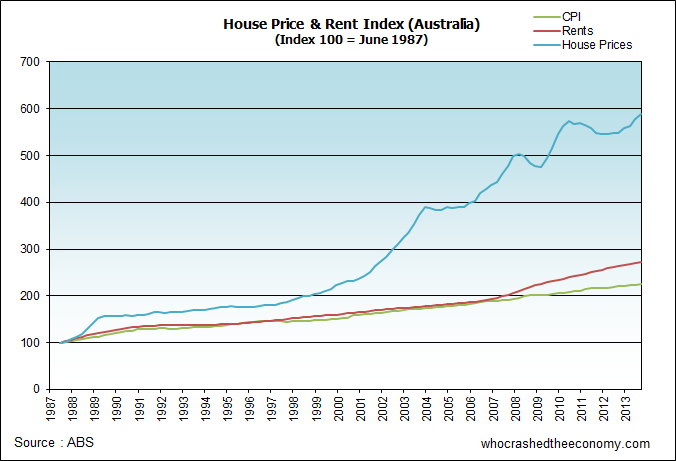

Record low interest rates have put a rocket under the Sydney property market, propelling yearly growth to an unsustainable double-digit 11.4 per cent according to official figures released from the Australian Bureau of Statistics (ABS). The size of the Sydney market has helped prop up the rest of Australia, with the weighted average of the eight capital cities returning a frothy 7.6 per cent gain for the 12 months to September.

Canberra and Adelaide is still in the doldrums going backwards 1.2 and 0.6 per cent for the quarter. Perth (0.2%), Darwin (0.4%), Brisbane (1.2%), Hobart (1.4%) and Melbourne (1.9%) reported modest gains, while the red hot exuberant Sydney market fired up a 3.6 percent result and fears of a new bigger property bubble.

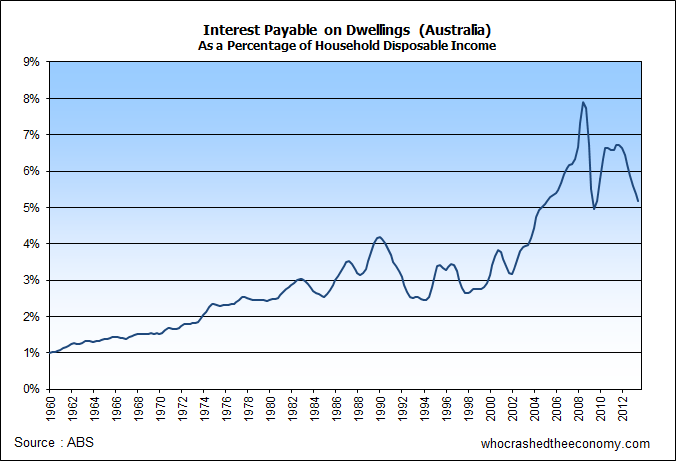

Record low interest rates have seen interest payments on dwellings plunge in recent times, creating a false economy as the uneducated leverage back into the property bubble. Few consider the prospect, interest rates could ever rise again.

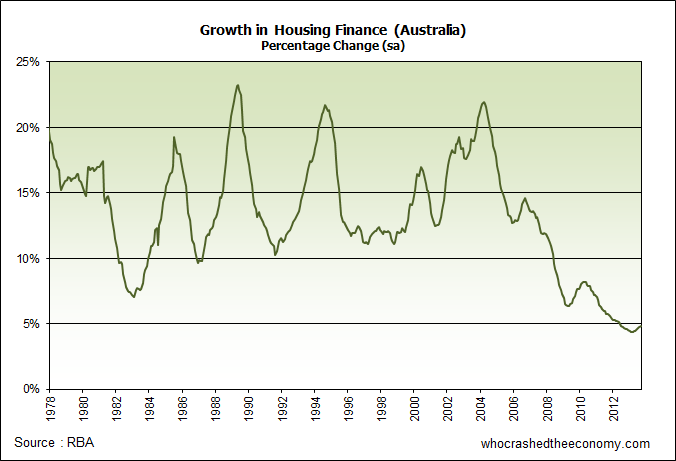

This has seen an up-tick in the growth of housing finance, after scraping lows not seen since records existed 37 years ago.

