Treasurer Joe Hockey has once again demonstrated ignorance toward issues effecting everyday Australians, this time denying Australia is amidst the grips of a credit fuelled housing bubble.

His comments come almost a month after he said the fuel excise increase won’t effect the poor. The out of touch Treasurer told ABC radio, “The poorest people either don’t have cars or actually don’t drive very far in many cases.”

Hockey’s argument today is Australia’s housing bubble isn’t debt fuelled, but caused by a lack of supply.

“I’m not so sure it’s credit fuelled,”

“It is just an infinite mantra for international commentators, for analysts based overseas to say ‘well, you know, there’s a bit of a housing bubble emerging in Australia,” commented Hockey after the Bank for International Settlements (BIS) yesterday released a report showing Australia has the second most overvalued property market in the world.

“That is rather a lazy analysis, because fundamentally we don’t have enough supply to meet demand.”

“That doesn’t suggest there’s a bubble; there might be a price increase of some substance, but you’d expect the market to react and produce some more housing.”

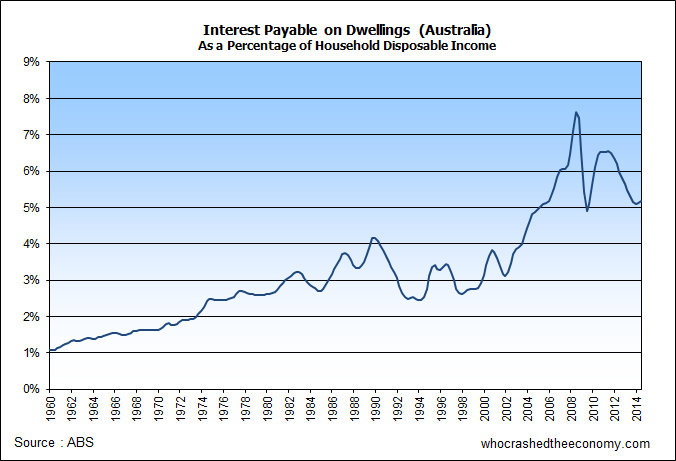

Actual data from the Reserve Bank of Australia show Australians have racked up excessive household debt levels, suggesting the bubble is in fact credit fuelled. Australia’s household debt to disposable income is one of the highest in the world.

Despite the official cash rate sitting at levels not seen in over 50 years, Australians are still paying more to service their mortgages today as a percentage of household disposable income, thanks to record debt levels, than in 1989 when interest rates hit 17 percent:

A recent report shows Joe Hockey owns four investment properties.

Hockey said today, “I don’t see at the moment any substantial risk.”

» Joe Hockey denies Australia in a property bubble – The Sydney Morning Herald, 16th September 2014.

» Hockey dismisses any property bubble – The Australian Financial Review, 16th September 2014.

When the bubble does burst because of an internal or external shock, the likes of Hockey will use the excuse that the burst itself was not caused by high property prices. But if property prices weren’t so out of whack an external shock would have little effect on property. You just have to look at places in the US that didn’t inflate during the bubble and didn’t burst as a result of the bust (as explained over at MacroBusiness).

There will probably be many factors that cause the bust or result from the contagion (most of which the admin has listed on this blog):

Unemployment ticking up because consumers have withdrawn spending to pay off large debts.

A decreasing terms of trade as a result of a slow down in China and a fall in iron ore prices.

Falling wages.

Falling dollar leading to higher inflation (initially).

Withdrawal of government spending because of falling tax receipts (from lower commodity prices, fewer workers and less GST revenue). The government forecasters have got their forecasts all wrong in the last few years.

Another stock market crash.

Diversify your investments and get ready.

Can we just stop giving lip-service and credence to politicians please? We all know that they lie and deceive and deflect. Yet the media still parades them in front of cameras and microphones as if they were special and had something important to say.

And why is it that anybody who says anything contrary to the opinions of politicians is always reduced the moniker of ‘commentator’. The thing is Mr Hockey, all those ‘analysts based overseas’ are all laughing at you and Mr Abbott right now, and you’re too pig-headed and stupid to admit that you may just be wrong.

