2016 is set to bring more pain for Perth property punters as prices continue to fall on the back of diving commodity and energy prices, rising unemployment, stagnant wage growth, surging vacancy rates and plunging rents.

With more mines destined for care and maintenance resulting in more job losses and pay cuts forecast this year, there are no signs of bottoming for the troubled property market.

The state government’s mid-year review in December disclosed a blowout in the state budget deficit to $3.1 billion by the end of the financial year, attributed to slumping GST revenue, declining mining royalties and a collapse of business investment capex.

WA Treasurer Dr Mike Nahan said “Put that into context, that’s the biggest revenue shock government, state or federal, has experienced in Australia since the Great Depression of the 1930s.”

Immediately following the mid-year update, the government enacted a recruitment freeze, with the only exception, police and teachers. Yesterday, WA Health Minister Kim Hames confirmed 1,163 full time equivalent positions would need to go in the Health Service in the coming months.

The latest Australian Bureau of Statistics labour force data for the month of November, reported a 13-year high jobless rate of 6.6 per cent for WA.

According to SQM Research, the rental vacancy rate for Perth is now 3.9 per cent in November, up from sub 1 per cent just three years ago. The rising vacancy rate has been a joy for renters who have seen rents fall 8.5 per cent for houses and 8.1 per cent for units over the past year.

Realmark executive director John Percudani told News Limited, “Vacancy rates have been enormous and rental adjustments have been huge and that’s because so much of the stock has flown into the rental market at a time when the market is obviously diminished, people who weren’t able to sell for the price they wanted moved their homes into the rental market”

Accurate statistics on residential property prices are hard to come by. The ABS show prices have fallen 3.41 per cent in the June and September quarters. More timely data from RP Data suggest prices have fallen 4.9 per cent and outgoing National Australia Bank chairman, Michael Chaney, has been quoted for saying “The housing market here has fallen almost 10 per cent in the last year and is pretty soft.”

But nowhere has the pain been more felt than in the mining towns.

Investors who didn’t get the memo that the surge in many commodity prices were based on a temporary, but significant mis-allocation of capital in China, naively sent property prices in mining towns into the Stratosphere. They are now licking their wounds.

Data compiled by SQM Research show house prices in Northern WA is down another 21.6 per cent last year, bringing the three year decline to 35.5 percent. Unit prices are down 19.0 per cent for the past year, or 34.0 per cent for the past three years.

Rapidly falling prices are not the only worries of landlords in Northern WA. Plunging rents, and high vacancies are making it difficult to repay loans taken out at the top of the bubble.

Rents for homes in the area are down 38.5 per cent for the year, and 63.1 per cent over the past three years. If you can find a tenant for your unit, asking prices are now 26.2 per cent cheaper than a year ago and 59.6 per cent than three years ago.

And remember the 1960s three-bedroom, one-bathroom fibro and iron house the ABC reported was brought for $1.3 million in 2011? The article, published in February last year, stated it was passed in at auction $360,000 and later relisted for $590,000. We can now report realestate.com.au indicates it is under offer for an undisclosed price. SQM reports Port Hedland house prices are down another 13.9 per cent last year and 40.0 per cent over the past three. Let’s hope the finance doesn’t fall though and the investor can finally put this nightmare loss to bed.

