On Sunday, the Bank for International Settlements (BIS) released residential property price statistics for most developed countries around the world – (‘Australians struggle with world’s second largest housing bubble’). The data confirms Australia has the second most overvalued residential property market in the world, second only to Norway. The data, collected at the start of this year, shows on a price to rent metric, Australian residential property prices were 50 percent overvalued. On an income to rent metric, Australian house prices were 40 percent overvalued. House prices have appreciated significantly since the survey was done.

One of our readers, Alex, asked if there were a similar report comparing capital cities of Australia?

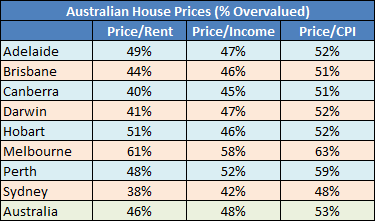

Here it is for the June 2014 quarter:

Notes:

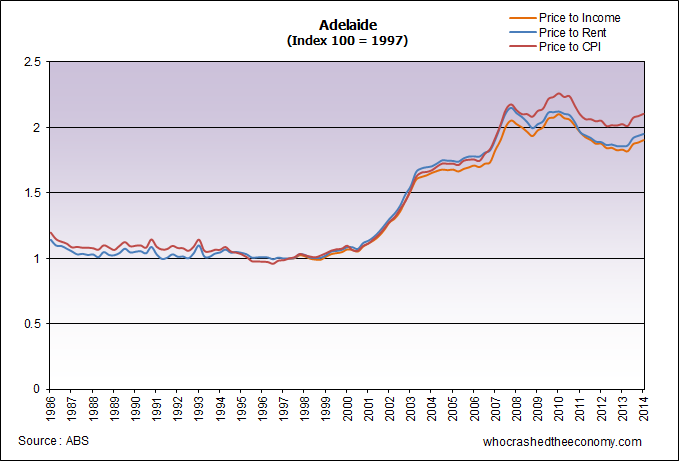

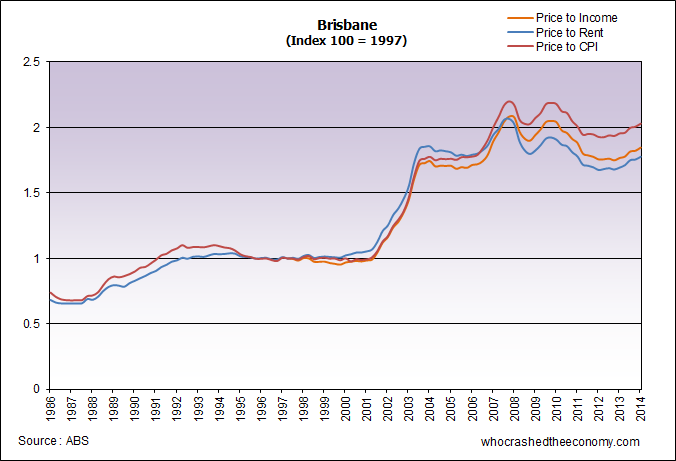

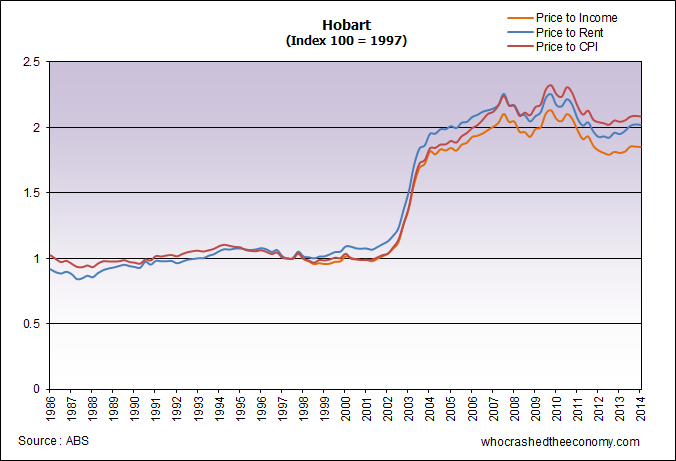

We have indexed the data to 1997, a period of stable house price growth (research shows long term house prices only rise by inflation). Note income is derived from a single wage – the ABS Wage Price Index – total hourly rates of pay excluding bonuses and is not household disposable income.

A price to CPI ratio (real house price) has been included. There is evidence both rents and incomes are inflated. Rents started to rise faster than inflation after the financial crisis, but with the significant influx of investors in the market at present (investors accounted for a record 49.7 per cent of total loans in July), rents are now contracting and will likely further exacerbate over-valuations. The same can be said for wages, with wage growth and household disposable incomes coming under pressure.

The over-valuations assume a healthy, stable market (like in 1997). If the economy were to deteriorate, larger falls could be expected.

There was an article “published” yesterday on news.com.au about “endies”, employed people who can barely afford to live in their own cities. It was amazing in the comments how opinions varied, usualy across generational lines. I think alot of the current investors who have homes they intend to sell to fund their retirements are going to be in for a rude suprise.

I do think people who frequent this page are in a minority and that the vast majority of Australians are happy with how things currently stand. Shame.

After deeply analyzing all of the housing bubble data for many years, I can honestly say, that although many claim there is or was a housing shortage, the only real direct causal relationship I could ever find as to why Australian House prices left the galaxy and fundamental economic reality a long time ago, was the ease at which banks began to lend to anyone who could fog up a mirror.

