With a smirk on his face, Treasurer Joe Hockey told naive Australians today, the Reserve Bank’s cut to the official cash rate is “good news”. With a continuing deteriorating economy, the Reserve Bank was once again forced to cut the official cash rate, this time to a record low of just 2 per cent.

“I say to the Australian people directly, now is the time to borrow and invest, whether you be a household or business” the delusional Treasurer urged. “Now is the time to have a go. To borrow some money and to invest.”

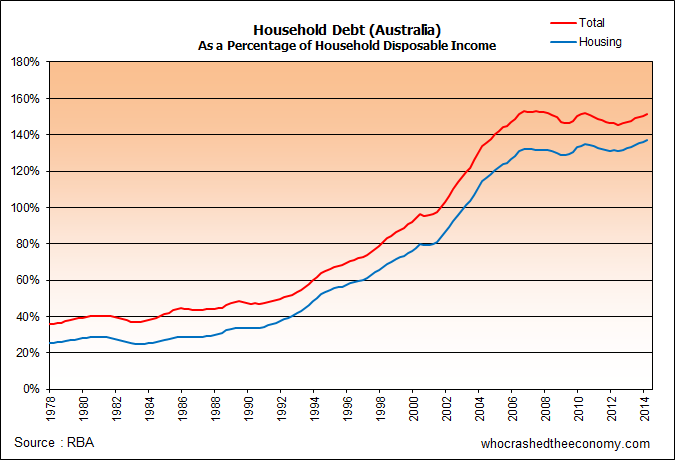

But with regulators trying to douse asset bubbles created from cheap credit, the Treasurer’s advice is likely to undermine their work and put economic stability at risk. Australia now has a record household debt to household disposable income ratio of 153.8 per cent at a time when jobs are being lost and real wage growth is slowing, if not negative. According to Barclay’s, household debt in Australia is the highest in the developed world. Further household leveraging would not be at all prudent.

Increased productive business investment, on the other hand would be welcomed, but the Treasurer is not going to gain this by blowing bubbles.

» Statement by Glenn Stevens, Governor: Monetary Policy Decision – The Reserve Bank of Australia, 5th May 2015.

» Interest rate cut: Treasurer Joe Hockey urges Australians to spend – The Sydney Morning Herald, 5th May 2015.

The fish always stinks from the head.

Zero interest rates here we come!

History will show they were just idiots playing politics. And boy is history about to be made.

Hockey is brazen,forthright and honest in who supports and paid for his rise to power.(Banks and Real Estate groups). He is corrupt, unfit and insane to be treasurer of Australia. Those in the near future who will suffer the consequences of his statements should file class action law suits against Hockey just as many people are doing against Banks that lent them money they could never pay off. BOOOO and SHAME on you. HOCKEY MUST GO!!!

Cicero ” The sinews of war are infinite money”.

Disappointing to call Hockey the Australian Treasurer, I saw somewhere there are $675 billion dollars worth of business loans in this country, it seems the only investment Hockey and the RBA will support is property speculation, god forbid anyone in this country wants to buy a house to live in. I’ve been waiting 4 years now, I guess I’ll be sitting on my hands a little longer and won’t be taking the idiotic advice from the Australian Treasurer.

8 years for me. Once I have confidence in the market I’ll buy. The govt is certainly not making it easy tho….

SO tell me guys, would now be a good time for me to leave my secure job in northern Ireland as a service engineer in the compressed air industry, and return back to Brisbane where I lived for a while, would now be the time to sell my house here and buy a property back in Brisbane, seeing now as interest rates are so low, what do you all reckon????

Is Bill shorten writing Joe,s pathetic media releases now ?

Truly unfit to manage our taxpayer dollars. Resign now please Mr Hockey.Hand in your entitlement,s .

These words from an educated , 2IC of Australia are well beyond any truth.

Yes sir ……. no recession, Massive depression

Does anyone know if Hockey needs a Financial Services Licence when he gives financial advice “directly” to the Australian people?

