quiet as a mouse … unless it comes tumbling down

It appears that Australian housing has reached what looks like a permanently high plateau

That’s right Brian because we the taxpayer are propping it up via NG and ponzi grants. But shhh don’t ask Wayne Swan about Negative Gearing, he’d rather talk about his Bruce Springsteen record collection.

NG is only part of the problem. Eventually even all of the potential NG’s are debt saturated.

Zero aggregate credit growth is the end game… IMHO.

Equity in dwellings is is not real until a transaction occurs.

A buyers deposit + buyers credit – exisiting seller debt = equity for the seller

Do the math when credit growth = zero

@Peter & Average Bloke..

Agree totally..Once people holding NG’d properties realise zero growth over a prolonged period they will start saturating the market with more properties 4 sale, thus increasing supply and pushing prices down. Apart from credit growth at it’s lowest level for 35 years, unemployment is the key ingredient, and as long as people are employed and can afford to NG their properties many gullible people (a large % of us Aussie’s unfortunately) will continue to do so at the expectation of gains in future.

If employment were around 9% like the US, then you will see a much different story…and a crash hit much sooner..

@ Domenic

1.44% new dwelling construction rate (130,000 / 9,000.000 = 1.44%) at a price of 2.93 X GDP = 4.22% of GDP dwelling construction rate

Dwelling credit growth is 0.3 – 0.4% per month on 86% of dwelling debt/GDP = 3.14 – 4.2% GDP dwelling credit growth

Construction margins are presently 0 – 2%

There have been hunderds of construction companies go insolvent or bankrupt this year

There is barely sufficient credit being created to purchase all the current dwellings being constructed and ZERO net credit to fuel equity expansion in existing dwellings.

It looks like game over to me.

@ Domenic et al

http://www.rba.gov.au/statistics/frequency/fin-agg/2012/fin-agg-0112.html

http://www.rba.gov.au/statistics/frequency/fin-agg/2012/fin-agg-0212.html

http://www.rba.gov.au/statistics/frequency/fin-agg/2012/fin-agg-0312.html

http://www.rba.gov.au/statistics/frequency/fin-agg/2012/fin-agg-0412.html

http://www.rba.gov.au/statistics/frequency/fin-agg/2012/fin-agg-0512.html

http://www.rba.gov.au/statistics/frequency/fin-agg/2012/fin-agg-0612.html

The RBA continues to LOWER the effective mortgage interest rate and Housing Credit growth continues to decline. In fact on a monthly basis it has almost halved from 0.5% to 0.3% in the 6 months to June

The Net Equity for a dwelling seller = the buyers deposit + buyers new credit – sellers old credit outstanding

ZERO credit growth in aggreagte means buyers new credit = sellers old credit, therefore the sellers equity = buyers deposit

But our state premier (South Australia) says it’s because of bureaucracy that builders are struggling…they are going to rush through approval on new projects eg. multi story apartments in the CBD.

Seriously, by producing more residential living space, how is that going to help the residential property market?

This property collapse is one hot potato that no-one can hold on to.

This is in my top 3 figures of all time on the housing bubble. It sits nicely when put next to Prof Keen’s figures and is simply bear porn that I can ogle at all day.

In fact, posting on BP now…

Keep up the great work. Cheers Bob