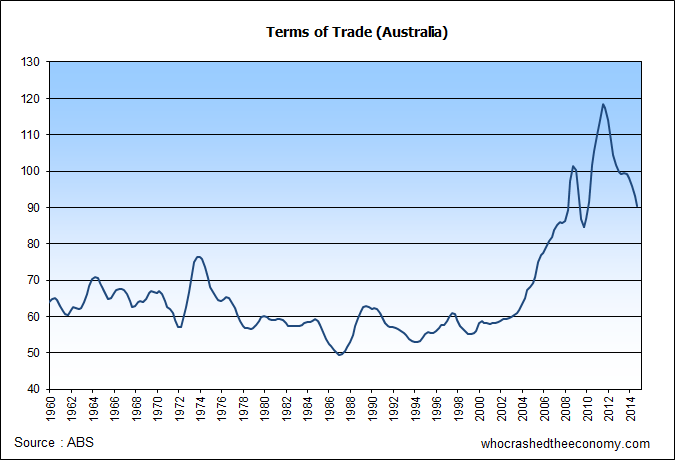

Australia is now in the grip of the largest terms of trade collapse since records started in 1959, unleashing havoc on Federal budgets that will ultimately flow through to wages and household balance sheets.

The terms of trade is an index calculated by the Australian Bureau of Statistics (ABS) showing the relative ratio between export to import prices. A fall in the terms of trade indicate Australia needs to export more to maintain the same level of imports – making Australia economically worse off.

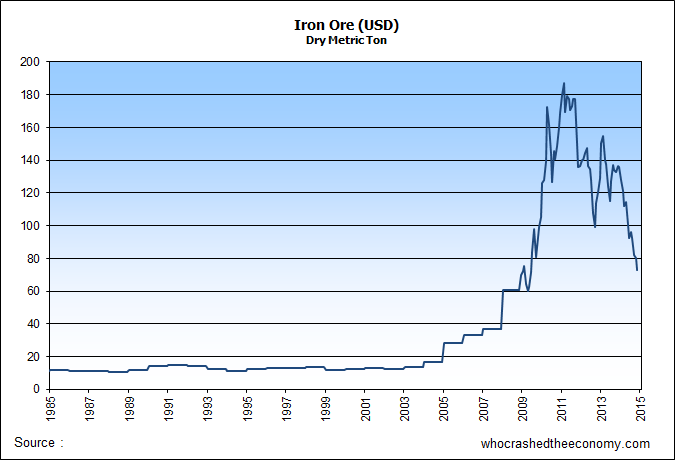

The price for Australia’s number one export, iron ore continues to fall with prices down 46 percent in the 12 months to November. Since the peak in February 2011, prices have collapsed just over 60 percent. The fall in the iron ore price is due to a slowing in China’s fixed asset investment due to over building.

Australia’s other major exports such as coal and wheat has also experienced significant falls.

Our commodities boom has seen Australians enjoy the second fastest wage growth of any developed economy over the past 13 years, according to the OECD. Data from the International Labour Organisation show Australian wages grew the most of any G20 nation between 2007 and 2013.

But times are changing.

The latest ABS wage price index (WPI) shows total hourly rates of pay excluding bonuses remains subdue, rising just 2.57 percent in the past year. This is the lowest growth since the series started in 1997.

» Falling wages to upset household debt dynamics – Who Crashed the Economy, 30th May 2014.

» Beijing housing sales falls 35% – Iron Ore falls through $90 – Who Crashed the economy, 17th June 2014.

» Real wages start to fall – Who Crashed the Economy, 19th February 2014.

» GFC2 – Will it be made in China? – Who Crashed the Economy, 30th June 2013.

This documentary perfectly sums up what’s wrong with the economies of the west (and that includes Australia).

http://www.smh.com.au/tv/Money/show/How-the-West-Went-Bust/Addicted-to-Debt-4301182.html

2.57 percentage I have a feeling this statistic is fudged and the real percentage is lower.