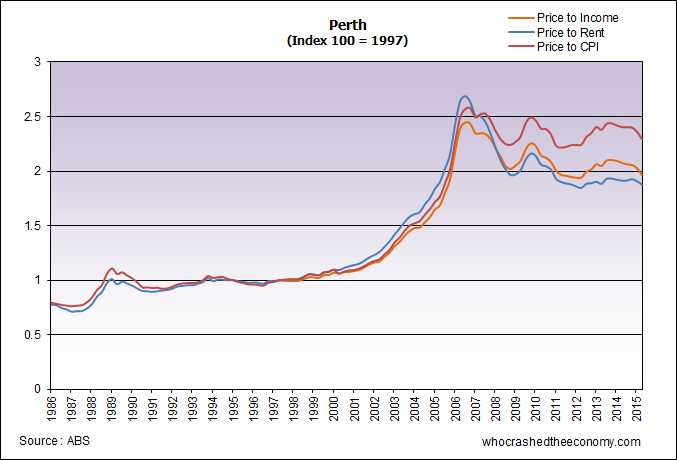

Economists who study housing bubbles and long term price trends have found, logically, house prices generally do not appreciate faster than household income, or the ability to service the mortgage/debt. In comparing markets, they often compare the change in the ratio of house prices to income and house prices to rents. In a normally functioning market, both should rise at roughly the same rate and should be flat, like in the case pre-bubble 2001. Once the bubble bursts, these ratios generally return to mean.

Based on this, it could be concluded on a price to rent basis, in September 2015, Perth houses prices were 47 per cent overvalued. On a price to income metric, it’s closer to 49 per cent. One could assume the market has quite a way further to fall.

» Perth house prices down almost 10% – Sky News, 18th December 2015.

» WA deficit blowout of $3.1b revealed in mid-year review – The ABC, 21st December 2015.

And herein lies the problem with having separate news within each State. I don’t remember Victorian news ever reporting this once over the past year.

When I lived in Queensland they used to spruik “10,000 people a month coming to Queensland pushing up house prices.” My mother-in-law had the same in South Australia and Melbourne spruiked the same crap. So there were 10,000 people a month just moving between States?

I’d post this link to a few friends but it would just come with aggravation, excuses as to why it won’t happen in Melbourne or Sydney and they’ll throw a bunch of REIV mantras, falsehoods, false predictions of the future etc.

Hey what happened to Hockey’s false prediction that “If house prices go down rents with skyrocket”? LOL.

One hour drive outside of major cities and in most regional areas the price of houses has only doubled in 30 years. If you factor in the price of land going up 800% in this time frame, we come to the realization that house production costs (including labour and materials) have remained stagnant just like workers incomes since 1985.

I wonder if WA still want to annexe themselves away from the Eastern states and go it alone.

They were pretty keen on the idea when iron ore was $200 a tonne.

Fun game: Spot the lies/bs in this article.

http://www.couriermail.com.au/business/billions-wiped-from-federal-government-coffers-through-capital-gains-tax-property-discount/news-story/e773438f7cb262b58d998177f84f76c4

I know most of us here have been saying ‘this is the year’ every year for the last 5/10 + years.

I’ve been saying it for 15years now. No kidding.

But, I’m almost certain and willing to bet an iced coffee on this being the year the falls start, I don’t think we will see the crash in 2016, but the falls have started.

The USA topped out in 2005, yet it took until 2009 to hit crisis.

I totally underestimated how powerful the mining boom was. Looking at commodity prices, government surplus’s, and cap-ex spending it’s now clear that Australia has one hell of an economic black spot. Canberra is becoming Washington, in that it will consume any and everything, regardless of end benefit, just to keep the cogs of the economy turning until past the next election.

I have friends who win government contracts, they sickeningly laugh at how hard they are ripping the tax payer.

@estupidos

Mate, I spent one of my longest days ever at the in-laws for Xmas…. Oh my. People who are coming up to retirement, who don’t own their homes outright, are borrowing huge money for holiday homes (Holiday homes here in SA are one of the biggest laughs I’ve ever seen….. Black point, cost of block $25k, cost to build $200k, on market and selling for over $1M…. LOL idiots!)

But I suppose it’s not just housing, I told a bloke that now’s the wrong part of the cycle to be dumping their payout in the ASX…. Of course I was told “it doesn’t matter what they cost, because I’m after the dividend”…..and his financial planner sails off into the sunset with a lovely commission.

The whole finance industry is sick, sick, sick. It’s not just the Chinese who are borrowing to invest with no concept of what investment actually is.

When one learn’s that a dollar is only a pretend commodity written by the RBA, that has to be paid back with labour or innovation, it’s hard to view the world the same as these debt slaves.