This still appears to be going on today albeit most people (the average Joe and Wendy Sixpacks) are now severely debt-saturated from the past debt/mortgage feeding frenzies. Their credit cards (based on home equity too) would by now be getting a good work-over as well.

Even the mining boom (which is now clearly over) appeared to be nothing more than the basis/pinnacle upon which Australian banks were able to obtain the cheap and easy money from offshore banks to throw at the average Joe Sixpack in Australia for mortgages, rather than being based upon any actual increases in any productivity of any kind.

The direct relationship I found was as follows:

Australian House Prices is directly proportional to the ease/price at which Australian banks obtain offshore funds and (APRA) standards adopted at which to throw those funds at anyone who can fog up a mirror.

It has never had anything whatsoever to do with any increases in productivity or health of economic fundamentals.

So the critical point to watch is the actual price of money (cost to Australian banks for borrowing from offshore).

This will provide the precise timing as to the actual real beginning of the major collapse of the housing bubble.

It will not be pretty so be well prepared.

Claudem777 – so true. There is no housing shortage, it’s just a ‘call to action’ used to market the housing boom.

Didn’t the United States have a housing shortage? Then after it crashed, the banks had to bring in the bulldozers because the oversupply of dwellings were further depressing the market. The Bank of America was paying something like $7,500 to level each house.

Bulldoze: The New Way to Foreclose – 2011.

Spain also had a housing shortage – how the landscapes are littered with half built dwellings.

Then didn’t the National Housing Supply Council of Australia make a “mistake” overstating the number of households by a million to support claims of a shortage.

Vanishing Households Undercut Claim of Australia Shortage – Bloomberg, 2012.

@ 2 & 3

Correct regarding shortage. How anyone could fall for that is beyond me. You would have to work and live in the CBD and never leave it to even think this could be true. Even here in nanny-state SA, we have seen mile after mile of new houses for the last 20 years appear to the north, the south and out over the hills. Then there are the sharks that used new technology (read google earth) to find large properties, knock on the door and ask the old widow if she would like $50k to help her out (we’ll buy your back yard and sub-divide).

I have no doubt that Adelaide is the Australian Detroit. We are set to loose 50,000 jobs in manufacturing alone over the next 2 years. Entire suburbs to the north of Elizabeth will be deserted and just like Detroit, only 2 in three houses will be occupied, possibly even less.

Weather our banks will bulldoze is yet to be seen. But if they are hit with council rates that keep rising I wouldn’t be surprised.

And all this, as homelessness reached record highs. Those in power should be ashamed how they let one of the most prosperous countries on earth become the financial slave of Wall Street and England’s golden mile.

I see that marketwatch.com are reporting that by 2017 rates will be 3.75%. ROFLMAO. How is the USA government going to pay 3.75% on $20TRILLION. What a laugh. Impossible.

While it is true our banks borrowed heavily from off shore during GFC, recently more of it is self funded internally. What triggers the rate rise I don’t know, but it will crush everything:

1: Individuals are at their credit limit, late repayments are already an issue

2: Business is at it’s credit limit, not only with banks, but with suppliers and also with share-holders, there aren’t too many folks out there willing to pump money into flat lining companies (in fact there was some interesting data out of silicon valley: VC’s are burning cash faster than during dot com………)

3: Governments are tapped, they continue to tax harder, they continue to borrow more…but cant contain their expenses.

And Costello says Australia’s luck is running out? Mate it’s not our luck that’s out, it’s our credit!

Oh, and I forgot to mention, Iron ore has dropped of a cliff…So too most other metals (including silver and gold) and now China’s committing to cleaning up air ways with better use of fossil fuels (read coal mining exec’s dumping their shares).

Yep, cost of living to the moon. Wages static, real incomes falling and real inflation way above trend….. This has no happy ending for the unprepared.

This is what a housing shortage looks like here in Japan.

http://www.japantimes.co.jp/community/2014/09/05/how-tos/can-japan-level-its-problem-with-vacant-buildings/#.VBo_81eM0m0

Speaking og the BIS.

BIS central bank warns against ‘illusion of permanent liquidity’

http://www.france24.com/en/20140914-bis-central-bank-warns-against-illusion-permanent-liquidity/

Good Grief!

I have lost faith in Alan Kohler:

http://www.news.com.au/finance/economy/is-there-a-housing-bubble-thats-about-to-burst-in-australia/story-e6frflo9-1227062516640?pg=1#

Please do not forget the fractional reserve or rehypothecation of capital borrowed offshore.

prepper

http://www.youtube.com/watch?v=H_rm8r4TDWY&feature=youtube_gdata

prepper

http://www.youtube.com/watch?v=GA7wPMP5mco&feature=youtube_gdata

prepper

http://www.youtube.com/watch?v=z_xdP6sipNs&feature=youtube_gdata

prepper

Either the end is nigh, or new gained momentem shooting prices to pluto, this is a sign of utter madness…

That’s a lot of chocolate bars! Corner store sells for $4.45 million – $1.85 million above the reserve – in the ultimate proof Sydney’s property market has lost the plot

http://www.dailymail.co.uk/news/article-2761792/Convenience-store-sells-4-45million-1-85-MILLION-reserve.html

This is out of control.