Joe Hockey fact check

http://www.abc.net.au/news/2015-05-06/hockey-negative-gearing/6431100

Capitalism depends on capital. Without savers the system collapses. Our moronic government has now declared war on them with low interest rates and encouraging “Borrow money and invest” (speculate). The final nail in the coffin will be a tax on bank accounts that will be announced in the budget. This is not the recession we have to have but an all out destruction of the economy by ignorant corrupt politicians.

http://armstrongeconomics.com/archives/30158

“Australia now has a record household debt to household disposable income ratio of 153.8 per cent”

Admin or anyone what as the US and Europes at their peak before the GFC?

@ Andrew L:

Hit the nail on the head. This is an outrageous comment from Hockey, even for him. I feel like there should be a collective complaint made to ASIC.

average_bloke,

If we minus the nominal interest rate by inflation rate, this lucky country has negative real interest rate.

Yes, for the sake of real estate…

Yup, the fact check above shows Hockey is wrong, whats scary is the our treasurer is so incompetent that he doesn’t know this history, but I suspect he really does not it, so it just shows what a goddamn liar he is. Please resign, Joe Hockey, you are unfit to govern, whether giving fake advice, or partaking of $50,000 luncheons form imported chefs.

http://www.smh.com.au/business/retail/woolworths-to-axe-800-jobs-as-weak-food-petrol-lead-to-sales-fall-20150506-ggv1rd.html

http://www.miningaustralia.com.au/news/worleyparsons-to-cut-2000-jobs

http://www.miningaustralia.com.au/news/job-cuts-at-ravensthorpe-nickel-mine

http://www.theaustralian.com.au/business/latest/jbs-to-axe-130-melbourne-jobs/story-e6frg90f-1227334489837

http://www.abc.net.au/news/2015-04-22/car-components-job-losses-loom-after-holden-greg-combet-says/6412372

http://www.abc.net.au/news/2015-05-04/maritime-union-protesting-over-fuel-tanker-job-losses/6441630

Mr Hockey was scathing of the then Labor opposition party when he declared that lower interest rates are a sign of economic weakness and therefore “bad news”. Now the liberal party is in power and all of a sudden lower interest rates under the liberal party is “good news”. How can anybody take this man seriously. History will show that today’s leaders are corrupt, false and greedy. Together with the RBA they don’t know what they are doing. If you have never had a recession for 25 years and you squandered the mining boom and constantly patted yourself on the back you are obviously going to make some serious misjudgements. It is clearly showing that so called leaders of the day are not sure if they are coming or going. They are putting on a brave face, but even blind freddy can see through the fake facade.

@LBS

The ABC aired a story tonight on the news criticising Joe Hockey for encouraging more debt. It also interviewed business, saying it is all well to borrow to invest in more stock, plant etc, but there is no demand – Why would you do it?

They put some slides up on debt levels, suggesting Australia’s household debt is growing, while most other countries are trying to de-leverage:

2014

2007

In 2007, the USA had 130 per cent household debt to income vs our 180 per cent today. (The 180 percent is a ratio of household income, not household disposable income)

I’ve had a old chart on the household debt page for a few years now that plots the household debt levels until 2009.

Spain peaked at 140 per cent, The USA about the same.

@admin

Wow 140 US compared to 180 Australia……. Gees this is going to end ugly for Australia when it pops. Thanks Admin great info

@bubbleblower. You are right. Politicians have always gotten away hypocrisy and corruption because they are always and easily forgiven by the sheep ooops voters.

more cuts to come.

prepper

the reason we are not being represented

http://larryhannigan.com/docs/Flora_News_26-Queensland_Corp.pdf

prepper

Australia has overtaken the United States as the land of packaged bullshit

Everyone tries to sell you some form of it and it’s got to the point that’s it’s every day so it’s very regular. Now it’s concealed by discounted interest rates which sounds attractive but the catch is…….wait for it…..pay lots lots more for it than what it’s worth. Yes bullshit buyers…come and buy a shitty house in a shitty suburb (no offence just getting my point across) and tell your friends . George Carlin would be proud. The lucky country with dumbasses , how fitting. Or is this the new season of The Walking Dead……shame shame shame on our pathetic polititions

I am going to come to the defence of RBA on this one as I have seen a few commenters suggesting the RBA wants property speculation and is in cahoots with the government. They have specifically said they don’t. The only tool at the RBAs disposal is interest rates. Business is struggling so the only action they can take is to make it easier on businesses to raise funds by lowering rates. They aren’t able to legislate to limit investment in housing, this is the governments responsibility. The blame for this lies squarely on the government. I personally think the RBA has done the best they can. What else could they possibly have done? Raise rates and have the whole thing come crashing down? I would hate to be the guy making that call, the mob would hang you. Businesses would contract, more unemployment meaning a lot less money to pay off all this debt. Rock and a hard place.