All eyes will now be on the Reserve Bank of Australia to see how it intends to react. Will it be forced to follow in the footsteps of the RBNZ and implement macroprudent controls?

» 6416.0 – House Price Indexes: Eight Capital Cities, Sep 2013 – The Australian Bureau of Statistics, 4th November 2013.

Too bad the A dollar is too high. Otherwise the RBA could be in a position to consider putting rates up tomorrow. Retail sales look positive too.

I doubt politicians will implement any serious controls to curb the rise in house prices. Many are corrupt and indifferent to any sense of reason and logic and answer only to their important bank/real estate industry groups who provide money into their political campaign funds.

SPREAD THE WORD-DONT BUY NOW!!

No offence but get a job that pays more. If house prices go up 11.4% and you spend all your wage on housing then demand a wage increase of 11.4%…

It’s pretty basic economics. Even if house prices crash you’re still going to have a wage that’s at the top of the rung.

Stop winging at the bottom and do something about it if your dream is to own a house go do it.

Who cares first home buyers make up 6% of the market and 5% of the financing.

Housing isn’t a government utility.

It’s PRIVATISED. Don’t earn enough for a mansion in the bay? What’s that? You’re and accountant and your wife’s in child care? What did you expect to afford… Get a job in construction or politics and see how much people have to sweat and stress to get to the top spots. It’s not pretty. You miss birthdays, you pick up alcoholism or drugs, you have your first heart attack at 36, you’ve been married and divorced twice. With 3 kids to two women.

Hard work is always rewarded.

But if your job is to clean up horse shit all day it’s not going to matter how hard you shovel, at the end of the day you’re still shovelling shit.

We give everyone the opportunity in Australia to stand up and make something of themselves. To become more than they might have by themselves. We take the drinks the inbreds the crims and we try to make them more. Stop complaining because everyone is given the opportunity to become anything they want. It’s your choice to if you want to suceed or spend a lifetime winging about how unfair it is.

Macroprudent controls? Didn’t you hear? Joe Hockey and the RBA said no housing bubble here so no need for any of that haha. Although smokin Joe did criticize Labor for too much debt and then just went and raised our debt limit to 500 billion so who knows?

Will be interesting to see what happens when interest rates start to rise.

Forgive me for sounding too conspiratorial, but I wonder what would happen if the US economy eventually collapses? I realize we are here in Australia, but given the fact the US economy affects the rest of the world, if the US economy was to implode, that means the US buys less of Chinas exports, who will in turn buy less of Australia’s mineral exports.

With Australia’s economy heavily reliant on China buying what Australia digs out of the ground, if the Chinese economy slows (because of the US), then Australia is screwed.

@Placeholder

no offence, but nobody is ‘complaining’ here. we are just NOT BUYING NOW!!!

FYI, i DO have a job. me and my partner have our own small business, and we DO earn just shy of 200k before tax annually, and average house here in Adelaide is around 400k. but we are NOT BUYING NOW. we simply just don’t wanna throw our hard(maybe not as hard as average working bloke) earnings away.

we only pay $380 rent for a brand new 3b2b2g house in a decent suburb here in Adelaide, no council fee, no water fee, no bank interest fee, no plumber fee, no electrician fee…etc. believe me or not, the rent here in Adelaide still dropping.

BTW, ‘If house prices go up 11.4% and you spend all your wage on housing then demand a wage increase of 11.4%.’ is NOT ‘pretty basic economics’, is just pretty basic stupidity, u even fail primary school economy class.

@Placeholder. In my experience anyone wishing for hyperinflation is up to their eyeballs in debt and want inflation to wash all the debt away. Am I right?