Still property prices continue to rise, in some places accelerate I guess something needs to keep the economy pumping along.

@TC – I suspect there is a lot of faulty data coming out of the ABS.

It’s like ABS employment data, no one really believed we created 121,000 jobs in August 2014, the largest monthly increase in the history:

ABS backtracks on jobs data after August surge

And why is there such a divergence between ABS and Roy Morgan unemployment?

Pete Says – they are using the same slight of hand that is being used in the US in terms of ‘calculating’ the figures. No one believes the growth rate of the US.

They can only lie for so long before the majority wake up a realise they are stuffed.

Excellent news. Soon we will have real growth based on what we produce and manufacture and not growth based on the accumulation of debt as it has been for far too long. Australia’s so called economic boom has only benefited the super rich while the rest of us have allowed ourselves to fall into complacency believing wage growth reflects our wealth while in fact it is an indication of how much debt we have. Let the demise of this false economic boom prevail. Bring it on I say.

@ Theo,

Very well said.

I think the only concern now is how much more Chinese money will flow into Australian RE. The Australian government have no interest in stopping this from occurring. What are some of the external factors could come into play which will change this cycle?

So our external income is collapsing.

If we want to maintain the same level of lifestyle, we have three options:

1: Sell assets to external interests.

2: Ramp up government deficit spending

3: Create a ponzi scheme seeing an asset increase in $ value, even if it’s true worth doesn’t

Oh hang on. All three of these were in full swing before the terms of trade collapse.

Oh dear…….

I’ve been banging on that this time would come for years: I have cousins who went mad in the mining boom stock market: Made big gains, spent it all: went to make it back, then lost it in the collapse…and are now left with massive CG tax bills….. After loading up on lifestyle debt. But he told me I was the one missing out! LOL. I’m richer than ever. And I haven’t even started my buying binge yet: Newsbreak: The bottom aint in yet!

As noted on another blog today the LNP quietly tabled the MYEFO at the end of last year and have toned down their rhetoric on debt and deficit. It is appropriate that the LNP are in power when this terms of trade shock is occurring given their recent history of doling out middle class welfare while banging on about deficits. Oh the schardenfreude.

The human face of all this are the miners returning back to their home towns with no prospect of work. The Gold Coast currently has the largest youth unemployment and the homeless are impacting deeply on welfare groups. I can already hear the pitch forks being sharpened when the 99% realise that the mining boom was not about them or their future. While most of the mining profits were shipped offshore the local economy was hollowed out and the only additions to the infrastructure was for shipping minerals.

Brandon Smith:”Globalists are not just terrible people in a random sense.They have constructed an entire culture of deviance.They are organized evil, and this is a problem that we must deal with soon.”

Mike Ruppert:”In the empires vision,love and art and religion count for nothing.It is as if the human race existed only in a statistical dimension.A calculus equation in need of a solution.Distilled ,all our pursuits,esentially ask just two simple questions.Who are we really and why are we here.We have been looking at the wrong places for our answers.”

Maybe the LNP should do what KRudd did and just give everyone a check for 500 or 900 dollars to spend on the economy that will solve it….. LOL of course I am joking….:)

Now watch as we repeat the folly of every other bubbled nation and push interest rates down even further. We are addicted to credit and can’t get enough of it.

This is an interesting article about the Swiss National Bank, and is this a ominous warning for the banks here in Australia?

http://www.smh.com.au/business/world-business/why-switzerland-threw-in-the-towel-20150116-12rhxc.html

The miners who got laid off must have been very short sighted to think these huge construction projects would last forever. If they didn’t save up a decent nest egg over the past 15 years then they were stupid. The mining industry in Australia is now history. With the exception of one Biotech company(CSL), manufacturing is also history. Even if the dollar devalues it’ll take decades to re-build a manufacturing hub in Australia. It took 20 years to do it in Ireland and is the only thing keeping us going. The only thing keeping the Oz economy going at the moment is dirty money from China which is propping up property prices. Your Government has basically sold your kids futures down the river and mismanaged what could have been a healthy and diverse economy to be enjoyed by anyone who wanted to have a “fair go”.