@12

Let met get this right: $1M, often $2M or even more. Good grief. Do these buyers have a direct loan with the USA fed?

Anyways, check this: http://www.news.com.au/finance/money/desperate-first-home-buyers-can-get-into-market-with-2500-deposit/story-fnagkbpv-1227064406739

Sub prime isn’t an issue in Australia we are told. lol. Just like the mining boom would last 100 years….That NLP could produce a surplus in 18 months…..That there will be now new taxes….

http://www.news.com.au/finance/real-estate/how-to-save-a-100000-home-deposit-in-25-years/story-fndban6l-1227064955149

Quote: “AMP financial planner Andrew Heaven of WealthPartners Financial Solutions told news.com.au that even though everyone becomes focused on the rate of return on term deposits or shares, they actually make a minimal difference. He said: “It’s the discipline of saving that makes the greater difference.”

For example, a couple with a pre-tax household income of $150,000 (equal to two people on the average Australian full time salary) could have a deposit of $100,000 in two-and-a-half years with a little elbow grease.”

LOL weren’t we told only 4% of Australian house holds earn $150k. That $150K was classed as rich? LOL. (Never mind the part where he says ignore return on investment, fund managers do as a general rule anyway, they just take it out of your capital)

They are all out of touch.

Wages in reverse,

Interest rates low.

Rising house prices,

Astronomical utility & essential service rises,

Rising employment,

BUT YOU MUST SAVE TO BUY A HOUSE: erm…what about the local economy, it’s already FUBARed and you want to pull even more out of it?

It’s it any wonder the FIRE sector is the most profitable in Australia, and the Aussie 4 banks are the MOST PROFITABLE SECTOR IN THE WORLD?

Screw everyone except your ideal house vendor! Pay them what they want, maybe even more just to ensure you can secure the property… LOL.

There is no way in hell this can end nicely. Every week that this progresses I can see how and why the USA economy fell into the abyss in 2009 so rapidly and deeply.

Not only have Australian’s put their entire savings into property, they have put their super into property (there will be no pension in 15 years or less given that the Fed’s can’t balance their budget), but they have even put their taxes into property via negatively gearing.

There will be unemployment and poverty like Australia only saw before the war. This will be frightening for several generations who only experienced growth by credit, without being productive: There will be a large number of “millionaires” who think they are sitting pretty who will be begging for capital in years to come, but who will lend it to them when they say “But I made a fortune in property, I can do it again!”

Yeah, well I made a fortune the real, but hard way, outside of property. And you ain’t getting diddly of mine mate.

are you afraid admin

prepper

My post @ 13 didn’t come through right. Sorry all.

Basically I was saying that the economics on that store property are TERRIBLE! At best they will get their money back in >25 years, in today’s dollars not allowing for inflation, or ANY EXPENSES.

The part about $1M or $2M was about property here in Detroit (read Adelaide), weekly/daily we see properties for these kinds of figures: Who lends anyone $2M for a property in Adelaide? Seriously, this is ridiculous, “They must be borrowing direct from the USA fed” to get cash that easy. Oh well.

Dear friends.The bread and butter.I am a carpenter with 40 years experience.In the late seventies and early eighties,around Sydney harbour foreshore,I did fit-out work on many residential unit developments.The contract rate,for a typical 2 bedroom apartment,was around $2500.The work took 10 days to complete.You could have bought a house in Northbridge at around 80 to 90k(old house on 700 sq.meters of land).Today project home builders pay contractors around $1600 to fit-out 4 bedroom 2 storey home.What on earth is going on?These homes are being built for 50k materials and max.40k labour.This is not the lucky country anymore.This is slavery for all REAL workers.

Who will think of the poor Mum and Dad property investors?

http://www.theaustralian.com.au/business/property/negative-gearing-not-just-enclave-of-the-rich/story-fniz9vg9-1227065817755

Making Millions through Real Estate the Tom Vu way!

https://www.youtube.com/watch?v=kzsSpDyBc_4&feature=youtu.be

Aren’t we all supposed to be shuddering in our boots over radical Muslims or something instead of unimportant stuff like the future of our nation? While the media is focussing on the possibility someone might get their head cut off you can be certain the banks are having a field day getting rich at the expense of the future.

Break out the pitchforks.

Actually, this might not mean much to most people, but I have found in the past that when there are major news diversions towards either Terror/Terrorism and or War, it usually heralds in either the beginning of a new economic era (e.g. end 2001 to now – Monstrous Housing Bubbles combined with a tremendously irresponsible mis-allocation of resources through a historically unprecedented era of easy (fiat) money OR a time to end a past major economic era (War and Terrorism ventures/news generate more debt (i.e. fiat money in modern money mechanics) than anything else possibly could, which usually means an end to the current phase of lending easy (fiat) money to anyone who could fog up a mirror (THERE IS NO WAY THIS KIND OF THING COULD EVER HAPPEN WHEN USING REAL MONEY SUCH AS GOLD AND SILVER/COMMODITY MONEY).

@21

I don’t like to be a conspirator, but the Swine flu was a total farce to cover the USA economy there for a while (was it the debt ceiling?), just like bird flu and a few other ‘possible’ disasters. What worries me, is the amount of support that the governments have for going back to Iraq and the middle east. For Afghanistan, there was a fair amount of support, not so much on Iraq, but this time as a late night political professor said on radio, the USA, UK, French and Australian governments have got the green light from the public: Six months ago we had a budget crisis, now we can afford to go to war in at least two countries: Is Ebola a sideshow for this?