Judgement day is coming…

I think Joe’s blatant bubble denial is more arrogance than ignorance.

The today delivery a story of the fraud taking place from foreign investment. It was explained in simple terms as if most didn’t know it was happening until this major headline hit the news.

Crazy…utter madness….

The WA government spent millions building flats in karratha which are now empty !

The News today delivery a story of the fraud taking place from foreign investment. It was explained in simple terms as if most didn’t know it was happening until this major headline hit the news.

Crazy…utter madness….

The WA government spent millions building flats in karratha which are now empty !

I don’t blame Hockey at all. Understand his position. To call a bubble would require that he do something to correct it. But no party, Libs or Labor, would want to prick the bubble, nor have the bubble pricked while Australia is on their watch. There will be blood on the streets and whoever is in charge then will have to clean it up, without much success, thereby gifting the next government to the opponents. Better to keep the bubble afloat and if it does break, whether brought about by extraneous circumstances or not, let’s hope it happens when it is the other guy in charge.

Also, I read yesterday that O’Dwyer is open to the idea of letting first home buyers access their super funds for loan deposits. It once again shows that both sides will do whatever they can to keep the bubble afloat, if not blow it bigger. And measures like first home buyers’ grant, accessing super funds to “help” in home ownership are truly the politicians’ best friends. Such measures allow the pollies to ostensibly proclaim to all that they are doing something about home ownership affordability to most of the uninformed in Australia, when in fact we know, and the pollies know as well, that these measures only serve to blow the bubble bigger. The only way I see this whole house of cards come crashing down is when there is a global rise in interest rates.

I’m most probably and stupidly drawing a longbow, does this have anything, even indirectly, to do with our esteemed Treasurer;

http://www.hockeys.com.au/

House prices will always go up in Australia. There is a shortage of land..hehe

I’d rather invest in Bank shares and receive fat dividends from all the debt slaves working to pay me my money.

Get back to work you debt slaves!!! don’t miss your mortgage payments.

Joe Hockey is in complete control. No problem here folks.

“We don’t view criminals as individuals with rights” is the key. Dont be fooled! He knows how dire the situation is.

The money junkies are too busy trying to launder their fake money, for real money to enter the economy. Free markets do not exist, when there are subsidies, bail-outs, money-laundering and government hand-outs to corporate institutions.

4 – the official version of what is going on in Karratha – rental prices halved!

http://pdc.wa.gov.au/index.php/download_file/view/566/

It’s not denial.

It’s business.

http://www.hockeys.com.au/index.html

There is no over supply in houses there is a shortage of affordable housing for families on one wage. In my suburb there are at least a dozen empty houses sitting waiting to be sold for a least half a million dollars; with nothing available to rent. It is a lovely area, close to a good public school and we simply cannot get a house in the area. No one wants to rent decent houses right now they all want to sell and get out of debt I think. Where do the families that want to live in a certain area and can’t afford to buy live? This whole system is corrupt and something has to change, I get the feeling that a correction needs to happen but no sure how that will really help in the long run.

The politicians don’t want to deflate the bubble as collectively they have a $300m property portfolio. No politicians in the past have addressed this the elephant in the room so why should Hockey. Hockey is the current ‘minder’ and is obviously arrogant and ignorant. The focus on the greedy feckless poor and ill is to take the focus away from the elephant. More importantly though Hockey is ill equipped to deal with an economy that is likely to tank in a very big way.

If there is a shortage in housing, why Joe is sitting on the fence?

And having a weak Aussie dollar, probably help to stimulating more overseas investors to purchase and create more shortage?

Unfortunately Australia is run by lazy and short sighted politicians (and greedy business people). They simply dig and sell; then now simply sell everything above ground, playing blaming games without caring about future of Australia. NO vote to them all.

The single income family cannot compete with people who own multiple investments, foreign investors or rising housing prices. We cannot borrow enough money and we cannot repay it. I pray for the bubble to burst.