According to China’s National Bureau of Statistics, real estate inventory reached 686 million square meters at the end of October, up 18 per cent from a year earlier. With the average size of an urban Chinese home 60sqm, this represents an excess of approximately 11 million unsold homes.

At the height of the GFC, Beijing instructed local governments to invest heavily in infrastructure. Unable to borrow, local governments set up LGFVs (Local Government Finance Vehicles) to invest in fixed assets and in many cases SoEs (State Owned Enterprises) to build them. The majority of the stimulus was sunk into building new cities that the western world argue lie mostly empty.

Not surprisingly, the unsustainable residential construction boom entered a downturn in 2014 with weak demand and burdening oversupply, and has failed to recover in 2015 despite the central bank cutting benchmark interest rates five times and slashing banks’ reserve ratios.

Land sales represent a large chunk of local government fiscal revenue and has plummeted 32% in the first 8 months of 2015. Many local municipalities need land sales to remain solvent.

The challenge on what to do with the vast number of new, empty homes was a topic for discussion at the three day Central Economic Working Conference, held in December.

Following the conference, it was announced rural residents relocating to urban areas will be able to register as city residents, allowing them to either purchase or rent property. China has a household registration system more commonly known as “hukou” that prevents migrant workers from purchasing property in urban areas. The government also plans to launch a low-rent public housing program, and to support rental enterprises.

Analysts are skeptical the move will fuel sufficient demand to fend of a crisis. Migrant workers simply don’t make enough to afford China’s exuberant urban house prices, let alone rent them.

The 11 million new unsold homes, don’t include the many, many more that are considered “commodity homes”. In 2010, a report indicated there were 64.5 million urban electricity meters that recorded zero electricity consumption over a 6 month period. In 2014, a survey from China’s Southwestern University of Finance and Economics found as many as 1 in 5 homes, or 49 million, in China’s urban areas are sold, but vacant. Outstanding mortgages on these vacant loans total 4.2 trillion yuan, according to the University.

As property prices have only gone up in this relatively new economy, citizens purchase empty homes as an investment or store of wealth. Many are concrete shells, that the buyer will need to fit out at a later date. Malcolm Turnbull wrote in an article for the Sydney Morning Herald in June 2010, One property analyst was very candid when asked why there were so many apparently unoccupied flats in Beijing as there were no lights on at night: “The flats are occupied. Cash is living there.”

Other homes are brought for the future, be that for their children or retirement. Some are even brought as a means to launder money. Its also been suggested that land sales are a boom for local governments, but people moving in is a burden as it starts to cost local government operating costs such as public transport and waste management. For this reason, there is an incentive to keep cities empty for as long as possible.

Turnbull went on to write:

Asset bubbles are like a Ponzi scheme – everything is fine until the cash dries up and asset prices stop rising. Like it or not we are exposed to the Chinese property bubble. The iron ore China buys from Australia is turned into steel, and most of that goes into building apartments and infrastructure. Our bauxite and alumina exports are turned into aluminium, of which about 40 per cent goes into construction in China.

So at the same time as we congratulate ourselves on escaping from the consequences of the property bust in the United States, the resources boom that underpinned our strong economic performance is itself based on another debt-fuelled property boom in China.

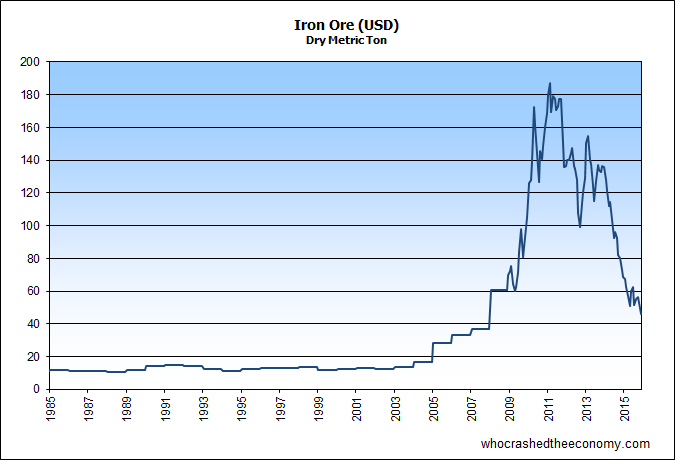

Iron ore

The Chinese construction sector is the biggest consumer of industrial metal. The slowdown in the past two years has reaped havoc for commodity prices, none more than Australia’s largest export, iron ore.

The latest Resources and Energy Quarterly from the Office of the Chief Economist, Department of Industry, Innovation and Science reports:

China’s steel consumption is estimated to have fallen by 3.5 per cent in 2015 to 714 million tonnes, following a fall of 3.3 per cent in 2014. China’s steel consumption has been heavily affected by weakness in residential construction, following a rapid increase in housing supply over the past few years. The China Academy of Social Sciences estimates there are nearly 18 million unsold apartments across China.