Some even suggest, that as the yield on government bonds drops too low, and no-one buys them……you can increase their value by CREATING uncertainty….As above, this would not be possible under a gold/silver currency…..Interesting.

@ Claudem777

+1

prepper

I’ll be the last person to defend the goings on in Australian property. It’s clearly very frothy.

But the issue is that we are currently in a very low interest rate world. Expecting rental yields to stay at 8-10% when interest rates have dropped from 10% to 4-5% is unrealistic. And unless and until interest rates increase again, there is no reason to expect catastrophy.

The store was sold on a gross rental yield of 4.2%. That’s a real yield not a nominal yield. If inflation averages say 2%, that’s equivalent to a 6.2% gross return. Net of costs maybe 5.0% pre-tax return.

That’s better than you can get in the bank. You’re hedged against inflation. And then there is longer term development upside from rezoning.

Would I buy it? Absolutely not. It’s expensive and risky (i.e. if interest rates rise; economy roles over). But it’s not manic.

I think many are simply failing to allow for the reality that there is no reason to believe interest rates will inevitably be high again in the future. Interest rates reflect the equilibrium between the demand and supply of savings, and the world currently has too much savings. Witness the ECB and Japan currently offering negative interest rates on reserves. There is so much excess supply of savings vs. demand for funds that interest rates are going negative in some markets.

We may just have to put up with the reality in the future that you’re only going to make 2-4% real returns on your savings, not the 5-10% people were accustomed to in the past. If 2-4% is the current cost of capital, the sale of properties on 2-4% rental yields is entirely justified.

PS also, in a growing economy, it’s reasonable to expect property prices to rise faster than the rate of inflation, at a rate that more realistically tracks nominal GDP growth. Nominal GDP growth, coupled with interest rates, is the best measure of growing affordability.

I think the datasets showing property only rises at the pace of inflation are skewed downwards by the addition of new houses at the fringe of the city. Marginal construction costs should only rise at the rate of inflation. But the value of pre-existing housing stock in areas that are more central to the city will rise faster than that.

Assuming a constant share of income devoted to housing, they will rise in line with nominal GDP. Desirable houses in desirable suburbs will grow faster than that; average houses in average suburbs in line with nominal GDP; and less desirable houses below the rate of inflation.

Getting a starting yield of 2-4% (net of costs), plus trend rental and capital growth of 4% (2% nominal, 2% real), generates an all in return of 6-8%. In a low return world, that’s reasonable. Gearing the asset (or any asset) up to 90% though is very risky. That’s where the risk comes in.

“It’s funny how if Negative Gearing doesn’t matter, the lobby groups fight so hard to keep it.”

https://www.youtube.com/watch?v=K2I80WEVKE4&list=UUi3WZlKputf4Kv6AFDiLYVg&feature=player_detailpage

@ LT

Sorry to correct you but this is completely wrong!

“I think many are simply failing to allow for the reality that there is no reason to believe interest rates will inevitably be high again in the future. Interest rates reflect the equilibrium between the demand and supply of savings, and the world currently has too much savings.”

There is absolutely NO RELATIONSHIP between savings supply and loan demand. The is no equilibrium. We operate in a FIAT, fractional reserve currency system. This means $1 of base money can be lent out (for example) 10 times, allowing there to be $11 dollars “in existence”. The reality is that there is $1 in existence as $10 of these dollars are cancelled out by debt (the one ‘existing dollar’ doesn’t exist either, as the government issued it against a loan for one dollar to a bank and get’s paid interest on it).

In a FIAT fractional reserve currency, there is always more debt than dollars. It’s mathematically impossible. For the system is based on $1=$1 + interest. The reality is that there is only debt. The only reason dollars have any value is people believe the government can manage the currency supply against taxes.

The reason the central banks are pushing interest lower is so that the price of money (interest) is lower, and people, companies, governments will borrow it—–Unfortunately, human behaviour doesn’t work like that, and as individuals when we see our parents struggle under debt, or our co-workers loose jobs, or rapidly rising cost of living etc, etc, we loose confidence and stop borrowing.

But, in reality the cost of money means nothing in terms of stimulating demand. Want an example? Iphone 6, over $1,000 for the top version…… Certainly not low cost, but the demand is huge! Go to the other end of the scale, crappy little $45 touch phone at the servo, but where is the demand? See, cost has nothing to do with demand.

What cost of money can do though, is destroy your income if you’re over committed to debt.

So saying there is an excess of savings it utter rubbish. 30% of Australian households can’t round up $300 in cash, or $3,000 in cash of an emergency. Where is the excess cash there? Global interest rates are low due to central bank intervention.

If interest rates were a true free market, then you would find that the retiree’s out there would not be content with 3%pa from their deposits, especially when they see the boomers borrowing $700k for a depreciating building that’s got $50k of materials and $30k of labour in it.

Want an example? Peer to peer lending is a thing, and it will grow as both sides of the loan/saving equation grow savvy with the concept: Check https://www.peerform.com/ Loans start at 7.12% and go to 28%. So that one example throws the excess savings out the window.