Basically low interest rates can be seen to be both good and bad news at the same time depending where on then fence you sit in this economic environment.

However the reality is low interest rates are a reflection of an economy struggling. What we need and will get is a big stock market crash. Even the FED Ms Yellen is waving the white flag yesterday realizing all assets are “quite high”. They have just figured it out, however they are behind the curve. The train wreck is in motion which will present new opportunities eventually. I guess 7-8 years on from the 2008-2009 GFC, means we should get ready for a bit of action shortly and a bit of a clean out. This should be fun looking at the broadening double top megaphone pattern configuration chart pattern that is flashing on my screen.

Eesh, this is truly unbelievable. I’m in my mid 20’s and have been saving 70% of my income for several years now in preparation for what’s starting to happen. All of these lay offs in the WA mining sector & now the construction sector + associated industries.. followed by stories of guys with 2+ highly geared “investment” properties who will be all trying to sell at the same time very soon. Just wait for another 10% correction like what’s already begun & all these “investors” will be flooding the exits together once they’re feeling some job insecurity and/or are underwater on their mortgages. The pop is close!

http://www.watoday.com.au/wa-news/dale-alcock-staff-jobs-crisis-wa-economy-claims-more-victims-20150506-ggvkid.html

http://www.watoday.com.au/wa-news/dale-alcock-staff-jobs-crisis-wa-economy-claims-more-victims-20150506-ggvkid.html

https://au.news.yahoo.com/thewest/a/27685890/perth-renters-get-upper-hand/

The national debt is a function of trade deficit and low productivity. NO. A private central bank charging interest on the issuance of currency out of thin air,thereby creating an unsolvable compounding mathematical spiral,is what causes the National Debt.

@56andoverit or @anyone else

What do you mean with “a private central bank”? Can you prove it?

According to http://www.rba.gov.au/qa/role.html it is a “a body corporate wholly owned by the Commonwealth of Australia” whatever that means.

Also can you prove they print money out of thin air?

Cheers,

I’ve been reading this forum and others for a while. Mainstream and alternative. I start to wonder, what is the point?

There are many positions. Some are below.

Naive people that would think the RBA is doing their best, as much as woolworths is cheap and has fresh food.

Smart people that are analyzing the different factors that can move the economy. As if 2 + 2 = 4.

At the end of the day, it seems to me – with my limited knowledge – that it actually doesn’t matter. There is no narrative, no logics, no reasons. But there is an agenda, you can see if you step back a bit from life.

We are just flooded with ideas, stories, lies. I find it hard to believe in anything these days (other than people being selfish and trying to get what they want at the expense of others – but this is nothing new). We collectively make it a reality, but it shouldn’t necessarily be.

For example: Today I saw on the news this article that goes a bit like “chinese are coming to buy everything”. So I suppose I should believe everything they say in the news, and therefore I should blame the chinese, the government that allows them to buy property, and I should get in a hurry to buy as many properties as I can before there is nothing left.

If I was to do it, then I will be the one contributing with the speculation. If I don’t, I would be the one left behind and missing the chance of becoming rich and awesome.

So, it is simply a campaign from certain people that want to create certain behaviour in us. And we do it, or we don’t. Either way we fall in their agenda.

How can we all wake up? Yes, we, each one of us, to think by yourself. Discern.

I read the other day a bit about Iceland. They seem to have waken up, but haven’t found a lot of info. Would like to learn more.

At work, at church, family, everywhere I go people seem to be hypnotized. They believe in woolworths, mygov and coke happiness. Some even tell how happy they are to pay tax in the best country in the world (they have not lived anywhere else).