With the average life of a currency being 40 years, and the fact we have seen:

The gold standard dropped

Partial gold reserves dropped

Pure fiat and fractional reserve lending

and it’s clear that pure fiat and fractional lending is at it’s limit…. What makes me say that??? Well, when the central banks have to print to buy stuff off of the banks just to keep the cogs turning you know it’s the end of the line….

So when you’re entire global economy is funded using printed (pretend) currency…. and that systems at it’s end…… where do you go to from there??????

I don’t know. But I do know, I have the skills to ensure I can earn a living at almost any stage, and that’s a lot more than many.

http://www.domain.com.au/news/sydneys-growth-run-is-over-in-2016-domain-group-20151214-glk3h8/

Even the mainstream isn’t denying there will be a housing slowdown. But they don’t want to call it a crash just yet. More like a small correction in an ongoing bull market. I believe 2019-2020 is the time we go from ‘mild correction’ to full-blown banking and financial crisis. The entire time the government will deny there is a problem until it is too late.

When the crisis happened in America, millions of people lost their jobs, homes, savings, and pensions. Since then, street violence, suicides, mass shootings, and racism have all soared. One of my friends who recently went holidaying over there remarked that the only food she could get was either dirt cheap fast food or high end luxury meals. Not much available for a middle-class worker trying to eat a little healthy. The reason was obvious; there is no middle class in America anymore.

What’s going to happen in this country is going to be far worse than the US, because Lehman Brothers’ assets were only 5% of US GDP and each of the Big Four banks has assets nearly equal to 50% of AUS GDP. All of them are leveraged just as much or more than Lehman. The only thing we can do is drift away on our lifeboats as the titanic sinks and most of the people around us drown.

Home prices stagnate in December after 2015 surge

I notice the same thing Paul, especially all the comments of stagnating.

Sydney is down 1.4 per cent in the past three months, a significant turn around from the double digit gains.

“However, CoreLogic RP Data’s head of research Tim Lawless said he is not expecting the Sydney market to experience serious price falls.”

This is all excellent news. House prices will become affordable and so will rents. Who says this is bad? Not me and a lot of other people who are getting minimum wage. They scare people into believing you will be out of a job if this happens. So what!! I’ll get another one. People lose their jobs even in the so called boom times. Besides job growth in boom times is only temporary because it is debt fuelled. Its a win-win situation for the majority while all the vested interests in the housing industry will pay for their greed. Bring it on I say.

@Matty:

And therein lies the truth: “I have the skills to ensure I can earn a living at almost any stage”.

Many of these people are just coasting on tax dollars: Payouts, subsidies, bonuses ad nauseum to help them pay their way but their day to day lives and jobs add no value. They are replaceable and productivity won’t be severely impacted when they’re dropped.

I always said I welcome chaos because I will survive it and many of these large corporations that need big infrastructure will collapse and people who do “monkey see; monkey do” work will be dumped.

I know all the “house prices never go down” idiots out there always try to get naysayers to name a fixed date or year of collapse and then derisively laugh when it doesn’t eventuate but they fail to consider the amount of effort being put in by Government policy, tax handouts and exemptions, RE lobbying etc. Then they pull out the crystal ball when it suits them: “House prices will flat line but not go down” will be the first layer of defence followed by “But houses will only drop 5%, 10%, 20%” until it’s so bloody obvious they can no longer BS their way out of it.

I think the average punter is a mug and they’re being taken for a ride but they are willingly buying into it and investing their egos and Self-worth into a Ponzi scheme supported by everyone in the higher echelons of our hierarchical system of greed until it collapses like so many Multi-level Marketing Schemes when the Government, Bankers and RE wankers will all walk away with no accountability and point the finger at the punters saying “Well you’re adults and financial responsibility is your issue.” Hardly behaving like adults on the housing upswing.

Rant over 🙂

@Matty: Where does it end? A massive war of course! That way we can blame foreigners for our plight, keep the population busy producing stuff to blow up, pollies become leaders, and the currency game gets reset for a few more decades. Win-win all round!