Oh yeah…..The average aussie retires with $55k of net assets…..Doesn’t sound like excessive savings to me.

Wow. Downward spiral continues until shtf:

http://www.abc.net.au/news/2014-09-23/bma-mine-job-losses/5762766

http://www.smh.com.au/national/public-service/union-fears-job-losses-as-telstra-takes-over-medicare-centrelink-call-centres-20140917-10i5ku.html

LT,

Maybe I’m a bit naive, but aren’t the yields actually negative for those using negative gearing?

And as others have stated, interest rates didn’t magically fall because of some new economic environment. The measures of inflation in the last decade and a half have been constructed to deliberately hide the cost of living increases.

So yes property prices do rise more quickly than inflation when you remove them from the measure of inflation. The “automatic stabiliser” that would have kept them from inflating well above CPI has been removed.

Yes, there has been a lot of (fiat) money printing going on in the form of QE (Quantitative Easing)and in so-called ‘normal’ circumstances, doing so would actually water down the value of the (fiat) money already in circulation thereby causing inflation, if not hyper-inflation.

However, although there has been an astronomical level of (fiat) money printing going on (money printing without real productive wealth to back it up), the Central Banks around the world have largely hung onto the money (that is, not lending very easily to productive business or for great investment ideas or even for more normal/traditional personal loans).

Most of the (out of this world and historically-unprecedented) amount of money that has been printed (which is really only a computer ledger entry these days)over the past 13 years or so has deliberately been directed almost exclusively toward housing, which is where the actual hyperinflation has appeared.

I laughed so many times in the past few years when the average Joe Sixpack would excitingly exclaim “My house is now worth a million dollars!” (an average Joe Sixpack home in the burbs is really only valued between 135 and 180K without the hyperinflation at work).

So anyway, yes, house prices have been cleverly removed from the inflation measure indices because IT IS EXACTLY HERE WHERE THE HYPERINFLATION has shown up.

This is remarkably clever in that people have taken part (indeed exacerbated)in their own longer term destruction through being deliberately deceived and having their own greed (or at least common human nature) being used against them by making them all feel “wealthy” (i.e. the wealth effect lie) when what has really happened is that the astronomical (and quite frankly dangerous) amount of excessive fiat money printing has shown up as hyperinflation only in the real estate sector.

If the banks were to suddenly start lending (dropping the con game of the last 13 years) to real productive businesses again and for the more traditional personal loans, the cost of a loaf of bread would suddenly reach $20.00.

I am and have been absolutely flabergasted as to why people cannot see what has been going on for the past (at least) 10 years.

What is even more troubling to me, is the question of why the central bankers began to engage in such as deceptive exercise as from 2001 onwards?

It is because the financial system as we once knew it is more or less broken and actually finished running its course back around (September 11) 2001?

And where do we go from here?

This will most definitely end badly for a great many.

RBA considering drastic property market intervention

http://www.abc.net.au/pm/content/2014/s4094120.htm

Hitting something with a wet lettuce leaf is not ‘drastic property market intervention’

http://www.golemxiv.co.uk/2014/09/next-crisis-part-one/

http://www.golemxiv.co.uk/2014/09/next-crisis-part-two-manifesto-1/

prepper

Oh yeah, they are ‘considering’ intervention. They’ll consider starting to organise some pre-planning committees before a few forums behind closed doors to address the scoping of the agenda for the preliminary investigations of the planned talks with vested interests.

“Grey money from China helps blow our property bubble” by Paul Sheehan on September 29 2014.

http://www.smh.com.au/comment/grey-money-from-china-helps-blow-our-property-bubble-20140928-10n7a8.html

Average property price in Sydney in august 930k.Average at end of September 1.04 million. Property bubble!What property bubble?

No no no! Think of the poor Mum and Dad investors!

http://www.abc.net.au/news/2014-09-29/verrender-its-official-there-is-no-real-estate-bubble/5775112

The ABC has got to stop telling the truth, otherwise Hockey and the RBA might actually have to do something.

@35

(In a sarcastic voice) How can there be a property bubble? There’s been a 40% rise since 2007. 2007! Property doubles every 7 years, so we are in fact below trend.

But, mean while. The noise around property bubble is now reaching fever pitch. While I’m not going to call the top here, I highly doubt it can be that far away.

We’ve seen one of the craziest IPO’s ever (Alibaba), coupled with sliding share markets, new wars and continual falls in commodity prices.

You can put money on a housing collapse just before the RBA/Government bring in new regulations. These guys are ALWAYS too late.

http://www.realestate.com.au/blog/buy-house-isnt-sale/?rsf=outbrain:amplify

LOL, we are now being encouraged to buy houses that aren’t even on the market.

I recently spent some time at a friends pawn broking shop. What an eye opener, have no doubt Adelaide is Australia’s Detroit. Old, crying widows selling jewellery to pay power/gas/council rates/rego/doctors bills etc. Isn’t this the lucky country?

