Australians have enjoyed the second fastest wage growth of any developed economy over the past 13 years according to the OECD. Interest rates are now at record low levels not seen in almost 60 years. You would think the average Australian would be on easy street.

But a survey from National Australia Bank today reveals almost 1 in 5 Australians are living pay day to pay day, struggling to make ends meet. Of those, 70.4 percent are dipping into their savings and 40 percent have been spending on credit cards.

Why?

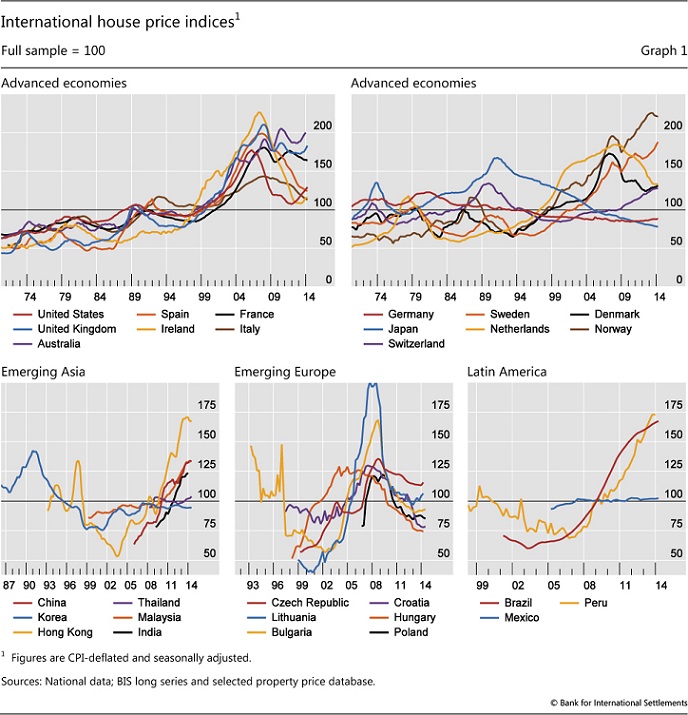

The answer can be found in the Bank for International Settlements (BIS) quarterly review on Residential property price statistics across the globe, released today, that finds Australia has the second most expensive housing market in the world, second only to Norway.

And the National Australia Bank’s answer to all this? Today it has teamed up with Good Shepherd Microfinance to loan people who find themselves in difficult financial circumstances, more money.

» Almost one in five Australians never have any money left over from their regular pay packets, according to a NAB survey. – SBS, 15th September 2014.

» Australia’s house prices second-highest in world: BIS – The Sydney Morning Herald, 15th September 2014.

» BIS figures confirm Australian housing overvalued – The ABC, 15th September 2014.

» Residential property price statistics across the globe – BIS, 14th September 2014.

https://www.moneysmart.gov.au/borrowing-and-credit/credit-cards/credit-card-debt-clock

The average Australian has $4200 in credit card debt according to the debt clock. Plus add on the mortgage and car loan. A really worrying situation when the economy tanks.

Fortunately unlike most gen y’s I pay off all my credit card bill by the due date and save 30-40% of my wage. Still can’t save fast enough for a house, but at least I’ll have savings when the bubble pops.

@Brad

You are aware that Australian’s have the highest personal debt of any country, right? Couple that with record local governments, state governments and the Federal Government all in up to their necks, with no stable budgets in sight…..

None of the countries that were hit hard by the GFC (USA, Ireland, Iceland, UK, Greece, Spain etc) had personal debts anywhere near where Australia is….

Is it any wonder Australia is regarded as the “Miracle Economy”……..In exactly the same way the Celtic Tiger was admired…….

Now…what’s that sound? It’s oil usage and world trade slowing…

Is there a chance to find a similar report comparing capital cities of Australia? I suspect it may come down to a huge surge for Sydney and Melbourne and relatively humble data for the rest.

Second??

SECOND??!!!

That won’t do! This is Straya! We bloody come first at EVERYTHING, mate.

Cut interest rates! Crank up Securency’s printing presses! Cut the banks’ prudential reserves to .1% of assets, open up the market to Chinese shysters looking for a place to stash their ill-gotten gains – lend lend lend! Buy buy buy! Australia for the win!!

@Brad, good on you mate, keep saving, your day will come. But at all costs avoid getting caught in the downdraft. Be wary of banks ‘bailing in’ your deposits, and try to diversify from the overpriced Aussie.

Alex, watch this space. I have graphs for last quarter, but I’ll get them updated and posted.

You will be surprised. On a price/rent metric last quarter, Adelaide was 48% overvalued, Brisbane 43%, Canberra 39%, Darwin 41%, Hobart 51%, Melbourne 61%, Perth 49% and Sydney 36%. (Australia overall was 45% overvalued on my metric – BIS said we were 50%)

@Matty yes I am aware of Australia’s debt situation. Net income to debt ratio of 150% is my understanding. We also have $5 trillion dollars worth of housing in Australia that if 50% overvalued means 2.5 trillion could be wiped out in a crash.

Its a scary thought. Another problem is I don’t have any idea of how to protect my deposits from a bailout of the banks. It seems people that have done the right thing and have lived within their means will be obliged to bailout greedy and stupid specuvestors.

@Still Renting. If you look at Norway, their bubble is deflating. Australia’s is out of control and rapidly inflating.

I give it to the end of the year – Then we will have the biggest housing bubble in the world.

How do we protect deposits?