Hmm not surprised really. Insane but sensible when you think about Negative Gearing.

http://vimeo.com/117079696

Any further discussions are probably academic as the bank runs have already started in Europe and will no doubt engulf our banks, housing market and economy. Get cashed up and hold on to your hats!

http://kingworldnews.com/former-white-house-official-warns-europe-in-danger-of-mega-bank-runs-that-endanger-the-world/

http://www.wsj.com/articles/australias-west-humbled-by-iron-ore-slump-1419876073

More jobs gone today: Mining company Arrium to cut 600 jobs in SA amid falling iron ore price

Australia is getting everything it deserves. The nation of fat drunk rednecks chose to believe that the mining boom would go forever and that house prices always go up.

Now Australians are looking at rising unemployment, and a dollar that is plummeting. Normally the lower dollar would cause local goods to be substituted for imports, except that all local production was destroyed in order to ‘make way’ for the mining boom, so there are no local goods to buy.

Suck it, Austraia! You’re largely a nation of anti-intellectual, complacent, Abbott voting, self-entitled bogans. Australians were oh so happy to see OTHER people being screwed over; be they refugees, the young, or the poor. Now that it’s clear that the aspirational bogans are in for a stomping, they’re getting very nervous. Soon they’ll be squealing like stuck pigs and looking for someone else to blame.

“See me suffer, see me pain, must be someone else to blame”.

I’m going to sit back and laugh while the complacent boomer and late X’er idiots that control the country sacrifice every last bit of productive capital attempting to prop-up their precious house prices and protect their precious tax-dodges and entitlements (super rorts and pensions for people with $million+ houses, anyone?).

Australia: you have collectively made this bed for yourselves. Now you can lie in it.

CaptainReality very good comment and that is what I have said to all my Aussie friends for years. You point the finger at everyone else for year. Gillard telling all these countries to pull their heads in a few years ago……. I like Australia but the Australian economy really doesnt matter to the Global economy is really on a little pimple to the rest. The world will not crash if Australia goes down. I left Australia in 2009 to move back to the US where I am from after living in OZ for 8 years. All I heard was the US is f#$ked blah blah blah. I said guys you better be worrying about your own backyard as your debt levels and putting your head up Chinas ass is going to back fire…… I saw alot of the Australian society get very arrogant and now they dont want to talk about it. LOL

@21

Yep. The big money has gone where it shouldn’t have. Only yesterday, I’m stuck at the hardware store unable to complete a turn with the trailer on, because some ‘upper class’ woman has her 4WD (sorry…sorry, SUV) parked in the way:

She COULD NOT comprehend that we needed her to move forward 2 feet so we could turn….. Never mind we were blocking the entire car park, waiting for her to get it together…. She got in the car TWICE, jumping out both times, complaining she didn’t want to go in the trade centre drive through….. (move forward two feet! god damn woman how hard it is to see what’s going on here?)

In the end my mate says “Just f@$%^&&g move”. Then she panicked and did move… Oh, for the love of god……

How on earth can people like this survive? Seriously, I doubt she could get a job as a check out chick (they’re a dying breed now anyways). Even a 6 year old kid knows when to move their bike.

The answer to their “flourishing” is of course a totally distorted economy. I would imagine for the best part of 30 years, her husband or herself have a jobs in the FIRE or related sectors that have given her this lifestyle. She’ll argue that she earned it, but the truth is far from that.

I know several of my mates, who are on the same page as most of us on this blog, are now saying “Finally, my wife see’s what I’m talking about..” or “The wife’s scared!”.

One of my mates wife has been told her whole office is to be shut. And it’s off shored to Asia, with even less staff. When she questioned the director ‘How will all this work get done over there by less people?’ The response summed up capitalism, globalization beautifully “At $X per hour, we don’t give a f#$k”. Conversation over.