The banks have sucked the life out of Australia. They are a law unto themselves:

“Give me control of a nation’s money and I care not who makes the laws.” Mayer Amschel Rothschild

don’t worry, plans are in place to further whittle down the ABC and its pesky news services.

jonathon holmes of ABC’s ‘Media Watch’ has a petition out to try and save the axing of “Lateline” business program on the ABC tv

https://www.communityrun.org/petitions/abc-7?t=dXNlcmlkPTkwMDg2NCxlbWFpbGlkPTU4NzU=

Sometimes I wonder what Australia would look like in a genuine depression (double-digit unemployment, banking collapse, property foreclosures, political instability, food insecurity, etc.). I reckon the more unaffordable housing becomes the closer we are to a real economic collapse. Australia isn’t America; one day the world will stop buying our worthless commodity-backed fiat currency. When that happens, we will be left standing in the cold with no bailout forthcoming. Considering the current rapid “correction” of coal and iron-ore prices, that day might be closer than we think.

@ Matty (#38)

Check this out…

http://paid.com.au/

Proudly showing off a business award from Telstra…

You’re all good enough at math here to do a quick calculation… but that’s a pretty damn high interest rate.

I’m putting this here for reference, because who knows when the site will change/adjust to look cheaper/better.

Put their simulator slider on borrow $1000.

1) Costs over 4 months $300. Total to repay $1300.

OR

2) Costs over 1 month $140. Total to repay $1140.

“Worse than a flamin’ credit card!”

Are we there yet?

http://www.news.com.au/finance/real-estate/quickfire-bids-jumps-200k-in-two-minutes-in-hot-north-balgowlah-house-auction/story-fnd91nhy-1227073871555

This behaviour signals the top. Give it 6-12 months and it will unfold.

i say 12 months

prepper

David C – in response to your comments:

“Maybe I’m a bit naive, but aren’t the yields actually negative for those using negative gearing?”

Yes – net rental yields are frequently below mortgage rates at present. However, the rental yield is a net yield (i.e. is indexed to inflation), whereas the mortgage rate is a nominal yield. In real terms, the two are about the same at present.

Also, house prices are not all purchased by people on leverage. Wealthy individuals can purchase houses outright on a cash basis as well. And if the choice is between buying treasuries on a 2.5% yield, or solid properties with 2-4% yields, many choose the latter. There is lots of anecdotal evidence that more and more of the property buyers in the latest cycle has been cashed up foreigners (e.g. from China) doing just that.

“And as others have stated, interest rates didn’t magically fall because of some new economic environment.”

Yes they have fallen because of a new economic environment. While central banks notionally have been the ones responsible for lower interest rates, they have really only been following what economic forced would have dictated interest rates to be even without central bank intervention.

Look at measures of global inequality. They have shot through the roof. Wealthy individuals save and invest their income, rather than spend it. So as inequality rises, the amount of “liquidity” (i.e. savings looking for a home) circulating in the world economy increases, which drives down interest rates and drives up asset prices.

The propensity of countries like China to run current account surpluses and recycle the capital surplus back into US assets has also been key to this trend. Evidence for the “savings glut” comes from the fact that interest rates on bonds actually declined during the 2003-07 boom – unprecedented for boom times – suggesting that rising debt in the US was a function of “supply push” of excess savings/liquidity, not “demand pull” for credit.

Charles Dumas’s book “Bill from the China Shop” is an excellent exposition on this.

In addition, the reason why central bank interest rates are at zero in the first place is because the propensity to save exceeds the propensity to borrow and invest. If lower interest rates were having the conventional effect of stimulating borrowing and investment, the economy would boom and inflation would heat up, and rates would then need to rise, but this has not happened. We are in a “liquidity trap” at the moment, where interest rates of zero are not low enough to balance savings with investment. That is what Japan has suffered from for 25 yrs, and interest rates have remained zero the whole time.

This liquidity trap will remain in effect until global wealth inequalities are reversed. That could take a very long time. Until then, DM interest rates will likely remain low.

LT

Matty,

In response to your comments

“There is absolutely NO RELATIONSHIP between savings supply and loan demand. The is no equilibrium.”

Rubbish. For the global economy or any economy with capital controls, savings need to equal real capital investment + increase in debt. That’s an identity so is true by definition. Any one individual country can have an imbalance, and that shows up in the current account surplus/deficit. One country’s current account deficit needs to be counterbalanced by an equal and opposite surplus from other countries, however.

Savings (net of investment) and lending therefore MUST be in equilibrium at all times. However, if the propensity to save exceeds the propensity to borrow, interest rates will fall, and vice versa. That’s why countries with inadequate savings (such as many emerging economies) have high real interest rates, while those countries with excess savings (eg Japan) have low rates.

My point is that the world is in an environment where the propensity to save exceeds the propensity to borrow at present. Consequently, interest rates are low.

Low interest rates increase the value of annuity-style cash flow assets – whether it be property, infrastructure assets, existing long bonds, or super-franchise companies like P&G and Coke.

That is the real reason asset prices (including property) have been rising. It’s orthodox and to be expected.

Like I also said, I’m not denying the risk that interest rates eventually rise, which is a real risk to the market, or that prices are expensive. Nor am I ignoring the risks of China blowing up and pushing Australia into a recession. For the record, I own no ANZ property at present and have absolutely no intention to buy property at current prices, because the risk/reward proposition is unattractive to me.

However, what I am saying is that the prices are not a mania, and are actually an orthodox response to lower interest rates.

Re your other comments

“We operate in a FIAT, fractional reserve currency system. This means $1 of base money can be lent out (for example) 10 times, allowing there to be $11 dollars “in existence”. The reality is that there is $1 in existence as $10 of these dollars are cancelled out by debt (the one ‘existing dollar’ doesn’t exist either, as the government issued it against a loan for one dollar to a bank and get’s paid interest on it).”