Others smoke 2 boxes a day, take antidepressants and renovate their renovated houses while they find a nanny to look after thier new baby which they paid hundreds of thousands to have thanks to invitro.

Is anybody there?

Just some random thoughts…

@ Trece 30

The RBA is owned by the Crown, and the Crown is owned by Private Bankers who Gained ownership in 1694. The Federal Reserve is a private owned bank that started in 1913 . Who did you think owned these banks and ran the show ? To answer your question thoroughly is beyond the scope of this site but if you are interested I suggest you research a lot. If you sleep well after you do your homework then it’s because you didn’t research correctly. It’s quite time consuming and disgusting once you find the truth how the financial system operates and you will untangle a lot more than just finances and banking …..just saying but you will get it. Good luck.

@Trece Decenas

RBA: CROWN: (Crown Corporation): QUEEN OF AUSTRALIA: Her Majesty Queen Elizabeth II: HOLY SEE…

all different persons…Blacks Law…

https://www.youtube.com/watch?v=iFDe5kUUyT0

https://www.youtube.com/watch?v=N_mVoOVVykI

http://larryhannigan.com/docs/Flora_News_26-Queensland_Corp.pdf

https://www.youtube.com/watch?v=r2TrTSmJU2s&list=PL9F379VIZ5ApoFkZxDNk-L6MIkoYyQuXR

THEIR IS TWO OF YOU…

prepper

@Claudem777 – woah, back up Sparky! Admin, please… this is either some form of sarcasm that has gone too far, or this needs to be deleted. What has any of this drivel got to do with the economy?

@ Trece

Well done and congratulations for not accepting things as they appear: Your biggest hurdle has been cleared. Finding the truth about any of this is really quite hard. Popular society has completely baffled itself. And, ironically, the truth is simpler than the lies we are living through.

I don’t have the exact wording, but one quote put it clearly in perspective for me. Something along these lines :

“Either it’s a COMPLETE ACCIDENT or it’s planned, that the rich (ie. top 1~5%) get richer after every political, economic, war driven or social event: Elections, recessions, wars and social break down, it’s the same, the rich get richer: So either you’re ignorant and accept it’s all by coincidence or it’s planned”

Pretty obvious in that light.

The two best sources for my ‘enlightenment’ are:

The book “The creature from jeckyll island”, details the creation of the federal reserve, the IMF, world bank etc. My favourite chapter is about third world loans, loans given that will never be paid back, but ALWAYS receive interest, then when it’s clear it can’t be paid back, they REFINANCE and do it all again…Never improving the country, merely scooping weekly interest payments from the poor. Either accident or planned……….

The second is fairly recent: https://www.youtube.com/watch?v=iFDe5kUUyT0 It’s quite long, but watch it a couple of times…. For the cost of running a printing press, the rich get interest payments on BILLIONS (Now TRILLIONS) of dollar…each and every week….Either accident or planned……

There’s also an incredibly simple youtube clip of a young girl who worked it out (the truth is simpler than these lies remember) She simply asks “Who REALLY benefits from governments running deficits and taking on huge loans?” Is it the poor, does it relieve them of poverty? No….Is it the working class, does it provide free health, free education, safer suburbs, increase job security? No…Who really benefits? Easy,…where does the interest payment go…That’s the benefit, straight into the pocket of the rich.

So the real lie is this:

We are told we can have it all: TODAY!

Houses, cars, holidays, computers, iphones, couches….Even a card with no restrictions on what we spend the money on…ANYTHING FOR SALE we can buy today using credit….

But the rich are happy to take just a weekly interest repayment in return….

The rich then use those repayments to buy REAL ASSETS, gold, silver, mines, banks, commercial property, art, rare cars, WEAPONRY, bunkers, castles, islands, the best managers and CEO’s money can buy… Politicians? Tax havens? Tax law exemptions?

So..while I can’t own a central bank at this point in time, I can emulate the rich’s behaviour: Purchase real assets that produce more wealth, and re-invest: It’s hard at first, but once the balls rolling it only accelerates.