@estupidos

I agree. I continually have to deal with people who are fat, unfit, unproductive, and to top it off DUMB!

I always break stuff down to the extremes to see what the trend is (it’s so amazing that next to no-one does this!). So I look at said fat, unfit, unproductive and dumb individual and ask “if everything stopped tomorrow, how would you survive?”…. Can they grow a garden, much less chase and catch a feed? Can they collect wood for a fire? could they start a fire? Could they even walk 1km to get some water………

Holy f#$k, these people are totally useless. They wouldn’t last 72 hours in a total societal/economic breakdown.

So my next question is… How do they survive now then? and the answer is almost always the same “it comes back to them making a living either directly or indirectly selling finance”. Whether it’s homes, cars, insurance, TV’s etc….. It’s the fiat system at work keeping these bastards fed.

Almost daily I meet good people who have/had skills, but their jobs are now gone either through off-shoring, or the consumption of the demand for their skill through the currency system.

it always comes back to currency. ALWAYS.

For as long as 1 + 1 = 2, time will equal money. It did when we wore no clothes and ate apples, and it does today when some IT worker in India can do the work of some Aussie at home…. So while the fraudsters are madly printing, selling fresh cash to the public, they are destroying everything the public own and value. Be it possessions, skills or desires.

Never, ever in history have countries been so dependant on each other for finance, labour, skills, manufacturing, or even food. it’s a complete disaster. While I hate what the unions did to our manufacturing, we are completely stupid to allow everything to be foreign made.

@Chockolate.

You are right. I do believe so. But as an optimist, I don’t state such things publicly. Some say it’s already begun. In fact, it began when China fixed their currency to the US$, their meddling over the last 12 months only reinforces this idea. It starts as currency fixing, then currency wars, then trade wars, then…well, you work it out.

@Matty. Completely agree with everything you said. 😀 I think the same and I love the use of extremes to find the truth of something. People argue against the method but it always shows relative stupidity in a stubborn belief system or a lack of insight.

Specufestors desperate for tenants now using gift-card bait.

http://aca.ninemsn.com.au/article/9071259/rent-bonus

I reckon that this is a tactic being implemented by state Real Estate Associations to avoid a drop in overall average rents. Notice how not one of the bait tactics in this clip mentioned actually dropping the rent to gain tenants!!

A $500 iPad isn’t much when you sign up for a 12 months lease, its effectively just $10pw over that period, and most landlords will try to put the rent up more than that by the time the lease renewal comes around.

I guess this kind of tactic is helpful in areas where there is a high vacancy rate or there is something about the property that is turning people away, like no air-con or bad location.

I like to look at rent listings in mining towns just for a laugh, they often advertise with things like this, free rent, gifts etc.. a lot of the time they list the property as “big price reduction” or in other words “I was asking for way too much because I’m greedy but now I think my price which is probably still too high is good value!”

I have never seen so many realist comments about the Australian economy. @5. Matty I also have been saying that the property market will crash but for the last 20 years. I am so glad that I did not buy property in Melb or Syd 20 years ago. I avoided a disaster there!

A $500 iPad.. pfft. give me a 20% discount if your serious. Own the property, wear some risk for once.

Agree with many of the posts that an iPad or similar is not that meaningful, and a drop in rent far more attractive. But I believe what it does signal is clearly there are landlords out there feeling some heat, and big investment loans that need to be serviced. The thought of going weeks with an empty IP could be a concept to uncomfortable for many investors to bear. Maybe this is a sign that the next step will be a gradual decline in rents ? The days of 30 prospective tenants competing for a lease that we saw in news items several years back might be over ? Let’s hope so.

Sounds like the Karara iron ore project faces collapse next week with the loss of 1,000 jobs:

Gindalbie Metal’s WA iron ore mine Karara faces collapse

@17

Thank you for that link Peter, and the job carnage in Australia continues, coupled with the recent Dick Smith saga, with up to 3,300 jobs on the line.