Given the lacklustre performance of the housing sector through 2015 and the significant amount of housing inventory still to be cleared, residential construction is not expected to be a significant driver of China’s steel consumption in 2016.

According to the report, the Department has downgraded the iron ore price for 2016 to $US41.30 a tonne.

In recent days the iron ore price has made a comeback, but analysts are confident it will be short lived. Chinese domestic buyers are bringing forward some purchases prior to seasonal supply decreases in January and February.

A poll conducted by Reuters, suggests iron ore could fall below $US30 a tonne in the next few months, forcing high cost producers to the wall.

» Chinese debt binge is fuelling a dangerous property bubble – The SMH (Malcolm Turnbull), 16th June 2010.

» Resources and Energy Quarterly, December 2015 – Office of the Chief Economist, Department of Industry, Innovation and Science, December 2015.

» China to destock housing inventory – Xinhua News Agency, 21st December 2015.

» China to destock housing inventory: key meeting – China Daily, 21st December 2015.

» China unveils new policies to help farmers buy homes in smaller cities – South China Morning Post, 10th December 2015.

As predicted apartment prices are falling

http://www.businessinsider.com.au/australias-high-rise-boom-is-weighing-on-apartment-prices-2015-12

David C the local unit market has nothing to do with this article. Its about the decreasing terms of trade brought by lower commodity prices as a result of China’s economic mismanagement. When the flow on effects of that fully hit Australia, there will be deflation across the board not just units.

Its just a question now of when the next recession really kicks in hard. Dont bank on a speedy recovery as there is a lot of debt to be written down to put things back into a semblance of equilibrium.

Titty,

I can read. I was just pointing out that other factors may lead the downturn. Someone was arguing a blog post or two ago that property other than inner city apartments would hold up. My contention is that this sector will lead the whole market lower.

As far as I am aware, most of the profits from mining go overseas to international shareholders. The main effect of a downturn in mining is the scaling back of high paying jobs in that industry and a reduction in the royalties that the state governments get.

Titty Surprise – I guess you are suggesting economic management here in Australia and elsewhere in the West is top notch.

The real threat from China is the offering of their physical stocks of commodities (iron ore, coal, copper, etc) back into the world market.

Drive along the Pacific Highway from Hornsby to North Sydney. It seems like 40% of apartments are vacant. All are sold many of plan. 1 bed 800k , 2 bed 1 million , 3 bed 1.2 million. Beyond the reach of most young locals. They call Sydney new Shanghai. There is a lot more to this than the media or the politicks tell us. The biggest country with smallest population with highest property prices , in the cities , in the world. High real estate prices = unsustainable debts. Win win for the banks only.

@6

I have a close friend who lives on the north shore, and when I visit him, I see these new apartments popping up everywhere. Sadly, the same thing is happening everywhere else in Sydney.

My question is, if so many of these apartments are vacant, then why would people buy them if they are not going to live in them?,or at the very least rent them out? Doesn’t that mean that these 40% of vacant apartments are “dead real estate”.

I wonder if Sydney will end up with the “ghost cities” you see so often in China.

China is going down and there will be no soft landing. The result will bring down international real estate markets and crash the humungous global debt bubble, but not in a bad way. Those who are prepared will be able to buy that house they have always wanted or perhaps that Ferrari for the price of a Holden. Remember the huge fortunes of the last century were started in the Great Depression. So Happy 2016 it will be the opportunity of a lifetime.

http://www.businessinsider.com/chinas-real-estate-bubble-is-collapsing-2015-12?IR=T

In 20 years the government may look back and admit they made a huge mistake of selling off Australia to the Chinese. I am only one of many that are completely priced out of the market for anything even remotely close to the CBD. My work is located in the CBD and short of travelling 1.5 hours door to door each way (3 hours daily) my only option is to rent. I have tried purchasing but I cannot compete with China’s massive upper class. I feel like a temporary resident in my own country. To know that the Australian government turned its back to illegal purchasing for so long makes me feel betrayed. I am not against foreigners purchasing property but there needs to be an orderly and fair system to ensure that Australians are not spending the next 50 years of their life paying off huge mortgages because of China’s obsession with Australian property and our government’s stamp duty greed.

I liken Chinese purchasing of Australian property to a swarm of locusts (not comparing Chinese people with locusts but their instead their buying behaviour) and our government loves it.

@ nexusxyz (comment #4)

“I guess you are suggesting economic management here in Australia and elsewhere in the West is top notch.”

Very bad guess – I never suggested it, and never would.

So, tell me the future of property market.