So, Aussie, you screwed China and the rest of the world with your commodity and high dollar game. How does it feel when the world screws you back via low labour prices AFTER you lost your manufacturing and industry. Ouch…. Interesting times.

@ Matty,

Yup, when I said that’s what my guts tell me, that’s what my guts tell me. I observe this “common” behaviour on an almost daily basis. Had a client only this week wanted work performed on a garden fixture and offered $10. $10 bucks! I had to explain what I charge to be called out for the first hour (I’m one of the more reasonable cheaper ones). She looked at me dumbfounded then proceeded to complain she’d just paid $1.85M for this large house, having lived in a unit in Double Bay, Sydney, and that she didn’t have the money to just throw around on “services”. I responded by saying “I’m not some 10 year old boy” then shot her a friendly look telling her I didn’t give a %^^# if the job got done or not.

Little old me has to chuckle, post the brain-melt and saliva on auction day, ppl are shitting themselves at the cost of maintaining the dream, the REAL work hours that go into the “must-have-now dream, and just one job loss away from one big real nightmare.

Next I’ll talk about my theory of “Post boom – how we ended up with a surplus of single divorced woman aged 25-45” I know of one marriage held together by loss making investment properties and the family buisness plan. It’s sad what speculation has done to this nice couple.

I’m amazed at the joy some people seem to be getting at Australia’s coming day of reckoning! When it gets bad for Australia, its going to be bad everywhere else too. And where would you rather be then? The answer is an easy one!

Living in Northern NSW, the first reality check for people buying small acreages, is the cost of mowing lawns! This is generally one of the first tell tale signs of financial difficulty too, the lawns are overgrown, and the area maintained becomes smaller and smaller. 9 out of 10 buyer usually downsize within 10 years as it is too expensive and too much work to maintain.

My mate in RE said properties in the $600,000-$700,000 are selling like hotcakes, whilst anything over a million have done nothing for over a year.

I too have a sizable saving stash and have been patiently waiting, I almost jumped in, but my offer was knocked back.I’m pretty happy about that now, as I think we will see the correction later this year.

Anyone out there a fan of Martin Armstrong?

http://armstrongeconomics.com/2015/01/15/the-coming-mortgage-panic-set-off-by-swiss/

Oops! sorry about that bump. Never mind. We can still export real estate, can’t we?

@24

Yep. Everyone I know is in the same position as you re: customers being ridiculous.

We are now riding the crest of the next GFC aka GFC II. This one will be a combination of a debt crisis and a massive global currency crisis.

When history is written of 2015, the Swiss, knocking back the EU peg will be clear as the trigger. This move, alone, is massive. What it says is “As a sovereign nation, in charge of our own currency, WE DO NOT TRUST THE ECB TO MANAGE THE CURRENCY”. This is huge.

Finally, we have got a enpowered, political will in Greece that will reject the EU and it’s bail outs. This also will be huge. This will be the first, post war, developed nation to default on it’s currency. This will shake the bond market to it’s core. Those on fixed incomes are to be decimated by the fall out. The entire EU bond market will need to be revalued, yields will reach for the moon, the ECB will run the printing presses harder to keep currency ‘flowing’…… But the base demand will be falling. I don’t think we will see hyperinflation, but it wont be nice.

So how does this effect us here in Aus. We’ll, bonds will fall, meaning interest will rise. Our government’s interest repayments will increase….against an imploding budget.

Our dollar is neither good nor bad, not good enough to reignite exports and investment, not bad enough that our imports will become cheaper.

And, everyone is tapped out on debt. Seriously look around you:

Easter eggs at the checkout on 2nd of JANUARY

We looked at a new Hyundai: Build date 2013!

Nissan had it’s 2014 run out sale start in AUGUST.

Home and land packages at 2/3rds of the price a few years ago.