@ DX

Agreed. Pretty clear that someone stating it’s as easy as getting a better job purely to afford housing doesn’t comprehend the problem.

@ Nexus789

It will be a repeat of what occurred in the USA in 2006. Rates rise, domestic economy continues to slow, unemployment rises, then a slow weep of foreclosures explodes into a tsunami with a trashed local economy, high business and personal debts, government bail outs of all manner of privatized sectors leading to a totally unsustainable government balance sheet.

Ironically the USA is back in a housing bubble of sorts with it’s recklessly loose financial quantative easing. And as for the stock market bubble, that’s just plain out of control.

I’m with DX here, I personally think the most important assets for any Australian at the moment goes something like this (will vary depending on personal situation)

1: Ability to create income: By create I mean rely on yourself for income: not some boss, not some government subsidized job, but the ability to say “I can see that I will be able to sell x widget at a profit of $y” and do this to cover your expenses.

2: Access to finance: whether

personally funded

credit

other peoples money

Remember most Australian’s don’t have real cash in the bank in excess of their liabilities. Most peoples credit will be trashed when SHTF. And access to other peoples money? Hell it’s hard enough to find investors for small \ medium business now, do you think it will be any better in a once in a life time recession?

That’s it! No cars, houses, holidays, boats, 80 inch tv’s, fancy clothes etc. etc. It’s all froth. If you have the means, then I’m all for enjoying it: But if you don’t, then don’t expect sympathy from me.

The main mistake I see is that people don’t value their ability to get credit: I see it in my industry constantly: The rep’s are complaining about how far behind customers are on their accounts: When SHTF do you think these guys are going to be supportive of their struggling customers? Hell no, but the clever guys expand during tough times, and to do that you need great credit: I make sure my suppliers get paid before me: CONSTANTLY. My ability to get credit is more important than having a nice TV at home.

@DX I’m also in Adelaide: Perhaps we should catch up over a beer? 🙂

Hyperinflation? It’s going to happen wether you like it or not with rates at 2.5%

Get on the right train and keep up with the transition or you’ll be one of the people stuck in a job at minimim pay with the government giving you 2.5% pay rises because by their calculation most government employees already own a house and hence done need their wage increase to keep in line with house price inflation. The govt is the biggest business In Australia remember and they use any paper or excuse to keep wages as low as they can.

Also. Seriously? You guys are on 200k and you are advising people to ‘not buy now’ when any financial planner would tell you to ‘BUY NOW’ while in your area house prices are only 2x your income AND loan repayments on 400k at 20% down @4.75% is $400 a week. I call BULL$HIT on you mate.

You pay $380 rent

Repayments on a house would be $400

And you choose to rent.

You have to be mentally retarded. You’re fishing to keep people renting.

@pete

Nope. 0 debt. Bout 200k in savings in a bank in Venezuela in USD at 13% interest gettin about 10+% back tax free.

Another 100k in NYSE ishares 100eft after the meltdown at 15% got 18% last year. Which was cool. Again overseas and saying over there tax free.

Remaining 60k paid the 20% on a unit in Perth for 500p/we giving about 8% returns. Now bad but it’s paying the unit off for free.

I’m just saying that all the replies scream ‘don’t buy don’t buy’ when it should be. ‘Make your money work, fk Australia off, but if you must, buy buy buy responsibly so you end up on top.

Telling people ‘I’m on 200k and we say don’t buy’ is sending the wrong message. It’s going to leave people renting and leaving their money in crap interest accounts trying to save but they are making a loss.

PS I’m 27 next month. Dare you to find anyone out of uni who’s been out 5 years and paid off their hecs and has almost 500k in positively geared assets. Ie has paid off a house. All because I didn’t invest in Australia. Granted I live at home still and don’t pay rent but I know how to make money and paying rent or interest out of your real income is a fools game. May as well spend your income on booze, smokes and hookers.

