Before heading out the doors for Christmas, the Reserve Bank of Australia (RBA) board indicated “on present indications, the most prudent course is likely to be a period of stability in interest rates.” The last time the RBA had taken the knife to interest rates was on the 7th August 2013, some 16 months earlier. Australia’s central bank was anticipating on keeping the last remaining and precious 10 official cash rate cuts left in the war chest for the next crisis, at the envy of so many other central banks presiding over failed debt fuelled crises with cash rates sitting at zero.

But in a surprise and sudden move, the Reserve Bank decided yesterday it had no choice but to act against a backdrop of a rapidly deteriorating economy, and in the process, risk putting the icing on the world’s largest housing bubble.

Outside of a brief mention on a strengthening US economy, yesterday’s statement by RBA Governor Glenn Stevens on the monetary policy decision was packed full of doom and gloom.

It indicated the Eurozone economies and Japan were “both weaker than expected” and “China’s growth was in line with policymakers’ objectives” – which is a positive way of saying China’s growth rate came in at 7.4 per cent in 2014, the lowest figure in 24 years and the first time the country missed its growth target in 17 years.

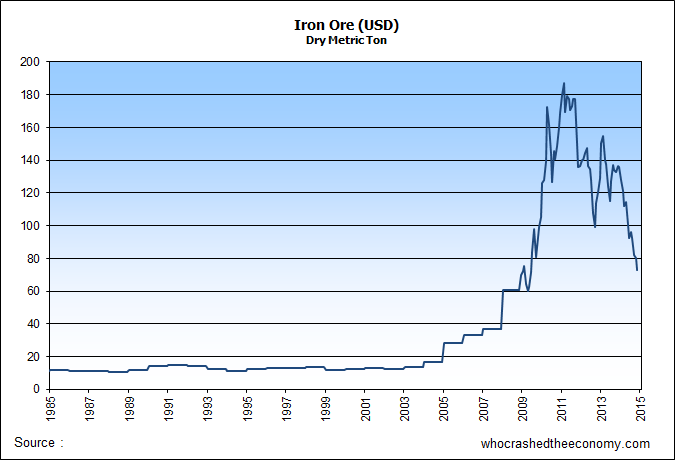

China’s decline after an insatiable appetite for commodities is causing havoc for world commodities prices, a pain almost unbearable for Australia who bet its entire future on China and the triumphant “100 year” resource boom. The Reserve Bank noted “commodity prices have continued to decline, in some cases sharply.” Our largest export, iron ore is down 46 per cent in 12 months. In a post in January (Falling back to earth – Our terms of trade collapse) we showed what affect this is having on our terms of trade and what this will mean for wage growth and jobs – or more precisely lack off – going forward.

One potential positive is the significant decline in world oil prices, with the RBA noting it will “temporarily” lower CPI inflation before the falling dollar erodes any benefit.

Domestically, the RBA suggests growth is “continuing at a below-trend pace” with an emphasis on domestic demand growth being “overall quite weak” causing unemployment to rise over the year.

One possible driver for the surprise decision to cut could be the stubbornly high Aussie dollar. The central bank notes even with the recent 18 per cent plunge in the past 6 months, the Australian dollar still remains above its “fundamental value, particularly given the significant declines in key commodity prices.”

And Australia’s much hyped housing bubble featured predominately with the bank noting credit growth has picked up, with “stronger growth in lending to investors in housing assets” (Sydney investor led housing bubble irrefutable) and noting the surge in dwelling prices in Sydney. Dr Andrew Wilson from the Domain Group recently reported Sydney house prices are in “hyperdrive” after prices surged an unsustainable and very dangerous 29 percent in just two years, out-striping CPI and wage inflation several-fold.

Yesterday’s rate cut is only likely to fuel what the RBA’s “central bank”, the Bank for International Settlements (BIS) last year reported was the world’s second most expensive housing market in the world (Australians struggle with world’s second largest housing bubble), behind oil exporter Norway.

The RBA tries its hardest to allay concern saying it “is working with other regulators to assess and contain economic risks that may arise from the housing market.” We reported last year, (Property bubble a Macroprudential challenge for regulators) that the Council of Financial Regulators, who is chaired by the Reserve Bank of Australia, is working on Macroprudential controls in a bid to contain the bubbling housing market. In December, hot on the release of the Murray report, the watch dogs started to bark – but have yet to bite (Woof – The watchdogs have a bark!)