The highest ever rate of utility disconnections

1/4 have to seriously compromise to pay the power bill

Big department stores selling jeans at $8 (i almost bet that is a loose leader)

Mining tanking faster, and harder than even I tough possible (went past the car auction yard the other day, never seen anything like it, 4WD after 4WD with lights, bull bars, tray tool boxes and antennas….all mining rigs, that were on lease, now back with their owners… ouch) I have several mining customers, haven’t heard from them for ages, where as they were very regular customers.

The political unrest we see is as a result of our currency systems collapsing under it’s own weight. Read/watch Professor Niall Furgusen’s Ascent of Money.

As a conservative voter Howard and Costello did a great job, but I now see, it wasn’t all them. Massive terms of trade, coupled with the massive private debt boom, made for a very stable environment. Now, collapsing budgets, exploding health, education and social programs are killing our leaders. It looks like we may have four changes of Prime Minister in less than 10 years! It sounds like some crazy little European nation, but no, this is Australia. The economy is so out of control that the government can’t catch it, can’t reign in it’s spending while keeping votes, but can’t raise taxes to catch it’s shrinking tax base…. All while it promised to build a surplus.

A surplus. LOL. Episode 4 of Mike Moleney’s Hidden Secrets of Money, will tell you WHY we wont and don’t have a surplus. Howard didn’t need a deficit as the terms of trade were so strong, but that’s now gone. If the government doesn’t keep borrowing more, and more and more, our economy will collapse anyway….

Bankers know their currency game is nearing it’s end. Gold and silver are in high demand. Hell, the USA ran out of silver at some dealers a couple months back, but the prices are still low. The bankers have manipulated the precious metal market. They’re ramming fiat currency down our throats, while they use the interest payments from governments to buy precious metals.

It’s beautiful. They print money which costs a few cents, they get interest payments which is a high multiple of this, and then buy hard assets. They get real gold, silver, hard assets, for printing a few notes… While you and me sacrifice 40+ hours every week, of which >30% goes straight to the government.

I might not be a central bank, but I act like one. Buy, own, posses, acquire, make, build, I don’t care how it’s done, but the end game is to own hard assets. If that’s what the bankers are doing, it’s what you should be doing.

(Housing, bought on mortgage isn’t a hard asset, as you don’t own the house til paid for in full…….)

@ Matty,

well said.

only the us mint sold out of 1 oz silver eagles twice last year…

they might do it again

http://srsroccoreport.com/u-s-mint-unloads-another-million-silver-eagles-over-the-holiday-weekend/u-s-mint-unloads-another-million-silver-eagles-over-the-holiday-weekend/

prepper

Matty (27) I wonder if the Aussie dollar will continue to fall?

Buying hard assets seems the right way to go, but they are simply overpriced and may be for some time!?

I’ve heard it said before ‘wait till they all start yelling ‘we are now at the bottom of the crash – then wait another year or two before buying.’

Will be an interesting few years.

Len

@29

Not sure when or where the bottom is. If we get some crazy bail out like USA, it’s likely Sydney and Melbourne will dip then boom, just like Cali and NYC. There’s another housing crash building in the USA as I write, but this time it will be linked with a bubble NYSE, which is at crazy levels.

Investors the world over are chasing pipe dreams. Massive leverage, minimal returns, but a reliance on capital gains. It’s a powder keg, the likes the world has never seen.

Hard assets are overpriced in some areas. But then look at silver for example: It’s below cost of production…. I was more a gold type of guy, but silver is an interesting read.

If you’re a great manager small businesses offer incredible opportunities. I’ve seen several businesses in my sector sell for below Plant and Equipment value: Great opportunity, but very sad for the owners, who are often retiring, believing that the sale was to be their superannuation.

The government are fast locking themselves into a corner: They are stripping over 2 million small business owners through GST, workcover and IR, yet the business owners themselves often EARN less than their GST payments….. Only to find their business is worthless and that the pension is a crap deal after all that hard work. Think about it, 2 million small business owners are fuming at the government, and it’s getting worse DAILY. The government has something like >$80Billion outstanding in company taxes, they are unlikely to see: I agree, bad operators should be culled ASAP, but good operators who run into legitimate cash flow trouble should be cut some slack regarding tax payments.