@ Pete

Spot on! Things are even worse when one have inter-connected global economy with interest groups proposing for no barrier to trade.

+ Will the “hyperinflation” be contained in one place or move across borders?

+ Will other place retaliate or perhaps even worse they are just too “ignorant” to realize it in the first place (hence, they are left off-guard)?

+ Even if they realize it, do they have the socio-economic capacity and socio-political maturity to respond to such an event?

I doubt so …. with an exception of few advanced and “older” countries. What are the proportion between “old” and “new” countries across the world?

@Placeholder – What planet are you on? You are so totally misguided, misinformed and mystified, it beggars belief. Perhaps if you read more of this blog you might learn something, like, erm, the truth maybe!

@ Placeholder

Sorry to be blunt: But don’t be such a know it all: When you clearly aren’t.

Hyper-inflation is a politically induced situation: Interest rates are not the cause. Every case of hyper-inflation through out history will show this.

Obviously you can read the books your wage earning lecturers pointed you at. Do some research: And don’t be so cocky: At 27, you have to make your pile last another 73 years yet….just saying. Can you be sure you can make money so easily when this credit boom is in full scale reverse?

“Hyperinflation? It’s going to happen wether you like it or not with rates at 2.5% ”

I have to laugh at that one. 2.5%!. The U.S. has a ZIRP and is printing 85 billion a month via QE. They can only get 1.2% inflation (September, 2013) – below the Fed’s target at 2%. Don’t underestimate the effects of crimpling debt. Cash rate at 2.5% LOL.

http://www.businessspectator.com.au/article/2013/11/6/economy/what-central-banks-are-really

@Placeholder – Oh, you’re 27 and still living with your parents? That explains everything. You sound like one of those rich kids I went to school with back in the UK who thought it was acceptable to live off the misfortune of others, probably with daddy’s capital. Anyway, I’m happy for your good fortune, as I’m sure you’re worked really really hard for it. Now please go away and gloat somewhere else – the rest of us have bills to pay!

Haha when the Fed stops the

$85B NYSE will crash. the people that have lot of money and asset will far worse off as need us working people to feed off. Will not be able to handdle the hard times.

Placeholder. You are an outlier (if all you claim is true). The trouble with where we are at if you ask me, is that we have a system where outliers, exceptions if you will, are put upon pedestals as shining examples of what we are ALL capable of achieving if we try hard enough (or demand high enough wages as you put it). The reality that the current state of affairs can’t handle, is that you cannot convince everyone (for eternity that is), that this is true. Call me bitter, a loser, someone incapable of earning enough money, but this is the reality that I, as well as many others face.

You must also realise that as an outlier, you may be taking your status for granted. Be very grateful to all those who have contributed to your current position. Very, very, very grateful. You must also realise, that if everyone were to be in your position, then houses would be 10 times what they cost now, and the other guy who was just that much luckier than you would be saying to you, pretty much what you are saying to people here.

It’s a vicious cycle, isn’t it my friend.

I’m watching with interest to see how this will end. As someone who could buy but never will (not at these prices) and has no debt (but you need a credit card…) it amazes me the amount of people willing to pay hundreds of thousands of $$$ for a house so they can say they “own” it.

We have been pressured by everyone under the sun (get in now etc. etc.) to buy, and yet our life wouldn’t be more fulfilled by owning a house.

Will it crash? (who knows).

If it does crash, when? (hmmmm, 2016/2017?) we have always been behind the u.s when it comes to these things.

@meck01, same here. Working hard and saving well at the moment. People say prices haven’t fallen but earlier this year I noticed significant reductions in Sth East Melbourne. now it’s on the upside but you have to be patient and they will slow down again. When that happens I will buy, and a downturn will not affect me.