As we reported then, it is widely expected the regulators will decide to impose capital charges on higher risk investor loans, especially interest only loans. This would require the bank to hold more loss absorbing capital and would likely pass this cost on to the property investor though higher interest charges without effecting owner occupiers, the diminishing first home owner or business. However, recent indications is such framework will be delayed until later this year only exacerbating the current concerns.

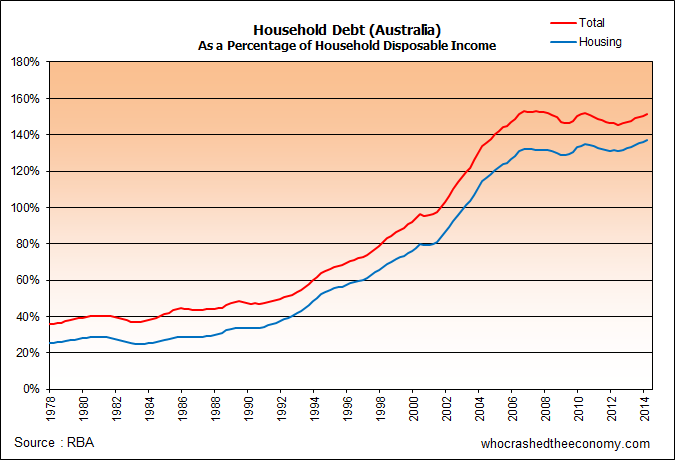

The latest statistics from the Reserve Bank, prior to this rate cut, show households are once again starting to leverage up after the period of stability in interest rates when they should be trying to de-leverage and de-risk. Total household debt as a percentage of household disposable income is just 0.4 per cent from the peak during the 2008 GFC. The majority of household debt is locked in residential housing which is at a record high of 139 per cent of household disposable income.

This unprecedented and significant run up in debt over the past 25 years is why the Australian economy is in the doldrums now – and why so many economies collapsed in 2008. Despite having a larger housing bubble than the US in 2007, Australia masked and delayed the devastating effects though an unprecedented mining bubble flooding the country and households with excess money – through middle class welfare, high wage growth and monumental investment returns. Worst still, Australian’s became complacent as the ‘miracle economy’ was tossed around. The recent collapse of the mining bubble, now leaves Australia’s household debt greatly exposed and potentially the next domino to fall as jobs are lost and loans become unserviceable. Only today, Bloomberg reported to the world, “This is what an economic hangover looks like. More offices lie empty in Perth, Australia, than at any time since 1996, while the number of homeowners seeking to offload properties has surged 45 percent from a year ago.”

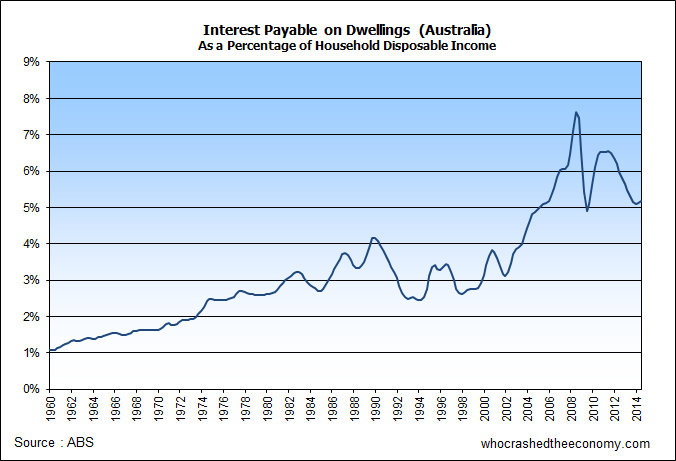

This is not the time for the average Australian to be complacent on interest rates at levels not seen since the 1950s. To illustrate the significance of the household debt bubble, figures from our National Accounts (ABS) show households still allocate more of their household disposable income to interest on dwellings today, than in 1989 when interest rates peaked at 17 per cent. Low rates have been offset by astronomical household debt levels.