Good luck. (oh, there’s no luck it’s all PLANNED)

So I just heard this through the grapevine; a bunch of people this past week have tried to get interest-only loans from the big 4 and gotten rejected. It seems APRA is cracking down on lending standards; some are saying they are as good as banned. Any anecdotes to share on this?

Don’t tell me the wall of text above was serious

Thankyou Paul.

Claudem 777 the Truth will always crush lies and deception.I also thought the legal system would bring justice to my injustice.To the point,a developer stole $250.000.00 from me.I won 2 court cases.Then had to pay legal costs of $55.000.00 because he shut down one of his companies.OZ is a façade.

@ Claudem777

Thanks for sharing that, and for the advice not to enter into the blame game.

I am just trying to figure it out with the intention of not being naive any more.

I would like to not participate in this “love of money”, but I find I need a country to live, a suburb, a house, a job, relationships… and all of these people and entities are following the rainbow.

It is interesting how you call the church: “Incorporated”. I started to call it “institutionalized” a while ago. It is amazing how they can use the name of the creator, and make it all sound like Christianity, but it is not. It is the love of money dressed in sheep clothes.

I am in a way ok with it. Even if I go there and pay, sorry pray, I am ok – after all is my relationship with the creator.

But then I find myself in the middle of Rome. Babylon, Sodoma?. When you read the accounts in scripture you can realize nothing has changed other than the illusion that we are in a nice society in the 21st century with ipads for everyone.

I wonder if people inSodoma were widely aware they are evil, or they were blisfully blinded like us (we are the good guys that bring democracy in the world and have the cancer foundation that sells hats in shopping center retail shops that pay $50K per week rent).

Its kind of I am the only one going the other way around: “I shall not want” – Psalm 23 (the key of freedom, not wanting).

It is hard to talk to people about these stuff. Especially “believers”. Nobody wants to listen. They just want to go back to the ponzi of the love of money (lets buy this week sermon as he talks about 3 steps to be a millionaire). Obviously the incorporated places of worship do not want to talk about this.

I get so puzzled when I go to those places of worship and hear the claim “we are so lucky. This country. We are free. We are not persecuted”. Yeah right, you are not persecuted because you are going with the system, and you are not standing for the truth, not one little bit.

I suppose the Romans were clever enough to bring the world to the church, before it was the other way around.

Anyways, glad to read this forum and find there are people out there that are looking for the truth.

If you had a choice, would you change the past, avoid your “trouble” in the courts and live blissfully in ignorance. Or you think you are better off now that you know but also went through hardship?

i have just shorted westpac and anz bank for expiry for december,maybe i should have done it for next year

Whilst we are bringing religion to the discussion…

A good time for church charities to invest in Australian food growers, manufacturers and canneries.

I can see a huge demand for tins of baked beans and tomato soup in the coming 18 months. If current figures are anything to go by, food banks are seeing the start of “their boom years”

P.S. Just a personal gag, but next person who gets a Porsche SUV via finance for reasons of safety first and only gets a punch in the nose.

@42

Re: Porsche Safety.

Gotta laugh at a relative: He’s a real estate salesman (tried other stuff, but the moneys to slow) and she’s also in the game (don’t know, don’t care). They show up to a birthday party the other week.

Now they rent because “we can’t afford a place”, yes, it has me beat they have a very nice income….

Now, they show up to this birthday in a brand new MB s-class “for the safety” of their new born… OMG…WTF is wrong with this world.

I just laughed as we drove off in our 15 year old Korean built hatch that has been an awesome, reliable, cheap to service and run “snot-box”.

Anyone watch on SBS the other night The super-rich and us…. It’s all a coincident, or all planned.

@43

I would be surprised if they own the Mercedes Benz.

99% of Real Estate agents lease wanky, “hey-look-at-me-aren’t-I-an-awesome-looking-successful-real-estate-agent-who-can-sell-your-investment-property-for-more-than-the-other-agents” german saloon.

average bloke @42, 43 etc-All these people are subsidized by the majority of us who are earning minimum wage. Certainly they are not to blame nor the government but the voter

It’s true…we have a country full of many wankers…..they breed and have other wankers and teach them to become bigger wankers than the wankers they are. What wankers.