Another newsltd re spruik dressed up as news.

http://www.couriermail.com.au/realestate/news/paddington-and-manly-same-names-big-price-difference-between-brisbane-and-sydney/story-fnihpu6h-1226756171416

And another…

http://www.smh.com.au/money/investing/benefits-of-buying-interstate-20131105-2wxs0.html

Gotta love this quote…

”

The problem with buying close to home, according to Lomas, is that we believe we know the area when we may not actually be as knowledgeable as we think. Interestingly, she also says seeing or inspecting a property is not always a good thing.

”I think actually looking at a property is dangerous, because it allows you to have an emotional buy-in,” Lomas says.

”

Come on everyone! what are you waiting for? Don’t go on an inspection, just pick up that phone and jump in! Don’t miss out!!!!

Jj

Ralph has seven houses and he pays someone else to spend his money or incress his debt. Silly Ralph.

Don’t look just buy buy buy.

In todays Sydney Morning Herald, there is another report on how Sydney’s property market is going ballistic with people paying huge amounts of money for homes.

What I can’t understand is the contradictory messages we get from the media. On one hand the economists and politicians are telling us how great the economy is, but at the same time the media are also reporting massive job losses and rising unemployment.

With steadily rising unemployment, no job security, and wages that are simply not keeping up with the cost of living (especially house prices), how are people going to able to service a massive mortgage??

This is madness: I now personally know of several people who have quit their investment properties and the one thing they have in common “We didn’t make much, but it’s a huge relief”.

And I know some of them, if they did their sums CORRECTLY (ie. factor in interest repayments, insurances, rates, fees, stamp duties etc) are well and truly behind. Even with interest at 2.5% or what ever you earn today, they would have been better off with money in the bank, and they wouldn’t be scared to answer the phone every time it rings in case “It’s the bloody rental again! Such and such (insert item) is broken, leaking, stuck, smells, cold, out, off etc”

As for don’t inspect a property if you’re thinking of buying…WTF?

Seriously? Maybe I’ll buy some shares in a company with out doing any research. May be I’ll buy a small business with out checking it out. Hell, maybe I’ll jump on the next IPO, because people always do well out of them…

Makes me laugh, people will jump online to save $5 on buying a low cost item (at the expense of local employment), but they will drop 1/2 a million dollars on a property they may have never seen! And usually, that 1/2 a million dollars isn’t even theirs! It’s borrowed, and then that’s often mortgaged off another ‘asset’. It’s a great mathematical system that works great in booming asset/credit cycles. But the downside when the system goes against you is just too large a risk. The average punter has no idea how exposed they are: Hell, even the safest (lol) banks in the world (ie. Australian) can’t determine how exposed they are:-How and Mom and Pop meant to calculate that?

The rich get richer and the poor get poorer: Now I believe almost any Aussie can be wealthy if they work the system sensibly: But what we have seen is this:

The poor were encouraged to pour their money (from their physical and mental labour) in to consumable items, then into the stock markets, then into super, then into property (now using their super to borrow to get into property: the greatest trick in the world!). And at every stage the rich are skimming from the top: They own the business you consume from, they started the companies that you bought shares in, they own the property development companies, they own the finance companies that you give your super to, they own the banks you pay interest to, and now they own the finance company that uses your super to borrow from the banks to buy property. It’s fantastic! At no stage do the rich have to do anything amazingly innovative or at the other end forcibly to get the money from the working poor/middle class:-Society has built itself to automatically feed the profits from all sectors of life to the rich.

It you have people, using their super (life long savings remember!) to borrow into newly developed housing, you have performed the greatest fete in finance: Using a persons life savings as a deposit to borrow hugely to purchase an item that was created for no reason other than ‘investor demand’ from a parcel of land that cost little, with a house that cost little.

It’s ironic that the people who will get burnt the hardest by this property boom, are the ones who can least afford to have to rebuild their finances for retirement. While the rich will simply go and lease a new Ferrari (cos why pay cash, when they can go put that cash to work in a business that will bring more in).

This is sure going to be spectacular: But it’s still a while away yet.