It also goes a long way to explain why domestic demand growth is “overall quite weak” according to the RBA. With so much capital misallocated to housing/shelter and the high cost of living, there is little disposable income left to underpin consumer spending and create jobs to fill the void from the mining boom.

While the Reserve Bank would like you to be out spending, the best thing Australians can do now is to start paying down that white elephant – household debt – and as fast as they can. According to interviews of the indebted, conducted by one of the television news services tonight, that is exactly what people intend to do.

And to finish with some light comical relief, shortly after the announcement of the rate cut, Treasurer Joe Hockey said the rate cut, caused by a rapidly slowing economy, was “good news” – While the decision was solely a matter for the RBA, his government contributed to the cut by keeping inflation low, even going as far to confidently state there will be further cuts to come. While, I suspect he didn’t bother reading the governor’s gloomy statement following the decision, and I know for sure Hockey doesn’t control world oil prices, you wonder if there is an ounce of truth about his contribution. Is the current political circus etching away at consumer & business confidence? I have no doubt it has some role to play.

» Statement by Glenn Stevens, Governor: Monetary Policy Decision – Reserve Bank of Australia, 3rd February 2015.

» Mining Bust in Perth Shows Damage That Led Australia to Cut Cash Rate – Bloomberg, 3rd February 2015.

Lower rates, increase debt. A mathematical equation acurately describing an aspect of general human psychology.

“People are dumb!”

– George Carlin

Speaking of the RBA, the people at MacroBusiness asked a good question;

Why did Glenn Stevens attend Cabinet?

http://www.macrobusiness.com.au/2015/02/glenn-stevens-attend-cabinet/

Come back Steve Keen…..all is forgiven. I’d say our Stevo is laughing his ass off over a few beers tonight in Kingston, London. He knew, as did anyone with half a brain, that this was going to happen sooner or later. Sell your Aussie dollars now, if you’ve got any, because they won’t be worth a spit in 12 months time as the economy tanks. The Australian economy is heading down the dunny. Unemployment will only get higher from here on out. I hope you’ve all been good boys and girls and saved your pocket money for a rainy day……because it’s about to piss down.

@Lucis – Capt Steven’s Cabinet meeting is about this:

Joe Hockey’s budget backdown, Fin Review Today

“The Abbott government is dramatically dumping long-standing budget goals, including budget savings and pre-election tax cuts, as federal cabinet heard a gloomy update from Reserve Bank of Australia governor Glenn Stevens and Treasury secretary John Fraser.”

Hockey was rapped on the knuckles for saying the cut was all good and it was “unshackling the economy”.

@3. Pete

Oooooohhhhhhh Mannnnnnn!

Well, I think it may be time to learn how to hunt, grow veges, purify water, and all that good wholesome stuff. Amazing! This is where savings and no-debt got me to.

Very good article admin, well done!

If the average Aussie household gets serious about paying down debt they would have to start by eating into the principle with increased monthly payments.

An increase of $100 per week diverted from spending to paying down principal would probably send this country spiralling into depression.

The problem is the principle is so large that an extra $100 per week trying to pay it down means ‘Jack Shit’.

Excellent article of more good news that an economic correction in on the way. Australians obsession with debt is fast coming to an end. Australia’s economy will grow on what it can afford and especially produce and not based of accumulating more debt to fund growth. Most Australians should reflect on their share of the blame for allowing the country to come to the brink of bankruptcy and economic collapse, if they continue to see debt as their sole means of survival. However, this pales to nothing when most Australians voted for a corrupt political system that encouraged massive debt and did very little to prevent it. Guilty as charged.

@Theo even when you explain the basics to people they don’t seem to grasp the effect their borrowing has for the Australian economy.

@Michael Francis many people simply could not find the extra $400 per month as they are leverage up to the hilts buying the latest gadgets and re-paying their car loans.

For as long as the RBA continues to lower interest rates the people will keep spending as they believe it is their right. Buy now pay later.

Australia is a ‘rentier’ economy that is going to collapse as the debt merry go round stops. We can see the impact of lowered commodity prices in Canada. It is already, I believe, from what I read having a negative (positive?) impact on the Canadian housing bubble. Australia is no different – just a different set of commodities.