Theo,agree with you 100%.The last state election,in nsw for the first time ever,we voted with pens and on-line internet.Previously,we always voted with pencils and if we did with pen it was informal.The system is an agenda.Hard to blame the people under the circumstances.When you think about it,if we had any say in it they would not be there.Holding us to ransom.By the way,minimum wage has not budged for 35 years.

35 years ago a house in Northbridge cost $53.000.

The great OZ dream,in Sydney,for punters only.I mean investors.

Pick a bale of cotton.

https://www.youtube.com/watch?v=vb8Rj5xkDPk

prepper

@ karl

good move..i think time period?

https://www.youtube.com/watch?v=gHVgRgYdCsQ

prepper

The Trans-Pacific Partnership: the dirtiest trade deal you’ve never heard of. Please watch on youtube.

Apparently all still good over here in Adelaide, despite the dead suburbs.

http://www.adelaidenow.com.au/realestate/news/its-not-always-a-dead-end/story-fni0ci8n-1227347284263

Maybe this is WW3… at least it’s not as messy as the other 2, and still doing the same job.

TL;DR

@admin,

This blog is fantastic, thanks for your time and effort in bringing to light issues that concern most of us. Presenting your post as economic events happen and keeping your and our feet on the ground. I’ve been reading this blog for years, and recently started posting. Allowing commenters to post freely, and part-take in discussion, whatever it may be isn’t censored. Thanks for that.

But, many entities and forces around us such as the mainstream media, commercial interests, politics, education, banking and finance, are setting up many people for failure due to mis-information propagated by institutions representing the above.

Mis-information can set people up for failure, and there seems to be a growing amount of it, by a few posters here. Maybe some comments should be dissmissed as either too irrelevant or mis-informing.

@30. Trece Decenas, and @37. wes,

Well said, it has to be said, and about time it is said.

@32 Me, @33 Paul, and few others,,

This RBA Crown-Corporation stuff, the Government is a Crown Corporation owned by a few in London City Centre… Prove it, really prove it, not by YouTube videos that neither present evidence of this. Many Australian Government agencies, even the Commonwealth Government, State Governments, indeed do have corporate entity registrations in Washington DC (you can look their SEC codes up), BUT, that does NOT mean there are 2 distinct entities with the same name, it is because these entities trade internationally, conducting business, and as usual, trade via corporate structures.

Coming around a long bend to this …two of you…. No there isn’t. There is only ONE of you. Yes, there are Admiralty Laws and Courts, Common Law and Courts, Civil Laws and Courts, as well as others. But, there is no YOU and BIRTH CERTIFICATE YOU, that apply to different laws and courts, there is just you.

Two popular propagators of this 2-you-birth certificate stuff, 1. Jordan Maxwell (US), who is still fighting his court case, to have his “sovergein car” released from a court impounding order until he pays his fines. He tried the birth certificate trick,… trick! No go so far.

2. Australia’s very own Santos Bonacci. Mr. Clocked up over $130K worth of traffic infingements, tried the birth certificate trick, yes there it is again, trick. Told the court he would discharge the infrigements with his signature, apparently that’s the real money value way, and now, Santos… is… in… hiding.

Look, you guys go off, clock up a few thousand bucks worth of parking fines, go before a Judge and say, …oh no! Your Honour, its’ not me you want, it’s here, this birth certificate you’re after…. Then post the YouTube video of your court case here.

Admin some censorship please, actually not censorship, rather some integrity please.

I’ll stop here.

This is expected to create mixed reactions especially among professionals in the industry. This should be given a thorough look to ensure that what appears to be profitable will really bring its expected advantages.

@ admin. A graph ratio comparison between average workers wages and the price of real eastae,in Sydney,over the past 40 years.Does it exist or could you make one?

http://www.whocrashedtheeconomy.com/graphs/Sydney_PriceIncome_PriceRent_PriceCPI_June2014.png

The above graph is price to income derived from a single wage, the ABS Wage Price Index – total hourly rates of pay excluding bonuses and is not household disposable income.

I’ll have to get it updated for March 2015.

Maybe wages have doubled in 40 years, but in Sydney, real estate has gone up thirty times.That’s 3000%.