Every week, some company or government department is laying off staff or shifting their operations to some low cost third world nation to save on costs. And then our useless and dishonest politicians insult our collective intelligence by telling us that the official unemployment rate is just under 6%, who are these muppets trying to kid?

@Master Yoda: Yep, there goes Laura Ashley and doesn’t Holden or Ford exit this year?

Morgan Poll has us at 9.7% unemployment. I’ll go with them based on the fact they tell us their methodology, and they haven’t deviated from it:

http://www.roymorgan.com/morganpoll/unemployment/rmr-vs-abs-estimates

It makes sense with the number of job losses and outsourcing going on over the last ten years.

Coles gets rid of another department this January where staff had to train Indian cheaper workers their job on the way out of the door. Don’t hear about that in the media. Well they’ve got rid of approx. 2500 IT staff over the last two years.

Woollies is the same. Just count all large companies exiting staff except the directors and the managers of course.

Just saw the same happen at a large Oil and Fuels company here in Aus. The insult was that those who were shown the door had to stay long enough to train the Indian workers (based offshore) to take over and do their jobs. If the left before the knowledge handover was completed the company refused to pay out benefits such as retrenchment, leave etc…

@Peter

Thanks for the link, the WA govt seems hell bent on keeping downward pressure on iron ore prices by royalties relief and other measures.

Definitely a winning formula being employed by our brilliant politicians.

When major bank RBS says that we are going into a global deflationary crises and to sell everything except high grade bonds we know that a Perth property correction is the least of our worries.

http://www.news.com.au/finance/markets/sell-everything-note-thats-set-off-share-market-panic/news-story/269fed7d1b5308dfd6fadc008d64cf99

Looking for a place to rent in a sought after area of Melbourne. Been monitoring rents for about 12 months now and in the last few weeks rents have been plunging. I reckon they’re down 15%. Funny to watch listings drop their price every week and most of them still go unrented. I would guess that rents are down about $50-$80 a week from a year ago. This is supposed to be the peak time for moving and not much seems to be happening, it’s only going to get worse for landlords as the year goes on. The smart ones are dropping their asking prices right out of the gate to get a good tenant in. I sense panic starting to set in. What’s more, every street has new construction going on! And then I open the Age today and it says rents are soaring! What a load of BS! Liars. Anything to prop it up!

And the irrational market craziness continues.

So the parents’ house that didn’t sell at auction but wasn’t listed as a pass-in sits at $1M and not moving.

So today my mother says “The prices are going up. The house we looked at that was up for 725,000 has gone up $65K and another one that was $1M is now asking $1.2M.” So I asked “Who’s buying it?”

I told her if they’re being passed in at lower prices why are they going up?

“Oh well the prices are going up because of the value.”

“Yes, but no one is buying them at the lower value or the new value so…”

Is this what happens when a vendor believes it is still a vendor market but it is becoming a buyers’ market? What also amazes me is the complete disregard for reality and the continuous mantras from the sources they take notice of.

I said, wage growth is low, banks are being threatened a credit downgrade by the ratings agencies if they don’t tighten their lending practices prices won’t flatline they’ll start to come down. The response? “Yeah but I spoke to a developer and he said it would only drop 5%.” I said, “C’mon, these clowns don’t have a crystal ball and if I were an investor who wanted fast and large gains and heard prices falling I’d dump.” I told them that a friend of mine has lived in three countries where this has happened with the same mantras and silly predictions and all crashed. Period!

But people only want to hear the good news story and argue with no information backing them, no study of the market and history, no taking notice of articles even in mainstream papers that warn the opposite.

I also posited that if I wanted to invest I’d invest in Western Australia because the prices have plummeted but eventually the world will need resources again, if not China then elsewhere and it’s all still in the ground so it will go up again. In fact a friend of mine noted that after the US housing crash it quickly picked up steam again with house flipping and quick onsales as the only game in town. No one learnt from the past so it would seem.

I’ll just sit back and watch.