Love it. This needs to happen. Australia business and govt need to come back to earth with everyone else. This is the beginning of the dominos about to fall. Watch whos govt national debt starts to climb as the govt has to start bailing out the banks…… Its coming.

Following the biggest mining boom Australia has ever seen we now have a government struggling for revenue, 11% + unemployment and a economy struggling to stay afloat by reducing interest rates and money printing.

Meanwhile Hong Kong will finish the financial year with at least HK$60 billion surplus which they will return to the people via tax rebates. Salary rebates of about HK$10,000, a waiver on property rates and a permanent increase in tax allowance for parents of HK$70,000 to HK$80,000 per child.( Hong already has the lowest tax rates of any developed economy) One official said “There is a need to stimulate Hong Kong’s domestic consumption by introducing measures to leave more cash in the hands of the public” Does anyone have a copy of “Economics for Dummys” that they can send to the government?

please consider,

https://www.change.org/p/tony-abbott-do-not-sign-up-to-the-trans-pacific-partnership-agreement

https://www.getup.org.au/campaigns/tpp/tpp/the-dirtiest-deal-youve-never-heard-of

we should repatriate all of australia’s gold…

since the 60’s 99.9% of australia’s gold has been held in a vault in london when trade was settled in gold..

http://thesovereigninvestor.com/gold/gold-repatriation-shows-concern-over-global-financial-crisis/

http://www.collective-evolution.com/2015/02/05/canadians-sued-the-bank-of-canada-won-mainstream-media-government-blacks-out-story/

prepper

All the RBA can do now is cut interest rates to stem the approaching recession. Lets face it, they’ve come far too late to the party on interest rate reductions. With china slowing year on year, Australia needs Direct Foreign Investment to create jobs and offset thousands of mining/manufacturing layoffs. That ain’t going to happen anytime soon, considering it’s high cost base. You have to wonder where the jobs for Aussie grads and school leavers are going to come from in the future? Once the unemployment rate hits 10-15% the shit’ll start to hit the fan.

Eurozone has negative interest rates, setting a good example for OZ.

The question, what is enough for a man-made bubble in the selfish benefit of politicians, government, bankers, RE agents, spruikers and the rich few?

Dear Sirs,

May we congratulate you on your skill, professionalism and ability to tell it how it is. Showing no fear or favour, you are the only organisation we know of that has the ability to stand on the side of the street like the little boy in the fairy tale “The Emperor’s new clothes”

For those of you that were never told this bed time story, a little boy stood at the side of the road as people marvelled, shouted, and cheered the emperor as he drove past in his carriage in his smart new cloths.

“Why are you cheering?” asked the little boy. Someone in the crowd shouted ” because of the emporor’s fine new clothes, look at the gold and silver and precious jewels he is wearing! Aren’t we lucky to have such a rich country to live in!” “You should be cheering too little boy!”

” But why ?” replied the little boy confused; “he’s got no clothes on!”

Moral of the story, Listen well to this great organisation. They are that little boy. The emporor? those that are working hard to crash our economy globally.

@LBS

How will the conservatives explain that one given their stance on debt and deficit? I hope this happens before they’re voted out of office in 2016.

A journalist should ask Hockey about his and his parties statements on interest rates in the last decade or so.

1. Interest rates will always be lower under a Liberal government (Howard and Hockey).

2. Interest rates are too low under Labor (Hockey).

But really who knows what Hockey’s position on the matter is.

I’d really like seeing Hockey squirm. I’ve watched his rants from his first days in Parliament and from the outset have thought he was an obnoxious prat.

But lets not criticise the conservatives alone. Labor took the baton from Howard and did huge amounts of damage under Rudd and Gillard. Politicians these days have no imagination when it comes to managing the economy. The only game in town is to keep asset prices inflated.

Further to my comments above, while you can expect rusted on voters to have blinkered vision of politics, the swing voters in Australia must have the memory capacity of goldfish when it comes to politicians making contradictory statements.

And the expectation that lowering interest rates will save the economy is just plain dumb. I listened to a news story this week explaining that retirees had been taking their savings out of the banks and purchasing property or shares with the expectation that interest rates would continue to fall and as a result the yields would be higher for those alternative investments.