Until the cost of business is dramatically reduced we will continue into this economic death spiral: Sure the retrenched workers will buy franchises, learn that 50+ hours a week earns 65% of business owners less than $20K per year…. And we’ll be told unemployment is ~6%. It’s a joke.

The trouble with people is, they never questioned through the 2000’s why things were so easy: Why were people replacing perfectly good TV’s with plasma’s…Why were people refinancing to buy a new SUV….Why we had 7 income tax cuts in a row…. They never questioned why things were so good….Now that SHTF for alot of people they’re blaming free trade, tariff reduction, their employers….When it was themselves who voted for the nice people, who borrowed amounts that can never be paid back, bought hugely inflated assets, gave up productive value creating jobs for paper pushing…..

It’s going to be interesting coming out the other side of this. I think there will be four types of people:

1: Those that were prepared and life rolls on the same. No big debts, no outlandish lifestyle.

2: Those that will profit from the crisis: Vultures, working capitalism as it was designed (I’m pro capitalism: Socialism/communism/nationalism breed lazyiness)

3: Those that throw their hands in the air “we’re broke, we borrowed to much and we got burnt: Never again” and they then live a far more conservative life

4: Those that say “Nah, it’s all good, it’ll be fine” and over the coming 20 years their lifestyle will gradually decline as they continue to hit their debt limits, never changing their habits.

I don’t know how far away nasty days are, but I know they are alot closer than they were only 5 years ago: As someone in his thirties, I am convinced of a currency crisis within my lifetime. Food on the table will become a true issue for plenty of Australian’s sadly:- When only 10 years ago we were spending like we couldnt run out of cash…sad.

Once again, I dont know if any of you follow Martin Armstrong, but for me, he has been very accurate. He reckons, after 2015.75, “the world economy will spiral into the worst depression in centuries.” Chilling words!

http://armstrongeconomics.com/2015/01/18/the-dollar-pegs-are-next/

If this is true, I don’t think trying to pick the bottom of the market a very good strategy!

@ Gavaroo

I’m not sure of timing, but a global currency crisis is definitely on the way.

China alone will cause chaos when it’s currency position is found by the free market. Imagine all the manufacturing that’s been closed down around the globe due to cheap ol’ china…Then finding China is no longer the cheap oasis a whole generation have been led to believe.

Then there is Germany, who will most likely face a revolution, after the public find out that Spain, Greece etc. wont pay off their debts collapsing the German export based economy with rocketing high debt and it’s own currency crisis.

Oh, man, the list goes on and on and on.

I am not sure if this real estate/property propaganda, but I just read an article in the Sydney Morning Herald that they will predict Sydney’s property market to continue booming in 2015. The article stated that property in some parts of Sydney had gone up as much as 29% in one year, and that the average price of median price in Sydney is close to $900K.

Forgive me for sounding like a broken record player, but how long can this madness continue?there is no more job security, the economy is going down the toilet, wages are dropping, yet somehow people are paying ridiculous amounts of money for overpriced property. There must be some serious mortgage out there.

http://thewealthwatchman.com/i-smell-a-trap/

prepper

@ Matty. – ” Food on the table will become a true issue for plenty of Australians”. I absolutely agree 100% with you on that one! I am lucky in the fact that I grow organic food for a living…. I know what it takes, and it aint easy!

@ Paul.- After WW2 in Europe, people who saved gold and silver, used it to buy food off the farmers!!

@ Everyone.- After looking at many different systems, I recommend that all of you start understanding how to build a methane bio-digester. They can be built small and large, and have many, many benefits. Kitchen scraps, lawn cuttings and even sewerage can be used!

This youtube clip is only as a brief introduction.

https://www.youtube.com/watch?v=TXXfLwvjO5k

@43 Paul,

Nice link. I’m only new to learning about silver, but some of that seems pretty legit.