Yes I’m aware we live in a fiat currency fractional reserve system. But so what? How does that invalidate my arguments?

“In a FIAT fractional reserve currency, there is always more debt than dollars. It’s mathematically impossible. For the system is based on $1=$1 + interest. The reality is that there is only debt.”

No it’s not mathematically impossible. It’s quite simple actually. The interest cancels out because the recipient of the interest (the lender) receives it from the borrower. The middlemen banks keep some, but that’s for providing a service.

People get very confused about debt. It doesn’t distort the monetary base. All debt does is “time shift” spending and disconnect it with the time money is earned from the time when it is spent. The interest is paid out of the earnings of the borrower and transferred to the lender, just like any other economic transaction, like if I provide you with a service (eg a haircut). I could sell you a $50 haircut and a $1,000 TV today. Or I could lend you $1,000 that you use to buy a TV, and in a year’s time, you pay back the $1,000 plus $50 in interest. In each case $1,050 has passed from your wallet to mine.

“The only reason dollars have any value is people believe the government can manage the currency supply against taxes”

Money has value because it is scarce/has limited supply, and has value as a medium of exchange because it is accepted by others and is extremely effective in minimizing transaction costs.

“The reason the central banks are pushing interest lower is so that the price of money (interest) is lower, and people, companies, governments will borrow it—–Unfortunately, human behaviour doesn’t work like that, and as individuals when we see our parents struggle under debt, or our co-workers loose jobs, or rapidly rising cost of living etc, etc, we loose confidence and stop borrowing.”

Yes exactly. Hence why interest rates are very low. The propensity to save (which includes, by the way, paying down debt – that counts as savings) exceeds the propensity to invest/borrow.

Maybe it won’t end for a while…

There are plenty of rich people in China who can’t wait to move out of a polluted country with no beaches and views.

They can afford 2 million.

They can afford 20 million.

They can afford 100 million.

Perhaps our governments will implement a resident exchange program. Swap a >500k/year income Chinese resident with a <500k/year income Aussie resident.

Wait, they're already doing that… people are leaving, right?

LT,

The fact remains if you don’t treat housing as an asset but instead as an item of consumption as every owner-occupier does, we have had high inflation. And if the yields on rentals have also kept up with inflating properties values so too the inflation in rents has been high. Just because you don’t measure it doesn’t mean it isn’t there.

Why would you measure inflation in one sector of the economy and then apply interest rates based on those inflation figures to the sector of the economy in which you are not measuring inflation.

damn blockquotes

50 years since JFK and we still have not woken up.The reserve is a private bank.OZ listed as a corporation at NYSE.Don’t let me tell you something that you all ready know.What are our soldiers(children) defending on the other side of the world.Our air force blowing up villages in middle east.Meanwhile big brother and million dollar mortcages.

To elaborate a bit more on my comments above, applying interest rates to housing loans based on measures of inflation in consumption alone is creating a positive feedback.

Consumption is low because of high housing cost, therefore we have to lower interest rates. Low interest rates are a signal for more people to pile into property, thus further increasing housing costs and reducing consumption.

Of course the end will come when consumption falls to such a low level that jobs are being lost left, right and centre.

As Paul Keating put it, recessions tend to sort out the spivs. The high interest rates in the early 90s were caused by a bubble in the property market (when CPI took into account the cost of housing). Unfortunately, because of poorly measured inflation now, this has become a country of spivs.

And just to be clear on my reference to Japan, Japan has had falling property prices with ZIRP because inflation really is low and its people have been saving. In Australia investors are borrowing not saving.

@56andoverit

Even so, we have long gone past the point of no return. The real issue is whether or not people will be able to survive the (unintended and unexpected) level of freedom that will arise as a consequence of a complete collapse of the global financial system. (i.e. No welfare benefits anymore and people having to suddenly look after each other again, which is nothing new, but something we have now long forgotten)

http://www.abc.net.au/news/2014-07-02/median-house-prices-rise-6-per-cent/5566944

“There is enough confidence in this environment, along with a regime of low interest rates, to keep the market ticking over comfortably and with no great surprises.”

I am surprised interest rates may be low but there is not enough employment for the continual growth in population or house prices.

But this is Perth for you in its own bubble within the greater bubble. numb-skull bogan thinking.

http://www.youtube.com/watch?v=PHe0bXAIuk0

Henry Makow.”The new world order is an extension of the imperialism of the “Crown”,a clique of bankers and their accomplices devoted to “absorbing the wealth of the world” and enslaving the human race. We are being colonized by this financial power.The bogus “War of Terror” obviously is directed against us.It is the naked fist of this imperialism.Our jobs and resources are exported.Illegal aliens are imported to divide our political culture and dilute our job market.The education system is used for mass indoctrination.News is controlled.Entertainment is filled with trivia,the occult,violence and pornography.Obviously, our masters wish to arrest our development. In every colonial situation,the political and cultural elite consists of people who serve the occupying power.Thus,let’s judge people not by their race,but by the service they perform for the invisible invader.And let’s not confuse them with the real imperialist “Money Power”. The sooner we see ourselves as colonized,the sooner we can declare our independence.”