We’ve been seeing unemployment increasing for the last couple of years and unemployed people don’t rent expensive properties or buy goods and services.

@Andrew Parker

Great example, I was reading that story to my kids a couple of days ago and completely missed the bigger meaning. Applying the same to the current economy, people have too much fear of seeing the economy as it is so instead use their imaginations and talk it up instead. Soon the little boy, or mass media, is going to see the reality or the economy and suddenly everyone will be able to see clearly.

For an economic system to be fair interest rates should be zero percent.Loan repayments should be on principal only.This act alone would stimulate all nations economies to the moon.A fair level playing field,for all participants,without the banksters mafia taking their cut and sucking the life out of all modern economies.I repeat,the federal reserve bank should be shut down.It is a private cartel syndicate.Why can’t we ,the people,make our own money at the Mint,in Canberra, as we were told when we started school.Instead we must borrow from the IMF.This greed is destroying the planet and everything on it.Charging interest is a lazy mans way of avoiding real productive work.This present system is forcing everyone to ” take their cut”,and shaft the people down to the end of the line.A crude but relevant example.In Sydney a cocktail,in a bar,costs $20.If the average worker here makes $20 per hour go figure.In Bali the cocktail costs $10 and the average worker there earns $5 per day.Australian children are renting from communist party officials children living here.This is what happens when usury is allowed to run its course.Our children have become debt slaves in their country.The sad reality is that nobody cares.We have been brainwashed to have no feelings.We function on ferocious instinct.Money is god.In Mexico children ‘hitmen’ murder for $50.The present reality!

Turnbull is GoldmanSacs main man here.Everything is scripted.Abbot did his job,by signing the The Trans National Free Trade Aggrement.We are now under complete control of multi national corporations.Agenda 21 where lies have become truths,and the truth must never be spoken.

In addition to massive job losses in mining, and oil,:

http://www.itwire.com/it-industry-news/listed-tech/66888-ibm%E2%80%99s-massive-job-cuts-start-400-in-australia-to-go

http://www.abc.net.au/news/2015-02-06/government-prepares-update-on-latest-round-of-job-cuts/6076948

The Fracking Bubble is Over: Harry Dent

https://www.youtube.com/watch?v=2pGAcjRG9WA

@ 56andoverit

Yes but look at the cushy job Turnbull will have with Goldman Sachs after he sets up carbon emission trading for the big international banks and makes them billions in commissions. Also expect sock puppet Abbot to be Governor General after he retires from politics.

It will not matter who the PM is, no policy is going to be a solution to reducing the amount of debt Australia has created. Australia got to where it is today by borrowing, home owners up-size take on more debt and use equity in their own homes to buy investment properties. the nation is sitting on its backside collecting rent, borrowing more and more while chasing the illusive equity mateee. The debt has soared over the past 5 years any macro-prudential regulation should have taken place 6 years ago.. it is all too late now.

We have no wage growth…we killed manufacturing, an aging population, foreign investors outbidding each other other monopoly housing.

“In Australia nothing will change until change is forced upon us.”

you have to laugh

http://ausbullion.blogspot.com.au/2015/02/four-years-on-and-nothing-has-changed.html

prepper

http://www.smh.com.au/business/markets/currencies/bell-potters-charlie-aitken-tips-australian-dollar-to-fall-below-us68162-20150211-13blxg.html

“In Australia nothing will change until change is forced upon us.”

@ average_bloke: Nailed it (the bottom line truth) in one comment!

But Hoocoodanode?

So, I have been watching house prices go ever north for years now, and have stayed out of the Sydney market because I thought it was insane. Seems more fool me. The RBA just keeps pumping the bubble.

I was always perturbed reading Doman yesterday, 21 Feb, citing houses selling for $1.5milliom in Ryde, $550k above the Rsererve. That is not rational at all. Furthermore, 8/12 bidders where Chinese mainly doing it over the phone from overseas. What happened to the fact you had to have PR to buy! And that foreigners can only buy new build property?

And before I am labelled racist, I speak Chinese, have live and worked there for years, and know one thing for sure. When it comes to making money, they do not play by the rules. Until we wake up to that we will continue to be screwed.