I hear what you are saying but I’m actually all for encouraging investment in ‘NEW’ property.

Problem is that the tax system encourages speculation on existing property.

If I remember correctly, over 90% of negatively geared property investment is tied up in existing property.

Duuuuuurrrr!

“The Crisis as a Classic Financial Panic”

http://www.federalreserve.gov/newsevents/speech/bernanke20131108a.htm

Well I spent half my money on wine, women and gambling and wasted the rest on housing.

…lived off $50 of food a week…

i feel really sad for them.

http://www.dailytelegraph.com.au/news/nsw/we-lived-off-50-of-food-a-week-gave-up-our-social-lives-and-saved-every-last-cent-to-raise-our-house-deposit/story-fni0cx12-1226756356862

@DX, thanks for that link, and whilst you have to admire that young couples determination to enter the property market, may God help them if either one of them loses their job/or interest rates go up.

@29 – I feel sad for them too, and there are more misguided idiots out there who will continue to inflate this totally unnecessary bubble. This Australian OBSESSION with owning a home is wearing very thin and seriously pissing me off. Caveat emptor people!

@DX interesting article…

I’m still trying to figure out if it was sponsored by a supermarket chain for the recipes or by the RE industry lol.

@Placeholder…

Here’s a reality check for you. Pass it round to all your mates too! They’re more than likely drinking the same fluoridated tap water as you are.

The Biggest Scam in the History of Mankind

http://www.youtube.com/watch?v=iFDe5kUUyT0

Find out what GOMO stands for.

http://theage.domain.com.au/real-estate-news/housing-blues-in-redhot-market-20131108-2x77f.html

According to SQM Research stock in Schofields is up, prices have not really moved in the last few years and rents have fallen below 400pw.

How much are Mirvac paying this “Senior Real Estate Reporter” to trot out these misguided individuals?

I don’t feel sorry for them I think good on ’em. Sounds like they saved hard & although I think they paid way too much in this climate & probably borrowed too much I wish them luck. If they can live on that they might make it but yeah if (when) times get tough prob not such a nice outcome but they are young & trying & fooled into believing the ‘don’t miss out’ hype.

I wished I saved harder when I was their age & property was reasonable. I guess it’s the world & market they’ve inherited & not of their doing so we should be kinder to them…

@ Letitia – that’s compassionate of you, but they are still junk-food eating, Today Tonight watching, Daily Telegraph reading idiots, and it precisely people like this who are inflating the bubble. If we all stopped buying, the bubble will burst – FACT!

For anyone that’s interested Negative Gearing was questioned on Q&A last night.

http://www.abc.net.au/tv/qanda/video-questions.htm#id=b3ce1047-c507-4360-bc5f-69e726d13abb

Surprisingly the panel agreed that NG tax breaks need to be ‘looked at’ but concluded that no political party would address this glaring problem for fear of a investor backlash.

Very sad, the aussie dream is truly dead.

Interesting numbers of stock on market in outlying areas of Melbourne. Realestate.com.au is worth a look in their map view.

Things must be getting bad when i see 100+ properties for sale in Apollo Bay and Lorne! Geelong also has heaps for sale.

@ Realist

Awesome! Awesome! Awesome clip. I thought I knew the system pretty well, but this took it to a new level.

Now….to create my own bank

@DX

http://www.dailytelegraph.com.au/news/nsw/we-lived-off-50-of-food-a-week-gave-up-our-social-lives-and-saved-every-last-cent-to-raise-our-house-deposit/story-fni0cx12-1226756356862

that link

A HEAP of people have been submitting comments and a heap of them are getting deleted.

There are random comments that say ‘congratulations, ignore the complainers’ but there are no complaining comments before them lol. They are cleaning up shop to make it look as easy as pie.

Someone posted a comment about the loan repayments and calculated how much they earn from what they said and it looks like they took out a loan for 10x their income and like 80% of their pay after tax.