@ Jas2u Says,

All well and good, but no mention of stable currency supply or fractional reserve.

https://www.youtube.com/watch?v=DyV0OfU3-FU

https://www.youtube.com/watch?v=EdSq5H7awi8

prepper

http://www.naturalnews.com/046290_Ebola_patent_vaccines_profit_motive.html

http://coercioncode.com/tag/ukraine/

prepper

When will this madness end? In the property section of the Sydney Sunday Telegrapgh, some of the insane prices people pay eg. a one bedroom unit in Enmore for $555K? I know a lot of this property bubble is being fuelled by China, but I don’t know too many people who can afford $555K for a one bedroom shoebox in inner city Sydney.

The great Australian dream of owning your own home (unless you are rich), is well and truly dead.

But what doesn’t make any sense is that unemployment is surging (the ABS are fudging the real unemployment rate), there is no more job security, manufacturing is virtually dead, and there is no confidence in the economy. Everything is ripe for an economic meltdown in Australia, the question is, when will this property bubble finally burst?

The military expenditure will tip the balance.At $70,000 up to $650,000 per bomb,$30,000 per hour to fly the plane that cost 4 billion to buy.Multiply it by 100 or 200 planes.Do you realise why all workers here have been on $20 per hour in hand for nearly 40 years.And the rates are going south.Do you think the multinationals pay for these wars?No it is taken from all workers hard earned toils.The answer is simple.No war No debt.Why do the 99% cover the cost of wars.Because we have no say in the decisions made.We,the people,vote with pencils.Soon to be replaced by on-line voting.But,the reality is,we are destroying families and homes on massive scales,in the middle east and maybe elsewhere,to people that have done no harm to us.Karma will not be kind to us,for not exposing this dictatorship by the 1%.Chemtrails are not conspiracy.Instead of looking at your i phone look up at the sky.

@ Yoda

This answer to your question is, when the Government chooses to stop using tax payers money and using a pissweak FIRB to support the Housing Market.

Judging by their actions it looks like the Government will NEVER stop propping up the market.

57 / 58 Yes, crazy it is. Yet just another symptom of a small player (Oz) living off the spoils of an Empire (USA) in decline. The writing is on the wall. Overshoot of carrying capacity, ecological collapse, a military spread too wide, water issues, energy decline, food supply, cage fighting and other mindless entertainment, media control, and an almost zombie-like consumerism. The housing thing is just one of many things to be concerned about.

There are many ideas out there about what happens when a civilization enters decline. Yet, from a more personal perspective, the answer is pretty much the same. Get self-reliant.

If you are awake to it, you can see this happening as we speak with like minded folk skirting around the edges reworking, reconfiguring, retooling in small localized self organized ways. It seems that is where the action is going to be from now on. And the big-wigs know this all too well.

Well, this is seriously concerning: http://www.news.com.au/finance/real-estate/bugger-saving-for-retirement-gen-y-want-their-superannuation-now-to-help-them-get-into-the-housing-market/story-fncq3era-1227088780618

“Just under half said they would diligently save for their first property, almost the same number were prepared to forego their retirement savings to get started.”

If this gets approved (and I sadly think it will, the banks rub their hands together) prices to the moon. Superannuation is a completely failed model.

You have to ask yourself, how is it possible that 7 years after the start of the GFC, people are forced to put 9% on top of their wages to a saving fund, that is still often lower than pre-GFC. The fund managers are having a blast. There should have been tightly regulated fee structures on Superannuation; but no, the government have completely failed the mum and pop workers of the nation.

What could be worse than poorly managed superannuation funds? Pouring that money into property in one of the largest bubbles in history, in an economy that is domestically imploding: With no positive outlook for manufacturing or value add industries. The politicians should be ashamed….. But they wont be, as they have their future fund, which is managed by the best guys in the land.

I’m a capitalist, but privatization, of things like utilities and the superannuation industry has completely missed the mark.

It isn’t enough to be a regular worker in Australia and expect a happy future. It is literally get rich or die trying.

Again, when this property cycle hits reverse, it will be spectacular.

Finance Minister Mathias Cormann is against using super to inflate the housing bubble.

Mathias Cormann warns super ‘not the key to housing’

“The purpose of superannuation is to provide an income stream in retirement,” he told ABC News24.

“There is a sole purpose test, which means that the reason you attract tax concessions as you make savings through superannuation is that those savings and the returns that they generate should be available to fund your retirement.

“Now for those who are concerned about housing affordability, pumping more money into the housing market by letting people access their superannuation savings more freely will not bring down the cost of housing; if anything, it would probably lead to further increases in the cost of housing.”

@ 56andoverit,

There is more to the story than what you have stated but getting close….

http://itccs.org/

prepper

Various Governments (both parties) stupid short-sighted policies which keep propping up unsustainable housing prices, cutting education funds which are the future of Australia and wasting so much money on wars have made me sick.

The Australians politicians have failed and betrayed the people who have elected them.

When I came to Australia 30 years ago, Australia was fair goes for everyone; it was so beautiful and fair country. Money did not decide or dictate everything.

Now things have dramatically changed. Everything is money, social and family values have dropped. Everyone in the family has to work harder to survive, pay the mortgage takes two or more jobs which lead to less family time; even no time to say hello to friends and neighbors.

Politicians have turned the beautiful Australia into the most miserable place.

It will be worse and worse unfortunately. I just missed those old good days.