@ plex

Nobody here has to believe anything. It’s a blog and information is shared, that’s it. I will add that most on here are at least are more in tune than the other zombies out there. Personally I’m not too bothered what others do or whether they believe anything I say, that doesn’t upset me. My interpretation of this site is that people are sharing information rather than trying to convince everyone. Basically anyone can read or hear something and if they decide they can either digest or regurgatate the information. It’s a very simple process. Surely I shouldn’t have to point that out. But about proving ? Your right, it’s quite difficult to prove practically anything. If your own eyes and ears were not there then you can’t know for sure. We all trust or distrust information based on the reputation of other individuals that are suppose to know the facts. Apparently you need to be a lawyer for anyone to take any notice of any evidence. I guess the history books are gospel too, because that’s proof of the past and Julius Caesar said so. Anyway Thanks for enlightening me, I learnt heaps.

After mining towns, Perth seems next until reality comes to Sydney by next year, i guess:

http://www.afr.com/real-estate/oncerich-wa-to-be-hit-by-property-slowdown-20150511-ggvp8l

http://www.abc.net.au/news/2015-05-07/perth-rental-vacancies-rise-as-low-interest-rates-encourage-buy/6450646

Plex is right though some need to smoke less and concentrate on providing factual information. If you are passionate about economics fantastic stick to this subject as we all come here to read, learn and share.

@Trece, I take offence at your comments. The hippies tried in the 70s to change the world by going completely against the grain… and achieved nothing. I wonder what you think the RBA should be doing if it is naïve to think they are doing their best? These is the system we are operating with so to simply say “do away with them” achieves nothing and will always be dismissed by those in power as childish drivel. I think the scope of these comments should be inline with the scope of the article. Or else the answer to every single article is to do away with capitalism.

Interesting thought to consider the nationalisation of Australian banks. They create the problems that sink governments so why not take them over and run them in the interest of the people?

http://armstrongeconomics.com/archives/30458

Anyone have any idea what is going on with Real estate in Brisbane, especially Cleveland Bayside area.

Thanks TC,

Another genius here, in case you didn’t notice the new in drug for getting high is ‘ice’.

Weed and smoking was cool in the 60’s so at least be in tune pal. I don’t have any facts though,just the word.

@Me I’m Gen Y so i wouldn’t know anything about the 60s drug scene. I hear real estate though is a hell of a drug.

TC… Very true very true, every drug has its up and down, funny enough a house sold in my local suburb for 1.3 million. Dont get me wrong I grew up here and it’s not a bad area but only a dickhead would pay 1.3 million to live hear. I find it entertaining. It’s still a fu……n coconut.

ITS STILL A FUCKEN COCONUT……the saying of a generation

Late to this conversation, Joe has changed his tune in the last couple of years. He used to say that falling interest rates are a sign of a failing economy and a sign that the party in power has no idea how to run the economy.

Many would say that nothing has changed, interest rates are coming down and those in power at this time have no idea how to run an economy.

The upsetting thing is that there does not seem to be anyone running in any party that has Australia’s interests as first priority, let alone as part of their platform. If they did then NSW would be building it’s new trains here, not in China.

The titanic is on its path to hit the iceberg. The lifeboats have already been reserved and even Australians are having a tough time in winning medals in Australia swimming.

Hockey’s refusal to abolish negative gearing only confirms he is a hypocrite and corrupt, publicly pretending to care, but in fact thinking nothing more than to promote his own political agenda. His arrogance is limited only to the size of his ego as no one can seriously believe his party’s policy that getting rid of negative gearing is “increasing taxes” on all Australians. This borders on narcissism. He is an economic despot who is only transparency is not his personal wealth portfolio and sources for his political party funding but his protection of vested interets including the Banking and Real Estate sectors. It is also his goal of repaying those who put him into power by selling off government assets at bargain prices. This is also celled nepotism. A pathological liar who has also reneged on many election promises. He lacks empathy as he only cares for nothing except buying votes, instead of promoting real social and economic equality, thus ensuring hmself into the next term of office. I would not be surprised if he has grand delusions on becoming Australia’s next PM. Deja vu anyone?