And the job carnage in Australia continues, yet our muppet politicians (actually I will take the muppet comment back as at least the Muppets had talent), keep telling us that unemployment rate here in Australia is only “5.8%”.

http://www.abc.net.au/news/2016-01-15/workers-lose-jobs-clive-palmers-qld-nickel-refinery-townsville/7091064

http://www.abc.net.au/news/2016-01-18/woolworths-to-exit-masters-hardware/7094858

http://www.applianceretailer.com.au/2016/01/dick-smiths-first-victims-of-dismissal/#.VpxuQ1LSvao

http://www.smartcompany.com.au/finance/49539-fast-lane-will-dick-smith-s-attempt-to-win-back-the-loyalty-of-customers-be-enough.html

How quickly times have changed. When Abbott was PM, every second night, he was on the telly with his hard hat and fluro vest mixing with the OZ workers in the mines, construction, at the beach etc. With Turn of the bull, we don’t see him on media for months then all of a sudden, he is in the middle east promoting the war effort with our troops (young men and women). Is this the only industry left for our children. Here all productive industries have been shutdown in the past 30 years.Look all around us the only people that seem to be working, in construction and mines, are the newly arrived immigrants from the poor countries. I wonder what the true unemployment figures are. Meanwhile the biggest residential building construction boom ever in Sydney with locals priced out of the market. This is all looking very strange. To most of our politicians, reading and repeating the scripts, all I can say is shame shame shame. You sold us out and turned this nation into a slave economy.

Oh, ok, I’ll bite. No mention of DSH or WOW pulling the plug on Masters????

The failure of WOW to build Masters into a profitable enterprise should be ringing alarm bells everywhere. When one of the most powerful, both economically and politically, companies in the countries history racks up $700m in losses on a billion dollar project you have to ask just how borked is the economy. This is a huge project with unlimited access to marketing and promotional resources, all the consumer data you can imagine, and they fail to make a buck…..It’s frightening.

How are the other 98% of business doing?? ie. small business.

I suggest this is a massive marker that will show the economy is in terminal decline.

No real sign of a property downturn here in Melbourne. core logic index creeping up every day. It looks like it will reverse its 3.5% drop from November within this month. Where is the big bang? all this measures introduced by APRA and ATO does not stop the house prices to edge higher.

Running out of patience. How long can it stay irrational high?

@ 28

Matty Masters and DSH are not exactly indicative of present economic condtions. Masters was always a a gamble, considering they just seemed to throw up stores in direct competition with Bunnings, who already had captured the market with years of advertising. Masters prices to me often seemed more expenisve than Bunnings also, and the range not as big. Bunning stores usually have queues at checkouts, Masters do not. Purely a volume issue.

With DSH that’s an internal management fault by the looks fo it. A cluey guy like Dick obviously doesnt have his hands on the levers enough anymore. They broke out fo the electronics parts game and tried consumer electronics. But it is a cut throat market, and Harvey Noman, the Good Guys etc have obviously perfected their game over the decades.

You cant have an unlimited number of players in any industry. If there are too many predators, some will starve.

I am not sure if this is real estate/property industry propaganda, or maybe there is some truth in saying that the dirty money from China flooding Australia’s property market cannot be stopped by Government regulation.

Make of it, what you will, I was of the understanding that the Chinese government were cracking down on crooked wealthy Chinese taking money out of the country, but I guess there are always of methods of getting around laws.

http://www.domain.com.au/news/australian-property-developers-refuse-to-panic-about-chinese-cash-controls-20160123-gmchch/

“Australian property developers are refusing to be panicked”

Pretty much sums up the attitude of the average property speculator. Nobody panics until the SHTF, but then it’s too late.

The fear of massive Yuan devaluation has driven $1 Trillion out of China in 2015. Massive capital leakage is unstoppable when aided by corrupt western banks. So expect a flurry of Chinese laundering in Melb & Syd until it all collapses.

http://www.zerohedge.com/news/2016-01-25/chinese-rush-buy-foreign-assets-mammoth-1-trillion-capital-flees-country