“Australians have enjoyed the second fastest wage growth of any developed economy over the past 13 years according to the OECD…” who’s wage have they been counting to get to this result?

For the past 5-6 years, all I’ve seen is people’s wages decreasing, work hours cut, or job-loss. And reading about this too.

@1. Brad, according to MoneySmart – Credit card debt clock, CC debit is going down, other debt clocks will state CC debt is increasing, and is much higher. Who knows?

@8. Frankie, a combination of under the floor, fake walls, behind the kitchen cupboard, the ceiling, do you have a backyard with good privacy? I know all very silly suggestions, but your question crosses my mind always.

Go somewhere that has a good view of a part of Sydney, look carefully, then realise that there are no principled people (lots of lip-service though), no virtuous, no meritocracy, no sensibility nor integrity, not even commonsense. You’ll see hightides, king tides, and endless tsunamis of stupidity, baseless status, the self-deceived hence liars (lies to hide their incompetencies).

That’s your surround. That is what the so called system is built on, from political institutions (ha! democratic), banking and finance (cartels), education, religious, the whole catastrophe.

Frankie, I say do whatever it takes, and stay within the laws made on a culture as described above.

Good question, @Frankie. Definitely, keeping your money in AUD is not the safest way. But you’ll lose a lot on converting to USD or EUR, plus interest rate on foreign currencies is almost 0.

Hmm, I think this bull run has quite a ways to go yet.

Investors have been re-assured time and time again that no political party has the courage to tackle negative gearing.

The Chinese are not slowing down either. They can’t invest in Canada anymore and which country has the most pissweak foreign investment body?? Hint: You are standing on it.

@Pete – woohoo!

Australia FTW!

@Brad: one thing you can do is open a share-trading account which is linked to your deposit account at your bank.

If the banking system implodes, it is likely to drag the Australian dollar down with it. You can use your share trading account to move your deposits into securities which are likely to rise when the banking system and Australian dollar fall – such as foreign currency (via the Betashares ETFs) or foreign shares and bonds (via various other ETFs).

You have options, search them out. Don’t let the banks and the government use you and your hard-earned savings as a shock absorber.

Interestingly we can find $400 million a year to send troops and stuff to Iraq / Syria – the political priorities are clear. Imagine if we spent that money of roads, hospitals, and schools instead.

Nope, the priority is for growth through debt, and the governments early actions of getting rid of the debt ceiling should have been a clear indicator what they have planned for this country. The banking cartels won’t be happy until we’re all begging them to lend us more money.

@Frankie, find a good managed fund that specialises in overseas markets. They’ll manage your money outside of the AUD. At worst, they’ll preserve your wealth, at best you might make a bit off the weakening AUD.

11. Chinese are bargain hunters. If they see a weakening AUD, from their perspective the price of an Australian house in RMB is going down whichever way the market is going. They’ll stop their purchases as why would you buy now when the price will be lower in a year. Good reasons for those already invested to exist and look for better investments elsewhere. If they had no qualms moving money from China to AU, pulling out of AU and going somewhere else without a dropping market is equally easy.

My theory on protecting your deposits.

Keep your deposit in a reward saver account and earn 4% per annum.

When all 4 big banks share prices fall by 30% then take it all out and run.

@Frankie,

Please be aware that our official inflation rate is much higher than reported. This is eroding the value of the currency at a higher rate than the interest rate received at the bank. This is also the case keeping it in you mattress; inflation eats into its value.

The only way to protect you savings from a bail in or inflation is to have it outside the banking system.

prepper

@ Paul

I’d go one better, outside the FIAT fraction reserve currency system….

@ Matty if you are referring to crypto currencies ? I think that stuff is ridiculous.

http://www.macrobusiness.com.au/2014/09/china-clamps-international-dirty-property-money/

http://www.macrobusiness.com.au/2014/09/china-housing-a-bubble-on-eve-of-destruction/

@frankie

hell no! Although one does wonder if a privately created currency would be better managed than a central bank currency.

I mean in things that are unlikely to loose value in real terms. There are heaps of them and its not limited to just gold and silver.

remember that if you dont do what the masses are you are probably doing something right. So avoiding massive debt linked to items that are loosing value or likely to loose value or even have no value you are so far ahead of the game.

I was moving a lump of cash between banks and the “account manager” was amazed at the amount being moved and wanted to know how many properties we have: none. He was dumbfounded and wanted me to leverage up into property. I asked if it ever occured to him we have such amounts of cash because we DONT have property? He could not see the big picture. If im paying interest every week to a bank then whats in it for me? My interest from the bank pays the rent so each week my pay goes towards more capital not some bankers new SUV. But apparently im doing it all wrong and “really need to speak to one of our financial advisors”.

the public really are lambs to the slaughter

@ Matty,

You have gone one better,

Currently there is work being done on a gold backed crypto currency

http://therealasset.co.uk/about/meet-the-team/

prepper

http://therealasset.co.uk/forbes-crypto-article/#!prettyPhoto

prepper

Watch Mike Maloney’s 7 stages of empire on YouTube. Sums it all up nicely. Those who do not learn from history are doomed to repeat it. Just never been done on a scale like this

A gold backed crypto hrmmmm pass

Frankie,

I approach this new development with an open mind.

After 6 years its market cap is $6,016,922,864 and one is worth $452.99 there is now 13,282,625 BTC and will only be 21,000,000

https://www.youtube.com/watch?v=Cs6F91dFYCs

prepper