Meanwhile, downward spiral continues across the world.This week:

http://www.theguardian.com/money/2015/jan/26/new-years-tradition-business-january-job-cuts

http://www.dailymail.co.uk/news/article-2927172/Biggest-corporate-lay-history-expected-days-IBM-believed-scrapping-110-000-430-000-workforce-world.html

http://www.theaustralian.com.au/national-affairs/defence/shipyard-closures-start-with-job-losses/story-e6frg8yo-1227170590103

http://www.cio.com.au/article/564880/sony-mobile-said-planning-1-000-more-job-cuts/

http://www.abc.net.au/news/2015-01-29/job-fears-as-bendigo-council-seeks-more/6053760

@ gavaroo,

Finally good to see some real remedy here.

There is more out there…

Must ask your self

https://www.youtube.com/watch?x-yt-ts=1422503916&x-yt-cl=85027636&v=PsAKNC8gmGA

http://mainerepublicemailalert.com/2015/01/29/free-energy-secrets-exposed/

prepper

Master Yoda,

Property prices are going up because all those first time buyers (who were once called first time home buyers) are now buying an investment property instead. Interest only loan and negatively geared no doubt.

Interest only – no principle is ever payed off, negatively geared – you never earn an income from it. Idiots! We breed them stupid in this country.

http://lh6.ggpht.com/-JBUE3j9E_fY/VMqm34WcH9I/AAAAAAAANLY/z0AEF62xapg/s1600/IMG_20150130_083034%25257E2%25257E2.jpg

prepper

The inmates have truly taken over the asylum in Europe.

Following the negative interest rate policies of some governments (Swiss -.75%) they have now come up with a NEGATIVE INTEREST RATE MORTGAGES in Denmark. I can’t wait for the RBA to go negative so that I can buy a whole High Rise Building with an interest only mortgage and retire on the income paid to me by the bank.

http://www.zerohedge.com/news/2015-01-30/denmark-you-are-now-paid-take-out-mortgage

some info on metal for you

http://gold88blog.com

http://thevictoryreport.org

http://sgtreport.com

http://kingworldnews.com

http://www.silverdoctors.com

i have more if you would like

prepper

@David C

Thanks for your comment, but forgive me for asking stupid questions as I don’t own any property, but why would you take out a loan for an investment property where you are only paying back the interest, and not the whole thing? In addition to being stupid, interest only loans sounds like debt slavery to the banks.

@ David C

Bang! Right on the bogan money…it’s borrowed, ain’t paid, ain’t delivering a return, ain’t gonna end happy! Spot on my friend. In my opinion that is just to qualify.

OZ is a slave labour gulag in 2015.If you are not a’poo-bah’mason forget it.No chance for better life.Here everyone gets shafted for real work performed.Democracy,we vote with pencils.Tragic,more like demoncracy.When will the people wake up?

Here’s an interesting exercise – overlay Stapledon on that TOT chart and check out the consistent 3-5 year lag for property prices to tumble post the TOT boom. I’m tipping carnage but not till 2017. It feels right too as there’s still room for rate cuts and the Chinese economy is a delusional slow boiling frog – both these will keep us growing till then.

Master Yoda, capital gains.

And as political instability shakes all parts of Australia, no commentator is announcing the true cause: It’s the economy stupid.

We are on the path to our 6th Prime Minister in under 10 years, (Howard, Rudd, Gillard, Rudd, Abbott, Turnbull/Bishop/Morrison/Joyce?) sounds like some poor Asian or East European country, but no, this is Australia.

Governments at no level can contain their budget, blow outs everywhere, health care exploding, tax receipts collapsing. This signals a very rough period ahead for many Australian’s. Middle class welfare will be unpredictable, given from the left, taken from the right and promised by both sides.

You have all been preparing for this haven’t you?

Sure have Matty I’ve been holding off buying a home while interest rates are lowered again. This has made the RBA’s intentions clear. While the mortgaged pay even less on their mortgages and true full time unemployment continues to rise I am happy to not buy into this shonky market of property growth based on lower and lowering interest rates which really is fuel to the debt.