I remember an identical article about a ‘couple’ in Perth doing the same thing with the exact same spin about how its affordable. They built out in the middle of no where. I remember the photo because it was a red English phone booth. One I had seen in the reject shop. The couple were pale as ghosts fresh off the boat from England. Heaps of comments telling them they just did the stupidest thing ever. They should have gotten advice because they were now flat broke for 30 years and couldn’t have kids.

This isn’t going to end well… I have a feeling, now that first home buyers are at their lowest point in recorded history no one else is buying but investors buying from each other which we all know just causing inflation, bubble and a pop. Just like every other country. I really feel sorry because I have a few friends who work hard, in steady jobs, day in day out just to make ends meet who bought a house and they don’t understand economics, or bubbles. All they know is how to work and be dedicated. Those are the ones who are getting screwed and its not fair or right.

Cant see this madness lasting more than a year. 12% growth year on year in sydney? even Ireland, spain, or the US didnt get that bad.

Is anyone familiar with Martin Armstrong and his Economic Confidence Model? If you scroll down on the link, you will see ‘The Real Estate Business Cycle’. Here it appears that there will be a huge contraction coming from 2015.75! Any thoughts? http://armstrongeconomics.com/models/7219-2/

@ Average Bloke

I just watched the program, and I agree some of the commentators suggested no party would touch modifying/stopping NG, in fear of a backlash. However I was relieved that all of them really had concerns about NG, including a home loan mogul.

But I could not help thinking that it was a small step forward, since the last NG query with Julia Gillard, and the blunt response offered. Slowly but surely this is becoming a mainstream issue, that soon will not be ignored.

We can only hope…

@ SkiChaser

Yeah mate, it was quite a moment. Especially when you consider that Aussie John was in agreement that changes needed to be made to NG along with the usual ‘red tape’ supply issues. This is a man who has made squillions (he has a 50million dollar house) with investor home loans, and yet even he thinks NG needs to be changed.

Sadly, though I think it’s still a numbers game with regards to political action. The investors and home owners still outnumber the FHB’s and renters and the politics reflect this.

@33. Average_Bloke, that article is confirmation that cults label those who are on the outside. I’m sure many will see the day when GOMO either means, Grief Over Mortgaged Out, or similarly, Grief! Over-Maxed Out.

@28. DX, Good grief. I can just imagine them waking up one morning, breaking out into an argument on who left the laundry light on all night.

The government will never. Ever. Ever. Get rid of negative gearing. Ever.

Your only hope to get a house is

a) parents die and leave you one

b) parents pay for your 20% deposit and some of the repayments while you still live at home with them.

c) you win the lotto

d) sister wives style. Get 3-5 incomes working to buy a unit in the city. Then at the end of each night crawl into bed like hamsters.

You know… Spain, Ireland, dubai, us, Japan, all had tax kickbacks for owner/investors too.

Not the same ‘law’ but they all caused the same effect. Disengagement of house prices to wage growth. And BAM. You got a artificial bubble created by the local government.

What’s worse is, if there’s even a hint of a whisper or a farts chance the words ‘negative gearing’ came up in parliament the australian housing sector would collapse instantly.

They all know it. They all see it. The Henry tax review told them about it. At the moment people who have the equity to buy more housing do so tax free. Which is wrong. Essentially you buy a house in australia, don’t have to pay for amenities and services while the people who pay tax foot your bill. Then once they’ve built a new school and shops you sell it and make someone’s kid pay triple what you paid for the taxes someone else paid to improve the area. It’s insane.

Either way it doesn’t matter how it happened but disengagement of the house price from wages was what happened in Ireland, Spain, Japan, the US, dubai. That ended up great for those countries right? …

Australia’s different. Our banks are strong, just look at them! They are worth more than the US banks! SAFE! 🙂

It’s not like 65-70 of our assets are all tied up in housing, a non exportable depreciating asset… Wait… Shit….